Good morning.

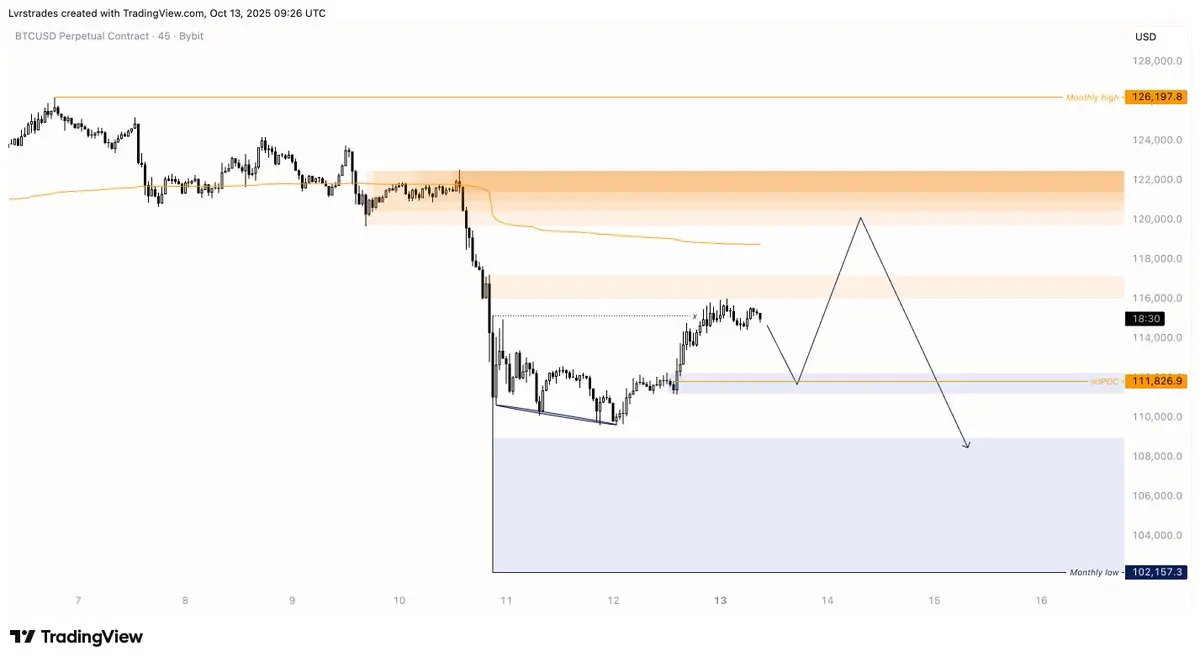

The market showed his intention. Now we wait for a range to form where big players will be accumulating.

Will take a couple of days, so not expecting much upcoming week.

The market showed his intention. Now we wait for a range to form where big players will be accumulating.

Will take a couple of days, so not expecting much upcoming week.