Tools Section: Mainstream On-Chain Analysis and Visualization Tools

This chapter systematically introduces the most commonly used and user-friendly on-chain analysis tools for ordinary users, from basic explorers to trending charts and advanced dashboards, helping investors build foundational on-chain reading skills that enable them to "understand, judge, and verify."

Blockchain Explorers: The “Encyclopedia” of the On-Chain World

Etherscan / Solscan: Why Every User Must Know How to Use Them

Blockchain explorers are the most fundamental “database interfaces” of the on-chain world. All the “price, holdings, transactions, addresses” information investors see ultimately comes from here.

What can investors do with them?

- View detailed paths of a transaction

- Check token holder distribution

- Investigate address behavior of KOLs / traders

- Verify contract code security

- Detect if someone is secretly selling off

Four Key Entry Points Every Beginner Must Master

Source: https://etherscan.io/

1. Token Tracker (Token Homepage)

By entering a token contract address, you can see:

- Total supply

- Number of holder addresses

- Circulation status

- Whether Mint permissions exist

- Whether blacklist permissions exist

Core judgment: Are there any “hidden risk” permissions?

- Can the owner still mint more tokens?

- Can trading be paused?

- Can tax fees be modified?

These determine whether a project can be manipulated.

2. Holders (Holder Distribution)

Used to judge whether “whales are concentrated” and whether the distribution is healthy.

Points to note:

- Is the top address share too high? (>40% is risky)

- Are there multiple newly registered addresses holding large amounts of tokens?

Tip: If the top holder is an exchange or liquidity pool, this is normal.

3. Transfers (Funds Flow)

Used to detect if someone is “quietly selling.”

Indicators to watch:

- Sudden increase in sell pressure

- Large transfers into exchanges

- Sudden activity from team addresses

These are often warning signs.

4. Contract

Quick checks:

- Has it been audited?

- Is the contract publicly readable?

- Is it an upgradeable contract?

Upgradeable contracts mean flexibility but often also imply risk.

Popularity and Market Tools: What Investors Need and Don’t Need

Many users think Dexscreener / DEXTools are just for “checking prices.” In fact, their real value lies in: reading sentiment from price behavior and assessing risk from trading structures.

Dexscreener / DEXTools: Quick Assessment of Liquidity + Popularity

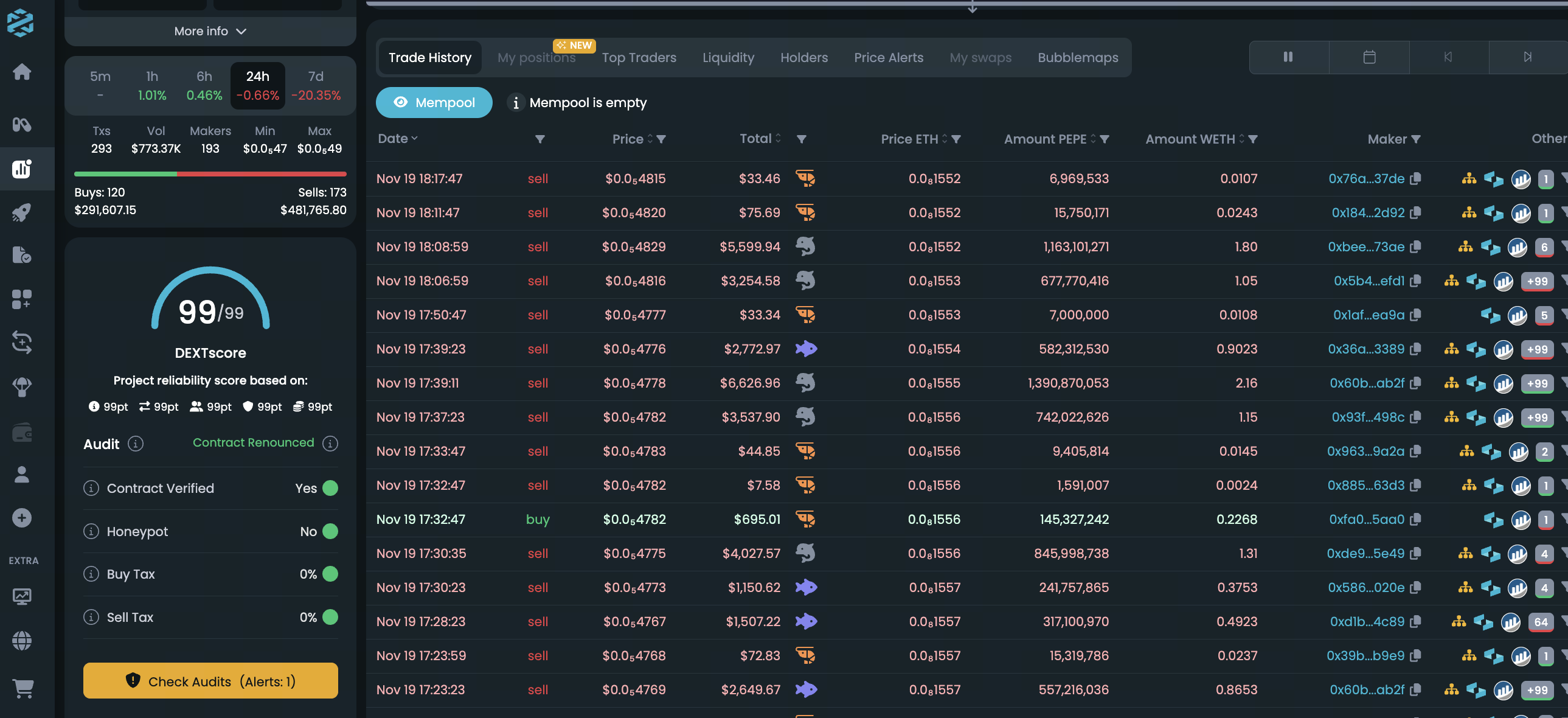

Source: https://dexscreener.com/ethereum/0xa43fe16908251ee70ef74718545e4fe6c5ccec9f

Traders can see:

- Real-time buy and sell data

- Liquidity pool (LP) size

- Candlestick trends

- Trading depth

- Multiple other indicators

Key Indicators: 4 Must-See Items for Beginners

1. Liquidity

Below $50k → higher risk; below $10k → extremely high risk (possible rug pull)

2. FDV (Fully Diluted Valuation)

Allows investors to quickly judge whether the project’s current price is expensive or cheap.

For example:

- Market cap $5M, FDV $500M → limited room for price increase

- Market cap $5M, FDV $8M → possibly still in price discovery phase

3. Pair Explorer (Trading Pair Analysis)

Investors can see:

- Buy/sell ratio

- Trading volume in the last 5 minutes

- Whale address trading activity

When investors see continuous buys every 1 second → often bot volume wash

4. Token Info (Security Check)

The most overlooked yet most useful part of DEXTools.

Includes:

- Remaining permissions

- Whether Mint is possible

- Whether LP is locked

- Whether it is a Honeypot (cannot sell)

How to Quickly Judge Whether a Meme Coin’s Popularity Is “Real” or “Fake”?

Suppose an investor sees a coin rise 300% in one day. The investor needs to check these three items:

- 24h Volume ≥ 500k: If only 20k → fake popularity.

- Real-time buy/sell: Are only bots trading? If trades occur at regular intervals (one trade every 1 second) → wash volume.

- Top Buyers: Are there real users buying? If all top 20 are new addresses → likely a wash trading or fake pump.