Traditional Finance Meets Blockchain: Tokenization Is Reshaping Global Markets

Market Context:

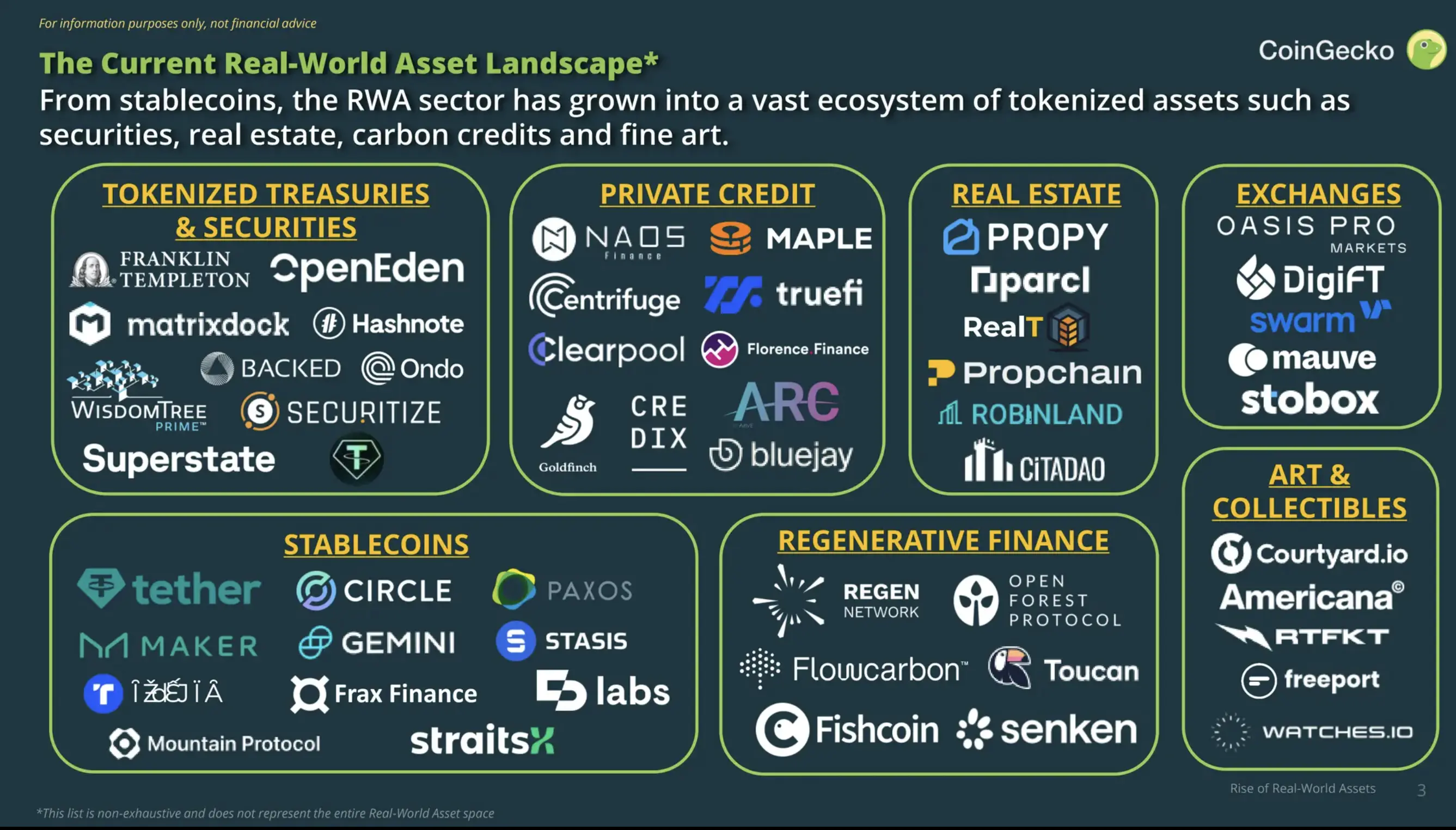

Major institutions like State Street, JPMorgan, and Goldman Sachs are no longer experimenting with blockchain—they’re actively launching digital asset platforms for tokenizing traditional financial products. From funds and bonds to treasuries, these assets are moving on-chain, enabling faster, cheaper, and more transparent financial transactions.

Analysis / Signal:

Tokenization is a systemic upgrade, not just a tech experiment. By digitizing assets, liquidity improves through fractional ownership, settlements happen in minutes instead of days, operational costs and reconciliation risks drop, and regulatory transparency is enhanced. For traders and investors, this signals a structural shift in financial infrastructure. Early adoption in tokenized products could create opportunities for efficient exposure to traditional markets with blockchain advantages.

Strategic Insight:

Dragon Fly Official observes that the next wave of financial innovation will come from institutions combining compliance with blockchain efficiency. Platforms like JPMorgan’s Onyx, Goldman Sachs tokenized funds, and State Street digital securities are proof that traditional finance is embracing Web3 capabilities. Positioning in tokenized ETFs, funds, or regulated digital bonds may be the first step in accessing this evolving ecosystem.

Actionable Takeaway:

Monitor institutional blockchain adoption closely. Consider allocating selectively into regulated tokenized products or infrastructure projects supporting asset digitization. This is where traditional market reliability meets blockchain efficiency, creating a new financial frontier.

#TraditionalFinanceAcceleratesTokenization

Market Context:

Major institutions like State Street, JPMorgan, and Goldman Sachs are no longer experimenting with blockchain—they’re actively launching digital asset platforms for tokenizing traditional financial products. From funds and bonds to treasuries, these assets are moving on-chain, enabling faster, cheaper, and more transparent financial transactions.

Analysis / Signal:

Tokenization is a systemic upgrade, not just a tech experiment. By digitizing assets, liquidity improves through fractional ownership, settlements happen in minutes instead of days, operational costs and reconciliation risks drop, and regulatory transparency is enhanced. For traders and investors, this signals a structural shift in financial infrastructure. Early adoption in tokenized products could create opportunities for efficient exposure to traditional markets with blockchain advantages.

Strategic Insight:

Dragon Fly Official observes that the next wave of financial innovation will come from institutions combining compliance with blockchain efficiency. Platforms like JPMorgan’s Onyx, Goldman Sachs tokenized funds, and State Street digital securities are proof that traditional finance is embracing Web3 capabilities. Positioning in tokenized ETFs, funds, or regulated digital bonds may be the first step in accessing this evolving ecosystem.

Actionable Takeaway:

Monitor institutional blockchain adoption closely. Consider allocating selectively into regulated tokenized products or infrastructure projects supporting asset digitization. This is where traditional market reliability meets blockchain efficiency, creating a new financial frontier.

#TraditionalFinanceAcceleratesTokenization