# SEConTokenizedSecurities

9.63K

The SEC confirmed tokenization doesn’t change securities regulation. Does this signal a more institution-friendly phase for RWA, and which sectors stand to benefit first?

HighAmbition

#SEConTokenizedSecurities

📌 Tokenized Securities, SEC Oversight, and Market Dynamics

The landscape of tokenized securities is evolving rapidly, with the U.S. SEC playing a central role in shaping both regulation and market behavior. Tokenized securities—digital representations of traditional financial instruments like stocks, bonds, or funds—are treated under existing securities laws, regardless of whether they exist natively on-chain or as digital representations. The SEC has made it clear that all legal obligations, including registration, disclosures, investor protections, and anti-fraud

📌 Tokenized Securities, SEC Oversight, and Market Dynamics

The landscape of tokenized securities is evolving rapidly, with the U.S. SEC playing a central role in shaping both regulation and market behavior. Tokenized securities—digital representations of traditional financial instruments like stocks, bonds, or funds—are treated under existing securities laws, regardless of whether they exist natively on-chain or as digital representations. The SEC has made it clear that all legal obligations, including registration, disclosures, investor protections, and anti-fraud

- Reward

- 17

- 20

- Repost

- Share

Falcon_Official :

:

Watching Closely 🔍️View More

#SEConTokenizedSecurities

The global financial landscape is rapidly evolving, and one of the most significant developments shaping its future is the rise of tokenized securities. Recently, the U.S. Securities and Exchange Commission (SEC) has taken notable steps to address this emerging trend, signaling a growing recognition of blockchain-based financial instruments within traditional regulatory frameworks. This move marks a critical moment for both institutional investors and the broader crypto ecosystem.

Tokenized securities are traditional financial assets—such as stocks, bonds, real estate

The global financial landscape is rapidly evolving, and one of the most significant developments shaping its future is the rise of tokenized securities. Recently, the U.S. Securities and Exchange Commission (SEC) has taken notable steps to address this emerging trend, signaling a growing recognition of blockchain-based financial instruments within traditional regulatory frameworks. This move marks a critical moment for both institutional investors and the broader crypto ecosystem.

Tokenized securities are traditional financial assets—such as stocks, bonds, real estate

- Reward

- 5

- 8

- Repost

- Share

Falcon_Official :

:

Watching Closely 🔍️View More

#SEConTokenizedSecurities

#SEConTokenizedSecurities

The global financial landscape is rapidly evolving, and one of the most significant developments shaping its future is the rise of tokenized securities. Recently, the U.S. Securities and Exchange Commission (SEC) has taken notable steps to address this emerging trend, signaling a growing recognition of blockchain-based financial instruments within traditional regulatory frameworks. This move marks a critical moment for both institutional investors and the broader crypto ecosystem.

Tokenized securities are traditional financial assets—such as

#SEConTokenizedSecurities

The global financial landscape is rapidly evolving, and one of the most significant developments shaping its future is the rise of tokenized securities. Recently, the U.S. Securities and Exchange Commission (SEC) has taken notable steps to address this emerging trend, signaling a growing recognition of blockchain-based financial instruments within traditional regulatory frameworks. This move marks a critical moment for both institutional investors and the broader crypto ecosystem.

Tokenized securities are traditional financial assets—such as

- Reward

- 4

- 6

- Repost

- Share

AylaShinex :

:

Ape In 🚀View More

🔥 TOKENIZATION CLARITY: WARNING OR GREEN LIGHT FOR RWA? 🏛️⛓️

The SEC has confirmed one key thing 👇

👉 Tokenization does NOT change securities regulation.

Same rules, same obligations — just a new wrapper.

At first glance, this sounds restrictive… but look closer 👀

This may actually mark the start of a more institution-friendly phase for RWA.

🧠 Why this is quietly bullish for institutions

Regulatory ambiguity is shrinking ⚖️

Institutions prefer clear rules over regulatory grey zones

Tokenization is being treated as infrastructure, not a loophole

This sends a strong signal:

💡 “Come build —

The SEC has confirmed one key thing 👇

👉 Tokenization does NOT change securities regulation.

Same rules, same obligations — just a new wrapper.

At first glance, this sounds restrictive… but look closer 👀

This may actually mark the start of a more institution-friendly phase for RWA.

🧠 Why this is quietly bullish for institutions

Regulatory ambiguity is shrinking ⚖️

Institutions prefer clear rules over regulatory grey zones

Tokenization is being treated as infrastructure, not a loophole

This sends a strong signal:

💡 “Come build —

- Reward

- 9

- 7

- Repost

- Share

DragonFlyOfficial :

:

💭 Regulation doesn’t kill innovation — it filters it. RWA with compliance attracts institutions; without it, it stays niche. I’m watching Treasuries + fund tokenization closely. Which RWA sector are you betting institutions will trust first? 👀👇View More

#SEConTokenizedSecurities

The growing attention of the U.S. Securities and Exchange Commission (SEC) toward tokenized securities signals a significant evolution in the way financial markets integrate blockchain-based innovation with traditional regulatory frameworks. Tokenized securities, which represent ownership in assets such as stocks, bonds, or funds via blockchain tokens, are becoming increasingly prominent as investors seek greater efficiency, transparency, and accessibility in financial markets. While the underlying assets remain traditional, the tokenized format leverages distributed

The growing attention of the U.S. Securities and Exchange Commission (SEC) toward tokenized securities signals a significant evolution in the way financial markets integrate blockchain-based innovation with traditional regulatory frameworks. Tokenized securities, which represent ownership in assets such as stocks, bonds, or funds via blockchain tokens, are becoming increasingly prominent as investors seek greater efficiency, transparency, and accessibility in financial markets. While the underlying assets remain traditional, the tokenized format leverages distributed

- Reward

- 3

- 6

- Repost

- Share

Falcon_Official :

:

DYOR 🤓View More

#SEConTokenizedSecurities

The increasing attention of the U.S. Securities and Exchange Commission (SEC) toward tokenized securities marks a significant evolution in the relationship between traditional finance and blockchain-based innovation. As financial markets explore digitization through distributed ledger technology, the SEC’s involvement reflects an effort to ensure that innovation progresses within a structured, transparent, and legally compliant framework.

Tokenized securities represent traditional financial instruments such as stocks, bonds, funds, or real-world assets that are issue

The increasing attention of the U.S. Securities and Exchange Commission (SEC) toward tokenized securities marks a significant evolution in the relationship between traditional finance and blockchain-based innovation. As financial markets explore digitization through distributed ledger technology, the SEC’s involvement reflects an effort to ensure that innovation progresses within a structured, transparent, and legally compliant framework.

Tokenized securities represent traditional financial instruments such as stocks, bonds, funds, or real-world assets that are issue

- Reward

- 4

- 6

- Repost

- Share

Falcon_Official :

:

1000x VIbes 🤑View More

#SEConTokenizedSecurities

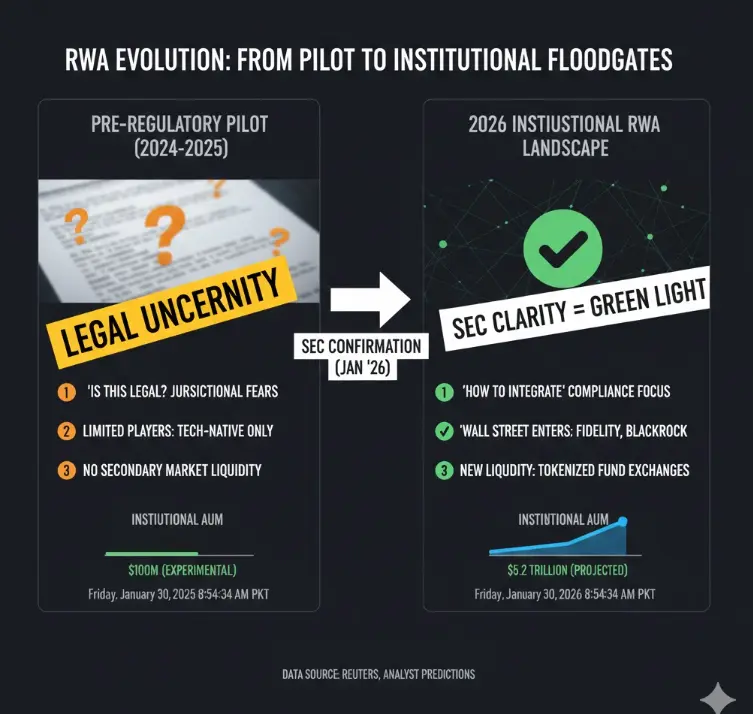

🏛️ SEC’s January 2026 Signal: The Green Light for Institutional RWAs

The SEC’s January 2026 clarification that tokenization does not change a security’s legal status is a double-edged sword — but for institutions, it’s mostly bullish.

By defining blockchain as record-keeping infrastructure, regulators removed the biggest blocker:

❌ “Is this legal?”

✅ “How do we plug this into compliance?”

This single shift de-risks the plumbing, not the asset — exactly what Wall Street needed.

🧩 Why This Is Institution-Friendly

🔹 Project Crypto (2026 Sandbox)

The SEC launched a de

🏛️ SEC’s January 2026 Signal: The Green Light for Institutional RWAs

The SEC’s January 2026 clarification that tokenization does not change a security’s legal status is a double-edged sword — but for institutions, it’s mostly bullish.

By defining blockchain as record-keeping infrastructure, regulators removed the biggest blocker:

❌ “Is this legal?”

✅ “How do we plug this into compliance?”

This single shift de-risks the plumbing, not the asset — exactly what Wall Street needed.

🧩 Why This Is Institution-Friendly

🔹 Project Crypto (2026 Sandbox)

The SEC launched a de

- Reward

- 5

- 4

- Repost

- Share

Falcon_Official :

:

HODL Tight 💪View More

#SEConTokenizedSecurities

#SEConTokenizedSecurities

The SEC stepping in on tokenized securities isn’t random — it’s inevitable.

As traditional assets move on-chain, the lines between legacy finance and digital infrastructure disappear. Tokenization doesn’t remove regulation; it forces regulators to confront how outdated frameworks apply to new technology.

The SEC’s stance makes one thing clear:

If a token represents equity, debt, yield, or ownership tied to an underlying asset, they’re going to treat it like a security — regardless of how modern the wrapper looks.

This isn’t an attack on inno

#SEConTokenizedSecurities

The SEC stepping in on tokenized securities isn’t random — it’s inevitable.

As traditional assets move on-chain, the lines between legacy finance and digital infrastructure disappear. Tokenization doesn’t remove regulation; it forces regulators to confront how outdated frameworks apply to new technology.

The SEC’s stance makes one thing clear:

If a token represents equity, debt, yield, or ownership tied to an underlying asset, they’re going to treat it like a security — regardless of how modern the wrapper looks.

This isn’t an attack on inno

- Reward

- 1

- Comment

- Repost

- Share

#SEConTokenizedSecurities

Regulation Is No Longer “If”, It’s “How”

The SEC’s increasing focus on tokenized securities marks a critical transition point for crypto markets. This is not a crackdown narrative — it’s a classification and control narrative. Regulators are no longer debating whether tokenization belongs in financial markets; they are defining under what rules it will exist.

1️⃣ Tokenization Has Moved Too Close to TradFi to Ignore

Tokenized securities now replicate core traditional instruments:

Equities

Bonds

Funds

Yield-bearing products

Once blockchain-based assets start mirroring

Regulation Is No Longer “If”, It’s “How”

The SEC’s increasing focus on tokenized securities marks a critical transition point for crypto markets. This is not a crackdown narrative — it’s a classification and control narrative. Regulators are no longer debating whether tokenization belongs in financial markets; they are defining under what rules it will exist.

1️⃣ Tokenization Has Moved Too Close to TradFi to Ignore

Tokenized securities now replicate core traditional instruments:

Equities

Bonds

Funds

Yield-bearing products

Once blockchain-based assets start mirroring

- Reward

- 1

- 1

- Repost

- Share

dragon_fly2 :

:

2026 GOGOGO 👊#SEConTokenizedSecurities

Regulation Is No Longer “If”, It’s “How”

The SEC’s increasing focus on tokenized securities marks a critical transition point for crypto markets. This is not a crackdown narrative — it’s a classification and control narrative. Regulators are no longer debating whether tokenization belongs in financial markets; they are defining under what rules it will exist.

1️⃣ Tokenization Has Moved Too Close to TradFi to Ignore

Tokenized securities now replicate core traditional instruments:

Equities

Bonds

Funds

Yield-bearing products

Once blockchain-based assets start mirroring

Regulation Is No Longer “If”, It’s “How”

The SEC’s increasing focus on tokenized securities marks a critical transition point for crypto markets. This is not a crackdown narrative — it’s a classification and control narrative. Regulators are no longer debating whether tokenization belongs in financial markets; they are defining under what rules it will exist.

1️⃣ Tokenization Has Moved Too Close to TradFi to Ignore

Tokenized securities now replicate core traditional instruments:

Equities

Bonds

Funds

Yield-bearing products

Once blockchain-based assets start mirroring

- Reward

- 6

- 7

- Repost

- Share

BabaJi :

:

2026 GOGOGO 👊View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

13.16K Popularity

29.46K Popularity

354.06K Popularity

32.66K Popularity

49.43K Popularity

2.87K Popularity

19.63K Popularity

9.34K Popularity

83.31K Popularity

30.19K Popularity

22.12K Popularity

27.01K Popularity

9.63K Popularity

16.69K Popularity

188.49K Popularity

News

View MoreThe United States announces the latest sanctions against Iran

6 m

Data: 2000 XAUt transferred from Tether to Abraxas Capital Mgmt (Heka Funds), valued at approximately $10.13 million

11 m

The USD/CHF breaks through 0.77, with an intraday increase of 0.81%

15 m

Data: Huang Licheng continues to increase positions in ETH and HYPE longs tonight, with new long positions worth nearly 5 million USD.

20 m

Data: 2440.67 PAXG transferred from an anonymous address, routed through intermediaries, and then flowed into Paxos.

33 m

Pin

Gate Square New & Returning Creator Rewards are ongoing!

Your ideas may be more valuable than you think!

Make your first post or come back post to share a $20,000 monthly prize pool!

Post with #MyFirstPostOnSquare to receive a $50 Position Voucher each

Monthly Top Posters and Top Engagers will each earn an extra $50 reward

Your crypto insights could inspire many—start creating today!

👉 https://www.gate.com/postGate Square “Creator Certification Incentive Program” — Recruiting Outstanding Creators!

Join now, share quality content, and compete for over $10,000 in monthly rewards.

How to Apply:

1️⃣ Open the App → Tap [Square] at the bottom → Click your [avatar] in the top right.

2️⃣ Tap [Get Certified], submit your application, and wait for approval.

Apply Now: https://www.gate.com/questionnaire/7159

Token rewards, exclusive Gate merch, and traffic exposure await you!

Details: https://www.gate.com/announcements/article/47889