Previsão de preço WHITE em 2025: Análise das tendências de mercado e do potencial futuro de valorização

Introdução: Posição de Mercado e Valor de Investimento da WHITE

A WhiteRock (WHITE), enquanto protocolo de ativos do mundo real, assume atualmente um papel central na tokenização de ativos financeiros tradicionais desde o seu lançamento. Até 2025, a capitalização de mercado da WhiteRock alcançou os 209,3 milhões $, com uma oferta circulante aproximada de 650 mil milhões de tokens e um preço em torno de 0,000322 $. Este ativo, apelidado de “ponte entre finanças tradicionais e blockchain”, está a transformar o acesso aos mercados financeiros globais.

Este artigo oferece uma análise detalhada das tendências de preço da WhiteRock entre 2025 e 2030, integrando padrões históricos, oferta e procura, evolução do ecossistema e fatores macroeconómicos, para apresentar previsões de preço profissionais e estratégias de investimento práticas para investidores.

I. Análise Histórica do Preço da WHITE e Estado Atual do Mercado

Evolução Histórica do Preço da WHITE

- 2025: Lançamento do protocolo WhiteRock, preço atingiu o máximo histórico (ATH) de 0,0027701 $ em 29 de maio

- 2025: Correção de mercado, preço desceu até ao mínimo histórico (ATL) de 0,0002197 $ em 8 de agosto

- 2025: Fase de recuperação, preço estabilizou por volta de 0,000322 $ a 24 de setembro

Situação Atual do Mercado WHITE

Em 24 de setembro de 2025, a WHITE negocia a 0,000322 $, com volume transacionado de 18 553,90 $ nas últimas 24 horas. O token registou um crescimento de 1,67 % nesse período, sinalizando dinâmica positiva a curto prazo. A médio e longo prazo, verificou-se uma queda acentuada, com uma diminuição de 18,52 % na última semana e uma retração de 21,27 % nos últimos 30 dias.

O valor atual de mercado da WHITE é de 209 300 000 $, ocupando a 287.ª posição entre todas as criptomoedas. Com uma oferta circulante de 650 mil milhões de tokens de um total de 1 bilião, a WHITE apresenta uma taxa de circulação de 65 %.

Apesar dos movimentos negativos recentes, a WHITE demonstrou um crescimento excecional ao longo do último ano, com uma valorização de 2147,72 %. Este desempenho evidencia o interesse sustentado dos investidores no modelo de tokenização de ativos do mundo real promovido pela WhiteRock.

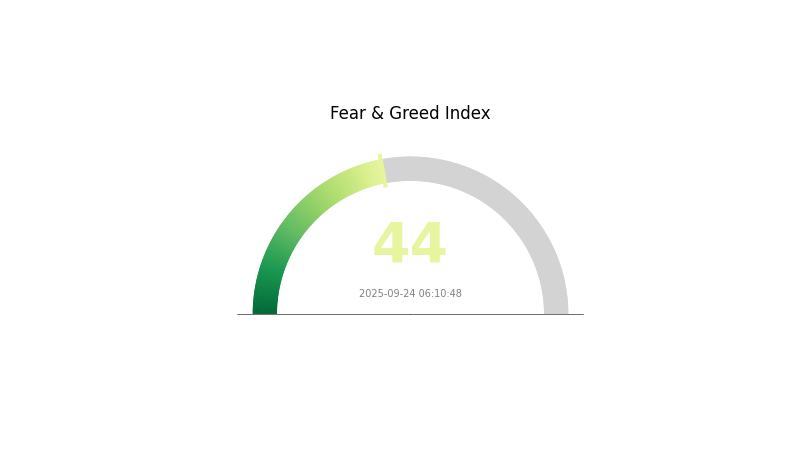

O sentimento de mercado para a WHITE encontra-se atualmente na zona de “Medo”, com um índice VIX de 44. Este quadro reflete a cautela dos investidores, justificada pelas recentes quedas de preço e pelo contexto geral do setor.

Clique para consultar o preço atual da WHITE no mercado

Indicador de Sentimento de Mercado WHITE

2025-09-24 Índice Fear & Greed: 44 (Medo)

Clique para consultar o Índice Fear & Greed atual

O mercado das criptomoedas atravessa um período de incerteza, refletido pelo valor 44 no Índice Fear & Greed. Este valor traduz uma postura cautelosa por parte dos investidores, sugerindo prudência nas decisões de mercado. Fases de medo podem constituir oportunidade para investidores de longo prazo, já que ativos tendem a estar subvalorizados nestes ciclos. Contudo, é imprescindível realizar uma análise rigorosa e uma avaliação dos riscos antes de investir. Recomendamos o acompanhamento dos principais desenvolvimentos e tendências do setor cripto.

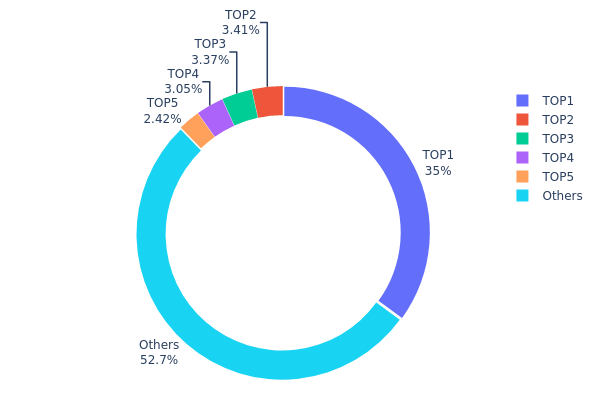

Distribuição das Posições de WHITE

A análise da distribuição dos endereços da WHITE revela uma forte concentração de tokens em poucas entidades. O maior endereço detém 35 % da oferta total, enquanto os quatro seguintes agregam mais 12,24 %. Esta concentração indica uma distribuição centralizada dos tokens WHITE.

Este padrão pode afetar a dinâmica do mercado. Grandes detentores (“baleias”) detêm capacidade para influenciar a volatilidade e a liquidez. Movimentações de tokens em larga escala por estes intervenientes podem provocar oscilações significativas nos preços. Adicionalmente, tal concentração suscita potenciais preocupações ao nível da manipulação de mercado, pois os principais detentores podem condicionar fortemente o valor e os volumes transacionados.

Do ponto de vista da estrutura de mercado, verifica-se uma descentralização limitada, já que 52,76 % dos tokens estão distribuídos por outros endereços, mas o peso dos grandes detentores fragiliza a estabilidade estrutural do token, tornando-o mais vulnerável a alterações súbitas caso decidam alterar a sua posição.

Clique para consultar a distribuição de posições da WHITE atual

| Top | Endereço | Quantidade | Percentagem |

|---|---|---|---|

| 1 | 0x7c6c...37d4e0 | 350 000 000,00 K | 35,00 % |

| 2 | 0x8bcc...3f585a | 34 084 266,27 K | 3,40 % |

| 3 | 0xe9c3...8decdd | 33 730 150,06 K | 3,37 % |

| 4 | 0x5fb7...aab294 | 30 534 826,30 K | 3,05 % |

| 5 | 0xc4d2...152f43 | 24 219 845,65 K | 2,42 % |

| - | Outros | 527 430 911,73 K | 52,76 % |

II. Fatores Principais que Influenciam o Preço Futuro da WHITE

Contexto Macroeconómico

- Impacto da Política Monetária: Os principais bancos centrais deverão manter políticas acomodatícias para sustentar a recuperação económica.

- Proteção contra a Inflação: A WHITE demonstra potencial como ativo de cobertura em ambiente de inflação crescente.

- Fatores Geopolíticos: A persistência de tensões internacionais e disputas comerciais continua a alterar a trajetória do preço da WHITE.

Desenvolvimento Tecnológico e Ampliação do Ecossistema

- Otimização do Blockchain: Melhorias técnicas na blockchain da WHITE poderão potenciar escalabilidade e novas funcionalidades.

- Aplicações do Ecossistema: O desenvolvimento de DApps e projetos dentro do ecossistema WHITE pode estimular adoção e gerar valor adicional.

III. Previsão do Preço da WHITE para 2025-2030

Perspetiva para 2025

- Previsão conservadora: 0,00022 $ – 0,00028 $

- Previsão neutra: 0,00028 $ – 0,00036 $

- Previsão otimista: 0,00036 $ – 0,00046 $ (dependente de forte adoção de mercado)

Perspetiva para 2026-2028

- Fase de mercado: Crescimento gradual e adoção alargada

- Previsões de preço:

- 2026: 0,00028 $ – 0,00048 $

- 2027: 0,00040 $ – 0,00051 $

- 2028: 0,00038 $ – 0,00066 $

- Catalisadores: Inovação tecnológica, parcerias estratégicas e evolução geral do mercado cripto

Perspetiva de Longo Prazo para 2029-2030

- Cenário base: 0,00052 $ – 0,00076 $ (crescimento estável do mercado)

- Cenário otimista: 0,00076 $ – 0,00098 $ (forte adoção e contexto favorável)

- Cenário transformador: Acima de 0,00098 $ (desenvolvimentos excecionalmente positivos no setor cripto)

- 2030-12-31: WHITE 0,00066 $ (preço médio estimado segundo previsões atuais)

| Ano | Máximo Previsto | Preço Médio Previsto | Mínimo Previsto | Variação (%) |

|---|---|---|---|---|

| 2025 | 0,00046 | 0,00032 | 0,00022 | 0 |

| 2026 | 0,00048 | 0,00039 | 0,00028 | 21 |

| 2027 | 0,00051 | 0,00044 | 0,00040 | 35 |

| 2028 | 0,00066 | 0,00047 | 0,00038 | 46 |

| 2029 | 0,00076 | 0,00057 | 0,00053 | 75 |

| 2030 | 0,00098 | 0,00066 | 0,00052 | 106 |

IV. Estratégias Profissionais de Investimento e Gestão de Risco para WHITE

Metodologia de Investimento para WHITE

(1) Estratégia de Detenção a Longo Prazo

- Destinada a: Investidores que pretendem exposição a ativos reais tokenizados

- Recomendações operacionais:

- Acumular WHITE em períodos de correção

- Manter a posição durante pelo menos 1 a 2 anos para maximizar o potencial de valorização

- Garanta armazenamento seguro dos tokens numa hardware wallet

(2) Estratégia de Negociação Ativa

- Ferramentas técnicas:

- Médias móveis: Monitorize as MAs de 50 e 200 dias para análise de tendência

- RSI: Utilize os níveis para identificar oportunidades de entrada e saída

- Pontos críticos para swing trading:

- Defina níveis de stop loss e take profit claros

- Acompanhe desenvolvimentos do projeto e anúncios de parcerias

Estrutura de Gestão de Risco para WHITE

(1) Princípios de Alocação de Ativos

- Investidores conservadores: 1–3 % da carteira cripto

- Investidores agressivos: 5–10 % da carteira cripto

- Profissionais: Até 15 % da carteira cripto

(2) Soluções de Proteção de Risco

- Diversificação: Invista em múltiplos projetos de ativos reais tokenizados

- Stop loss: Implemente para limitar perdas potenciais

(3) Soluções para Armazenamento Seguro

- Hardware wallet recomendada: Gate Web3 Wallet

- Armazenamento a frio: carteira em papel para depósito prolongado

- Medidas de segurança: Ative autenticação de dois fatores e utilize passwords fortes

V. Riscos e Desafios Potenciais para WHITE

Riscos de Mercado para WHITE

- Volatilidade: Flutuações acentuadas comuns em mercados cripto

- Liquidez: Potenciais obstáculos em operações de grande escala

- Concorrência: Surgimento de outras plataformas de ativos tokenizados

Riscos Regulatórios da WHITE

- Incerteza regulatória: Normativos globais em evolução sobre ativos tokenizados

- Desafios de conformidade: Cumprimento das leis em diferentes jurisdições

- Restrições potencialmente futuras: Limitações sobre negociação ou detenção de ativos tokenizados

Riscos Técnicos para WHITE

- Exposição a vulnerabilidades em smart contracts: Risco de exploits ou bugs

- Escalabilidade: Dificuldade em processar elevados volumes transacionais

- Complexidade de integração: Barreiras na ligação a sistemas financeiros convencionais

VI. Conclusão e Recomendações de Ação

Avaliação do Potencial de Investimento da WHITE

WHITE oferece valor sustentado a longo prazo como ponte entre a finança tradicional e o blockchain, embora riscos regulatórios e de volatilidade persistam no curto prazo.

Recomendações de Investimento para WHITE

✅ Iniciantes: Opte por posições reduzidas e fomente o conhecimento sobre ativos tokenizados ✅ Investidores experientes: Considere uma alocação moderada, monitorizando ativamente o projeto ✅ Institucionais: Explore parcerias e integração com operações financeiras existentes

Formas de Participação na Negociação de WHITE

- Negociação spot: Compre e detenha WHITE na Gate.com

- Staking: Participe em programas de staking do projeto, caso disponíveis

- Integração DeFi: Explore protocolos de finança descentralizada compatíveis com WHITE

O investimento em criptomoedas comporta riscos muito elevados. Este artigo não constitui aconselhamento financeiro. Os investidores devem tomar decisões de acordo com o seu perfil de risco, preferencialmente consultando profissionais da área. Nunca invista além do que pode suportar perder.

FAQ

Qual a previsão de preço para a ação Whitecap?

A ação Whitecap deverá registar um preço médio de 4,27 $ em 2025, com máximos de 6,21 $ e mínimos de 2,32 $.

Que criptomoeda tem a maior previsão de preço?

O Bitcoin (BTC) lidera as previsões de preço para 2025, seguido pela Ethereum (ETH), segundo tendências de mercado e análises especializadas.

Quais as previsões de preço para XRP em 2030?

O XRP poderá situar-se entre 4,67 $ e 26,97 $ em 2030, dependendo da adoção e da regulação. O valor de 10 $ é possível se houver forte envolvimento institucional e contexto favorável.

Qual a previsão de preço para a ação WC8 em 2025?

Prevê-se que a ação WC8 atinja um valor médio de 0,194 $ em 2025, com um intervalo possível entre 0,0653 $ e 0,320 $.

SIX vs QNT: Análise dos Indicadores de Desempenho de Duas Plataformas Líderes em Tecnologia Blockchain

EL vs HBAR: Análise Comparativa do Desempenho e Aplicações de Arquiteturas Distintas de Computação Quântica

Qual será o preço do ONDO em 2025? Análise das tendências históricas e das previsões de mercado

Previsão do Preço da BST para 2025: Análise das Tendências de Mercado e dos Principais Fatores de Crescimento

Previsão do preço do PLUME em 2025: Análise das tendências de mercado e dos fatores potenciais de crescimento para esta criptomoeda emergente

SIX Network (SIX): Vale a Pena Investir?: Avaliação do Potencial de Crescimento e das Tendências de Mercado na Infraestrutura da Economia Digital

Guia Completo sobre a emblemática Meme Coin digital dos Estados Unidos na Solana

Como investir com segurança em Meme Coins populares

O que é ZRC: Guia Abrangente sobre a Tecnologia de Compressão Zero-Knowledge Rollup