# BItcoin

6.62M

Dark_Angel

📉 #TariffTensionsHitCryptoMarket — 22 January 2026 Update

Global trade tensions, especially renewed US–EU tariff threats tied to the Greenland dispute, have pushed investors into risk-off mode — including in cryptocurrency markets. These tariff threats triggered volatility across stocks, bonds, and digital assets, causing sharp sell-offs and fear-driven trading early this week.

🔹 Bitcoin and major altcoins weakened as traders reduced risk exposure, with BTC sliding more than 7% at one point and broader crypto sell-offs intensifying.

🔹 Large liquidations were seen in leveraged crypto posit

Global trade tensions, especially renewed US–EU tariff threats tied to the Greenland dispute, have pushed investors into risk-off mode — including in cryptocurrency markets. These tariff threats triggered volatility across stocks, bonds, and digital assets, causing sharp sell-offs and fear-driven trading early this week.

🔹 Bitcoin and major altcoins weakened as traders reduced risk exposure, with BTC sliding more than 7% at one point and broader crypto sell-offs intensifying.

🔹 Large liquidations were seen in leveraged crypto posit

BTC0.82%

- Reward

- 1

- 3

- Repost

- Share

AYATTAC :

:

Happy New Year! 🤑View More

#CryptoMarketWatch

A Grounded Look at Crypto Prices, Market Psychology, and My Current View

The crypto market is currently in a phase where clarity is limited, but structure still exists. Bitcoin is trading near $91,600, while Ethereum is hovering around $3,170. These prices reflect pressure, yet they do not signal panic. The total crypto market capitalization remains close to $3.10 trillion, and Bitcoin dominance around 59% indicates that capital is consolidating in stronger assets rather than leaving the market.

Market Psychology Right Now

From my perspective, the market feels exhausted, not

A Grounded Look at Crypto Prices, Market Psychology, and My Current View

The crypto market is currently in a phase where clarity is limited, but structure still exists. Bitcoin is trading near $91,600, while Ethereum is hovering around $3,170. These prices reflect pressure, yet they do not signal panic. The total crypto market capitalization remains close to $3.10 trillion, and Bitcoin dominance around 59% indicates that capital is consolidating in stronger assets rather than leaving the market.

Market Psychology Right Now

From my perspective, the market feels exhausted, not

- Reward

- 4

- 4

- Repost

- Share

ybaser :

:

2026 GOGOGO 👊View More

🚀 $BTC Technical Update – Potential Rebound Zone Identified 🚀

Bitcoin ($BTC) is showing early signs of strength around $89,991.4, suggesting a potential rebound zone. Traders should monitor carefully as this level may offer a strategic entry point.

🔹 Buy Zone: $89,900 – $90,000

Entering within this range could position traders to capitalize on upward momentum while managing risk effectively.

🔹 Take Profit (TP) Targets:

TP1: $90,574.5 – first resistance level, ideal for partial profit booking.

TP2: $91,000 – psychological level, often attracts short-term traders.

TP3: $92,000 – strong resis

Bitcoin ($BTC) is showing early signs of strength around $89,991.4, suggesting a potential rebound zone. Traders should monitor carefully as this level may offer a strategic entry point.

🔹 Buy Zone: $89,900 – $90,000

Entering within this range could position traders to capitalize on upward momentum while managing risk effectively.

🔹 Take Profit (TP) Targets:

TP1: $90,574.5 – first resistance level, ideal for partial profit booking.

TP2: $91,000 – psychological level, often attracts short-term traders.

TP3: $92,000 – strong resis

BTC0.82%

- Reward

- 3

- 3

- Repost

- Share

HighAmbition :

:

2026 GOGOGO 👊View More

📊 #BitcoinAndETFNetInflows — Market Snapshot 🚀

Bitcoin spot ETFs are seeing a strong rebound in net inflows, signaling renewed institutional interest in the market. Recent inflow momentum suggests that large investors are reallocating capital back into Bitcoin through regulated ETF products.

🔍 Why this matters:

• Positive net inflows = more capital entering ETFs than leaving

• Indicates growing confidence from institutional players

• Often viewed as a bullish signal for Bitcoin’s medium- to long-term outlook

📈 Market Insight:

Sustained ETF inflows reduce circulating supply pressure and str

Bitcoin spot ETFs are seeing a strong rebound in net inflows, signaling renewed institutional interest in the market. Recent inflow momentum suggests that large investors are reallocating capital back into Bitcoin through regulated ETF products.

🔍 Why this matters:

• Positive net inflows = more capital entering ETFs than leaving

• Indicates growing confidence from institutional players

• Often viewed as a bullish signal for Bitcoin’s medium- to long-term outlook

📈 Market Insight:

Sustained ETF inflows reduce circulating supply pressure and str

BTC0.82%

MC:$3.43KHolders:1

0.00%

- Reward

- 5

- 3

- Repost

- Share

EagleEye :

:

Buy To Earn 💎View More

#TariffTensionsHitCryptoMarket

Renewed tariff threats are shaking global markets, pushing

investors into risk-off mode. After a brief surge, BTC saw a sharp pullback,

reminding traders how sensitive crypto still is to macro headlines. 📉

What’s happening? 🔹 Trade tension fears are

pressuring risk assets 🔹 Short-term sentiment

flipped fast after bullish momentum 🔹 Leverage and emotions

may be amplifying the move 🤔 Key question: Is the

market already pricing in escalating trade tensions, or is this just an

emotional overreaction to headlines? 🧠 Some see this as

healthy cooling before the

Renewed tariff threats are shaking global markets, pushing

investors into risk-off mode. After a brief surge, BTC saw a sharp pullback,

reminding traders how sensitive crypto still is to macro headlines. 📉

What’s happening? 🔹 Trade tension fears are

pressuring risk assets 🔹 Short-term sentiment

flipped fast after bullish momentum 🔹 Leverage and emotions

may be amplifying the move 🤔 Key question: Is the

market already pricing in escalating trade tensions, or is this just an

emotional overreaction to headlines? 🧠 Some see this as

healthy cooling before the

BTC0.82%

- Reward

- 3

- 3

- Repost

- Share

CryptoVortex :

:

Buy To Earn 💎View More

#CryptoMarketPullback

Smart Money Stays Calm

The crypto market is experiencing a healthy pullback — this is not panic, but part of the cycle. After significant upward movements, markets naturally cool down. Profit-taking, short-term fear, and liquidity adjustments often cause these dips. Historically, pullbacks shake out weak hands and pave the way for stronger movements.

🔍 What smart traders are watching:

- Key support zones rather than price noise

- Bitcoin dominance and volume confirmation

- On-chain data revealing long-term holders staying steady

📌 What this phase truly signifies: This

Smart Money Stays Calm

The crypto market is experiencing a healthy pullback — this is not panic, but part of the cycle. After significant upward movements, markets naturally cool down. Profit-taking, short-term fear, and liquidity adjustments often cause these dips. Historically, pullbacks shake out weak hands and pave the way for stronger movements.

🔍 What smart traders are watching:

- Key support zones rather than price noise

- Bitcoin dominance and volume confirmation

- On-chain data revealing long-term holders staying steady

📌 What this phase truly signifies: This

BTC0.82%

- Reward

- 5

- 5

- Repost

- Share

Peacefulheart :

:

2026 GOGOGO 👊View More

This is not fear, but sharp fluctuations in the macroeconomy.

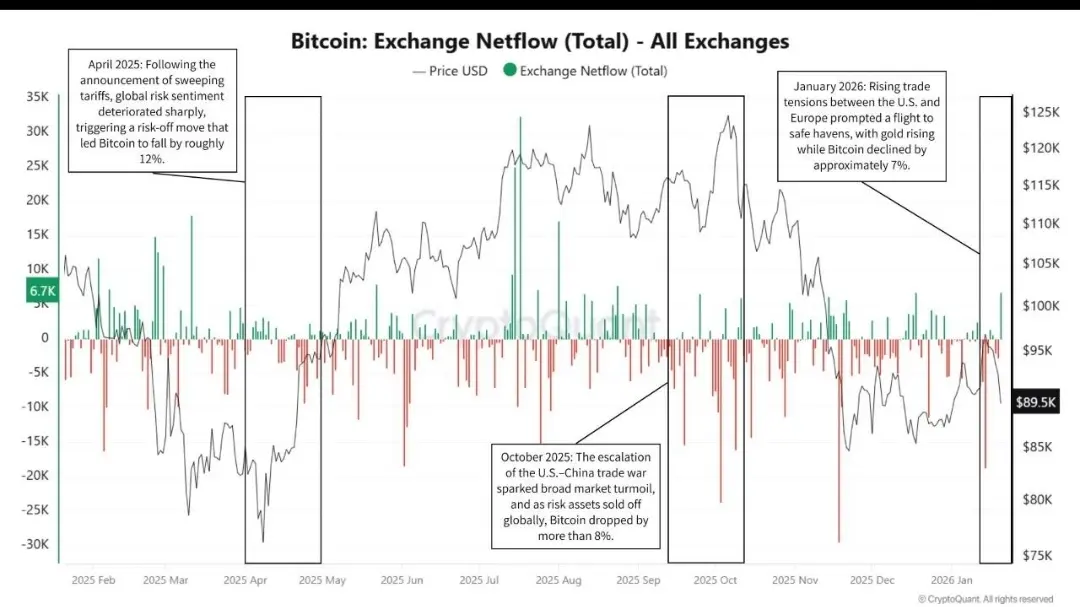

Every significant decline in #البيتكوين during 2025 and 2026 coincides with #tariff_ shocks and trade tensions.

April: Comprehensive tariffs = approximately 12% decrease in #BTCUSDT

October: Escalation of tensions between the US and China = approximately 8% decrease in #BTC

January: Trade risks between the US and the European Union = approximately 7% decrease in #Bitcoin

This illustrates how the market is currently handling Bitcoin: a risk-sensitive asset affected by growth, interest rates, and liquidity.

But here is the main po

View OriginalEvery significant decline in #البيتكوين during 2025 and 2026 coincides with #tariff_ shocks and trade tensions.

April: Comprehensive tariffs = approximately 12% decrease in #BTCUSDT

October: Escalation of tensions between the US and China = approximately 8% decrease in #BTC

January: Trade risks between the US and the European Union = approximately 7% decrease in #Bitcoin

This illustrates how the market is currently handling Bitcoin: a risk-sensitive asset affected by growth, interest rates, and liquidity.

But here is the main po

- Reward

- 2

- 1

- Repost

- Share

BasheerAlgundubi :

:

If cash flows stabilize, that will be another matter. Until then, it's just volatility resulting from political shocks... not the end of the cycle.#CryptoMarketWatch

A Grounded Look at Crypto Prices, Market Psychology, and My Current View

The crypto market is currently in a phase where clarity is limited, but structure still exists. Bitcoin is trading near $91,600, while Ethereum is hovering around $3,170. These prices reflect pressure, yet they do not signal panic. The total crypto market capitalization remains close to $3.10 trillion, and Bitcoin dominance around 59% indicates that capital is consolidating in stronger assets rather than leaving the market.

Market Psychology Right Now

From my perspective, the market feels exhausted, not

A Grounded Look at Crypto Prices, Market Psychology, and My Current View

The crypto market is currently in a phase where clarity is limited, but structure still exists. Bitcoin is trading near $91,600, while Ethereum is hovering around $3,170. These prices reflect pressure, yet they do not signal panic. The total crypto market capitalization remains close to $3.10 trillion, and Bitcoin dominance around 59% indicates that capital is consolidating in stronger assets rather than leaving the market.

Market Psychology Right Now

From my perspective, the market feels exhausted, not

- Reward

- 3

- 2

- Repost

- Share

GateUser-0749e41e :

:

bshau whajwnwsuw wsView More

📊 #BTC/ETHVolatilityIntensifies | Crypto Market Update ⚡

Bitcoin (BTC) and Ethereum (ETH) are experiencing heightened volatility as markets react to macro events, ETF flows, and profit-taking rotations. Price swings have intensified, testing both support and resistance levels across key trading zones.

🔍 Market Highlights:

• BTC: Consolidating near critical support zones; short-term swings driven by ETF inflows and macro sentiment

• ETH: Showing increased correlation with BTC, but with sharper intraday moves due to DeFi and staking news

• Volatility indicators: Rising, signaling potential opp

Bitcoin (BTC) and Ethereum (ETH) are experiencing heightened volatility as markets react to macro events, ETF flows, and profit-taking rotations. Price swings have intensified, testing both support and resistance levels across key trading zones.

🔍 Market Highlights:

• BTC: Consolidating near critical support zones; short-term swings driven by ETF inflows and macro sentiment

• ETH: Showing increased correlation with BTC, but with sharper intraday moves due to DeFi and staking news

• Volatility indicators: Rising, signaling potential opp

ETH1.56%

MC:$3.43KHolders:1

0.00%

- Reward

- 2

- 2

- Repost

- Share

HighAmbition :

:

2026 GOGOGO 👊View More

#CryptoMarketPullback

Rising trade concerns are

weighing on global markets, and crypto is feeling the pressure. BTC and

major altcoins have moved lower, signaling weaker short-term risk

appetite across the board.

🔍 What does this pullback mean?

🔹 A defensive shift as traders reduce exposure

🔹 Macro uncertainty driving caution in risk assets

🔹 Short-term weakness after recent volatility

🤔 The big question:

Is this just a defensive phase to reset the market, or a setup for

the next rebound once fear fades?

📊 Dip buyers are watching key support levels.

🧠 Patient traders are waiting for c

Rising trade concerns are

weighing on global markets, and crypto is feeling the pressure. BTC and

major altcoins have moved lower, signaling weaker short-term risk

appetite across the board.

🔍 What does this pullback mean?

🔹 A defensive shift as traders reduce exposure

🔹 Macro uncertainty driving caution in risk assets

🔹 Short-term weakness after recent volatility

🤔 The big question:

Is this just a defensive phase to reset the market, or a setup for

the next rebound once fear fades?

📊 Dip buyers are watching key support levels.

🧠 Patient traders are waiting for c

BTC0.82%

- Reward

- 1

- 3

- Repost

- Share

CryptoVortex :

:

Buy To Earn 💎View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

50.93K Popularity

32.41K Popularity

17.29K Popularity

63.84K Popularity

345.96K Popularity

10.95K Popularity

9.89K Popularity

18.77K Popularity

109.7K Popularity

25.2K Popularity

204.43K Popularity

19.79K Popularity

6.83K Popularity

15.95K Popularity

155.43K Popularity

News

View MoreElon Musk: X will upgrade its AI recommendation system, and ad delivery will be based on user interests

5 m

Bitcoin Policy Institute, Fedi, and Cornell University will jointly research American public opinions on financial privacy.

11 m

Gate Launchpool Episode 357 will feature Seeker(SKR). Stake BTC or USDT to share a 10 million SKR airdrop.

19 m

"Strategy Opponent Position" increased DASH short position, with a single coin floating profit of $860,000

24 m

South Korean prosecutors lose a large amount of seized Bitcoin, with losses potentially reaching $48 million

25 m

Pin

Strike Gold by Sharing Your TradFi Orders and Pictures!

Post on Gate Square and split $10,000 in rewards!

The TradFi Gold Lucky Bag is now live—1g of real gold every 10 minutes. Trade nonstop, win nonstop!

👉 https://www.gate.com/announcements/article/49357

🎁 50 lucky winners × $200 Position Vouchers ($10 × 20 leverage)

How to Join:

1️⃣ Post your order on Square with #GateTradFi1gGoldGiveaway, including:

A trade or draw screenshot

A brief experience sharing

2️⃣ Or create a related image (AI creation allowed) with a short promo line, such as:

Get gold on Gate App — 1g every 10 minutes!

⏰ Jan 2Gate Square New & Returning Creator Rewards are ongoing!

Your ideas may be more valuable than you think!

Make your first post or come back post to share a $20,000 monthly prize pool!

Post with #MyFirstPostOnSquare to receive a $50 Position Voucher each

Monthly Top Posters and Top Engagers will each earn an extra $50 reward

Your crypto insights could inspire many—start creating today!

👉 https://www.gate.com/postGate Square “Creator Certification Incentive Program” — Recruiting Outstanding Creators!

Join now, share quality content, and compete for over $10,000 in monthly rewards.

How to Apply:

1️⃣ Open the App → Tap [Square] at the bottom → Click your [avatar] in the top right.

2️⃣ Tap [Get Certified], submit your application, and wait for approval.

Apply Now: https://www.gate.com/questionnaire/7159

Token rewards, exclusive Gate merch, and traffic exposure await you!

Details: https://www.gate.com/announcements/article/47889