Gate Daily (February 10): Jump Trading acquires equity in Polymarket; MicroStrategy adds 1,142 Bitcoins

Bitcoin (BTC) continues its sluggish trend, currently around $70,050 as of February 10. Jump Trading will provide liquidity in exchange for a small stake in Kalshi and Polymarket, similar to venture capital arrangements. MicroStrategy increased its holdings by 1,142 BTC last week, and BitMine has accumulated a total of 40,000 ETH.

Macro Events & Crypto Hotspots

- According to Bloomberg, market maker Jump Trading is about to provide liquidity to prediction market platforms in exchange for small equity stakes in Kalshi Inc. and Polymarket. Sources reveal that Jump’s agreement with Kalshi will involve a fixed equity stake, while its share in Polymarket will increase over time based on trading volume in the U.S. market. This move allows Jump to acquire stakes in these two prediction platforms. Currently, Polymarket is valued at approximately $9 billion, and Kalshi at about $11 billion.

These types of market-making agreements are similar to venture capital arrangements, where Jump provides trading resources in exchange for equity. Prediction markets rely on market makers to provide liquidity and take on counterparty risk. Jump’s entry into prediction markets is part of its expansion beyond traditional assets like stocks. The company has reportedly increased staffing and resources to develop technology supporting event contract trading regulated by the CFTC, with over 20 employees dedicated to this business.

-

MicroStrategy added 1,142 BTC last week, totaling about $90 million at an average price of approximately $78,815. As of February 8, 2026, the company holds 714,644 BTC, worth roughly $54.35 billion, with an average price of about $76,056.

-

According to on-chain analyst Yu Jin monitoring, Bitmine purchased 40,000 ETH on February 10, worth approximately $83.38 million. This includes 20,000 ETH previously detected from FalconX.

News Highlights

-

Bitmine has accumulated a total of 40,000 ETH today, worth about $83.38 million.

-

Trump sets a 15% growth target; Waller’s entry into the Federal Reserve could increase pressure.

-

Federal Reserve Governor Waller: The Fed will launch a “Simplified Main Account” this year.

-

Federal Reserve Governor Waller: The crypto frenzy triggered by Trump may be waning.

-

Bloomberg: Stripe’s valuation could reach $140 billion in a new funding round.

-

Jump Trading will provide liquidity in exchange for small stakes in Kalshi and Polymarket.

-

Insider sources: Backpack is in talks to raise funds at a $1 billion valuation.

-

CME has launched futures for Cardano, Chainlink, and Stellar.

-

Last week, global listed companies net bought $92.83 million worth of BTC, down 24.5% quarter-over-quarter.

-

MegaETH is live on the mainnet, with the launch of the ecosystem front-end interface The Rabbithole.

Market Trends

-

Latest Bitcoin news: BTC continues its sluggish trend, currently around $70,050. In the past 24 hours, liquidations exceeded $125 million, mainly long positions; the majority of liquidations are longs.

-

U.S. stocks closed higher on February 9, with tech stocks stabilizing after last week’s AI bubble concerns, boosting market confidence. The Dow Jones Industrial Average rose 20.20 points, or 0.04%, to 50,135.87, hitting a new all-time high. The S&P 500 increased by 32.52 points, or 0.5%, to 6,964.82, just shy of its late-January record of 6,978.60. The Nasdaq Composite performed the strongest, up 207.46 points, or 0.9%, to 23,238.67.

(Source: Gate)

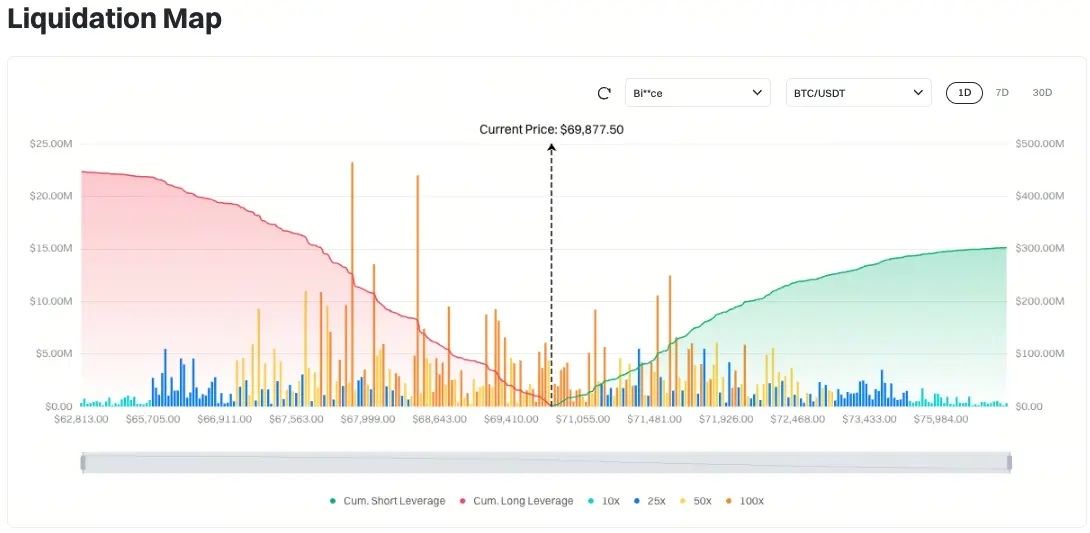

- According to Gate’s BTC/USDT liquidation map, with the current price at $69,877.50, if it drops to around $67,948, total long liquidations will exceed $251 million; if it rises to around $71,548, total short liquidations will exceed $119 million. Short liquidations are significantly lower than longs; investors should control leverage ratios to avoid large-scale liquidations during market swings.

(Source: Coinglass)

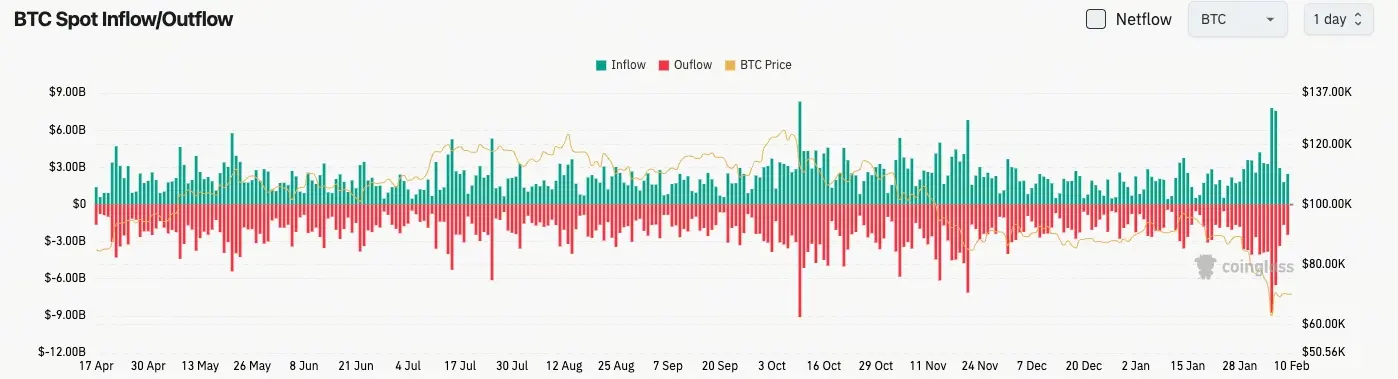

- In the past 24 hours, spot inflow was $2.46 billion, outflow $2.45 billion, resulting in a net inflow of $0.1 billion.

(Source: Coinglass)

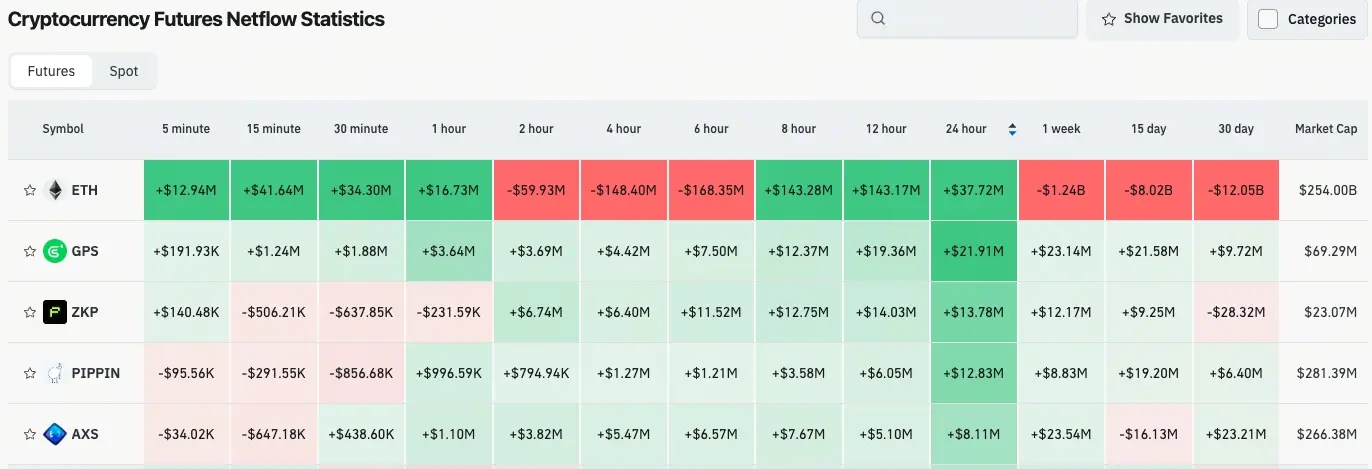

- Over the past 24 hours, net outflows in contracts for $ETH, $GPS, $ZKP, $PIPPIN, $AXS, among others, indicate trading opportunities.

X KOL Selected Opinions

Phyrex Ni (@Phyrex_Ni): “Monday isn’t very peaceful. Japan and China both have some influence on the US economy. After Shinzo Abe’s victory, China started reducing its US debt exposure. Although risk markets are somewhat volatile, the impact seems limited. US stocks shifted from a gap down to gains, boosting BTC back above $70,000. Currently, market sentiment is still healthy.”

“This decline has no clear reason yet; we need to watch more data. US stocks remain resilient. Cryptocurrencies tend to move in tandem with stocks, especially tech stocks, but the synchronization is on different levels. Due to liquidity issues, the previous pattern of sharper drops and stronger rallies has turned into sharper drops and weaker rallies.”

“The S&P 500 is nearly back to new highs, while Bitcoin is still down 40%. To break this situation, either the crypto industry needs stronger stimuli or liquidity needs to recover. If market expectations of liquidity returning are correct, such as significant rate cuts, that would be positive for crypto.”

“Looking at Bitcoin data, the turnover today isn’t very high, and investor sentiment remains restrained. Although there was some volatility during the day, panic didn’t set in. Crypto investors’ psychological resilience is strong. Currently, turnover is mainly from short-term investors; early investors haven’t shown much activity. The chip structure is very stable, which is a major difference from previous cycles. If early losses had led to large-scale participation in trading, the $60,000 level might not hold. But now, it seems healthy.”

Today’s Outlook

-

China’s M2 money supply (annual rate) at the end of January, previous value 8.5%.

-

US December retail sales (month-over-month), previous value 0.6%.

Related Articles

Bitcoin Price Dip to $35K? Familiar BTC Pattern Reveals Crash Isn’t Over

Morgan Stanley Initiates Bitcoin Miner Coverage, Rates Cipher and TeraWulf Overweight, Marathon Underweight

Data: 642.06 BTC transferred from an anonymous address, worth approximately 44.22 million USD

Bitcoin whale sell-off repeats FTX collapse history! 8 days of dumping 81,068 coins, panic spreading

Korea's CEX mistakenly sent $43 billion worth of Bitcoin, and financial regulators are investigating domestic digital asset platforms.