Should IBIT really take the blame for Bitcoin's sharp decline?

Writing by: ChandlerZ, Foresight News

When the market experiences a sharp decline, narratives tend to quickly seek a recognizable source.

Recently, discussions have intensified around the crash on February 5 and the near $10,000 rebound on February 6. Jeff Park, advisor to Bitwise and Chief Investment Officer of ProCap, believes that this volatility is more closely linked to the Bitcoin spot ETF system than outsiders have imagined, with key clues concentrated in the secondary market and options market of BlackRock’s iShares Bitcoin Trust (IBIT).

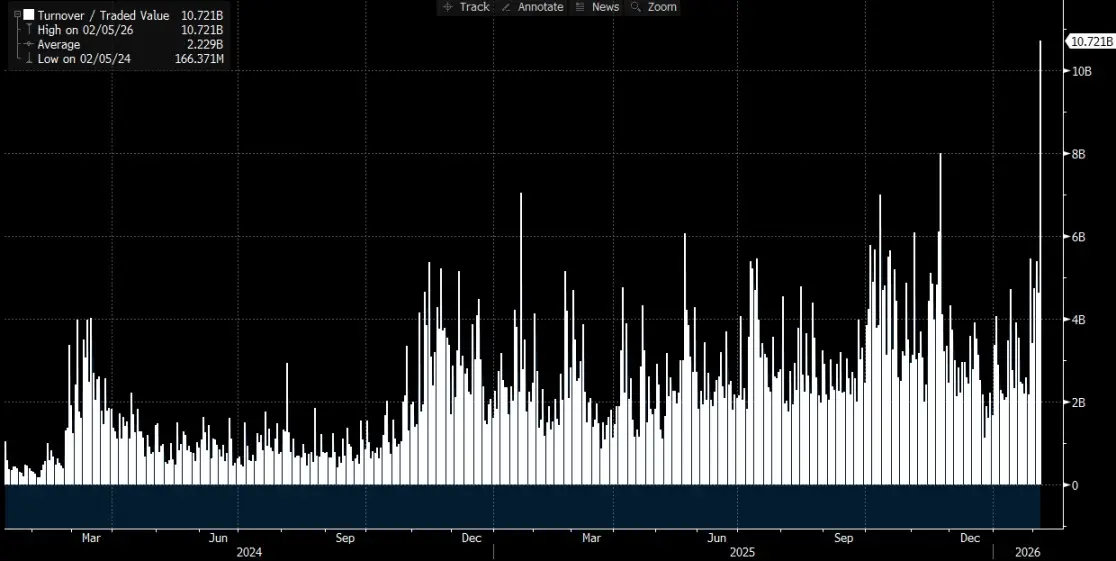

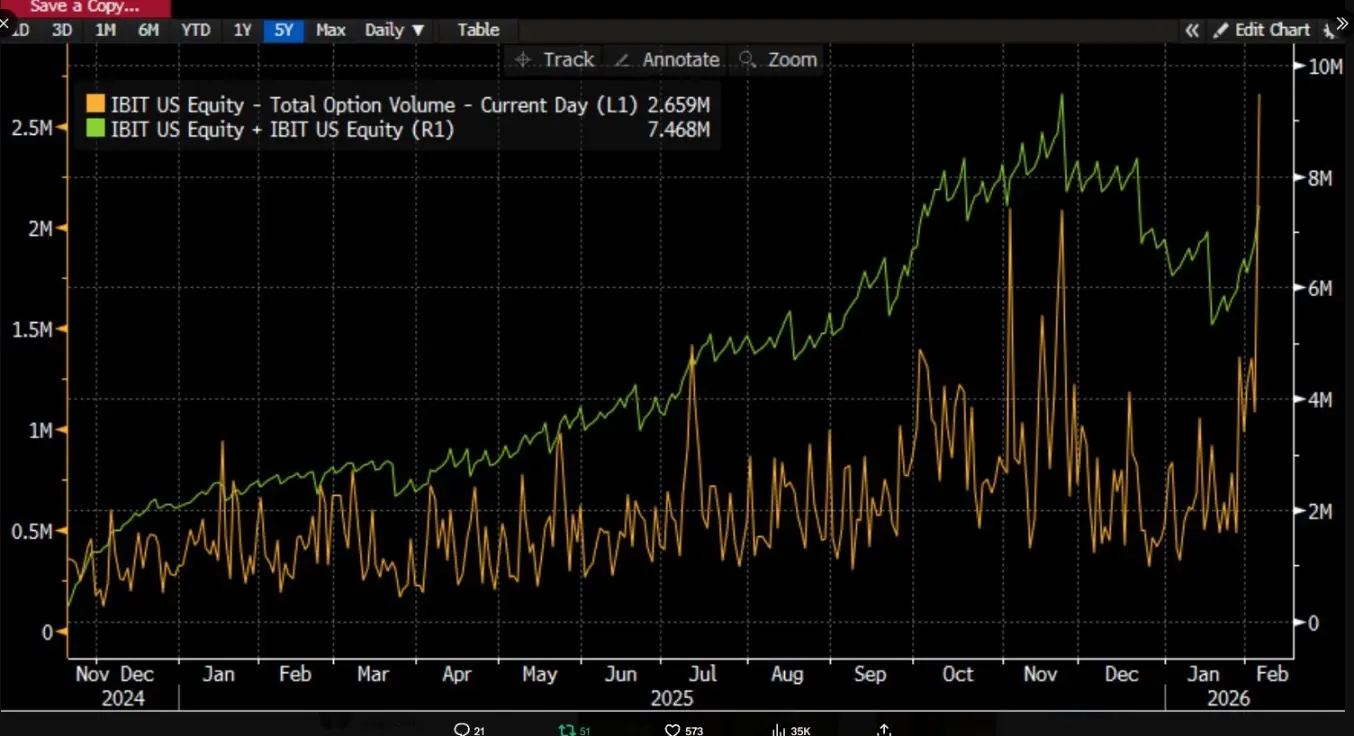

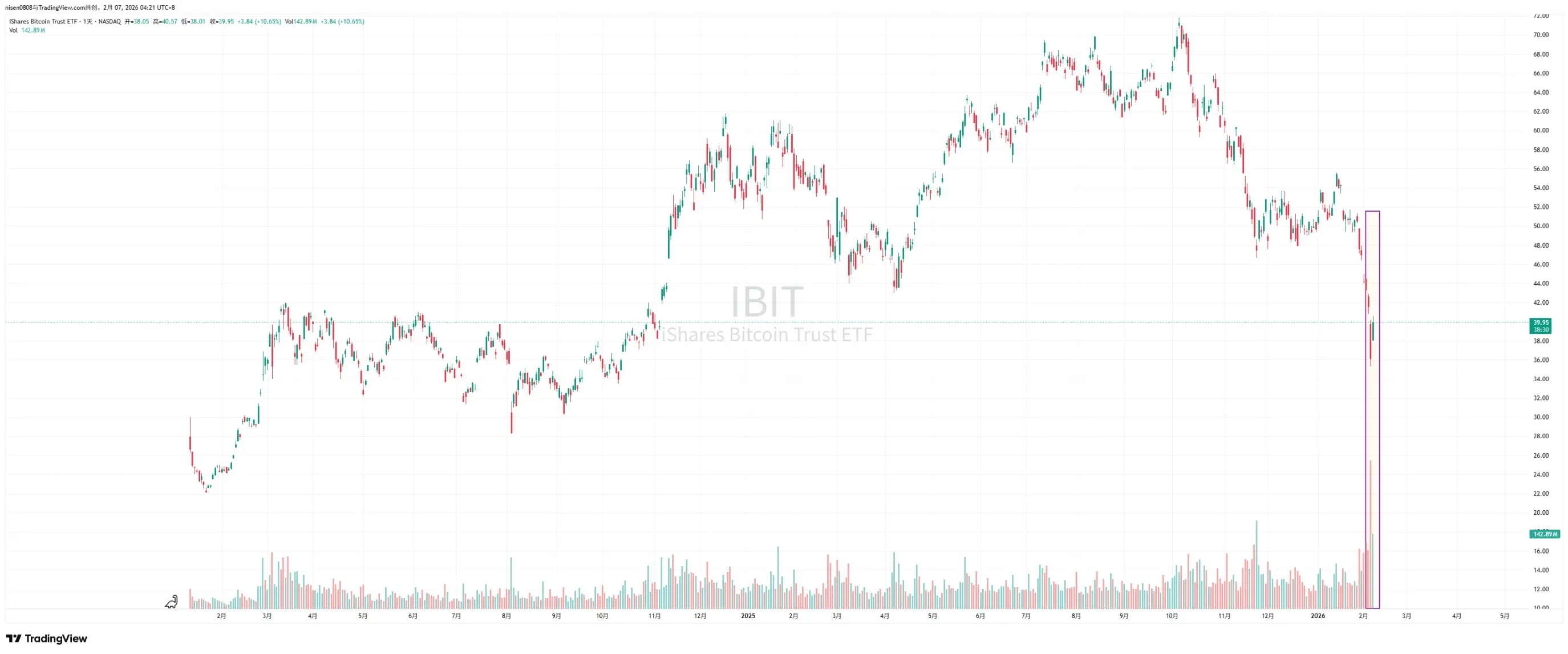

He pointed out that on February 5, IBIT saw record-breaking trading volume and options activity, with transaction sizes significantly higher than usual, and the options structure skewed toward puts. Counterintuitively, based on historical experience, if a price drops two digits in a single day, the market usually sees clear net redemptions and capital outflows. However, the opposite occurred. IBIT experienced net creation, with new shares pushing the size higher, and the entire spot ETF portfolio also saw net inflows.

Jeff Park believes that this combination of “sharp decline and net creation” weakens the explanation that ETF investors’ panic redemptions caused the decline. Instead, it aligns more with internal de-leveraging and risk reduction within the traditional financial system, where traders, market makers, and multi-asset portfolios are forced to reduce risk through derivatives and hedging frameworks. The selling pressure mainly stems from position adjustments and hedge chain squeezes within the paper capital system, ultimately transmitting shocks to Bitcoin prices through IBIT’s secondary market trading and options hedging.

Many market discussions tend to directly link IBIT institutional liquidations with the market’s plunge, but if the causal chain isn’t broken down into mechanism details, the sequence can be reversed. The secondary market trading of ETFs involves ETF shares, while primary market creation and redemption relate to changes in BTC held in custody. Mapping secondary market trading volume directly to equivalent spot sales lacks several necessary explanatory steps.

The so-called “IBIT triggering large-scale liquidations” debate is actually about the transmission path

The controversy around IBIT mainly concerns which layer of the ETF market, and through what mechanism, transmits pressure to the BTC price formation endpoint.

A more common narrative focuses on net outflows in the primary market. Its intuition is straightforward: if ETF investors panic and redeem, the issuer or authorized participants (APs) need to sell underlying BTC to meet redemption demands, putting selling pressure into the spot market, which causes prices to fall further and trigger liquidations, creating a cascade.

This logic sounds complete but often overlooks a fact. Ordinary investors and most institutions cannot directly subscribe or redeem ETF shares; only authorized participants can create and redeem in the primary market. The so-called “daily net inflows and outflows” generally refer to changes in total ETF share count, while secondary market trading, no matter how large, only changes the holder composition, not the total share count, nor does it automatically cause changes in the custody BTC holdings.

Analyst Phyrex Ni states that what Parker refers to as liquidation is actually the liquidation of IBIT’s spot ETF, not Bitcoin itself. For IBIT, the only trading in the secondary market involves IBIT shares, which are anchored to BTC prices, but the trading activity itself only occurs within the securities market.

The actual link to BTC only occurs at the primary market, i.e., during creation and redemption of shares, and this process is executed by APs (which can be understood as market makers). During creation, new IBIT shares require APs to provide corresponding BTC or cash, with BTC entering the custody system under regulatory constraints. The issuer and related institutions cannot freely use these assets. During redemption, the custodian delivers BTC to the AP, who then handles subsequent disposal and settlement of redemption funds.

ETFs are essentially two-tier markets. The primary market mainly involves buying and redeeming Bitcoin, with APs providing most of the liquidity. This is similar to generating USDC using USD, and since APs rarely circulate BTC through exchanges, the main purpose of spot ETF buying is to lock in Bitcoin’s liquidity.

Even in redemption scenarios, APs’ selling actions may not need to go through public markets, especially not through spot exchanges. APs may hold inventory BTC themselves or complete delivery and settlement within a T+1 window using more flexible methods. Therefore, even during the large-scale liquidation on January 5, the BTC redeemed by BlackRock investors was less than 3,000 coins, and total BTC redeemed across all U.S. spot ETF institutions was under 6,000 coins. This means the maximum amount of Bitcoin sold by ETF institutions to the market was about 6,000 coins, and not all of these necessarily moved to exchanges.

The liquidation Parker refers to in IBIT actually occurred in the secondary market, with a total trading volume of about $10.7 billion, the largest in IBIT’s history, which indeed triggered some institutional liquidations. However, it’s important to note that this liquidation was only IBIT’s, not Bitcoin’s. At least, this liquidation did not transmit to IBIT’s primary market.

Thus, the sharp decline in Bitcoin was merely a trigger for IBIT’s liquidation, not a Bitcoin liquidation caused by IBIT. The ETF’s secondary market trading targets are still ETF shares, with BTC only serving as the price anchor. The most impactful market effect would come from primary market sales of BTC, which could trigger liquidations, rather than IBIT itself. Although Bitcoin’s price dropped over 14% on Thursday, the net outflow from Bitcoin ETFs was only 0.46%. On that day, the total BTC held in spot ETFs was 1,273,280 coins, with a total outflow of 5,952 coins.

Transmission from IBIT to Spot Market

@MrluanluanOP believes that when IBIT long positions are liquidated, secondary market selling concentrates, and if natural market buy support is insufficient, IBIT may trade at a discount relative to its implied net asset value (NAV). The larger the discount, the greater the arbitrage opportunity, motivating APs and market arbitrageurs to buy discounted IBIT, as this is their usual profit-making method. As long as the discount sufficiently covers costs, professional funds will be willing to take on the position, alleviating concerns about “no buyers for the sell pressure.”

However, after taking on the discounted IBIT, the issue shifts to risk management. APs cannot immediately convert these shares into cash at current prices; redemption involves time and procedural costs. During this period, BTC and IBIT prices may fluctuate, and APs face net exposure risk, prompting immediate hedging. Hedging could involve selling spot inventory or opening short positions in the futures market.

If hedging involves spot sales, it directly depresses spot prices; if it involves futures shorting, it first manifests as price spreads and basis changes, which then influence the spot market through quant strategies, arbitrage, or cross-market trading.

Once hedging is complete, APs hold a relatively neutral or fully hedged position, allowing them to choose when to process the IBIT position more flexibly. One option is to redeem from the issuer on the same day, which will show up as redemptions and net outflows in official after-hours data. Alternatively, they can choose not to redeem immediately, wait for secondary market sentiment or prices to recover, and then sell IBIT directly back into the market, completing the transaction without primary market involvement. If the next day IBIT recovers to a premium or the discount narrows, APs can sell their holdings in the secondary market for profit, while also closing out previous futures short positions or replenishing previously sold spot inventory.

Even if the final share handling mainly occurs in the secondary market, and the primary market does not show significant net redemptions, the transmission to BTC can still occur. This is because the hedging actions taken by APs when absorbing discounted positions transfer pressure to BTC’s spot or derivatives markets, creating a chain where IBIT secondary market sell pressure, through hedging behavior, spills over into the BTC market.

Related Articles

Bitcoin Price Dip to $35K? Familiar BTC Pattern Reveals Crash Isn’t Over

Morgan Stanley Initiates Bitcoin Miner Coverage, Rates Cipher and TeraWulf Overweight, Marathon Underweight

Data: 642.06 BTC transferred from an anonymous address, worth approximately 44.22 million USD

Bitcoin whale sell-off repeats FTX collapse history! 8 days of dumping 81,068 coins, panic spreading

Korea's CEX mistakenly sent $43 billion worth of Bitcoin, and financial regulators are investigating domestic digital asset platforms.