Strategy CEO Phong Le: Bitcoin's fundamentals in 2025 are "unprecedentedly strong," calling for a long-term perspective

40m ago

2025 Cryptocurrency-Related Stock Market: Mining Hash Rate Stocks Surge, Token Concept Stocks Plummet

2h ago

Trending Topics

View More133.34K Popularity

2.68K Popularity

46.01K Popularity

1.33K Popularity

529 Popularity

Hot Gate Fun

View More- MC:$3.61KHolders:10.00%

- MC:$3.61KHolders:10.00%

- MC:$3.61KHolders:10.00%

- MC:$3.61KHolders:10.00%

- MC:$3.62KHolders:10.00%

Pin

🎉 Share Your 2025 Year-End Summary & Win $10,000 Sharing Rewards!

Reflect on your year with Gate and share your report on Square for a chance to win $10,000!

👇 How to Join:

1️⃣ Click to check your Year-End Summary: https://www.gate.com/competition/your-year-in-review-2025

2️⃣ After viewing, share it on social media or Gate Square using the "Share" button

3️⃣ Invite friends to like, comment, and share. More interactions, higher chances of winning!

🎁 Generous Prizes:

1️⃣ Daily Lucky Winner: 1 winner per day gets $30 GT, a branded hoodie, and a Gate × Red Bull tumbler

2️⃣ Lucky Share Draw: 10🔥 Gate Square Event | #PostToWinLaunchpadKDK 🔥

KDK | The latest Gate Launchpad spotlight token

Before: stake USDT to join

Now 👉 just post for a chance to win KDK!

🎁 Gate Square exclusive: 2,000 KDK total rewards up for grabs

🚀 Launchpad star project — big potential ahead 👀

📅 Event Duration

Dec 19, 04:00 – Dec 30, 16:00 (UTC)

📌 How to Join

Post on Gate Square (text, images, analysis, or opinions)

Content should relate to KDK price predictions at launch, project insights, or your understanding of the Gate Launchpad mechanism

Add one hashtag: #发帖赢Launchpad新币KDK 或 #PostToWinLaunchpadKDK

�🎨 Gate AI Creation Contest | One Sentence, Draw Your 2026

On Gate Square, anyone can be a visual creator — truly zero barriers to entry.

With just one sentence, generate an image and bring your vision of 2026 to life.

Create and post your work using Gate Square AI Creation for a chance to win the Gate Year of the Horse New Year Gift Box.

📅 Duration

Dec 17, 2025, 10:00 – Jan 3, 2026, 18:00 UTC

🎯 How to Join

1. Go to Gate Square → Create Post → AI Creation

2. Enter one sentence to generate your image

3. Post with #GateAICreation

🏆 Rewards

5 winners: Gate Year of the Horse New Year

CryptoQuant asserts "The bear market has arrived"! Bitcoin demand momentum has cooled off, possibly testing the $70,000 level again.

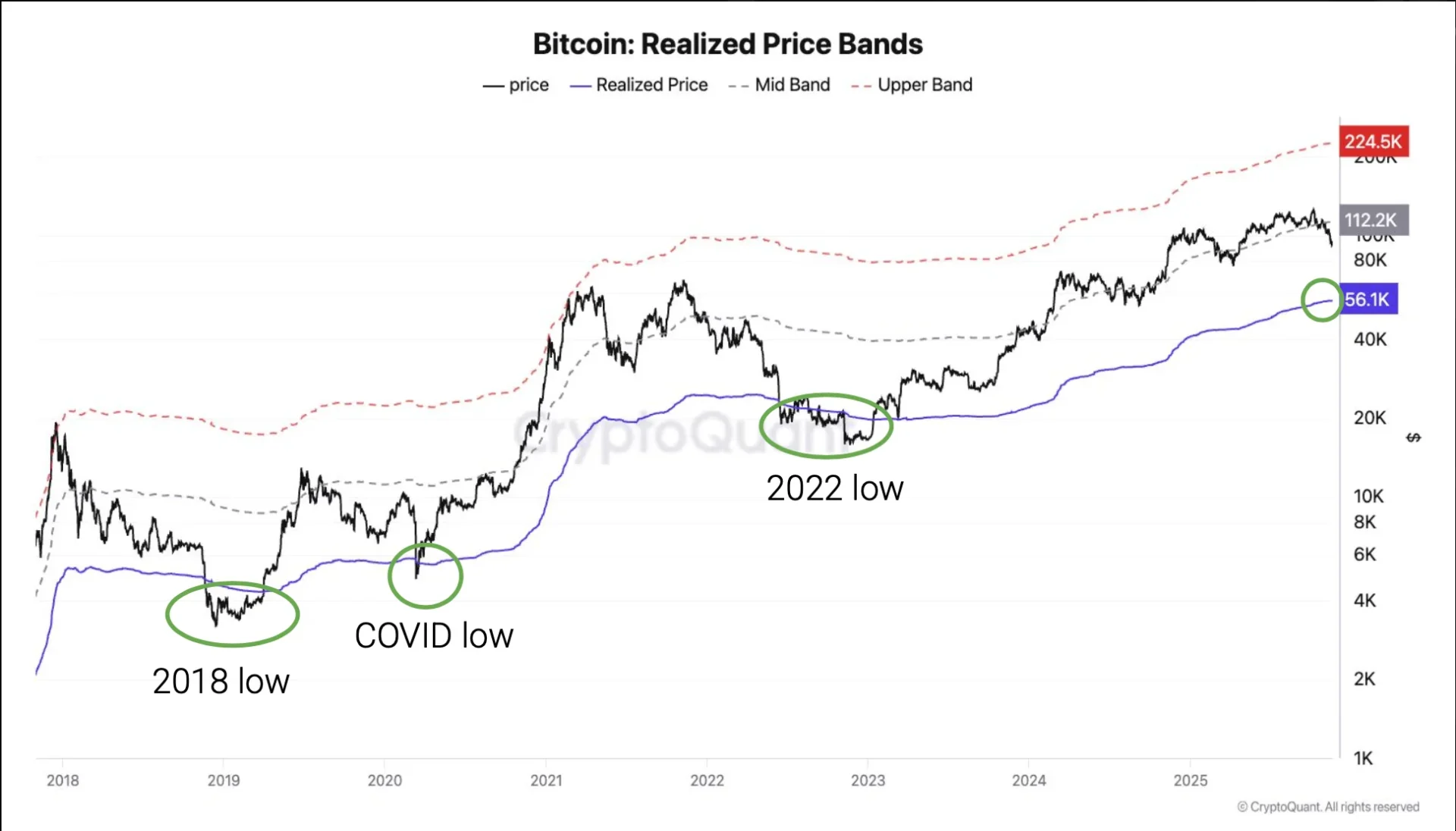

On-Chain Data Analysis Company CryptoQuant Issues Warning: Due to a clear weakening in Bitcoin demand momentum, cryptocurrencies may have entered a bear market, and the subsequent downside risks should not be ignored. Recently, CryptoQuant released a report stating: “The growth in (Bitcoin) demand has significantly slowed, indicating that the market is entering a bear market. Since 2023, Bitcoin has experienced three waves of spot demand surges, driven by the US spot ETF listing, the US presidential election, and Bitcoin reserve companies.” However, since early October 2025, this demand growth has fallen below the long-term trend line, indicating that the new buying interest in this cycle has largely been absorbed by the market, causing Bitcoin to lose a key support level. Based on the current weak trend, CryptoQuant believes that the downside risk for Bitcoin is gradually emerging. “$70,000” is the first important support zone. If the market cannot re-ignite bullish momentum, a further decline to $56,000 cannot be ruled out. The report states: From historical experience, Bitcoin’s bear market bottom often aligns with the “Realized Price” (reflecting the average cost basis of all holders), which is currently around $56,000. If this level is truly tested, it would mean Bitcoin has fallen approximately 55% from its all-time high, potentially making it the smallest retracement in a bear market to date. The medium-term support level for Bitcoin is around $70,000. Regarding the timing concerns of the market, CryptoQuant’s Head of Research Julio Moreno revealed: “A correction to $70,000 may occur within the next 3 to 6 months; as for the deeper drop to $56,000, if it happens, it could be in the second half of 2026.”

He further added that this bear market actually began in mid-November this year, following the largest liquidation event in cryptocurrency history on October 10.

3 Major Data Confirm: Capital is Withdrawing

CryptoQuant listed three key data points supporting the view that “the bear market has arrived”:

1. ETF Turning into Net Seller: In Q4 2025, US Bitcoin spot ETFs shifted to a “net outflow” status, reducing holdings by approximately 24,000 BTC, contrasting sharply with the strong buying activity of the same period last year.

2. Whales Pull Back: Addresses holding 100 to 1,000 BTC (including ETFs and institutions) are growing at a rate below trend lines, a sign of demand deterioration similar to late 2021, just before the 2022 major bear market.

3. Derivatives Cooling Off: The funding rates of perpetual contracts (calculated as a 365-day moving average) have fallen to the lowest levels since December 2023. Declining funding rates typically indicate reduced leverage appetite among bulls, a classic bear market feature. Additionally, the price has broken below the 365-day moving average, which is often regarded as a bull-bear dividing line in technical analysis.

CryptoQuant also presents a provocative view: “The core engine driving Bitcoin’s 4-year cycle is ‘demand cycles,’ not ‘halving events.’” When demand peaks and begins to decline, regardless of supply-side dynamics, a bear market often ensues.

It is noteworthy that CryptoQuant’s bearish tone sharply contrasts with recent Wall Street major firms’ perspectives, and the market remains highly contested between bulls and bears:

Regarding the timing concerns of the market, CryptoQuant’s Head of Research Julio Moreno revealed: “A correction to $70,000 may occur within the next 3 to 6 months; as for the deeper drop to $56,000, if it happens, it could be in the second half of 2026.”

He further added that this bear market actually began in mid-November this year, following the largest liquidation event in cryptocurrency history on October 10.

3 Major Data Confirm: Capital is Withdrawing

CryptoQuant listed three key data points supporting the view that “the bear market has arrived”:

1. ETF Turning into Net Seller: In Q4 2025, US Bitcoin spot ETFs shifted to a “net outflow” status, reducing holdings by approximately 24,000 BTC, contrasting sharply with the strong buying activity of the same period last year.

2. Whales Pull Back: Addresses holding 100 to 1,000 BTC (including ETFs and institutions) are growing at a rate below trend lines, a sign of demand deterioration similar to late 2021, just before the 2022 major bear market.

3. Derivatives Cooling Off: The funding rates of perpetual contracts (calculated as a 365-day moving average) have fallen to the lowest levels since December 2023. Declining funding rates typically indicate reduced leverage appetite among bulls, a classic bear market feature. Additionally, the price has broken below the 365-day moving average, which is often regarded as a bull-bear dividing line in technical analysis.

CryptoQuant also presents a provocative view: “The core engine driving Bitcoin’s 4-year cycle is ‘demand cycles,’ not ‘halving events.’” When demand peaks and begins to decline, regardless of supply-side dynamics, a bear market often ensues.

It is noteworthy that CryptoQuant’s bearish tone sharply contrasts with recent Wall Street major firms’ perspectives, and the market remains highly contested between bulls and bears: