SingleCycleDAMNXUN

Trend trading/micro market data/order flow/market auctions/price action/left and right side combined traders, bringing you insights that money can't buy.

SingleCycleDAMNXUN

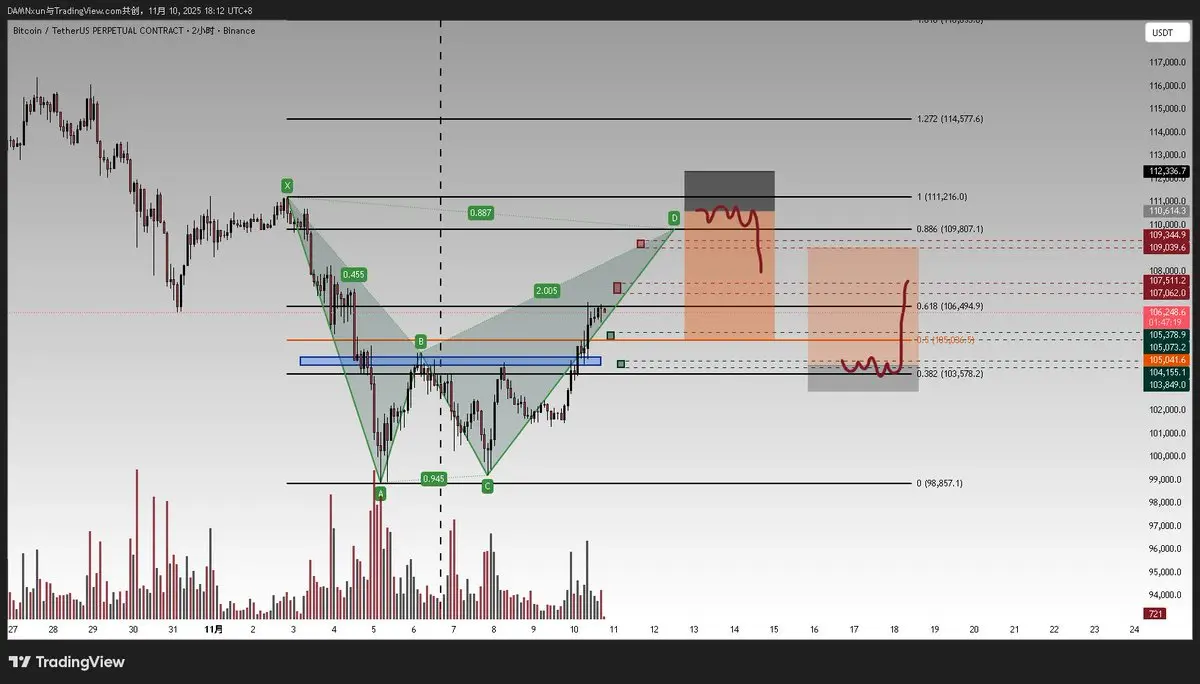

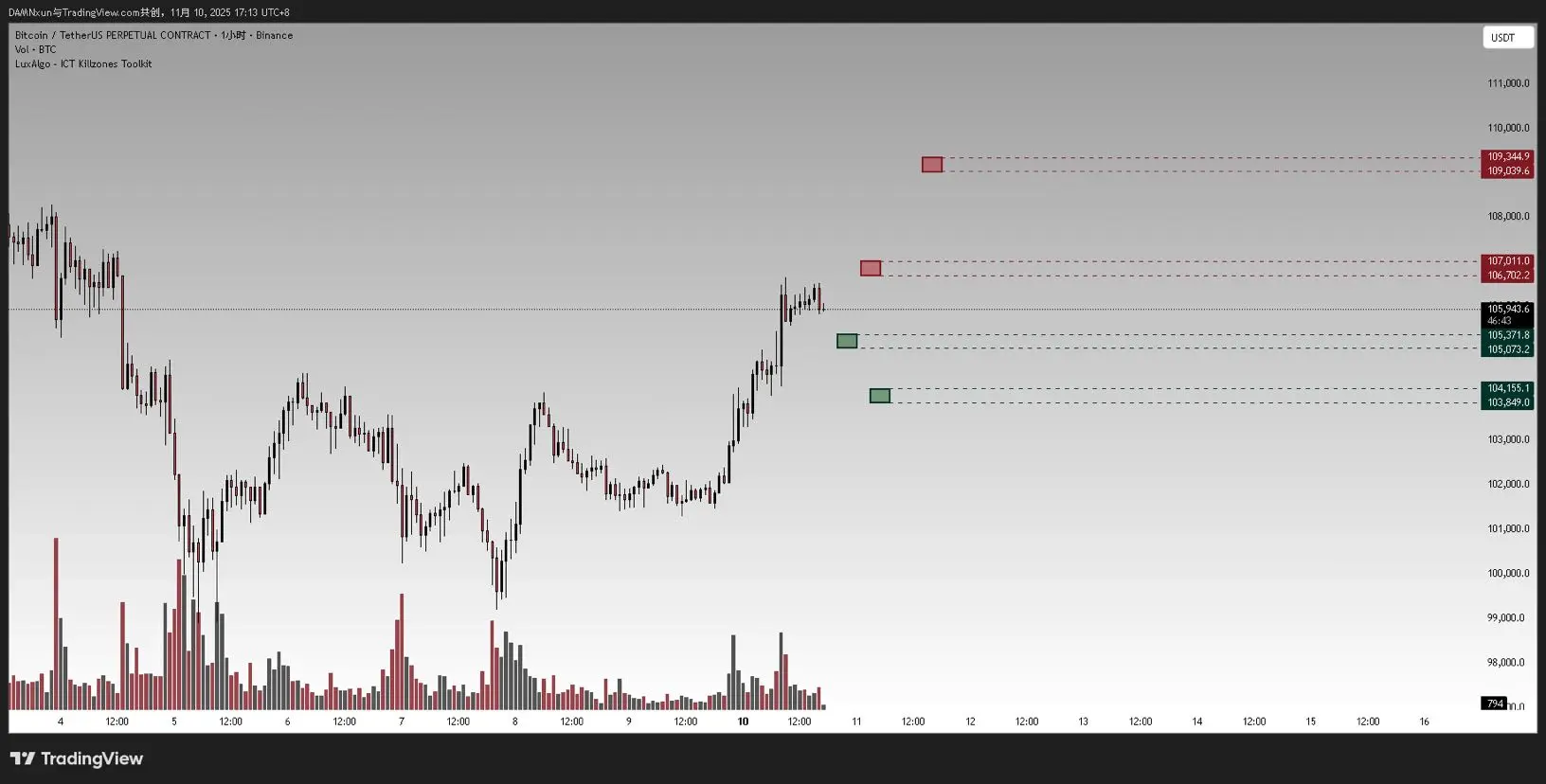

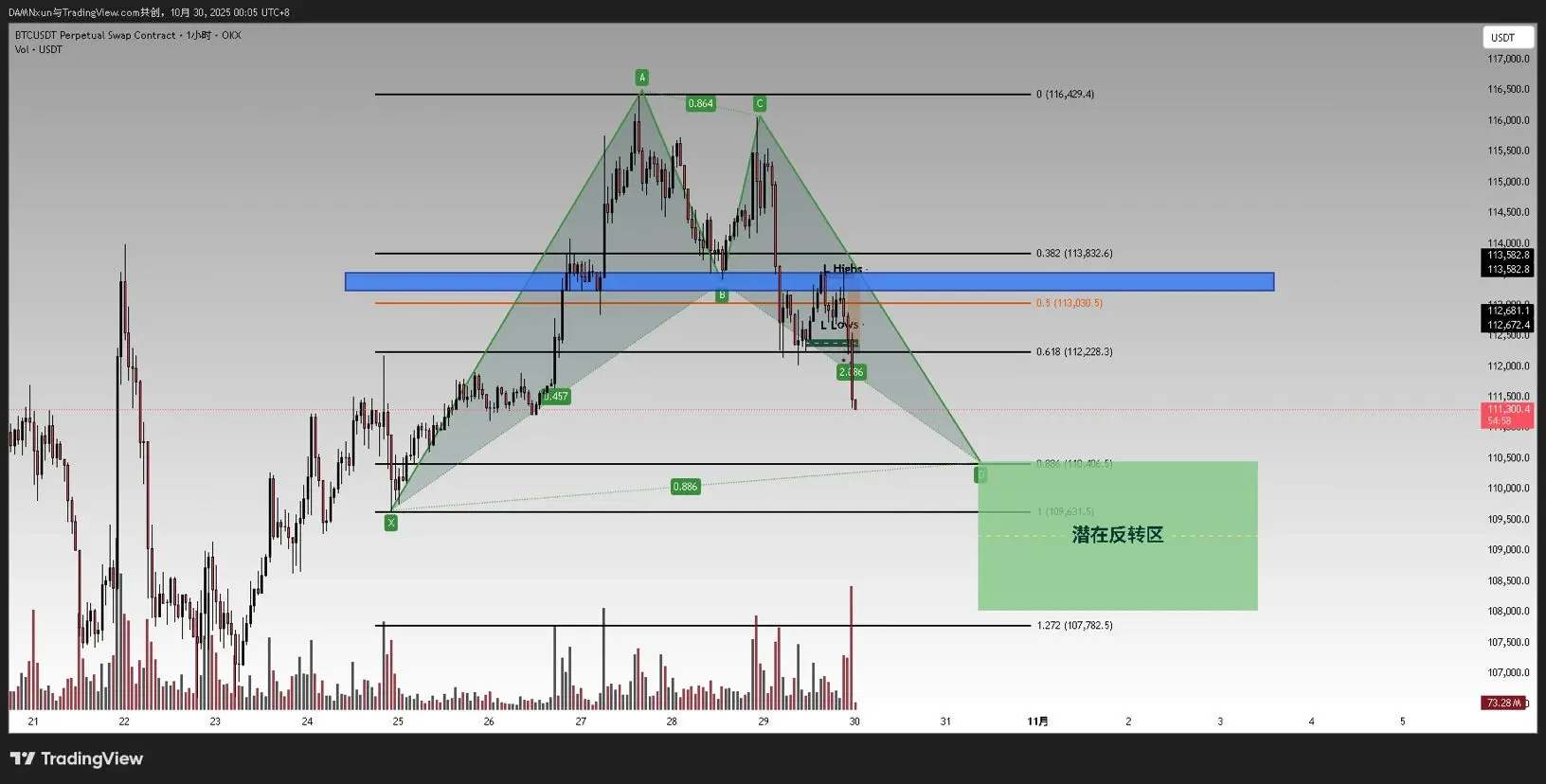

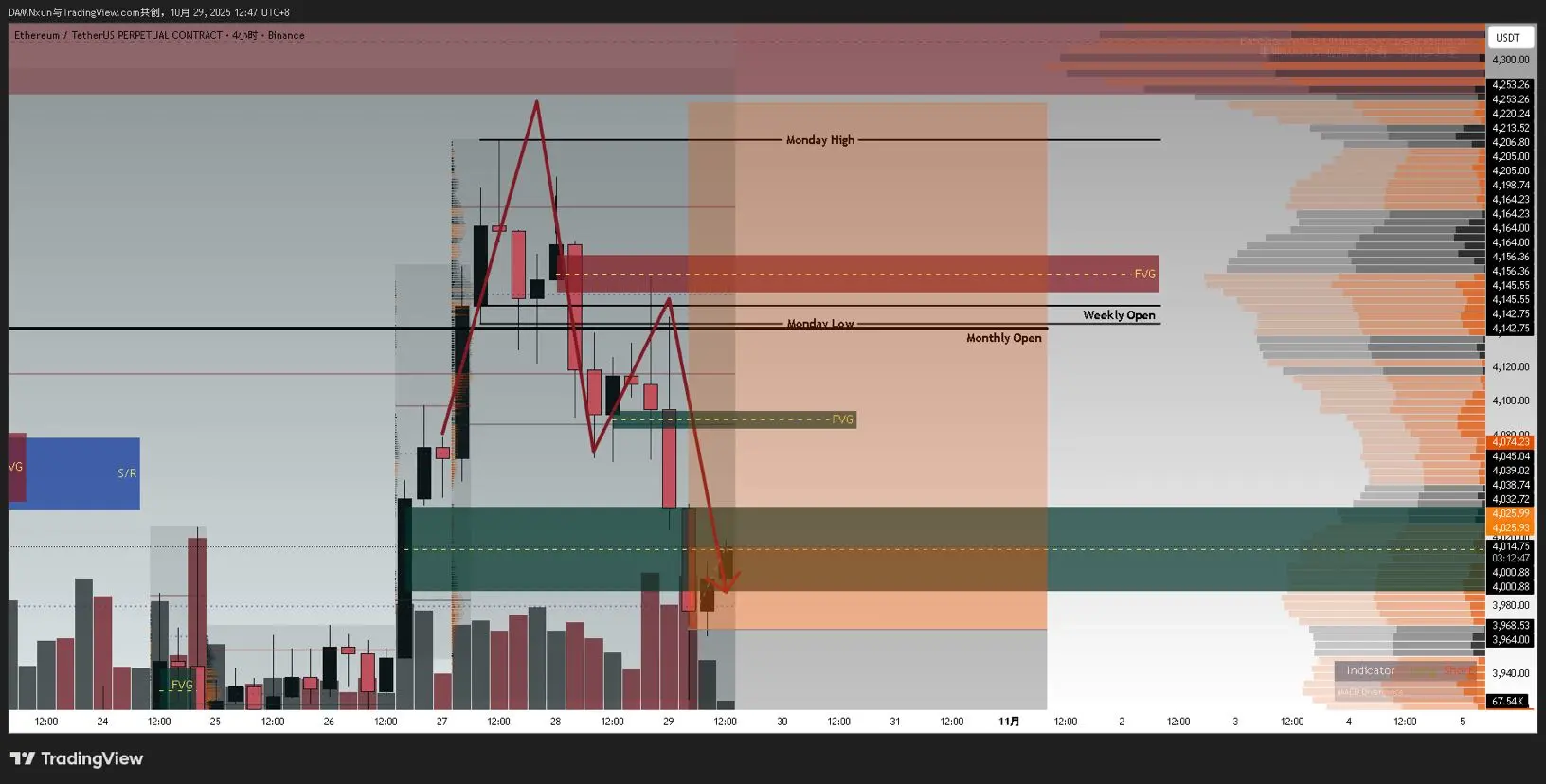

It seems that the market here is trying to hold up. Currently, the intraday strategy is more inclined towards a pullback to go long.

The two price points near the price and the dense liquidation zones above and below the big pie resonate.

The two distant points resonate with one and the empty range below, and the other resonates with the potential reversal zone of the bat pattern above.

Given the current increase in volatility, it's definitely safer to stick to these two points.

The two price points near the price and the dense liquidation zones above and below the big pie resonate.

The two distant points resonate with one and the empty range below, and the other resonates with the potential reversal zone of the bat pattern above.

Given the current increase in volatility, it's definitely safer to stick to these two points.

BTC0.87%

- Reward

- 2

- Comment

- Repost

- Share

$BTC Intraday Long and Short Strategy

🟢Long Position Strategy

•105400 Buy on rebound if it does not break (15-minute FVG)

•104400 Buy on dip if it doesn't break (15-minute FVG)

🔴Short Position Strategy

•107500 main resistance zone (stamp D+ nPOC)

• 109300 can be shorted if it encounters resistance, but if it stands strong, the target looks at 112-115K.

• Key levels today: pdHigh and the daily opening price

• Maintaining stability above> may form an early weekly low> continuing to rise

• Failed to hold the daily opening price (about 104k) > It is highly likely to fall back to the lower r

🟢Long Position Strategy

•105400 Buy on rebound if it does not break (15-minute FVG)

•104400 Buy on dip if it doesn't break (15-minute FVG)

🔴Short Position Strategy

•107500 main resistance zone (stamp D+ nPOC)

• 109300 can be shorted if it encounters resistance, but if it stands strong, the target looks at 112-115K.

• Key levels today: pdHigh and the daily opening price

• Maintaining stability above> may form an early weekly low> continuing to rise

• Failed to hold the daily opening price (about 104k) > It is highly likely to fall back to the lower r

BTC0.87%

- Reward

- 1

- Comment

- Repost

- Share

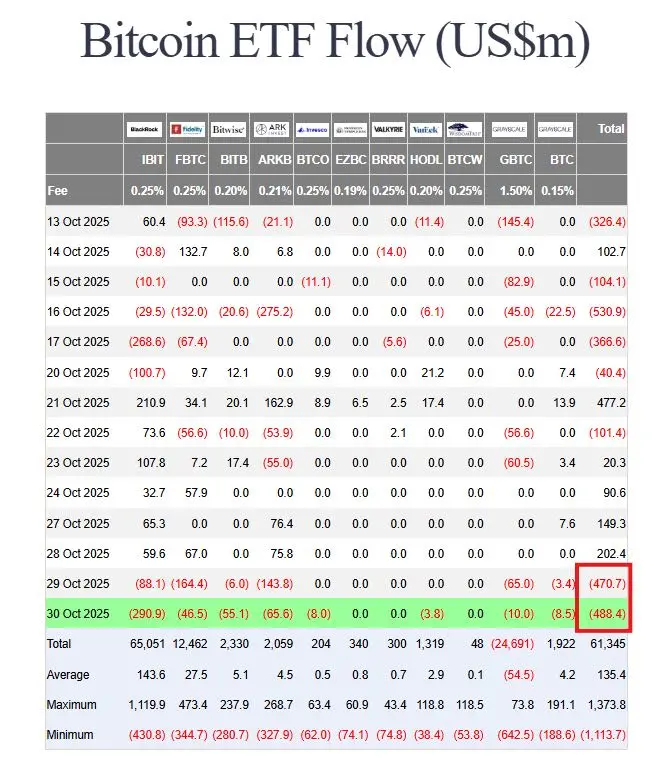

During the live broadcast in the evening, it was mentioned not to short for now; it's best to wait for a higher position to short. The current rebound feels very similar to the situation at the end of October, where sellers were unwilling to continue selling at the bottom, leading to a decrease in volume and a fall. Additionally, with the weekend approaching, there is no ETF sell pressure to trigger a rebound.

Unlike before, ETH/BTC has rebounded from the bottom without reaching the resistance level, mainly because the options market with institutional participation has become more optimis

Unlike before, ETH/BTC has rebounded from the bottom without reaching the resistance level, mainly because the options market with institutional participation has become more optimis

ETH-0.63%

- Reward

- 7

- 6

- Repost

- Share

CircumferenceZhang :

:

PIJS Chain's holding addresses surpass 50,000+; strong ecosystem consensus, continuous expansion of the value landscape, and the rise of new forces in Web3.View More

Volatility rise, a big one is coming next week!

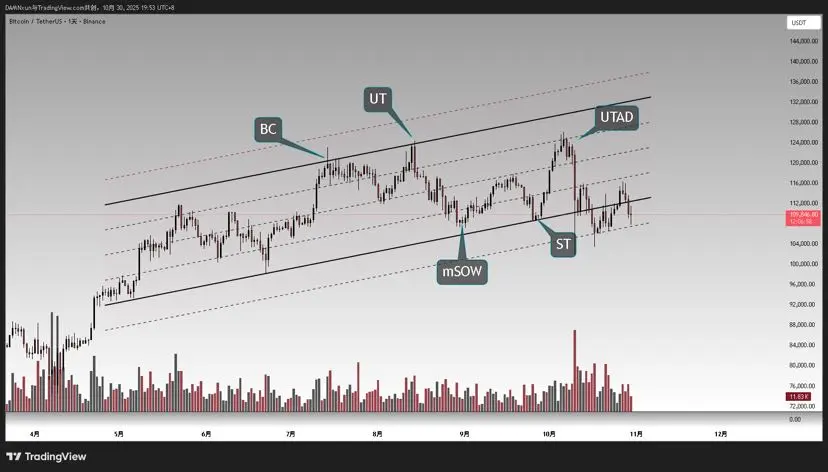

I just saw the rise in Bitcoin's volatility, and it's time for the market to split directions again, so I analyzed Bitcoin's market trend.

The distribution structure is confirmed technically. 😭

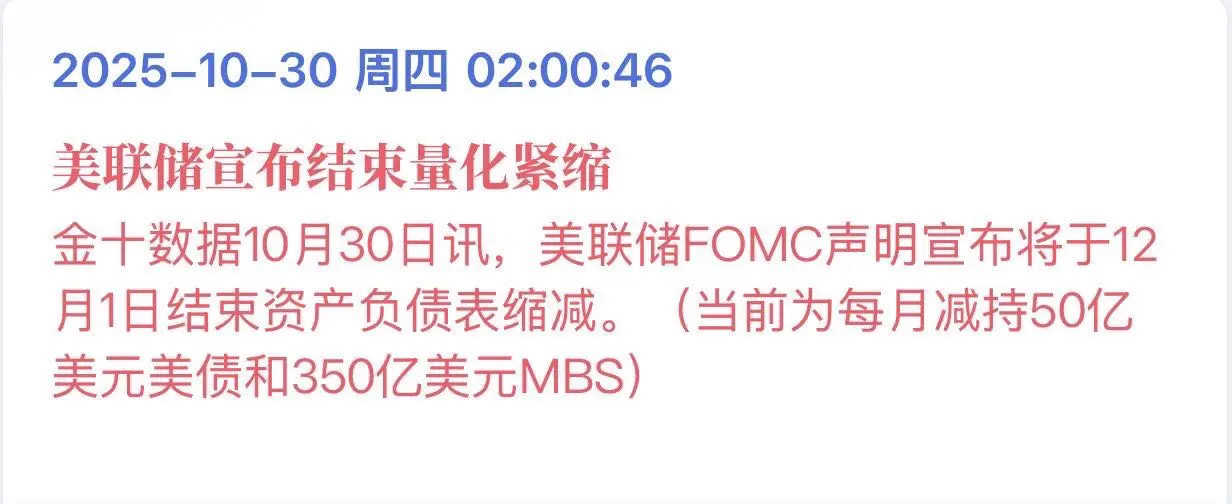

On the macro fundamentals:

1. The government is shut down and cannot open.

2. The Federal Reserve will only end its balance sheet reduction and conduct technical liquidity injections in December, and it may take until the first quarter of next year for liquidity to truly flow into the cryptocurrency market. 😭

3. 125 billion U.S. dollars in go

I just saw the rise in Bitcoin's volatility, and it's time for the market to split directions again, so I analyzed Bitcoin's market trend.

The distribution structure is confirmed technically. 😭

On the macro fundamentals:

1. The government is shut down and cannot open.

2. The Federal Reserve will only end its balance sheet reduction and conduct technical liquidity injections in December, and it may take until the first quarter of next year for liquidity to truly flow into the cryptocurrency market. 😭

3. 125 billion U.S. dollars in go

BTC0.87%

- Reward

- 8

- 6

- Repost

- Share

TheManFromQiWorries :

:

Pi nodes run OpenMind AI models, turning idle computing power into profit. Quickly integrate with PIJS Chain—besides mining, nodes can also earn extra Pi through AI tasks.View More

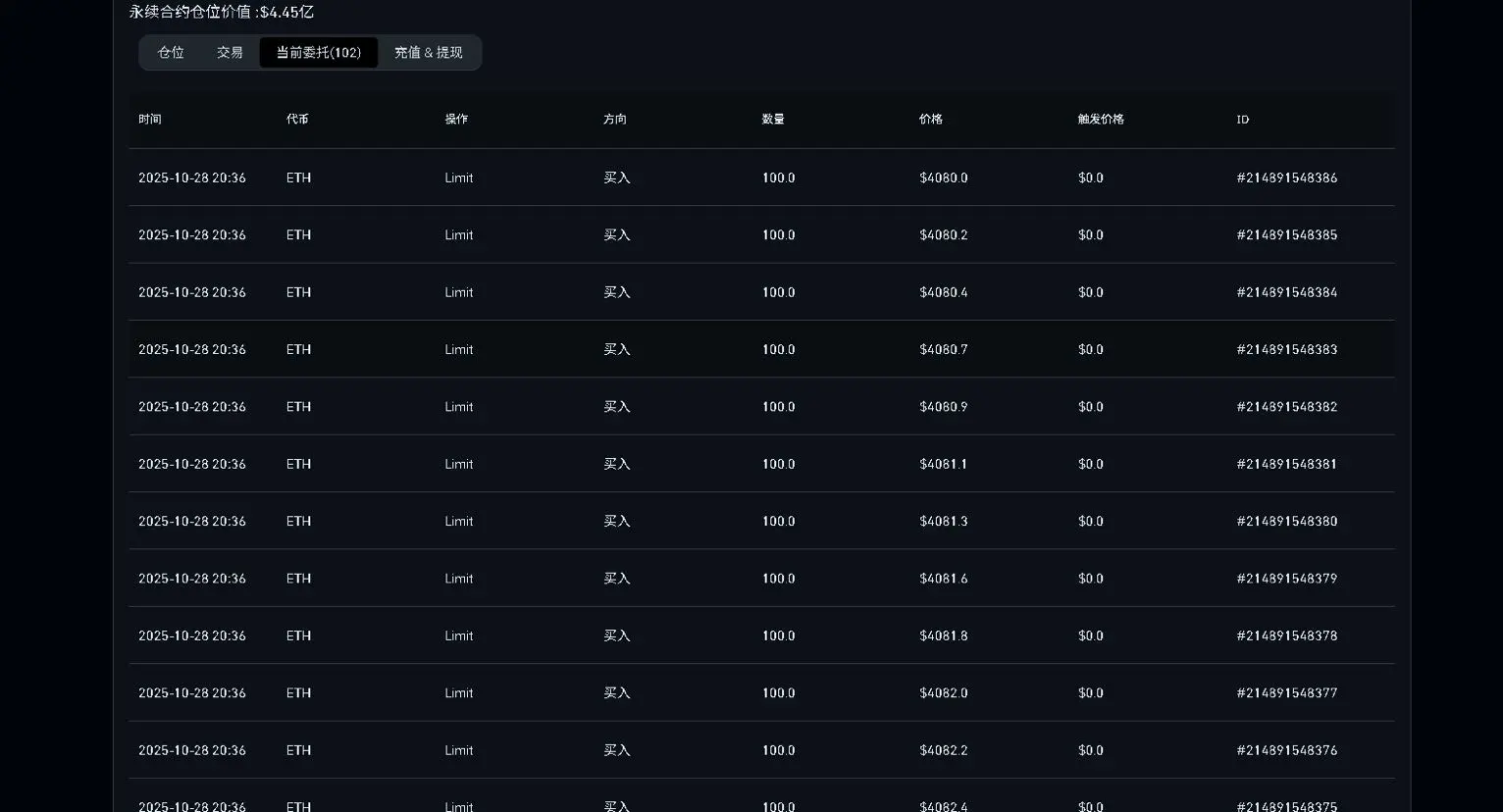

The previous 100% win rate Whale opened a long position again and got liquidated quickly.

Another insider who heavily shorted $BTC before the crash on 10.11 is also very close to a strong liquidation.

In the previous live stream analysis, I have never understood this Whale's operation of not taking profits and only adding positions, there are only two possibilities:

1. He is really foolish, but people who are this rich generally can't be that foolish.

2. He had already shorted and completed the sell-off with another account, which not only allows him to perfectly withdraw without cras

Another insider who heavily shorted $BTC before the crash on 10.11 is also very close to a strong liquidation.

In the previous live stream analysis, I have never understood this Whale's operation of not taking profits and only adding positions, there are only two possibilities:

1. He is really foolish, but people who are this rich generally can't be that foolish.

2. He had already shorted and completed the sell-off with another account, which not only allows him to perfectly withdraw without cras

BTC0.87%

- Reward

- 3

- 4

- Repost

- Share

EveningStar :

:

😂😂😂View More

In yesterday's live stream, it was mentioned that this dumping is primarily due to the large outflows from the ETF. Since Wall Street capital got involved, the market maker during this significant turnover period has been the ETF. Once the ETF stops buying, the price will experience a pullback, and with the ETF selling off in large quantities, especially as seen in the past few days, the price will also undergo a significant pullback.

The main reason is still Powell's speech being bearish - leading ETF investors to sell off for safety - ETFs are sold to market makers through over-the-c

View OriginalThe main reason is still Powell's speech being bearish - leading ETF investors to sell off for safety - ETFs are sold to market makers through over-the-c

- Reward

- 3

- 1

- Repost

- Share

Wb3_fish :

:

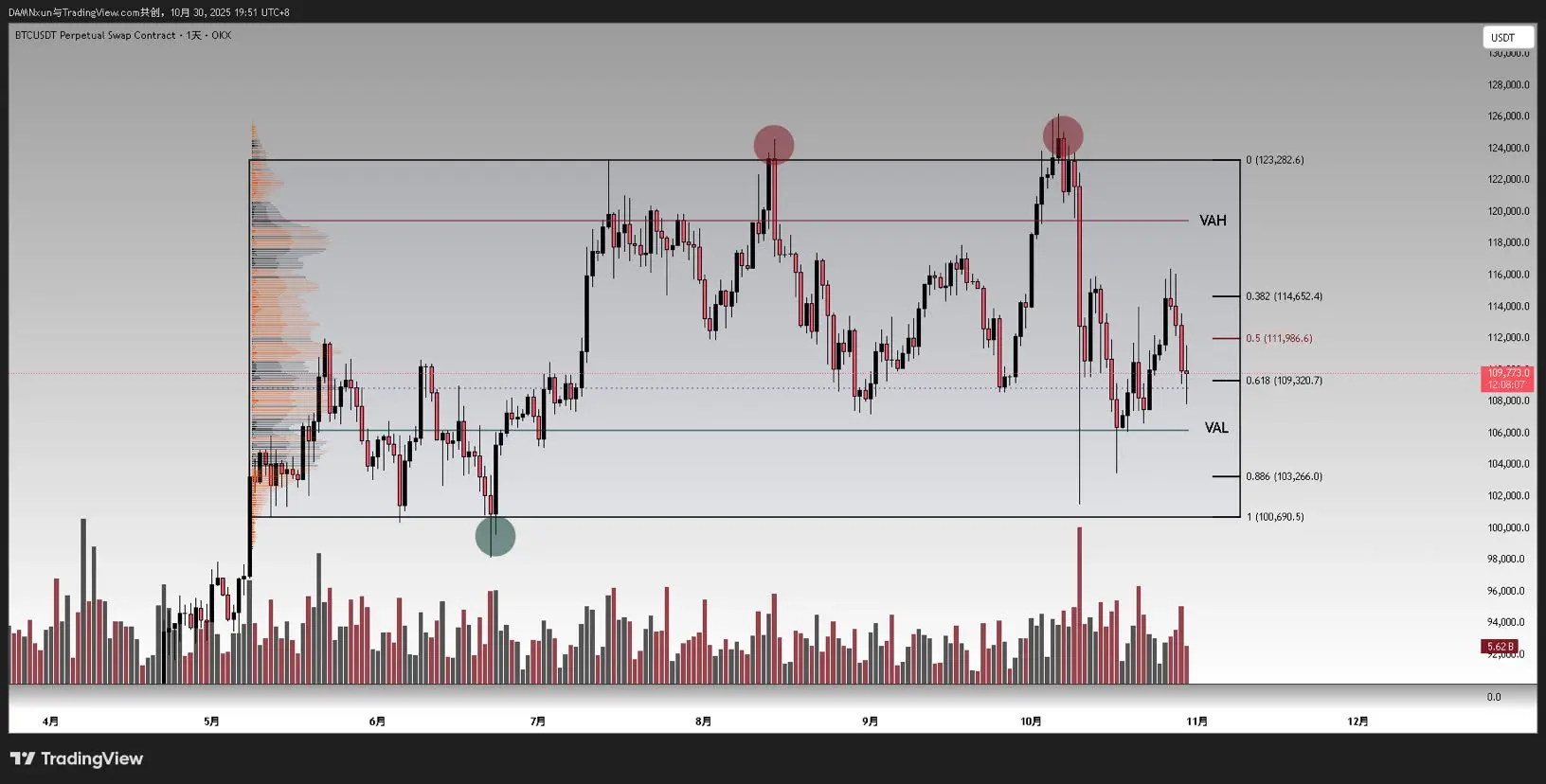

I think the short positions have come out, Ether below 3000.Don't talk about the macro, just look at the Candlestick. The small time frame Candlestick is irrationally jumping up and down. The daily chart Candlestick looks quite good, and it can be seen that the daily chart is oscillating within a large trading range.

Many people ask me why I don't layout short positions for medium to long term. For medium to long term short positions, you can layout at the top of the trading range, but this place definitely cannot be. It can be seen that even during those days of October 11, the VAL support below is still very effective, and the current price i

Many people ask me why I don't layout short positions for medium to long term. For medium to long term short positions, you can layout at the top of the trading range, but this place definitely cannot be. It can be seen that even during those days of October 11, the VAL support below is still very effective, and the current price i

BTC0.87%

- Reward

- 3

- Comment

- Repost

- Share

Yesterday, the Fed announced the end of the 29-month QT, which is Favourable Information, but Powell said that a rate cut might not happen in December, which is Unfavourable Information. Now both sides are in turmoil—one with rising inflation and the other with slowing employment. The core contradiction over the past two years has been prices; the core data on the non-tariff portion has actually dropped to 2.3-2.4%. As long as tariffs are not increased, overall inflation momentum will decline on its own. Now he is more worried about a sudden downturn in the labor market, as rates have already

View Original

- Reward

- 2

- 1

- Repost

- Share

GateUser-1f9c9859 :

:

Then, doing US stocks is also fine😁I received the 3860 from the live broadcast last night, and now my $ETH holdings cost price has been day trading up to 3930, which is close to the current price. Once I have unrealized gains, I will reduce position a bit and then continue to add. Otherwise, I will wait for a right-side breakthrough to hold above before adding back.

Overall, the problem is not significant; the market is overly pessimistic. The easing cycle is confirmed, but it is unknown when this liquidity will flow into the crypto space.

Live stream after dinner.

Overall, the problem is not significant; the market is overly pessimistic. The easing cycle is confirmed, but it is unknown when this liquidity will flow into the crypto space.

Live stream after dinner.

ETH-0.63%

- Reward

- 3

- Comment

- Repost

- Share

The order $BTC just hit a stop loss. Although it lost, this order has a risk-reward ratio that is worth the gamble with a stop loss of less than 200 points. Making money in contracts relies on the risk-reward ratio. It's worth taking a bold gamble on such a narrow stop loss order. Let's wait for the potential reversal zone below in the 1h.

BTC0.87%

- Reward

- 5

- 3

- Repost

- Share

TonightTiger :

:

Start a live stream and have some funView More

- Reward

- 1

- Comment

- Repost

- Share

A brother asked me if bullish traders can reach the other side?

I want to make it clear that some can. Low leverage, those who often watch my live broadcasts can definitely do it. The recent volatility is at its highest, so you need to ensure that you stay in the market.

The historical opportunity we are in is the current cycle of currency issuance, with the super devaluation of the dollar. All dollar-denominated, liquid reservoir assets and hard currency assets will continue to appreciate against the dollar.

There is also an underlying logic that I always mention: capital, smart money always

View OriginalI want to make it clear that some can. Low leverage, those who often watch my live broadcasts can definitely do it. The recent volatility is at its highest, so you need to ensure that you stay in the market.

The historical opportunity we are in is the current cycle of currency issuance, with the super devaluation of the dollar. All dollar-denominated, liquid reservoir assets and hard currency assets will continue to appreciate against the dollar.

There is also an underlying logic that I always mention: capital, smart money always

- Reward

- 3

- 2

- Repost

- Share

SuckersGreenYy :

:

eth misled meView More

$ETH 3960 received, yesterday ETH and BTC completed the CME gap fill, the open orders of $ETH 3890-3840 were not filled, so there is still space below, the first resistance level to watch above is around 4160, and the second resistance is 4280.

Last week I mentioned that in this kind of bull and bear market, not losing money is already a gain. If you can make a small profit, you have surpassed most people. This kind of market is quite comfortable to operate with low leverage and phased entry like me, but it's a bit frustrating that the open orders just can't get filled.

Last week I mentioned that in this kind of bull and bear market, not losing money is already a gain. If you can make a small profit, you have surpassed most people. This kind of market is quite comfortable to operate with low leverage and phased entry like me, but it's a bit frustrating that the open orders just can't get filled.

ETH-0.63%

- Reward

- 7

- 5

- Repost

- Share

Pot :

:

short information is comingView More

Fear what comes! The insider of the groove, making money without leaving, dumping in the middle of the night $BTC . Moreover, he specifically chooses to close positions when the liquidity is weak after the US market closes, very bad, and it is very likely that other accounts have already completed rat trading short orders to dump.

BTC0.87%

- Reward

- 3

- 3

- Repost

- Share

Wb3_fish :

:

It was reported that Donald Trump's son also joined by leading in copy trading with 50w USD. Advocate insider news. View More

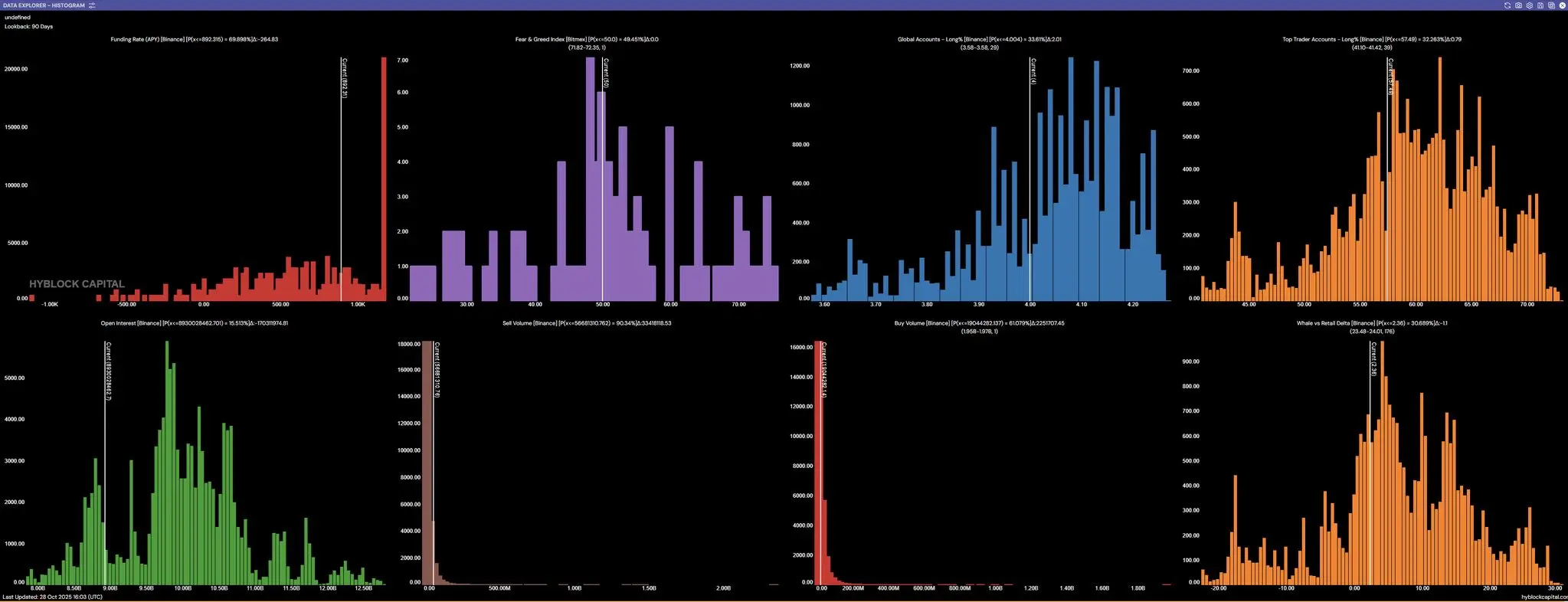

Give the long positions a boost of faith, I fed the data to AI for analysis, it may not be accurate, but it currently meets the prerequisites for a big pump. Do you understand what that means? It means that meeting the conditions doesn't guarantee a rise, but not meeting them definitely won't rise.

Emotional/Funding Meaning

1. Delta: 0.12 No strong selling pressure

2. OI 8.30B (-34%) leverage has been cleared

3. Global Long%

4.04% Retail Investors Are Extremely Fearful

4. Top Traders Long 59.49% Institutions Quietly Greedy

5. Funding Rate -892 APY short positions high fees

6. Sell/Buy

View OriginalEmotional/Funding Meaning

1. Delta: 0.12 No strong selling pressure

2. OI 8.30B (-34%) leverage has been cleared

3. Global Long%

4.04% Retail Investors Are Extremely Fearful

4. Top Traders Long 59.49% Institutions Quietly Greedy

5. Funding Rate -892 APY short positions high fees

6. Sell/Buy

- Reward

- 4

- Comment

- Repost

- Share

- Reward

- 3

- Comment

- Repost

- Share

$PAXG Gold is about to have another opportunity. If the interest rate cut is announced with favourable information, gold should experience an oversold wave. The target go long range is between 3790-3750, with the first target at 4150. If it breaks past 4200, a significant short squeeze may occur.

Low leverage, and wait for the dip to re-enter, placing orders directly can easily lead to losses.

Low leverage, and wait for the dip to re-enter, placing orders directly can easily lead to losses.

PAXG2.85%

- Reward

- 2

- Comment

- Repost

- Share

In the spot market for mainstream tokens, I have always recommended $BNB . The platform token of the world's number one exchange has already achieved deflation. BSC has its backing, while SOL is still in inflation. BNB has a clear chip structure and is a "dominating dealer coin" among mainstream tokens. With the rise of the BSC ecosystem, it has entered the value discovery phase. One advantage of this kind of coin is that it resists falls during black swan events; you can notice that the coins that fall the least during black swan events are usually these.

BNB-1.7%

- Reward

- 1

- Comment

- Repost

- Share