Semitism AI Taps Metya to Accelerate AI-Led Web3 PayFi, and DatingFi Innovation

Sentism.AI and Metya have partnered to enhance Web3 innovations by integrating PayFi and DatingFi with AI. This collaboration aims to improve transactions and social interactions within the Web3 ecosystem, setting a benchmark for combining blockchain and AI technologies.

BlockChainReporter·1m ago

Bitcoin’s Current Correction Mirrors a Previous Bullish Fractal — Is a Reversal Ahead?

Date: Sun, Dec 21 2025 | 05:34 AM GMT

The broader cryptocurrency market has experienced choppy and directionless price action over the past

BTC0.92%

CoinsProbe·5m ago

Bitcoin's "Realized Market Cap" firmly holds at $1.1 trillion! Analyst: The 2026 market outlook is worth looking forward to

Despite Bitcoin retracing over 30% in the past 10 weeks, causing concern among many investors, on-chain data shows that the spark of a bullish trend still remains alive.

According to Glassnode data, Bitcoin's "Realized Cap" currently remains firmly above the historic high of $1.125 trillion, indicating that there has not been a large-scale withdrawal of funds from the market, and suggesting that the bull market structure remains solid.

Unlike the commonly seen "Market Cap" (current price x total circulating supply), this on-chain indicator is more valuable for reference. "Realized Cap" is calculated based on the "last on-chain movement price" of each Bitcoin, removing the influence of short-term speculative trading, and reflecting the "actual cost basis invested by investors" and "actual capital inflow."

In other words, when the total market cap fluctuates wildly with price swings, the realized cap provides a more accurate picture of the underlying investment activity.

区块客·7m ago

Is Bitcoin’s Current Correction the Base for Bigger Targets? This Fractal Setup Suggests So!

Date: Mon, Dec 22, 2025 | 05:25 AM GMT

The broader cryptocurrency market has seen choppy and largely directionless price action over the past

BTC0.92%

CoinsProbe·8m ago

Toncoin Price Prediction: Whale Orders Surge, TON Bullish Breakout Confirmed, Surging Past $1.70

Toncoin (TON) price rebounds above $1.51, successfully breaking through the descending wedge pattern, opening an upward channel for the bulls. CryptoQuant data shows a significant increase in whale bulk orders, while CoinGlass's long-short ratio reaches 1.14, approaching the monthly high, indicating traders' growing confidence in a price increase.

TON4.65%

MarketWhisper·12m ago

BANK Breakout Gains Momentum as Traders Track Volume Signals

BANK trades above former resistance, confirming a breakout while volume remains the primary continuation signal.

Strong turnover relative to market cap reflects heightened speculative interest and active positioning.

Trader commentary supports divergence

BTC0.92%

CryptoFrontNews·19m ago

"Doubao" daily active users surpass 100 million! ByteDance's most cost-effective blockbuster threatens the advertising empire

ByteDance's AI application Doubao's daily active users (DAU) surpassed 100 million, becoming another hundred-million-level product after Douyin. An insider revealed that Doubao has the lowest promotional costs among the company's products that have broken 100 million DAU, mainly driven by user organic sharing and content popularity. The three-grid and other P-picture gameplay continuously topped trending searches, generating millions of organic downloads daily. Doubao is also rapidly expanding across multiple scenarios such as AI+hardware, and will participate in CCTV Spring Festival Gala interactive collaboration in 2026.

MarketWhisper·21m ago

Reputed Crypto Analyst Reveals Short-Term Bullish and Mid-Term Bearish Targets

Reputed crypto analyst reveals short-terms bullish targets.

The analyst remains bearish for the mid-term.

Despite low bearish targets, the analyst expects even greater dips to follow.

The price of BTC continues to trade in the higher $80,000 price range as the month of December draws c

BTC0.92%

CryptoNewsLand·23m ago

Former Mt. Gox founder retreats to Japan to do VPN, bids farewell to Bitcoin and shifts focus to AI agents

Former Mt. Gox CEO Mark Karpelès has retreated to Japan. He experienced the theft of 650,000 BTC, served time in Japanese prison, and went through bankruptcy liquidation. Now, he is focusing on VPN privacy protection technology and AI agent development. Karpelès currently serves as the protocol chair of vp.net, developing a VPN service that allows users to verify themselves. Surprisingly, he no longer holds any Bitcoin.

BTC0.92%

MarketWhisper·25m ago

Crypto ETFs Play "Game of Thrones": XRP and Solana ETFs Continue to Attract Funds, Are Institutions Abandoning Bitcoin?

The US ETF market in 2025 set a historic "triple crown" record, with a net capital inflow of up to $1.4 trillion, over 1,100 new products launched, and a total trading volume of $57.9 trillion. However, beneath this prosperity, the crypto asset ETFs are experiencing a fierce rotation of funds. Bitcoin and Ethereum ETFs faced significant outflows in December, totaling over $1.1 billion; in stark contrast, newly launched XRP and Solana ETFs continued to attract funds, with XRP ETF setting an astonishing record of 28 consecutive trading days of net inflows. This phenomenon clearly indicates that beyond the grand narrative of ETFs, institutional investors are becoming more and more selective, shifting their focus from mere "digital gold" to crypto assets with clear regulation and real-world utility. The structural shift in the market may have quietly begun.

MarketWhisper·26m ago

XRP Today News: ETF Draws $1.13 Billion, XRP Drops for Four Consecutive Days, Can the Bull Market Restart in 2026?

Recently, XRP price movement has entered a technical weakness, recording a fourth consecutive trading day decline on December 24, closing near $1.86, a significant retracement from the July all-time high of $3.66. In stark contrast to the price weakness, its spot ETF has demonstrated remarkable institutional absorption capacity, with 28 consecutive days of net capital inflows since its listing in November, totaling $1.13 billion. This divergence of "price falling, funds flowing in" reveals a deep contradiction between short-term profit-taking pressure and medium- to long-term structural optimism in the market. Looking ahead to 2026, the advancement of crypto-friendly regulatory bills, the potential Fed interest rate cut cycle, and the deepening utility of XRP in cross-border payments collectively form a positive narrative for its price recovery.

XRP1.18%

MarketWhisper·30m ago

Holiday Options Expiry Raises Short-Term Bitcoin Volatility

As Christmas approaches, crypto markets are seeing thinning liquidity and reduced leverage, increasing the risk of short-term price swings. A massive year-end options expiry may drive volatility, but history suggests any holiday moves are likely to fade in January.

Bitcoin Enters Thin Holiday

BTC0.92%

Coinpedia·31m ago

Ripple Could Have Sold as Much XRP as It Wanted, CTO Says - U.Today

The essay discusses Elon Musk's tax situation and defends his low tax rate by clarifying that taxes apply to realized gains. It then transitions to a discussion on Ripple's escrow system, revealing that it actually limited Ripple's ability to sell XRP, contradicting claims of market manipulation by executives.

XRP1.18%

UToday·31m ago

2026 Layer1 Final Prediction: Fragmentation Worsens, Interoperability Becomes the Only Lifeline

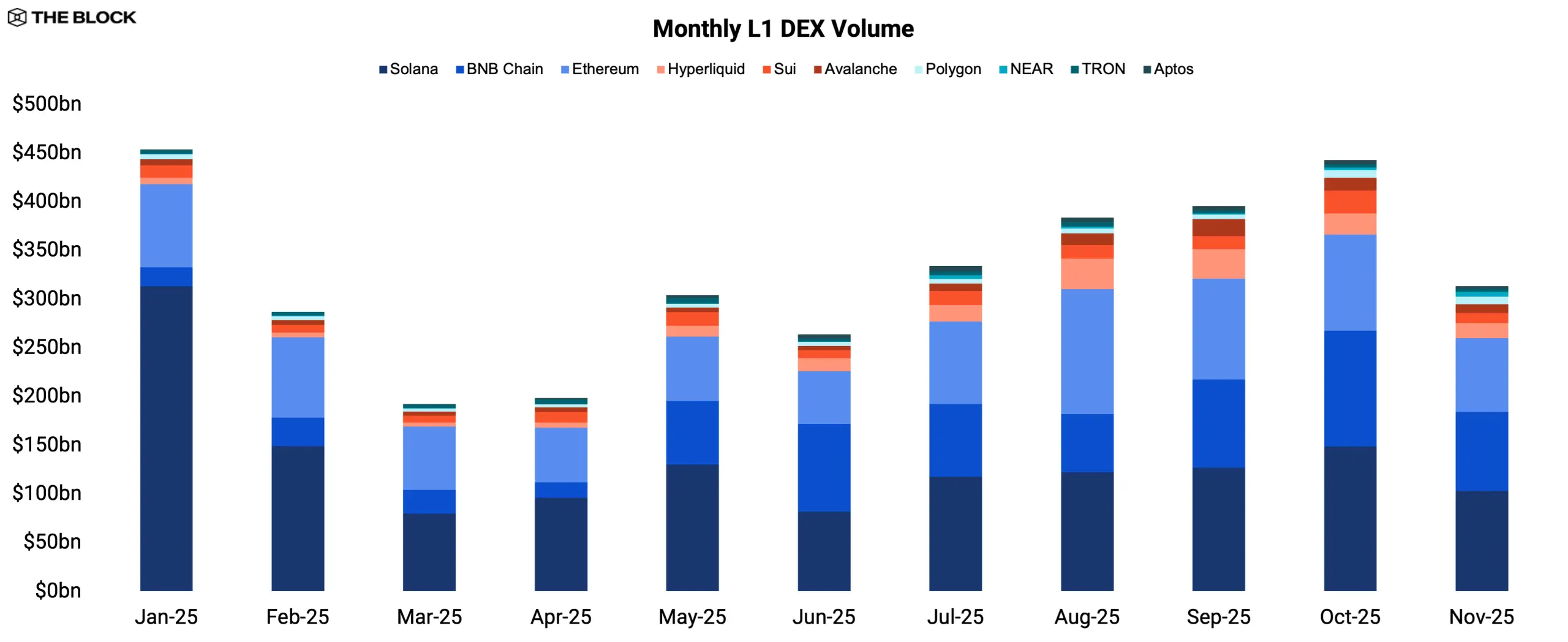

The 2025 Layer1 market undergoes a thorough split: Solana and BNB Chain rely on meme coin speculation to attract funds, Ethereum transitions to a settlement layer, and a net increase of $90 billion in stablecoins spurs the creation of dedicated "stable chains." Zcash experiences a surge of 661% due to privacy demands. In 2026, Layer1 accelerates its differentiation into speculative chains, settlement chains, stable chains, privacy chains, and performance chains, with interoperability becoming the only solution to provide a seamless experience.

MarketWhisper·40m ago

Load More

Hot Topics

MoreCrypto Calendar

MoreHayabusa Upgrade

VeChain has unveiled plans for the Hayabusa upgrade, scheduled for December. This upgrade aims to significantly enhance both protocol performance and tokenomics, marking what the team calls the most utility-focused version of VeChain to date.

2025-12-27

Litewallet Sunsets

Litecoin Foundation has announced that the Litewallet app will officially sunset on December 31. The app is no longer actively maintained, with only critical bug fixes addressed until that date. Support chat will also be discontinued after this deadline. Users are encouraged to transition to Nexus Wallet, with migration tools and a step-by-step guide provided within Litewallet.

2025-12-30

OM Tokens Migration Ends

MANTRA Chain issued a reminder for users to migrate their OM tokens to the MANTRA Chain mainnet before January 15. The migration ensures continued participation in the ecosystem as $OM transitions to its native chain.

2026-01-14

CSM Price Change

Hedera has announced that starting January 2026, the fixed USD fee for the ConsensusSubmitMessage service will increase from $0.0001 to $0.0008.

2026-01-27

Vesting Unlock Delayed

Router Protocol has announced a 6-month delay in the vesting unlock of its ROUTE token. The team cites strategic alignment with the project’s Open Graph Architecture (OGA) and the goal of maintaining long-term momentum as key reasons for the postponement. No new unlocks will take place during this period.

2026-01-28