- Trending TopicsView More

34.66K Popularity

108.64K Popularity

31.92K Popularity

27.07K Popularity

14.96K Popularity

- Hot Gate FunView More

- MC:$4.34KHolders:41.06%

- MC:$4.13KHolders:20.04%

- MC:$4.12KHolders:10.00%

- MC:$4.13KHolders:10.00%

- MC:$4.19KHolders:20.00%

- Pin

- 🚀 #GateNewbieVillageEpisode6 ✖️ @discovery

💬 Your greatest enemy is your own emotions.

Share your trading journey | Discuss strategies | Grow with the Gate Family

⏰ Event Time: Nov 12 10:00 – Nov 19 16:00 UTC

How to Join:

1️⃣ Follow Gate_Square + @discovery

2️⃣ Post on Gate Square with the hashtag #GateNewbieVillageEpisode6

3️⃣ Share your trading experiences, insights, or growth stories

— The more genuine and insightful your post, the higher your chance to win!

🎁 Rewards

3 lucky participants → Gate X RedBull Cap + $20 Position Voucher

If delivery is unavailable, the prize will be replaced - 💥 Gate Square #ETHPricePredictionChallenge 💥

📈 What’s your prediction for ETH in future?

🎁 4 lucky users will share $40 Position Vouchers!

👉 How to participate:

1️⃣ Follow Gate_Square

2️⃣ Like this post

3️⃣ Comment with your prediction

🗓️ Deadline: November 17, 2025, 04:00 UTC - 🚀 Gate Square “Gate Fun Token Challenge” is Live!

Create tokens, engage, and earn — including trading fee rebates, graduation bonuses, and a $1,000 prize pool!

Join Now 👉 https://www.gate.com/campaigns/3145

💡 How to Participate:

1️⃣ Create Tokens: One-click token launch in [Square - Post]. Promote, grow your community, and earn rewards.

2️⃣ Engage: Post, like, comment, and share in token community to earn!

📦 Rewards Overview:

Creator Graduation Bonus: 50 GT

Trading Fee Rebate: The more trades, the more you earn

Token Creator Pool: Up to $50 USDT per user + $5 USDT for the first 50 launche

Analysis of Uncommon Sector Movements: Extreme Sentiment Signals Indicate a Sharp Rebound in Anonymous and Storage Coins

1. Market Background

Recently, market rotation has accelerated noticeably, with less popular sectors showing phased activity. Leading anonymous coins DASH and ZEC initiated the rally first, followed by storage sector representatives AR and FIL, forming a short-term structure driven by “funds low absorption + oversold rebound.”

Meanwhile, mainstream coins BTC and ETH have gradually stabilized in the bottom area, with leverage clearing completed, and market sentiment shifting from extreme panic to cautious observation.

Against this backdrop, the willingness of funds to bet on undervalued tracks has increased, with anonymous and storage sectors becoming the most resilient representatives in this rebound.

2. Correlation Between Sentiment and Price

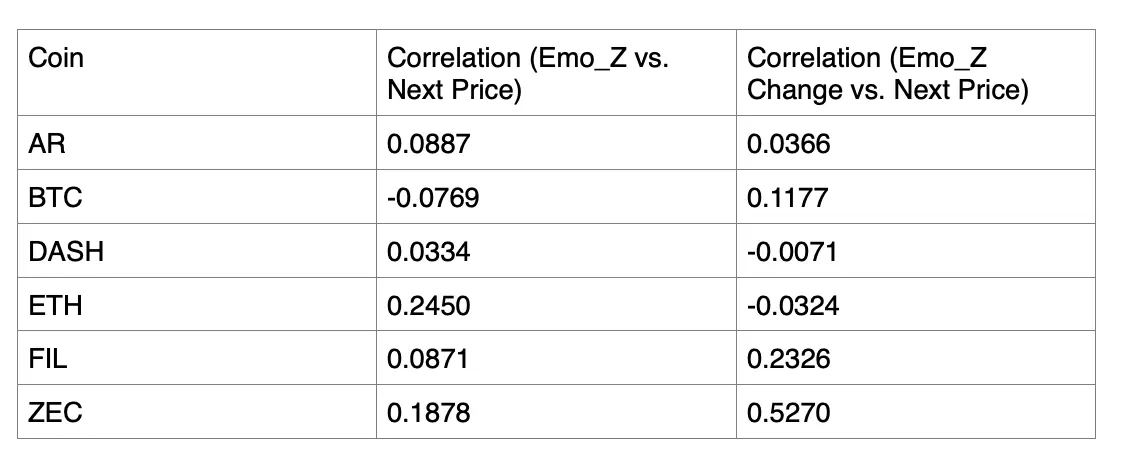

Based on hourly data, we calculated the Pearson correlation coefficient between the sentiment indicator (Emo_Z) and the next hour’s price change rate.

The results show that ETH and ZEC have the most prominent sentiment correlation, especially ZEC, where sentiment changes are significantly positively correlated with price changes (R=0.527), indicating that the anonymous coin sector reacts more sensitively to market sentiment fluctuations. In other words, when sentiment indicators change sharply, prices tend to respond in the short term with synchronized feedback.

3. Model Logic and Signal Interpretation

The model adopts an Correlation Adaptive Strategy Framework, which automatically switches signal directions based on the different coin types’ sentiment-price relationships:

This design allows the model to flexibly switch logic under different market environments, capturing both strong trending opportunities and reversal chances in less popular coins.

4. Backtest Performance of Signals

In the sample period in early November 2025, the model triggered 17 valid signals, correctly predicting 11, with a one-hour ahead price direction prediction accuracy of 64.71%.

Signals mainly concentrated during November 5 to November 7, during the initiation phase of anonymous and storage sectors, especially with ZEC, DASH, AR entering extreme sentiment zones multiple times.

Some typical signals are as follows:

5. Key Conclusions

6. Charts Display

The sentiment-price dual-axis charts included in the report clearly show the distribution of signals across different stages for each coin:

BTC_Price_EmoZ_OnEmoZLine:

DASH_Price_EmoZ_OnEmoZLine:

ETH_Price_EmoZ_OnEmoZLine:

It can be observed that the anonymous coins’ sentiment curves in early November showed significant turning points, with signals concentrated and having some foresight.

7. Risk Warning