USDC News Today

Latest crypto news and price forecasts for USDC: Gate News brings together the latest updates, market analysis, and in-depth insights.

A new Wallet Address deposits 8 million USD in USDC to HyperLiquid and goes long on ETH with 25x leverage.

According to Mars Finance news, a newly created Wallet has deposited 8 million USD into the HyperLiquid platform and opened long positions on ETH with 25 times leverage. The Position size is 10,695 ETH, worth approximately 37 million USD, with an entry price of 3,498 USD and a liquidation price of 2,808 USD.

MarsBitNews·16m ago

Visa Pilots USDC Payouts for Creators and Gig Workers

Visa is launching a pilot program allowing companies to send fiat USD payments, which recipients will receive in USDC stablecoin. Aimed at supporting gig economy workers, the roll-out is expected in late 2026, pending regulatory approval.

USDC0.01%

Decrypt·1h ago

Circle Q3 revenue hits $740m, USDC circulation nears $74b

Circle is cashing in on stability. The USDC issuer posted $740 million in third-quarter revenue, a 66% jump from last year, as its flagship stablecoin's circulation more than doubled.

Summary

Circle posted $740 MILLION in Q3 revenue, up 66% year-on-year, with USDC circulation rising 108%

Cryptonews·2h ago

Circle announced its Q3 financial report: net profit increased by 202% year-on-year to $2.14, and USDC scale doubled.

Circle's Q3 financial report shows total revenue reached $740 million, a year-on-year increase of 66%, with a net profit of $214 million, a year-on-year increase of 202%, both exceeding expectations. The circulating supply of USDC reached $73.7 billion, a year-on-year increase of 108%. CRCL on the US stock market reported $93 in pre-market, a fall of about 5%.

USDC0.01%

MarsBitNews·4h ago

JUST IN: Visa Begins USDC Stablecoin Trials, Targets Faster Global Payouts

Visa is testing USDC stablecoin payouts, enabling U.S. businesses to pay in fiat while recipients get stablecoins. This pilot aims for quicker, borderless payments for gig workers, with a broader rollout planned for 2026.

USDC0.01%

BitcoincomNews·7h ago

Circle Unveils Q3 2025 Earnings on November 12, Priming USDC for Institutional Surge

With Revenue Eyed at $700M and 19% Circulation Growth, Stablecoin Leader Signals DeFi Expansion and Profit Rebound Toward $1B Quarterly Milestone by Mid-2026

CryptoPulseElite·7h ago

Stablecoin payment revolution! Visa connects fiat currency to crypto wallets, opening nationwide in the US by 2026.

Visa is testing a service that allows corporate accounts funded with fiat currency to pay USD stablecoins to cryptocurrency wallets. On Wednesday at the online summit in Lisbon, Portugal, Visa announced that the pilot program enables users of its digital payment network Visa Direct to send stablecoins like USDC directly to crypto wallets.

MarketWhisper·8h ago

Visa launches stablecoin payment pilot, allowing creators to receive USDC payments instantly

In November 2025, global payments giant Visa launched a groundbreaking pilot project allowing U.S. businesses to directly pay creators, freelancers, and gig economy workers with USDC stablecoins via Visa Direct. Recipients need to have compatible wallets and meet KYC/AML requirements to enable cross-border transfers in minutes, especially benefiting regions with high currency volatility or limited banking services.

Visa CEO Ryan McInerney revealed that the company has processed over $140 billion in crypto and stablecoin transactions, with stablecoin-related card spending quadrupling year-over-year in Q4. This pilot is based on the September upgrade of the stablecoin pre-funding scheme and is expected to expand in the second half of 2026, marking a new phase in the integration of traditional finance and digital assets.

MarketWhisper·8h ago

Visa launches a stablecoin payment pilot, supporting creators and freelancers to receive payments directly in USDC.

According to Mars Finance, global payment giant Visa has officially launched a stablecoin payment pilot program, allowing creators, freelancers, and businesses to receive payments directly in USDC issued by Circle through Visa Direct, enabling cross-border instant settlement. Visa stated that during the pilot phase, businesses can initiate payments in fiat funds in the U.S., while the recipients can choose to receive USDC directly, with funds almost available within minutes, which will bring convenience to users in areas with currency fluctuations or limited bank access. Chris Newkirk, President of Visa's Commercial and Money Movement Solutions, said: "The launch of stablecoin payments means truly achieving 'funds available in minutes', allowing any global user to quickly and securely receive income." It is reported that this pilot is a further expansion of Visa's stablecoin program. In September of this year, Visa had...

USDC0.01%

MarsBitNews·8h ago

USDC Payroll Goes Mainstream: Paystand Acquires Bitwage

Paystand acquires Bitwage, integrating stablecoin payroll capabilities into enterprise payment workflows globally.

Stablecoin transfer volume reached $9 trillion in 2025, approaching half of Visa's throughput.

Combined platform eliminates banking delays, enabling instant cross-border

BeInCrypto·11-11 09:57

Circle introduces AI Chatbot and MCP server for seamless USDC integration

Circle has launched an AI chatbot and MCP server to simplify integrating USDC and smart contracts via its API. This innovation enhances programmable payments, promotes USDC adoption, and boosts blockchain integration in AI applications, benefiting developers and the crypto community.

USDC0.01%

TapChiBitcoin·11-11 02:58

Circle issued 100 million USDC on the Ethereum network.

According to Mars Finance news on November 10, whale-alert monitored that Circle issued an additional 100 million USDC on the Ethereum network at 22:58 Beijing time today.

USDC0.01%

MarsBitNews·11-10 15:31

A new Address deposits 3.62 million USDC into Hyperliquid and goes long on ZEC with 10x leverage.

According to Huoxing Finance news on November 10, Lookonchain monitored that a new address deposited 3.62 million USDC into Hyperliquid and went long on ZEC with 10x leverage.

USDC0.01%

MarsBitNews·11-10 10:24

XMAQUINA releases the proposal "Allocation of 800,000 USDC for the acquisition of common stock in 1X Technologies"

According to Mars Finance, on November 10, the Web3 Bots company XMAQUINA community released a proposal vote for "allocating 800,000 USDC for the acquisition of 1X Technologies common stock," with the voting ending on November 11. The proposal includes the intention to allocate 800,000 USDC from the DAO treasury to directly acquire 1X Technologies common stock through its Norwegian holding company 1X Holding AS. 1X Technologies is currently using NEO.

USDC0.01%

MarsBitNews·11-10 06:55

Hourglass: Users must complete KYC by November 12 at 7:59.

According to Mars Finance, on November 10, Hourglass tweeted that the KYC link for the second phase of the Stable reserve fund is now live. Over 24,000 wallets (with a total deposit amount of approximately 1.74 billion USD) have successfully passed the wallet review. Users must complete KYC by 7:59 AM Beijing time on November 12. Users who failed to complete KYC earlier can do so within this window. If a user has deposited USDC but has not received the KYC link, it indicates that the wallet has not passed the Chainalysis wallet review, and they can withdraw USDC directly from the contract at any time.

USDC0.01%

MarsBitNews·11-10 04:04

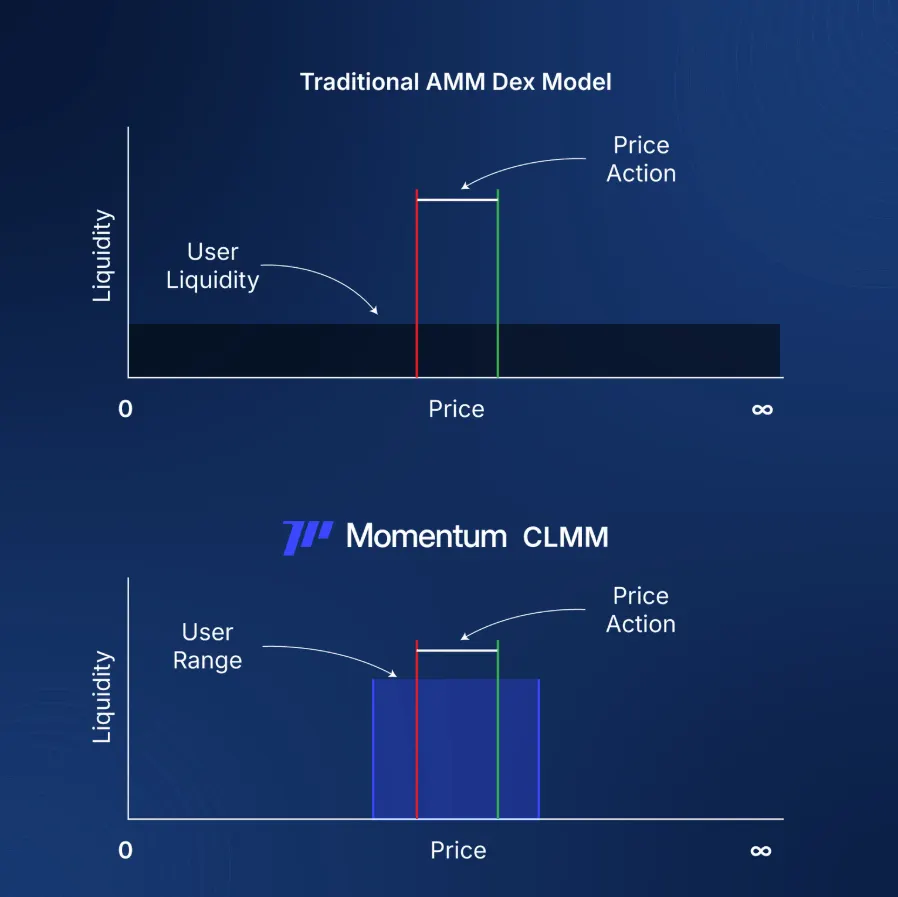

What is Momentum (MMT)? Sui DeFi's new star TGE skyrockets 4000%

What is Momentum (MMT)? Momentum is a decentralized finance (DeFi) hub based on the Sui blockchain, providing trading, staking, and asset management services within a unified ecosystem. MMT is the native token of the protocol, and after the TGE, its price surged from $0.39 to a historical high of $4.47, an increase of over 4000%.

MarketWhisper·11-10 02:37

Data: Two whale addresses spent a total of 21.06 million USDC to purchase HYPE tokens in the past 2 days.

According to Mars Finance, Spot On Chain monitoring shows that two Whale Addresses have collectively spent 21.06 million USDC to purchase HYPE Tokens. Whale "0x5AE" spent 11.21 million USDC at an average price of $39.23 to acquire 285,821 HYPE—still holding 2.79 million USDC in reserve. Whale "0x152" invested 9.85 million USDC at an average price of $39.54 to buy 249,073 HYPE—remaining 703,000 USDC. Both Whales are currently experiencing slight losses, but seem to be preparing for significant positioning.

MarsBitNews·11-07 12:28

The liquidity in the Sui currency market is tight! The utilization rate of mainstream lending protocol USDC is 100%, and users cannot withdraw.

The TVL of the Sui on-chain DeFi protocol has significantly decreased over the past month, mainly due to the loss of funds after the Momentum Airdrop and the outflow of funds from major lending protocols such as NAVI, SuiLend, and Scallop. In addition, the USDC utilization rate of NAVI and SuiLend has reached 100%, preventing users from withdrawing, and the high borrowing annual interest rates highlight the tight liquidity situation.

ChainNewsAbmedia·11-07 11:54

A user lost $1.22 million in cryptocurrency assets due to signing multiple phishing "permit" signatures.

Deep Tide TechFlow news, November 7th, according to Scam Sniffer monitoring, about 30 minutes ago, a user lost $1.22 million in cryptocurrency assets, including USDC and aPlaUSDT0 tokens, due to signing multiple phishing "permit" signatures.

USDC0.01%

DeepFlowTech·11-07 10:15

Whale Moves 14M USDC to Buy $8.3M in HYPE on Hyperliquid

A major crypto whale has made waves on-chain after moving millions into the trending decentralized exchange Hyperliquid. The trader deposited 14 million USDC and used most of it to buy over $8.3 million worth of HYPE tokens. This is a move that instantly caught the attention of on-chain

Coinfomania·11-07 07:47

Elixir: deUSD is officially invalidated, and the USDC compensation process will be initiated for all DeUSD and its derivations holders.

According to Mars Finance, Elixir's official Twitter announced that the stablecoin deUSD has officially been retired and no longer holds any value. The platform will initiate a USDC compensation process for all holders of deUSD and its derivations (such as sdeUSD). The affected range includes collateralizers on lending platforms, AMM LPs, Pendle LPs, etc. Elixir also warns users not to purchase or invest in deUSD through AMM or other channels.

MarsBitNews·11-07 05:13

A Whale deposited 14,000,000 USD USDC into HyperLiquid and bought HYPE Spot.

According to Mars Finance, a whale deposited 14,000,000 USDC into HyperLiquid and has bought HYPE on the spot market.

MarsBitNews·11-07 05:09

USDC Treasury has minted an additional 50 million USDC on the Ethereum blockchain.

Deep Tide TechFlow news: On November 6th, according to Whale Alert, the USDC Treasury minted an additional 50 million USDC on the Ethereum blockchain.

USDC0.01%

DeepFlowTech·11-06 15:18

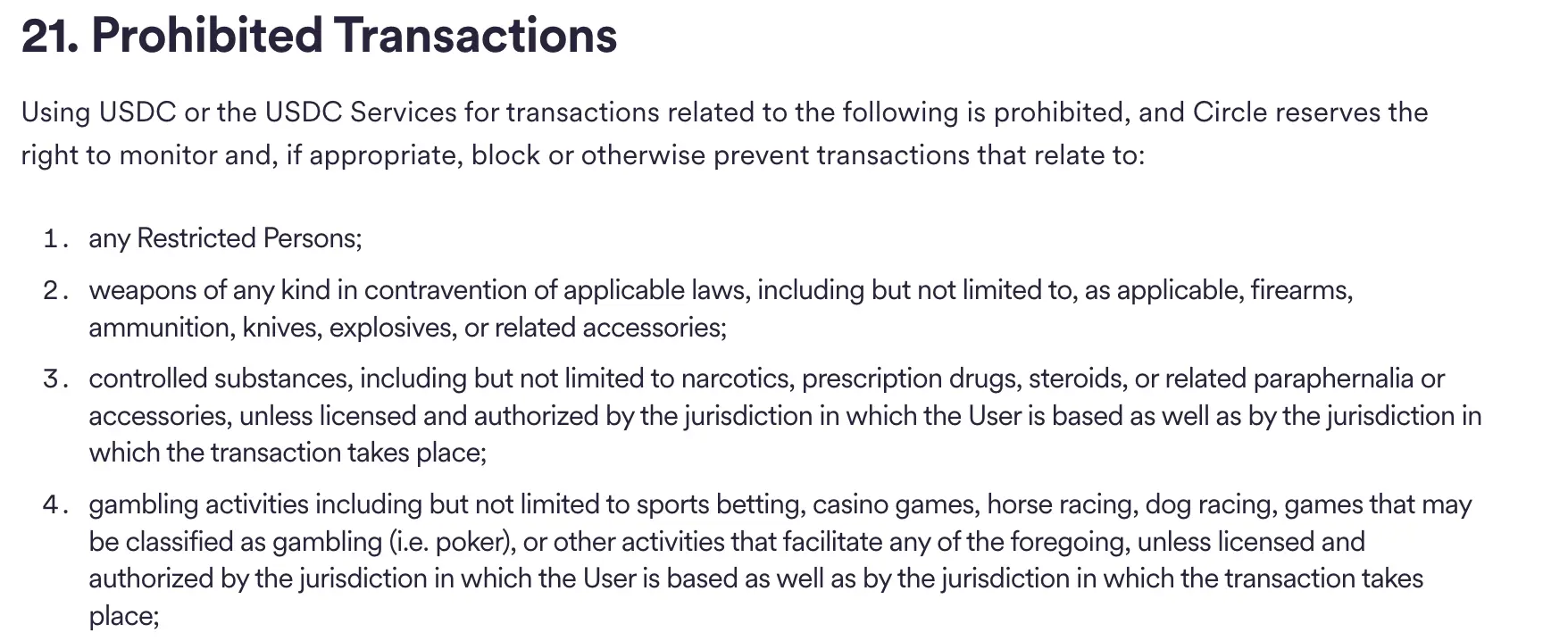

Circle Revises Terms to Permit Lawful Firearm Purchases With USDC

Circle’s policy change allows USDC use for legal firearm sales, reversing its previous blanket weapons ban.

Lawmakers and advocacy groups view the update as a step toward preventing financial discrimination in digital payments.

The policy revision follows recent U.S. stablecoin legislation under t

USDC0.01%

CryptoNewsLand·11-06 14:43

Circle Lifts USDC Ban on Legal Firearm Purchases, Aligning with GENIUS Act

Circle Internet Group has updated its USDC terms to permit legal firearm transactions, reversing a prior blanket prohibition and aligning with the GENIUS Act's federal framework for dollar-backed stablecoins.

USDC0.01%

CryptoPulseElite·11-06 09:41

Circle Allows Legal Firearm Purchases With USDC After Regulatory Pressure

Circle updated USDC terms to allow legal firearm purchases, ending its previous ban on weapon transactions.

The policy change aligns with federal regulations and industry advocacy against financial discrimination.

New regulatory clarity from the GENIUS Act encourages adoption and shapes the

USDC0.01%

BeInCrypto·11-06 08:15

Stable has launched the second phase of its $500 million USDC pre-deposit program and plans to convert it into USDT.

Stable, a leading stablecoin public blockchain, officially launched the second phase of its $500 million USDC pre-deposit program on November 6, 2025. The plan is to convert these USDC into new USDT, aiming to promote the development of the stablecoin market by enhancing on-chain liquidity.

USDC0.01%

MarketWhisper·11-06 06:51

Circle updates USDC policy to allow legal gun purchases, sparking discussions on stablecoin neutrality.

According to Deep潮 TechFlow news on November 6, Circle, a stablecoin issuer, has updated its terms of service to remove the previous ban on using USDC to purchase firearms. This policy change was made under pressure from the National Shooting Sports Foundation (NSSF) and gun rights advocates, who accused Circle of discriminating against legal business activities.

A Circle spokesperson confirmed: "We have clarified the terms, reflecting that USDC can be used for legal firearm transactions protected under the Second Amendment. We will not refuse USDC transactions involving legal firearms."

Republican Senator Bill Hagerty called it a victory "against the weaponization of the financial system." However, Kadan, the CTO of blockchain technology company Komodo,

USDC0.01%

DeepFlowTech·11-06 05:26

Circle Updates Terms of Service to Allow ‘Legal’ Firearm Purchases With USDC

In brief

Circle has updated policy on prohibition on firearms purchases following complaints from firearms industry advocates.

Senator Bill Hagerty called the update a victory against "weaponization" of the financial system and chokepoint-style discrimination.

An industry expert warned that the

USDC0.01%

Decrypt·11-06 05:24

Tangem launches Visa-backed Tangem Pay for onchain USDC spending

Tangem introduces Tangem Pay, enabling users to spend USDC with a virtual Visa card while retaining full control of their assets. Launching in November across the U.S., LATAM, and APAC+, it preserves user privacy and incurs no monthly fees.

Cryptonews·11-06 04:48

The encryption bug bounty platform Immunefi (IMU) token sale will start on November 12, 2025.

Immunefi Token sale will start on November 12, 2025, with a unit price of $0.01337, 100% unlocked at TGE, distributing 373,971,578 IMU, accounting for 3.74% of the total supply. The platform is dedicated to Web3 and smart contracts security and has raised $29 million.

USDC0.01%

MarsBitNews·11-06 02:45

USDC stablecoin now allows gun purchases! Circle has amended its terms to permit legal firearm transactions.

Stablecoin issuer Circle has updated its USDC policy to clarify rules regarding prohibited transactions, explicitly addressing the use of legally obtained guns and weapons. This week's cryptocurrency detective report noted that Circle revised its USDC terms, stating that the platform "reserves the right to monitor and, where appropriate, block or otherwise prevent transactions related to the purchase of guns, ammunition, explosives, and other weapons."

USDC0.01%

MarketWhisper·11-06 01:28

Circle Changes Policy, Now Letting Users Purchase Select Weapons with USDC

In a move that highlights the evolving landscape of cryptocurrency regulation and compliance, stablecoin issuer Circle has updated its policies concerning transactions involving firearms and weapons. This latest amendment aims to clarify the platform’s stance on prohibited transaction types,

USDC0.01%

CryptoBreaking·11-05 20:36

IMF Expert Report: Stablecoins Cause Surge in Demand for US Treasury Bonds, Posing Financial Risks

In the rapidly evolving International Monetary System, US stablecoins are quietly playing a key role. According to the research report "The Rise of Stablecoins and Implications for Treasury Markets" published in October 2025 by IMF experts Sonja Davidovic, Tarek Ghani, and Mariano Moszoro, stablecoins are rapidly penetrating the global payment system while significantly purchasing US Treasury bonds, leading to profound impacts on US fiscal stability and global financial markets.

This report by the Brookings Institution

USDC0.01%

ChainNewsAbmedia·11-05 10:53

Apex Fusion Integrates Stargate to Bring USDC Liquidity to Cardano

Apex Fusion's partnership with Stargate enables native USDC transfers across blockchains, enhancing Cardano's DeFi ecosystem by providing $2.5 million in liquidity. This integration improves cross-chain interoperability and stablecoin availability for developers.

Coinpedia·11-05 08:20

Unsecured Stablecoin Lending Fantasies

Article author: haonan

Article compilation: Block unicorn

Introduction

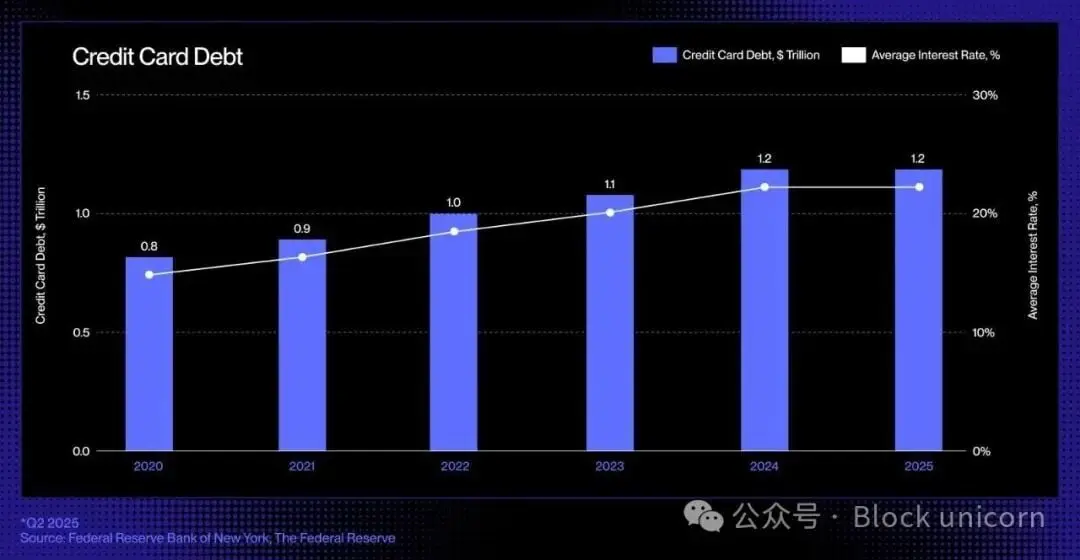

Users in the global unsecured consumer credit market are like fat sheep of modern finance—slow to act, lacking judgment, and lacking mathematical ability.

When unsecured consumer credit shifts to the stablecoin track, its operating mechanism will change, and new participants will have the opportunity to share the pie.

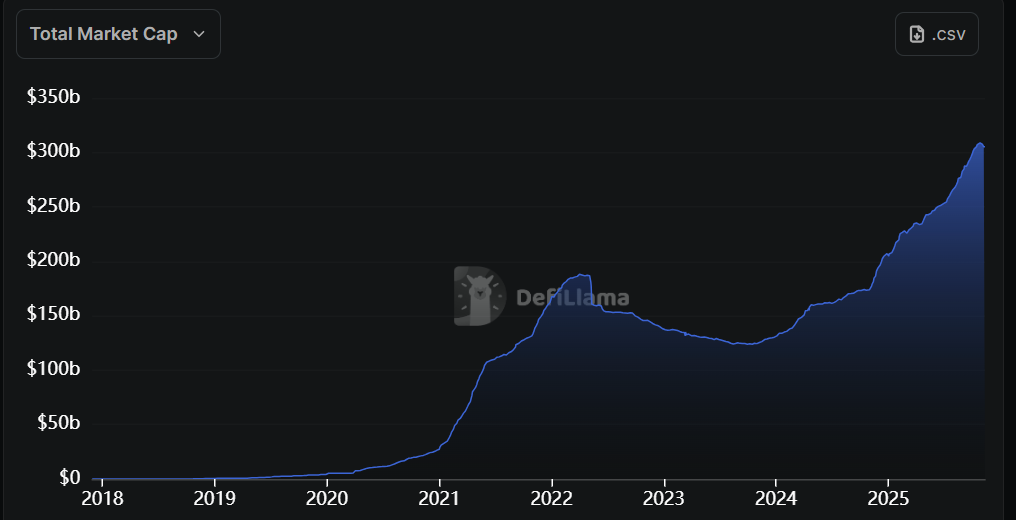

Market Size

In the United States, the primary form of unsecured borrowing is credit cards: this ubiquitous, highly liquid, and instantly available credit tool allows consumers to borrow without providing collateral during shopping. Unpaid credit card debt continues to rise and has now reached approximately $1.21 trillion.

Outdated Technology

The last major change in the credit card lending field occurred in the 1990s when Capital One introduced risk-based pricing, a groundbreaking move that reshaped the industry.

USDC0.01%

PANews·11-05 04:50

What is Belong (LONG)? The platform only serves genuine customers, disrupting the 580 billion market

Belong is a Web3 ecosystem that combines a content creator platform with decentralized venue marketing. The platform charges a low fee of 3% (compared to higher fees on Patreon), supporting anonymous cryptocurrency payments and NFT membership benefits. The core innovation, CheckIn, completely transforms the venue marketing market valued at $580 billion to $750 billion: venues only pay for verified in-store customers.

MarketWhisper·11-05 03:36

Binance launches DASH/USDC and ZEC/USDC spot trading pairs and Bots services.

According to Mars Finance, Binance will launch the DASH/USDC and ZEC/USDC spot trading pairs on November 5, 2025, at 16:00, and will provide Bots services for these two trading pairs to enhance user trading experience. Users can enjoy Taker fee discounts on existing and newly added USDC spot and Margin Trading pairs until further notice.

USDC0.01%

MarsBitNews·11-04 07:45

Load More

Hot Tags

Hot Topics

MoreCrypto Calendar

MoreAMA on X

Sushi will host an AMA on X with Hemi Network on March 13th at 18:00 UTC to discuss their latest integration.

2025-11-12

Sub0 // SYMBIOSIS in Buenos Aires

Polkadot has announced sub0 // SYMBIOSIS, its new flagship conference, to be held in Buenos Aires from November 14 to 16. The event is described as hyper immersive, aiming to bring builders and the broader ecosystem together under one roof.

2025-11-15

DeFi Day Del Sur in Buenos Aires

Aave reports that the fourth edition of DeFi Day del Sur will be held in Buenos Aires on November 19th.

2025-11-18

DevConnect in Buenos Aires

COTI will participate in DevConnect in Buenos Aires on November 17th-22nd.

2025-11-21

Tokens Unlock

Hyperliquid will unlock 9,920,000 HYPE tokens on November 29th, constituting approximately 2.97% of the currently circulating supply.

2025-11-28