- Trending TopicsView More

3.7K Popularity

4.7M Popularity

120.4K Popularity

78.7K Popularity

164.7K Popularity

- Pin

- 🍁 Golden Autumn, Big Prizes Await!

Gate Square Growth Points Lucky Draw Carnival Round 1️⃣ 3️⃣ Is Now Live!

🎁 Prize pool over $15,000+, iPhone 17 Pro Max, Gate exclusive Merch and more awaits you!

👉 Draw now: https://www.gate.com/activities/pointprize/?now_period=13&refUid=13129053

💡 How to earn more Growth Points for extra chances?

1️⃣ Go to [Square], tap the icon next to your avatar to enter [Community Center]

2️⃣ Complete daily tasks like posting, commenting, liking, and chatting to rack up points!

🍀 100% win rate — you’ll never walk away empty-handed. Try your luck today!

Details: ht - 💥 Gate Square Event: #Post0GWinUSDT# 💥

Post original content on Gate Square related to 0G or the ongoing campaigns (Earn, CandyDrop, or Contract Trading Competition) for a chance to share 200 USDT rewards!

📅 Event Period: Sept 25, 2025, 18:00 – Oct 2, 2025, 16:00 UTC

📌 Related Campaigns:

Earn: Enjoy stable earnings

👉 https://www.gate.com/announcements/article/47290

CandyDrop: Claim 0G rewards

👉 https://www.gate.com/announcements/article/47286

Contract Trading Competition: Trade to win prizes

👉 https://www.gate.com/announcements/article/47221

📌 How to Participate:

1️⃣ Post original cont - 🚀 #GateNewbieVillageEpisode2# ✖️ @独领风骚必暴富

💰 Share your first profit on Gate | 🎉 Recall your most unexpected gain | 🤝 Grow with the community

⏰ Event Date:Sept 24 04:00 – Sept 30 16:00 UTC+8

How to Join:

1️⃣ Follow Gate_Square + @独领风骚必暴富

2️⃣ Post on Gate Square with the hashtag #GateNewbieVillageEpisode2#

3️⃣ Share your first pot of gold or your most surprising profit on Gate—more detailed and interesting posts have a higher chance to win!

🎁 Rewards

3 lucky winners → Gate X RedBull Tumbler + $20 Futures Trial Voucher

If merchandise cannot be shipped, it will be replaced with a $30 Futures - 🚗 #GateSquareCommunityChallenge# Round 2 — Which coin is not listed on Gate Launchpad❓

Time to prove if you’re a true Gate veteran!

💰 Join the challenge — 5 lucky winners will share $50 in GT!

👉 How to participate:

1️⃣ Follow Gate_Square

2️⃣ Like this post

3️⃣ Comment with your answer

🗓️ Deadline: October 8, 2025, 24:00 (UTC+8) - 🥊 You’ve entered the Trading PK Arena, matching your opponent now...

One click to place an order and jump into the battle! Who will climb the leaderboard and claim the 👑?

Gate’s brand-new Indicators Radar feature is live! Here you can:

📈 Share your trades on the live candlestick chart to [Square] 👉️ https://www.gate.com/post

👀 Watch others’ trading moves in real time;

💬 Go head-to-head with fellow traders in the community!

Don’t just read—follow the tutorial below and get started 👇

📌 Note: This feature is available only on app version 7.20.5 or above.

Curve Finance's monthly revenue has increased by over 20% thanks to the DeFi explosion

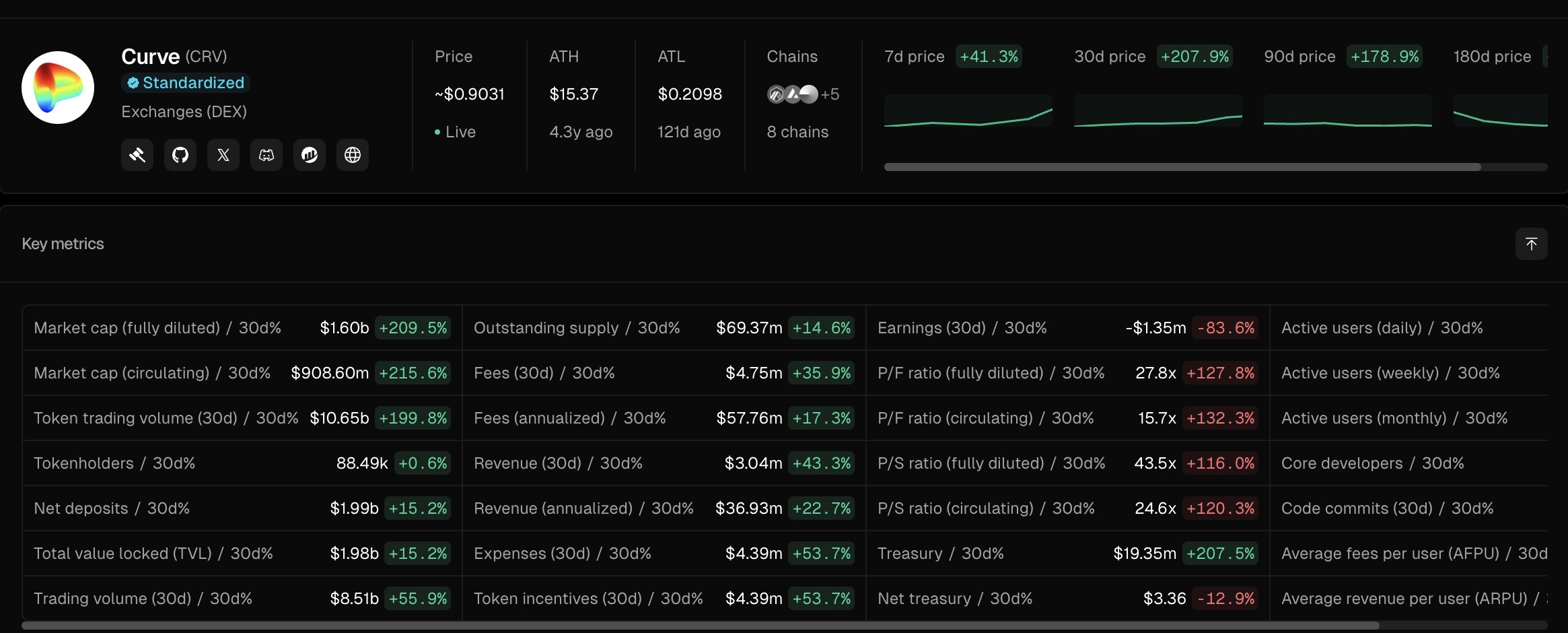

Curve Finance decentralized exchange platform achieved an annual revenue of nearly $37 million in the past 30 days, according to data from Token Terminal.

This revenue increased nearly 23% compared to the previous month, mainly due to 'increased demand for leveraged funding and the introduction of new products such as savings vault and scrvUSD token,' Curve said in its announcement on December 3rd.

"This growth rate is in line with the general optimism in the market after the recent US election," a Curve spokesperson shared, while emphasizing:

"Predictions about the cryptocurrency-friendly policies under President-elect Donald Trump's administration have bolstered market confidence, driving up coin prices and demand for products like crvUSD."

Source: Token Terminal## The vibrant year of 2024 for Curve

The native token of Curve, CRV, has increased by about 300% since Trump won the election on November 5. CRV currently has a market capitalization of over 1 billion USD, according to CoinGecko.

Launched in 2020, this decentralized finance (DeFi) protocol has taken strategic steps this year to compete with younger competitors.

In June, Curve deployed their crvUSD stablecoin to distribute fees to token holders, replacing the old model of paying out in pool shares of 3crv liquidity pool.

crvUSD is overcollateralized by a variety of digital assets, including Ether (ETH), Wrapped Bitcoin (WBTC), and other assets.

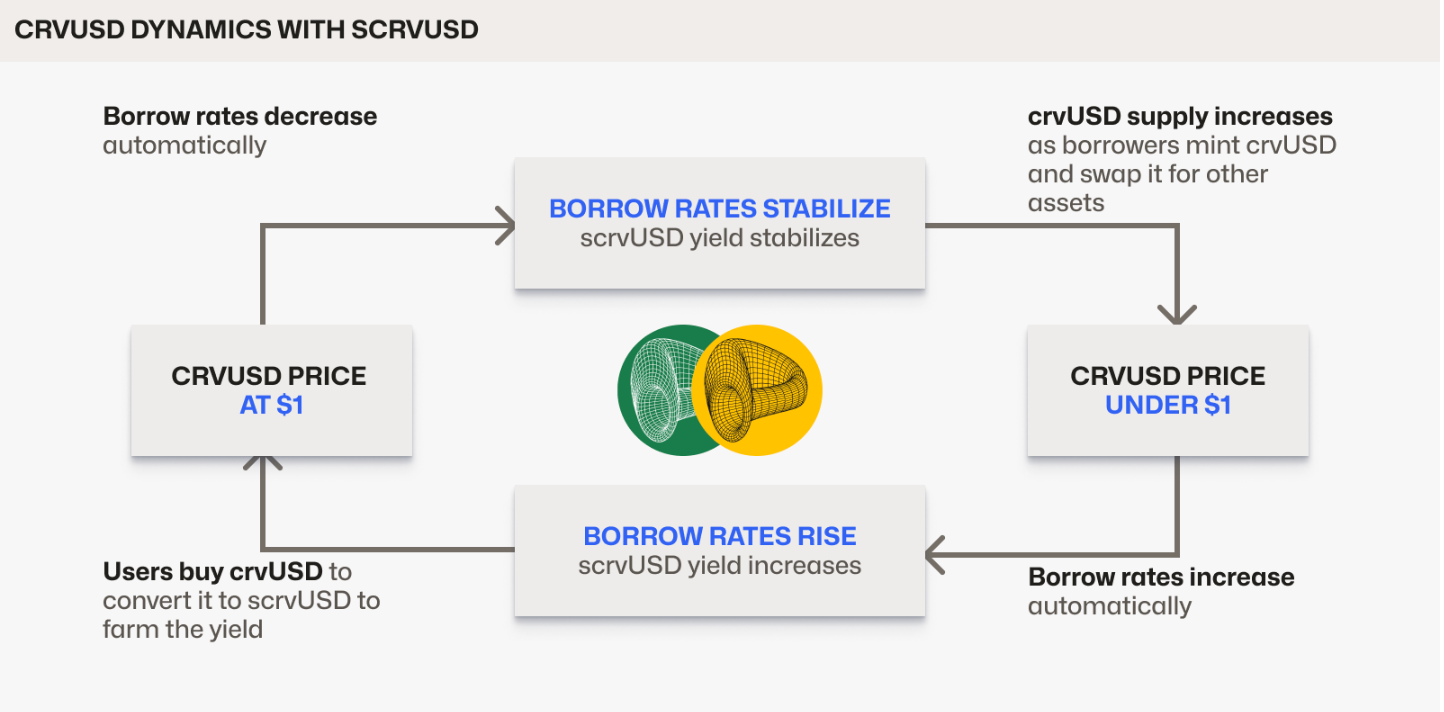

The graphics illustrate the impact of crvUSD and scrvUSD on the borrowing interest rates of Curve Finance. Source: Curve FinanceOn November 13, Curve introduced a decentralized profit-bearing stablecoin called “Savings crvUSD” (scrvUSD) to provide “low-risk profit” for investors and expand the scale of the crvUSD stablecoin.

Since its launch in November, scrvUSD has attracted nearly $14.5 million in deposits, Curve announced.

On November 29th, Curve partnered with the Elixir blockchain network to expand DeFi access for BlackRock's tokenized fiat market fund, BUIDL.

Low-risk profit demand

The demand for tokens promising low-risk profits is increasing.

This is especially true for the profits from tokenized real-world assets (RWA) - including bonds, silver, and other currency market instruments - as well as profits from protocol fees, such as scrvUSD.

Tokenized treasury products like BUIDL currently control more than $2.5 billion in total value locked as of Dec. 3, a more than threefold increase since the start of 2024, according to RWA.xyz.

Disclaimer: The article is for informational purposes only and is not investment advice. Investors should conduct thorough research before making any decisions. We are not responsible for your investment decisions.

Join Telegram:

Twitter (X):

Tiktok:

Càn Long

According to Cointelegraph