- Trending TopicsView More

3.7K Popularity

4.7M Popularity

120.4K Popularity

78.7K Popularity

164.7K Popularity

- Pin

- 🍁 Golden Autumn, Big Prizes Await!

Gate Square Growth Points Lucky Draw Carnival Round 1️⃣ 3️⃣ Is Now Live!

🎁 Prize pool over $15,000+, iPhone 17 Pro Max, Gate exclusive Merch and more awaits you!

👉 Draw now: https://www.gate.com/activities/pointprize/?now_period=13&refUid=13129053

💡 How to earn more Growth Points for extra chances?

1️⃣ Go to [Square], tap the icon next to your avatar to enter [Community Center]

2️⃣ Complete daily tasks like posting, commenting, liking, and chatting to rack up points!

🍀 100% win rate — you’ll never walk away empty-handed. Try your luck today!

Details: ht - 💥 Gate Square Event: #Post0GWinUSDT# 💥

Post original content on Gate Square related to 0G or the ongoing campaigns (Earn, CandyDrop, or Contract Trading Competition) for a chance to share 200 USDT rewards!

📅 Event Period: Sept 25, 2025, 18:00 – Oct 2, 2025, 16:00 UTC

📌 Related Campaigns:

Earn: Enjoy stable earnings

👉 https://www.gate.com/announcements/article/47290

CandyDrop: Claim 0G rewards

👉 https://www.gate.com/announcements/article/47286

Contract Trading Competition: Trade to win prizes

👉 https://www.gate.com/announcements/article/47221

📌 How to Participate:

1️⃣ Post original cont - 🚀 #GateNewbieVillageEpisode2# ✖️ @独领风骚必暴富

💰 Share your first profit on Gate | 🎉 Recall your most unexpected gain | 🤝 Grow with the community

⏰ Event Date:Sept 24 04:00 – Sept 30 16:00 UTC+8

How to Join:

1️⃣ Follow Gate_Square + @独领风骚必暴富

2️⃣ Post on Gate Square with the hashtag #GateNewbieVillageEpisode2#

3️⃣ Share your first pot of gold or your most surprising profit on Gate—more detailed and interesting posts have a higher chance to win!

🎁 Rewards

3 lucky winners → Gate X RedBull Tumbler + $20 Futures Trial Voucher

If merchandise cannot be shipped, it will be replaced with a $30 Futures - 🚗 #GateSquareCommunityChallenge# Round 2 — Which coin is not listed on Gate Launchpad❓

Time to prove if you’re a true Gate veteran!

💰 Join the challenge — 5 lucky winners will share $50 in GT!

👉 How to participate:

1️⃣ Follow Gate_Square

2️⃣ Like this post

3️⃣ Comment with your answer

🗓️ Deadline: October 8, 2025, 24:00 (UTC+8) - 🥊 You’ve entered the Trading PK Arena, matching your opponent now...

One click to place an order and jump into the battle! Who will climb the leaderboard and claim the 👑?

Gate’s brand-new Indicators Radar feature is live! Here you can:

📈 Share your trades on the live candlestick chart to [Square] 👉️ https://www.gate.com/post

👀 Watch others’ trading moves in real time;

💬 Go head-to-head with fellow traders in the community!

Don’t just read—follow the tutorial below and get started 👇

📌 Note: This feature is available only on app version 7.20.5 or above.

BNB Future Value Analysis: Insights and Predictions

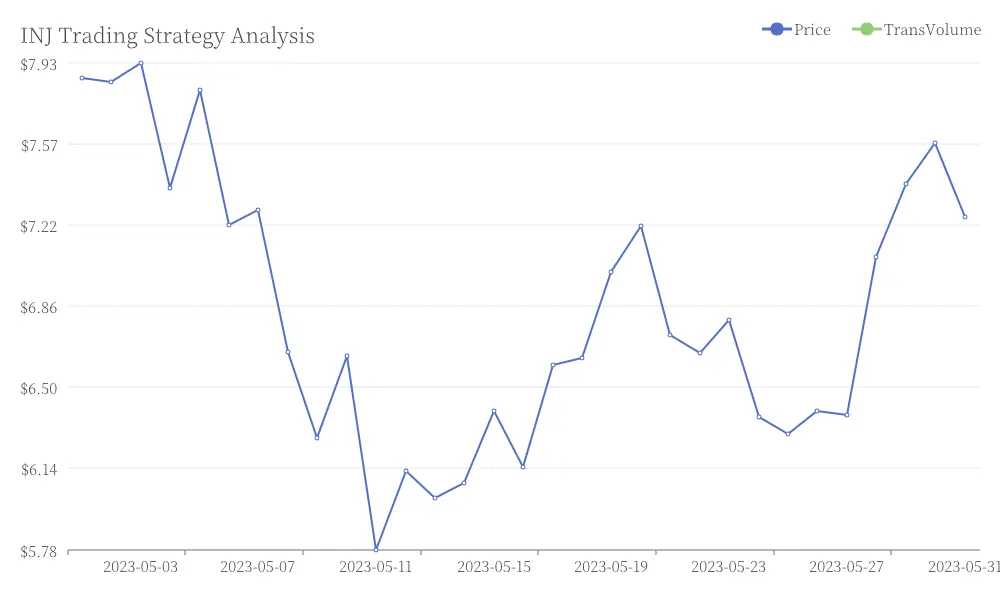

Trading Strategy for INJ

The cryptocurrency market presents an opportunity for a potential long position on INJ. Based on technical analysis, a limit order has been identified with an entry point between 29.7 and 29.97. INJ Trading Strategy Analysis

INJ Trading Strategy Analysis

Risk Management Parameters

Prudent risk management is crucial in volatile markets. For this trade, the following parameters have been established:

| Parameter | Value | Description | |-----------|-------|-------------| | Stop Loss | 28.7 | Exit point to limit potential losses | | Take Profit 1 | 30.9 | First target for profit-taking | | Take Profit 2 | 33.8 | Secondary target for extended gains | INJ Trading Strategy Risk Management Parameters

INJ Trading Strategy Risk Management Parameters

The stop loss is set at 28.7, representing a 3.5% risk from the entry point. This conservative approach aims to protect capital while allowing for potential upside.

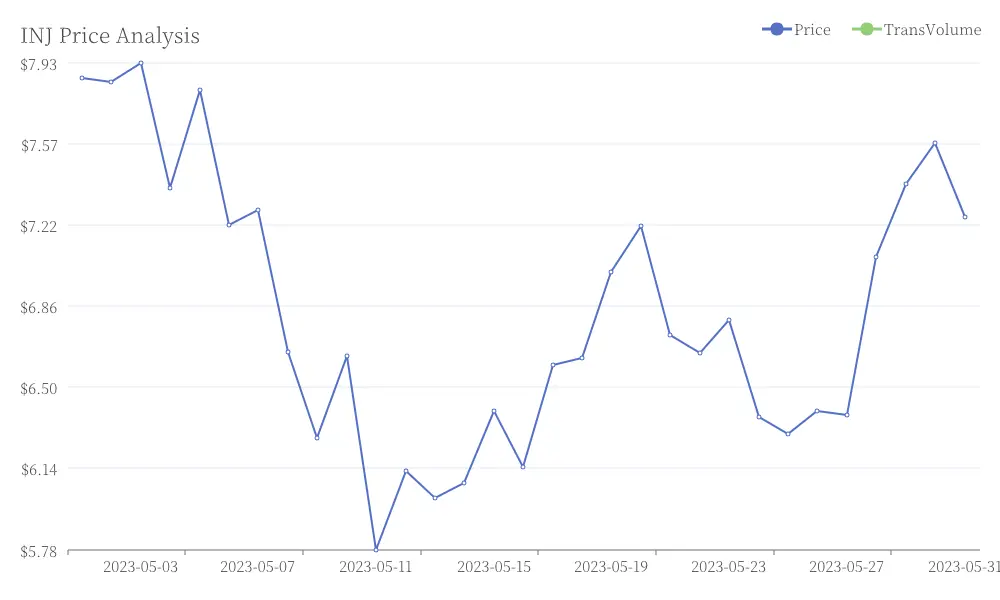

Market Context

INJ's recent price action shows a current value of 13.75, indicating a 3.10% decrease. This pullback may present an opportunity for traders looking to enter at a more favorable price point. INJ Price Analysis

INJ Price Analysis

Technical Outlook

The identified trading range suggests a bullish bias, with potential for upward movement. Traders should closely monitor key support and resistance levels, as well as overall market sentiment, to validate this outlook. INJ Trading Strategy Technical Outlook

INJ Trading Strategy Technical Outlook

Execution Strategy

To implement this trade effectively, begin by setting a limit order within the 29.7 to 29.97 range. Upon entry, immediately place your stop loss at 28.7 to protect your position. Establish take profit orders at both 30.9 and 33.8 for staged profit realization. Throughout the trade's duration, continuously monitor market conditions and be prepared to adjust your strategy based on changing circumstances and new information.

Remember, successful trading involves discipline and adherence to predefined strategies. Always conduct thorough research and consider your risk tolerance before entering any position.