Introduction to Gate Spot Grid

Gate spot grid is an automated quantitative trading tool that divides a set price range into multiple grids and automatically places buy and sell orders within each grid, capturing "buy low, sell high" profits from market fluctuations. Its advantages include being fully automated with no manual market monitoring, risk diversification, and strong suitability for range-bound markets. The platform also provides tailored options for different users: beginners can use copy trading, while experienced traders can create custom bots.

1. Introduction

Gate spot grid is an automated quantitative trading bot that divides a preset price range into multiple grids and places buy and sell orders within each grid, capturing “buy low, sell high” profits from market fluctuations. This bot does not require forecasting market trends and instead profits from range-bound price movements.

From its definition, the key characteristics of spot grid are:

Automated grid trading bot: Users set a price range (maximum/minimum) and divide it into multiple grids. When the price fluctuates within this range, the system automatically places buy orders at the lower grids and sell orders at the upper grids, generating profits from buying low and selling high.

No manual monitoring required: Once activated, the bot runs 24/7, automatically executing trades amid price fluctuations and effectively reducing the impact of human emotions.

Risk diversification: By distributing funds across multiple price points, the bot avoids concentrating all capital at a single level, reducing the risk of exposure.

Example:

- The BTC price range is set at $80,000 – $130,000 and divided into 50 arithmetic grids, each with a $1,000 price gap.

- If the price drops from $100,000 to $99,000, the grid places a buy order. When it rebounds to $100,000, the grid places a sell order, capturing the $1,000 price difference as profit.

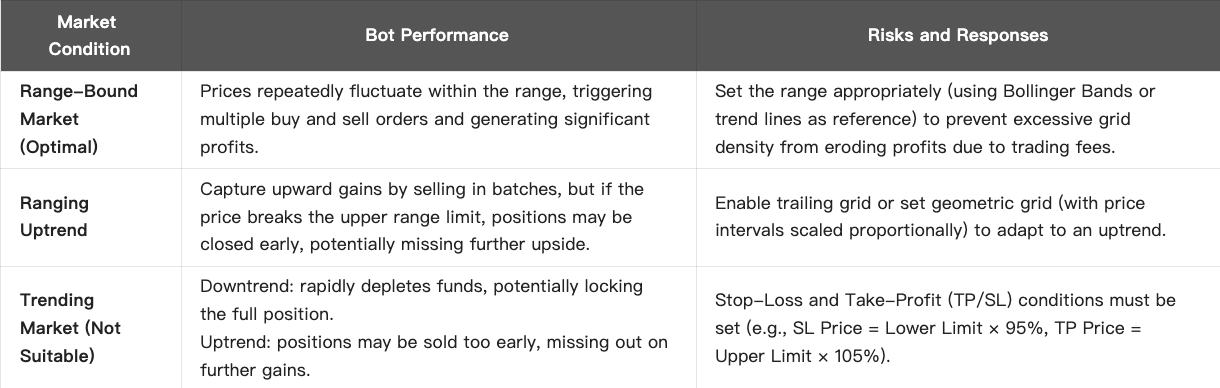

2. Suitable Market Types: Range-Bound Markets

The profitability of spot grid depends on price fluctuations rather than market direction, making it especially suitable for specific market conditions.

Data support: Approximately 80% of the time, the crypto market remains range-bound, providing a natural environment for grid trading.

3. Types of Suitable Investors

3.1 Beginners

- Advantage: Gate’s AI parameter recommendations and copy trading make it easy for users to get started, eliminating the need for complex analysis.

- Suggestion: Please select the major coins (e.g., BTC/USDT, ETH/USDT) with high liquidity and moderate volatility, avoiding sudden risks associated with small-cap coins.

3.2 Quantitative Traders

- Advantage: API access and historical data download (including order book depth, candlestick charts, etc.) are available, facilitating bot backtesting and optimization.

- Example: Using ATR (Average True Range) to calculate volatility. For instance, when BTC fluctuates 1% per hour, a single arbitrage trade can yield approximately 0.35% after trading fee deduction.

3.3 Medium- To Long-Term Investors

- Accumulating coins in a bear market: Activate HODL mode to automatically convert grid profits into tokens, accumulating tokens at lower prices.

- Asset risk hedging: Run a grid on the ETH/BTC pair to hedge single-asset risk and take advantage of the value volatility.

3.4 Volatility Traders

- Strategy: Select highly volatile coins (e.g., ATR > 5%) and increase arbitrage frequency through denser grids.

- Risk warning: Be cautious of transaction failures or liquidations caused by insufficient liquidity in small-cap coins.