Hundreds of crypto ETFs to launch, analysts warn: a wave of large-scale liquidations may follow the frenzy

U.S. cryptocurrency asset management firm Bitwise recently released 11 bold predictions for 2026, with the most notable being: under the push of SEC new regulations, the U.S. market will see over 100 new cryptocurrency asset ETFs. However, senior ETF analyst James Seyffart from Bloomberg sounded the alarm, believing that this issuance boom driven by regulatory changes could trigger a large-scale product liquidation wave as early as the end of 2026 to 2027. The market will seek a new balance amid frantic expansion and brutal reshuffling.

MarketWhisper·10m ago

Reputed Bitcoin and Crypto Expert Just Set Long Orders Between $80,000 – $84,000 BTC Price

Reputed Bitcoin and crypto expert just set long orders.

Orders set between $80,000 – $84,000 for a close between $90,000 – $104,000.

Can altseason occur during this pump, or will the next leg down play out first?

The price of BTC has been continually falling this week, starting with the

BTC0.68%

CryptoNewsLand·11m ago

ZK Price Set for Breakout as 4H Descending Channel Tests Key $0.055 Target

ZK price is testing lower four-hour channel support, showing a short-term bullish bounce as sellers lose momentum.

Resistance at $0.0337 and supply zones near $0.07–$0.08 remain critical for trend reversal confirmation and sustained upside.

Daily charts show a ma

ZK-5.88%

CryptoFrontNews·12m ago

If MSCI bans "more than half of DAT's market cap companies," will it trigger over $10 billion in sell-offs?

Morgan Stanley's MSCI Index plans to exclude companies with high "coin holdings," potentially triggering $15 billion in passive fund selling pressure?

(Background: Reader Submission » Why does MSCI have to act? Strategy is shaking the index system)

(Additional context: MicroStrategy demands MSCI to withdraw the "exclude MSTR" proposal: the 50% coin holding threshold is baseless, which is stifling American innovation!)

Less than a month before the "judgment day" on January 15, 2026, the index giant MSCI plans to reclassify companies with "digital asset proportions over half" on their balance sheets and remove them from the global investable market index. On the surface, it appears to be a classification adjustment, but in reality, it could trigger over $10 billion in forced selling under mechanical execution by passive funds, becoming the first crypto shockwave in the 2026 crypto market.

M

動區BlockTempo·12m ago

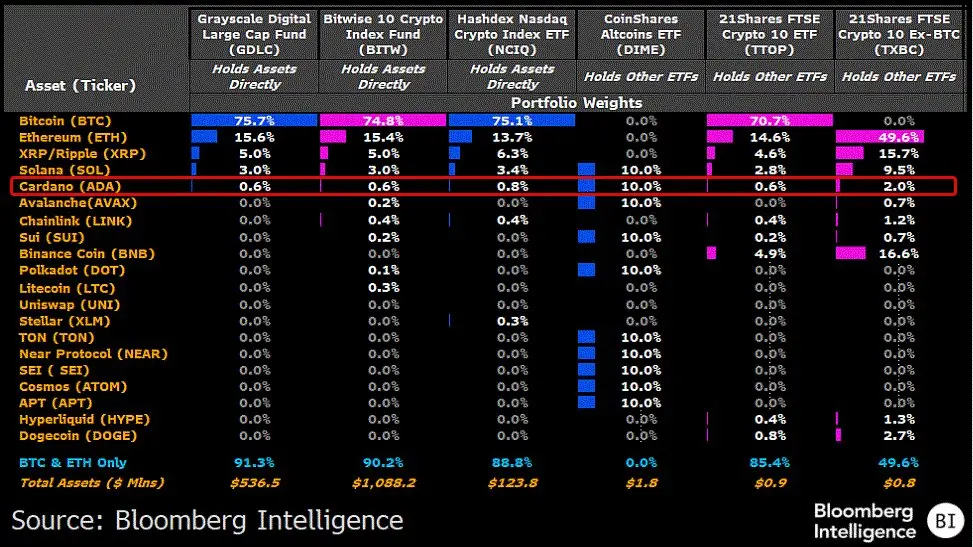

Cardano Stuns Bloomberg Expert With This ETF Milestone

James Seyffart from Bloomberg has emphasized Cardano's notable presence in the evolving crypto index ETP market, being included in six significant funds. While single-asset ETPs currently dominate, he forecasts growth for crypto index ETPs, despite no dedicated Cardano spot ETF being approved yet.

ADA-4.11%

TheCryptoBasic·18m ago

V God Reflects on Ethereum: The Protocol is Too Complex, Users Are Forced to Blindly Trust

Ethereum co-founder Vitalik Buterin posted on X platform stating that the Ethereum blockchain needs to better explain its functions to users in order to achieve true "trustlessness," which is a common challenge faced by all blockchain protocols. He explained that an important but underestimated form of trustlessness is increasing the number of people who can truly understand the entire protocol from start to finish. Ethereum needs to do better in this regard by simplifying protocols.

ETH-2.72%

MarketWhisper·19m ago

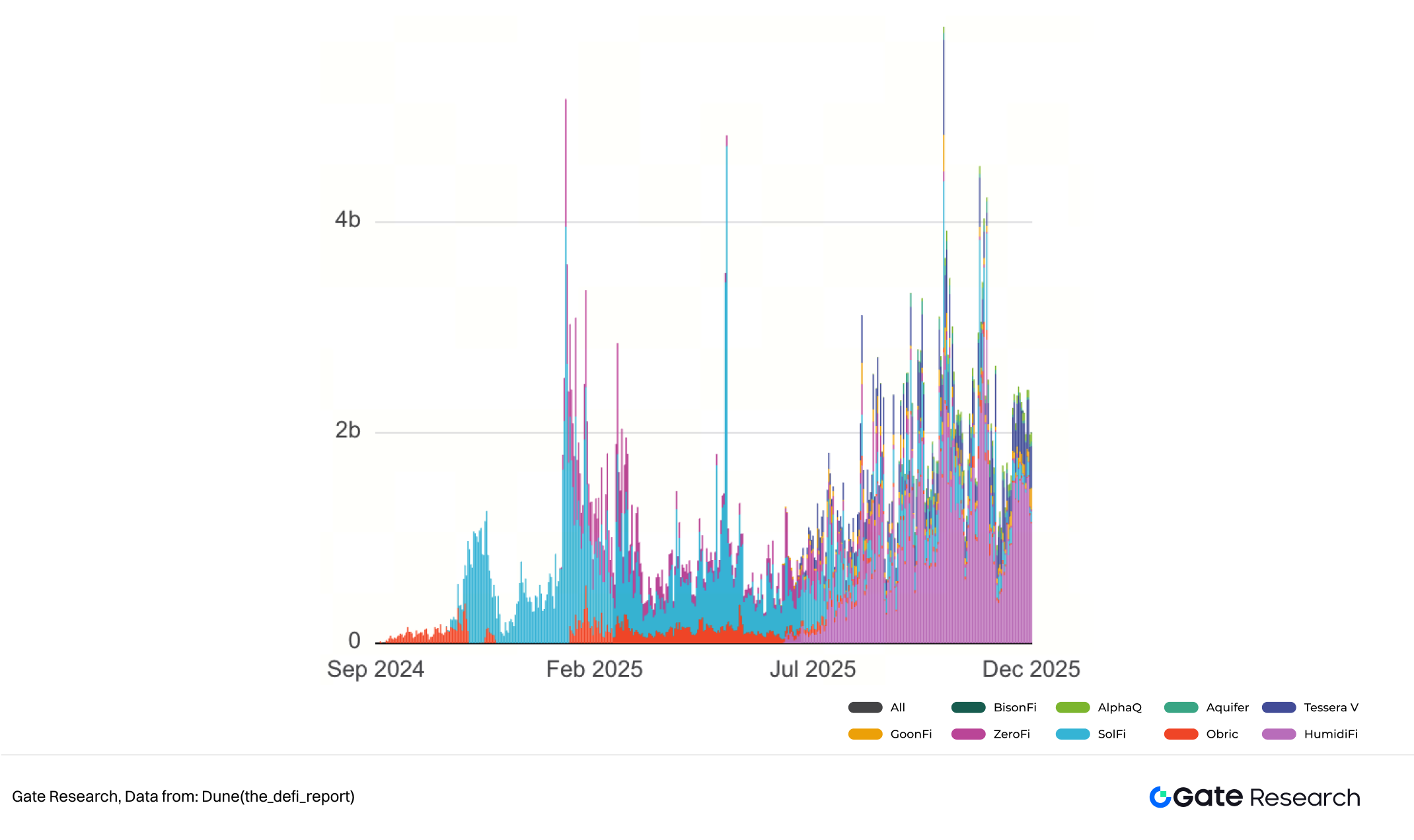

Gate Research Institute: Prop AMM Reshapes Solana's Liquidity Landscape

Summary

Prop AMM accounts for 20%-40% of Solana's weekly trading volume, with over 80% in SOL-Stablecoins.

Prop AMM's proprietary capital model eliminates impermanent loss (IL), converting it into hedgeable inventory risk.

Profitability does not rely on token subsidies; Prop AMM earns spreads, with profits = total spreads earned from market making - market value fluctuations of inventory assets - operating costs.

As Solana evolves towards an on-chain CEX model, Prop AMM will play a core market-making role.

I. The Three Iterations of AMM Evolution

One of the core innovations in DeFi is the Automated Market Maker (AMM), which replaces traditional order book models with mathematical formulas.

SOL-3.15%

GateResearch·19m ago

Ray Dalio Matches Donations for Connecticut Children's Savings

Ray Dalio is matching $250 donations for Connecticut children through the Trump Accounts initiative, promoting financial literacy and savings. His initiative aims to provide children with early insights into financial education and the importance of wealth accumulation.

RAY-5.6%

CoincuInsights·19m ago

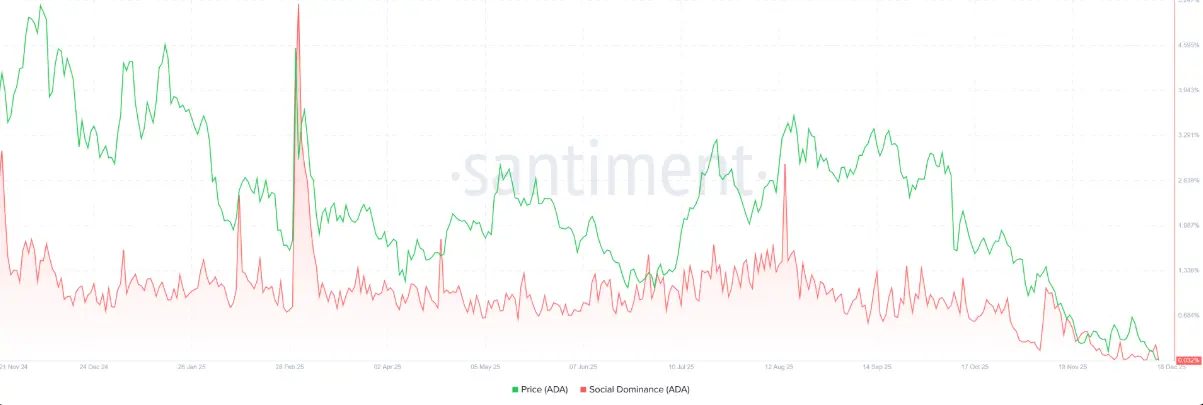

Cardano (ADA) dropped below 0.37 USD, hitting a two-month low as selling pressure increased.

Cardano (ADA) price continues to face selling pressure as it trades in the red, falling below the $0.37 mark on Thursday after losing more than 7% of its value since the beginning of the week. This correction is likely not over yet, as ADA's dominance on social media has significantly decreased, and at the same time

ADA-4.11%

TapChiBitcoin·20m ago

Avalanche bets on purpose-built chains as AVAX builders shrug off short-term hype

Ava Labs' John Nahas says Avalanche is betting on sovereign, purpose-built blockchains, targeting \~200 institutional and enterprise chains across finance and AI.

Summary

Ava Labs' John Nahas says Avalanche's growth comes from purpose-built chains for specific use cases, not chasing

AVAX-3.28%

Cryptonews·23m ago

Bitcoin bulls test B3’s tokenized RWA and stablecoin bet

B3 is launching a tokenization platform for real-world assets and a BRL-pegged stablecoin by 2026, integrating blockchain with Brazil's financial market. It aims to streamline trading and introduce options for Bitcoin, ETH, and SOL, pending regulatory approval.

Cryptonews·29m ago

Hex Trust Launches wXRP With $100M TVL via LayerZero Integration

Hex Trust has taken a big step into the multichain world. The regulated digital asset custodian announced a partnership with LayerZero to launch wXRP, a wrapped version of XRP built for cross-chain use. The product went live with around $100 million in total value locked. That is not a soft launch.

Coinfomania·34m ago

Vitalik Buterin angrily refutes the sell-off rumors! All ETH sales are for ecosystem development, not cashing out

Ethereum founder Vitalik Buterin recently faced a trust crisis within the community, with numerous rumors claiming he engaged in large-scale ETH sell-offs for personal gain. Vitalik Buterin denied the allegations, publicly emphasizing that selling Ethereum is not for personal profit or exit purposes, but to raise funds to support platform development and research projects. He clarified that the ETH sales are used to fund expansion solutions and Layer2 network construction.

ETH-2.72%

MarketWhisper·45m ago

Load More

Hot Tags

Hot Topics

MoreCrypto Calendar

MoreHayabusa Upgrade

VeChain has unveiled plans for the Hayabusa upgrade, scheduled for December. This upgrade aims to significantly enhance both protocol performance and tokenomics, marking what the team calls the most utility-focused version of VeChain to date.

2025-12-27

Litewallet Sunsets

Litecoin Foundation has announced that the Litewallet app will officially sunset on December 31. The app is no longer actively maintained, with only critical bug fixes addressed until that date. Support chat will also be discontinued after this deadline. Users are encouraged to transition to Nexus Wallet, with migration tools and a step-by-step guide provided within Litewallet.

2025-12-30

OM Tokens Migration Ends

MANTRA Chain issued a reminder for users to migrate their OM tokens to the MANTRA Chain mainnet before January 15. The migration ensures continued participation in the ecosystem as $OM transitions to its native chain.

2026-01-14

CSM Price Change

Hedera has announced that starting January 2026, the fixed USD fee for the ConsensusSubmitMessage service will increase from $0.0001 to $0.0008.

2026-01-27

Vesting Unlock Delayed

Router Protocol has announced a 6-month delay in the vesting unlock of its ROUTE token. The team cites strategic alignment with the project’s Open Graph Architecture (OGA) and the goal of maintaining long-term momentum as key reasons for the postponement. No new unlocks will take place during this period.

2026-01-28