2025 XLM Price Prediction: Expert Analysis and Market Forecast for Stellar Lumens

Introduction: XLM's Market Position and Investment Value

Stellar (XLM), as a decentralized platform for cross-border transactions, has achieved significant milestones since its inception in 2014. As of 2025, Stellar's market capitalization has reached $7.45 billion, with a circulating supply of approximately 32.35 billion coins, and a price hovering around $0.23. This asset, often referred to as the "bridge currency," is playing an increasingly crucial role in facilitating fast and low-cost international money transfers and asset exchanges.

This article will provide a comprehensive analysis of Stellar's price trends from 2025 to 2030, taking into account historical patterns, market supply and demand, ecosystem development, and macroeconomic factors, offering investors professional price predictions and practical investment strategies.

I. XLM Price History Review and Current Market Status

XLM Historical Price Evolution

- 2014: Stellar launched, initial price around $0.002

- 2018: Bull market peak, XLM reached all-time high of $0.875563 on January 3

- 2020: Market recovery, XLM price fluctuated between $0.04 and $0.20

- 2021: Another bull run, XLM reached local high of $0.79 in May

- 2022-2023: Crypto winter, price declined to around $0.08-$0.15 range

XLM Current Market Situation

As of December 15, 2025, XLM is trading at $0.23013, ranking 24th by market capitalization. The current price represents a 73.7% decrease from its all-time high. XLM's 24-hour trading volume is $1,368,446, with a market cap of $7.45 billion. The circulating supply is 32,352,837,894 XLM, which is 64.7% of the total supply of 50,001,786,892 XLM.

XLM has experienced negative price movements across various timeframes:

- 1 hour: -0.29%

- 24 hours: -1.8%

- 7 days: -6.32%

- 30 days: -12.65%

- 1 year: -45.76%

The current market sentiment for cryptocurrencies is "Extreme Fear" with a VIX index of 16, indicating high volatility and uncertainty in the market.

Click to view the current XLM market price

XLM Market Sentiment Indicator

2025-12-15 Fear and Greed Index: 16 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is currently gripped by extreme fear, with the sentiment index plummeting to 16. This indicates a highly pessimistic outlook among investors. Such extreme fear levels often present potential buying opportunities for contrarian investors, as markets may be oversold. However, caution is advised as the underlying reasons for this fear should be carefully evaluated. Traders and investors should consider diversifying their portfolios and implementing risk management strategies during this period of market uncertainty.

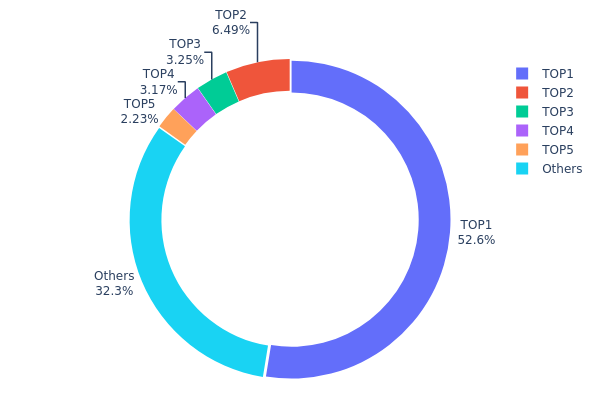

XLM Holdings Distribution

The address holdings distribution data for XLM reveals a highly concentrated ownership structure. The top address holds a staggering 52.57% of all XLM tokens, indicating significant centralization. The subsequent four largest addresses collectively account for an additional 15.12% of the total supply. This concentration of wealth in a small number of addresses raises concerns about market manipulation and price volatility.

The disproportionate distribution of XLM tokens suggests potential risks to market stability. With over half of the supply controlled by a single entity, any large-scale movement of funds could dramatically impact the market. This centralization also contradicts the principles of decentralization often associated with cryptocurrencies, potentially affecting investor confidence and the overall ecosystem's resilience.

Click to view the current XLM Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | GALAXY...ZILUTO | 554421152.03K | 52.57% |

| 2 | GDUY7J...LDERI4 | 68461825.55K | 6.49% |

| 3 | GDKIJJ...CCWNMX | 34265991.80K | 3.24% |

| 4 | GBFZPA...ZJJFNP | 33459507.10K | 3.17% |

| 5 | GB6NVE...4MY4AQ | 23508201.71K | 2.22% |

| - | Others | 340322342.69K | 32.31% |

II. Key Factors Influencing XLM's Future Price

Supply Mechanism

- Fixed Supply: XLM has a total supply of 50,001,806,812 tokens, with no new tokens being created.

- Historical Pattern: The limited supply has historically contributed to price stability and potential appreciation.

- Current Impact: With a fixed supply, increasing demand could lead to price appreciation in the future.

Institutional and Whale Dynamics

- Institutional Holdings: Major financial institutions are showing increased interest in XLM, potentially driving up demand.

- Corporate Adoption: Several companies are exploring Stellar's technology for cross-border payments and remittances.

- Government Policies: Regulatory clarity in some jurisdictions is encouraging institutional adoption of XLM.

Macroeconomic Environment

- Monetary Policy Impact: Central bank policies, particularly interest rates, can affect XLM's attractiveness as an investment.

- Inflation Hedging Properties: XLM is being considered as a potential hedge against inflation in some economies.

- Geopolitical Factors: Global economic uncertainties may drive investors towards cryptocurrencies like XLM.

Technical Development and Ecosystem Growth

- Stellar Network Upgrades: Ongoing improvements to the Stellar network enhance its functionality and appeal.

- Scalability Solutions: Implementation of layer-2 solutions could improve transaction speeds and reduce costs.

- Ecosystem Applications: Growing number of DApps and projects built on Stellar are expanding XLM's utility.

III. XLM Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.16773 - $0.20000

- Neutral prediction: $0.20000 - $0.25000

- Optimistic prediction: $0.25000 - $0.27113 (requires strong market sentiment and increased adoption)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increased volatility

- Price range forecast:

- 2027: $0.26256 - $0.43156

- 2028: $0.32634 - $0.39968

- Key catalysts: Technological advancements in the Stellar network, broader cryptocurrency market trends, and potential partnerships

2030 Long-term Outlook

- Base scenario: $0.35191 - $0.45000 (assuming steady market growth and adoption)

- Optimistic scenario: $0.45000 - $0.58795 (assuming widespread institutional adoption and favorable regulatory environment)

- Transformative scenario: $0.58795 - $0.70000 (assuming major breakthroughs in Stellar's technology and global financial integration)

- 2030-12-31: XLM $0.42916 (projected average price based on current trends)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.27113 | 0.22977 | 0.16773 | 0 |

| 2026 | 0.35313 | 0.25045 | 0.21789 | 8 |

| 2027 | 0.43156 | 0.30179 | 0.26256 | 31 |

| 2028 | 0.39968 | 0.36668 | 0.32634 | 59 |

| 2029 | 0.47514 | 0.38318 | 0.30271 | 66 |

| 2030 | 0.58795 | 0.42916 | 0.35191 | 86 |

IV. XLM Professional Investment Strategies and Risk Management

XLM Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors with a high-risk tolerance and long-term vision

- Operational suggestions:

- Accumulate XLM during market dips

- Set price targets and stick to them

- Store XLM in a secure hardware wallet or reputable custodial service

(2) Active Trading Strategy

- Technical Analysis Tools:

- Moving Averages: Use to identify trends and potential reversal points

- Relative Strength Index (RSI): Helps in identifying overbought or oversold conditions

- Key Points for Swing Trading:

- Monitor XLM's correlation with Bitcoin and overall market sentiment

- Set strict stop-loss orders to manage downside risk

XLM Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of portfolio

- Aggressive investors: 5-10% of portfolio

- Professional investors: Up to 15% of portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across different cryptocurrencies and traditional assets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallets for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords, and keep private keys offline

V. Potential Risks and Challenges for XLM

XLM Market Risks

- Volatility: XLM price can experience significant fluctuations

- Liquidity: Potential issues during high market stress periods

- Market sentiment: Susceptible to broader cryptocurrency market trends

XLM Regulatory Risks

- Regulatory uncertainty: Changing global regulations may impact XLM's adoption and use

- Compliance requirements: Potential increased KYC/AML requirements for XLM transactions

- Government interventions: Possible restrictions or bans in certain jurisdictions

XLM Technical Risks

- Network congestion: Potential scalability issues during high transaction periods

- Smart contract vulnerabilities: Risks associated with applications built on Stellar

- Technological obsolescence: Competition from newer blockchain technologies

VI. Conclusion and Action Recommendations

XLM Investment Value Assessment

XLM presents a unique value proposition in the cross-border payment and asset tokenization space. While it offers long-term potential for disrupting traditional financial systems, short-term volatility and regulatory uncertainties pose significant risks.

XLM Investment Recommendations

✅ Beginners: Start with small, regular investments to understand market dynamics ✅ Experienced investors: Consider a balanced approach, mixing long-term holding with strategic trading ✅ Institutional investors: Explore partnerships and integration possibilities within the Stellar ecosystem

XLM Participation Methods

- Spot trading: Buy and sell XLM on reputable exchanges like Gate.com

- Staking: Participate in Stellar's consensus mechanism for potential rewards

- Ecosystem involvement: Explore Stellar-based applications and services for deeper engagement

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

How much will XLM be worth in 2025?

Based on current market trends and projections, XLM is expected to trade between $0.22 and $0.87 in 2025. This prediction suggests potential growth and increased adoption of Stellar's blockchain technology for cross-border payments.

Can XLM reach $10?

Yes, XLM has the potential to reach $10 and possibly even higher. Market trends and adoption rates suggest it could break this barrier in the coming years.

Is XLM going to skyrocket?

XLM has strong potential for significant growth. Its innovative blockchain technology and increasing adoption in cross-border payments could drive substantial price increases in the coming years.

How high can XLM go realistically?

Realistically, XLM could reach $1 to $2 in a strong bull market, reflecting major adoption and increased utility of the Stellar network.

XZXX: A Comprehensive Guide to the BRC-20 Meme Token in 2025

Bitcoin Fear and Greed Index: Market Sentiment Analysis for 2025

Top Crypto ETFs to Watch in 2025: Navigating the Digital Asset Boom

5 ways to get Bitcoin for free in 2025: Newbie Guide

Bitcoin Market Cap in 2025: Analysis and Trends for Investors

2025 Bitcoin Price Prediction: Trump's Tariffs' Impact on BTC

Is Raydium (RAY) a good investment?: A Comprehensive Analysis of the DEX Protocol's Potential Returns and Risk Factors

Is Decentraland (MANA) a good investment?: A Comprehensive Analysis of Virtual Real Estate and Metaverse Opportunities in 2024

Gate Vault: A Multi-Chain Security Framework for Protecting Cryptocurrency Assets Across Blockchains

Is Compound (COMP) a good investment?: A Comprehensive Analysis of Market Performance, Risk Factors, and Future Prospects

Is Stable (STABLE) a good investment?: A Comprehensive Analysis of Risk, Potential Returns, and Market Positioning in 2024