2025 TLOS Price Prediction: Market Analysis and Growth Potential for Telos Blockchain

Introduction: TLOS Market Position and Investment Value

Telos (TLOS), as a powerful enterprise-grade blockchain for hosting decentralized applications, has achieved significant milestones since its inception in 2018. As of 2025, Telos has a market capitalization of $10,972,414, with a circulating supply of approximately 270,123,443 tokens, and a price hovering around $0.04062. This asset, known for its "unparalleled speed and advanced governance," is playing an increasingly crucial role in building fast, scalable distributed applications.

This article will comprehensively analyze Telos' price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide professional price predictions and practical investment strategies for investors.

I. TLOS Price History Review and Current Market Status

TLOS Historical Price Evolution

- 2024: TLOS reached its all-time high of $0.622416 on February 29, marking a significant milestone for the project.

- 2025: The market experienced a downturn, with TLOS price dropping to its all-time low of $0.02799574 on July 10.

TLOS Current Market Situation

As of October 8, 2025, TLOS is trading at $0.04062, with a 24-hour trading volume of $92,545.96. The token has experienced a significant decline of 10.32% in the past 24 hours. TLOS's market capitalization stands at $10,972,414, ranking it at 1368th position in the cryptocurrency market. The circulating supply is 270,123,443 TLOS, which represents 76.05% of the total supply. The token's price has shown negative trends across various timeframes, with a 15.40% decrease over the past week and a substantial 32.93% drop in the last 30 days. The current price is 93.48% below its all-time high and 45.09% above its all-time low.

Click to view the current TLOS market price

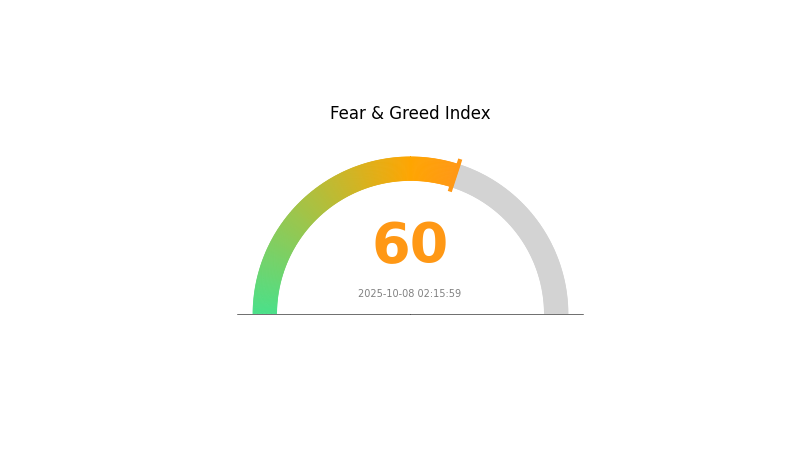

TLOS Market Sentiment Indicator

2025-10-08 Fear and Greed Index: 60 (Greed)

Click to view the current Fear & Greed Index

The cryptocurrency market is showing signs of optimism as the Fear and Greed Index reaches 60, indicating a "Greed" sentiment. This suggests that investors are becoming more confident and bullish about the market's potential. However, it's crucial to remain cautious and avoid making impulsive decisions based solely on market sentiment. As always, thorough research and a balanced approach to investing are recommended. Keep an eye on market trends and adjust your strategy accordingly.

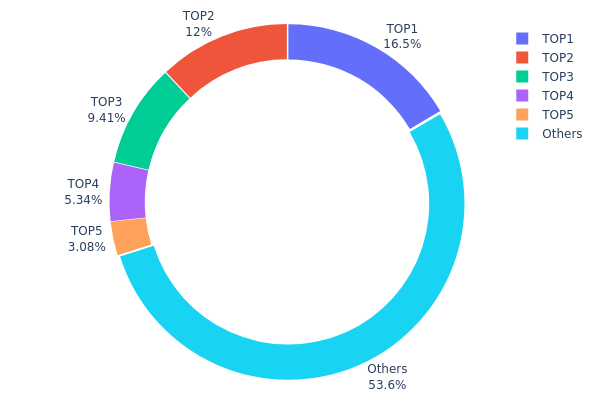

TLOS Holdings Distribution

The address holdings distribution data provides crucial insights into the concentration of TLOS tokens among different wallet addresses. Analysis of this data reveals a moderate level of centralization within the TLOS ecosystem. The top five addresses collectively hold 46.35% of the total TLOS supply, with the largest holder possessing 16.53% of all tokens.

This concentration pattern suggests a relatively balanced distribution, although there is a notable influence from major holders. The presence of several significant stakeholders, each holding between 3% to 16% of the supply, indicates a diverse power structure within the network. However, the fact that over 53% of tokens are distributed among numerous smaller holders demonstrates a healthy level of decentralization.

The current distribution structure may contribute to moderate price volatility, as large holders have the potential to impact market dynamics. Nevertheless, the absence of a single dominant holder mitigates the risk of unilateral market manipulation. This distribution pattern reflects a maturing ecosystem with a mix of institutional involvement and retail participation, potentially contributing to long-term stability and organic growth of the TLOS network.

Click to view the current TLOS Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xad01...eb5cbf | 1910.00K | 16.53% |

| 2 | 0x69e4...c75673 | 1387.50K | 12.00% |

| 3 | 0xa851...0c1f5c | 1087.22K | 9.41% |

| 4 | 0x32f9...c296df | 616.88K | 5.33% |

| 5 | 0xfe6f...61dd28 | 356.42K | 3.08% |

| - | Others | 6195.70K | 53.65% |

II. Key Factors Influencing TLOS's Future Price

Technical Development and Ecosystem Building

- Ecosystem Applications: TLOS serves as the native token of the Telos ecosystem, playing a crucial role in transactions, governance, and liquidity within the network.

Macroeconomic Environment

- Market Sentiment: Investor sentiment plays a significant role in influencing TLOS price movements. The overall mood of the crypto market can impact the token's value.

Supply Mechanism

- Current Impact: As of the latest data, TLOS had a market capitalization of $1.84 million, with a price of $0.91433988 per token. The 24-hour trading volume was approximately $1.57 million, indicating active market participation.

III. TLOS Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.03456 - $0.03800

- Neutral prediction: $0.03800 - $0.04200

- Optimistic prediction: $0.04200 - $0.04432 (requires significant market recovery and increased adoption)

2027-2028 Outlook

- Market stage expectation: Potential growth phase with increased volatility

- Price range forecast:

- 2027: $0.03164 - $0.04897

- 2028: $0.04108 - $0.05677

- Key catalysts: Technological advancements, expanding use cases, and overall crypto market trends

2029-2030 Long-term Outlook

- Base scenario: $0.04500 - $0.05300 (assuming steady growth and adoption)

- Optimistic scenario: $0.05300 - $0.05672 (with accelerated adoption and favorable market conditions)

- Transformative scenario: $0.05672 - $0.06000 (with breakthrough applications and mainstream integration)

- 2030-12-31: TLOS $0.05301 (potential stabilization point after periods of growth)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.04432 | 0.04066 | 0.03456 | 0 |

| 2026 | 0.04419 | 0.04249 | 0.02762 | 4 |

| 2027 | 0.04897 | 0.04334 | 0.03164 | 6 |

| 2028 | 0.05677 | 0.04616 | 0.04108 | 13 |

| 2029 | 0.05455 | 0.05146 | 0.03705 | 26 |

| 2030 | 0.05672 | 0.05301 | 0.03499 | 30 |

IV. Professional Investment Strategies and Risk Management for TLOS

TLOS Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Patient investors with high risk tolerance

- Operational suggestions:

- Dollar-cost average into TLOS over time

- Hold for at least 3-5 years to ride out market volatility

- Store tokens securely in a non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving averages: Use to identify trends and support/resistance levels

- RSI: Monitor overbought/oversold conditions

- Key points for swing trading:

- Set clear entry and exit points based on technical indicators

- Use stop-loss orders to limit downside risk

TLOS Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple cryptocurrencies

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 Wallet

- Software wallet option: Official Telos wallet

- Security precautions: Enable 2FA, use strong passwords, backup private keys securely

V. Potential Risks and Challenges for TLOS

TLOS Market Risks

- High volatility: TLOS price can experience significant fluctuations

- Limited liquidity: May face challenges in executing large trades

- Competition: Other smart contract platforms may outperform Telos

TLOS Regulatory Risks

- Uncertain regulatory landscape: Potential for unfavorable regulations

- Cross-border compliance: Varying regulations across jurisdictions

- Tax implications: Evolving tax treatment of cryptocurrencies

TLOS Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs

- Scalability challenges: May face issues as network usage grows

- Centralization concerns: Potential for concentration of block producers

VI. Conclusion and Action Recommendations

TLOS Investment Value Assessment

Telos offers potential long-term value as an enterprise-grade blockchain platform, but faces significant short-term risks due to market volatility and competition in the smart contract space.

TLOS Investment Recommendations

✅ Beginners: Start with small, regular investments to learn about the project ✅ Experienced investors: Consider a moderate allocation as part of a diversified crypto portfolio ✅ Institutional investors: Conduct thorough due diligence and consider Telos as a potential high-risk, high-reward investment

TLOS Trading Participation Methods

- Spot trading: Buy and sell TLOS on Gate.com

- Staking: Participate in Telos staking to earn rewards

- DApp usage: Engage with Telos ecosystem applications to gain exposure

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is TLOS crypto?

TLOS is the native cryptocurrency of the Telos blockchain, focusing on scalability and governance for dApps and smart contracts. It's used for transactions, network security, and decision-making.

Is telos a good investment?

Telos (TLOS) shows promising potential as an investment. Forecasts suggest a bullish trend, with positive price expectations in the coming years.

What crypto has the highest price prediction?

Bitcoin (BTC) is predicted to have the highest price in 2025. It remains a top choice for investors. Its consistent trend supports this prediction.

Which AI can predict crypto prices?

Incite AI is a leading tool for predicting crypto prices. It uses advanced algorithms to analyze market trends, offering precise insights through a user-friendly interface.

2025 CFX Price Prediction: Analyzing Growth Potential and Market Factors for Conflux Network Token

2025 GRT Price Prediction: Analyzing Graph Protocol's Future Value Trajectory and Market Potential

2025 XLM Price Prediction: Stellar's Potential Surge in the Evolving Crypto Landscape

2025 SLC Price Prediction: Analyzing Market Trends and Potential Growth Factors

2025 SYSPrice Prediction: Analyzing Market Trends, Technical Factors, and Institutional Adoption Potential

2025 REI Price Prediction: Market Analysis and Growth Forecast for the Real Estate Token Economy

How Do Exchange Inflows and SIREN Token Holdings Affect Market Sentiment and Price Movement?

What is SUSHI Market Cap and Trading Volume in 2025?

What is EGL1 coin fundamentals: whitepaper logic, use cases, and team background analysis?

What are the compliance and regulatory risks in cryptocurrency trading and how does SEC oversight impact your investments?

Mastering Web3 Wallet Integration: A WalletConnect Tutorial