2025 QBX Price Prediction: Analyzing Market Trends and Potential Growth Factors

Introduction: QBX's Market Position and Investment Value

QBX (QBX) as a decentralized loyalty currency, has been playing an increasingly important role in the loyalty and payments sector since its inception. As of 2025, QBX's market cap has reached $280,415, with a circulating supply of approximately 82,823,529 tokens, and a price hovering around $0.0033857. This asset, dubbed as the "loyalty currency innovator," is playing an increasingly crucial role in transforming customer loyalty programs and payment systems.

This article will provide a comprehensive analysis of QBX's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. QBX Price History Review and Current Market Status

QBX Historical Price Evolution

- 2024: QBX reached its all-time high of $0.14 on December 12, marking a significant milestone for the project.

- 2025: The token experienced a substantial decline, hitting its all-time low of $0.0009076 on May 8.

QBX Current Market Situation

As of October 31, 2025, QBX is trading at $0.0033857, representing a 97.58% decrease from its all-time high. The token's market cap stands at $280,415.62, with a circulating supply of 82,823,529 QBX. Over the past 24 hours, QBX has seen a trading volume of $17,669.80 and a price decrease of 8.41%.

Despite the recent downturn, QBX has shown some signs of recovery in the medium term, with a 15.73% increase over the past 30 days. However, the long-term trend remains bearish, as evidenced by the 90.072% decrease in value over the past year.

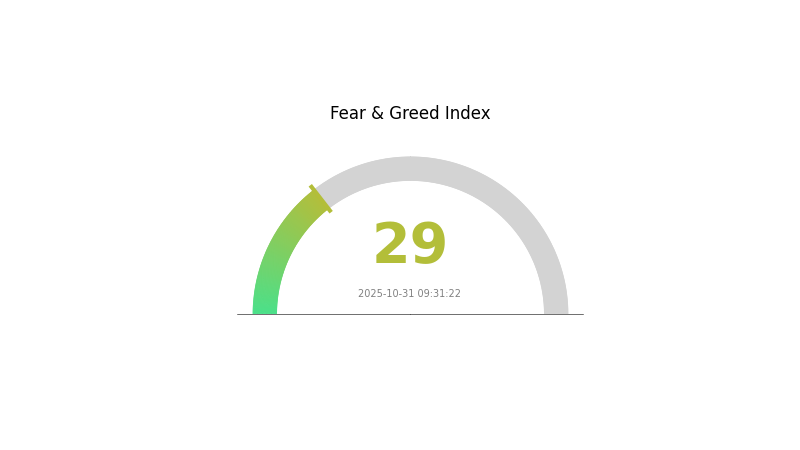

The current market sentiment for cryptocurrencies is characterized by fear, with the VIX index at 29, indicating a cautious approach from investors.

Click to view the current QBX market price

QBX Market Sentiment Indicator

2025-10-31 Fear and Greed Index: 29 (Fear)

Click to view the current Fear & Greed Index

The crypto market is currently experiencing a period of fear, with the Fear and Greed Index standing at 29. This suggests investors are cautious and potentially anticipating further market declines. During such times, it's crucial to remain vigilant and avoid making impulsive decisions. Some investors view fear periods as potential buying opportunities, adhering to the adage "buy when there's blood in the streets." However, it's essential to conduct thorough research and consider your risk tolerance before making any investment decisions.

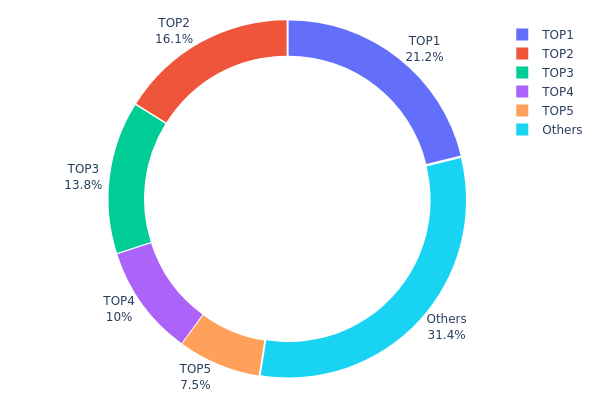

QBX Holdings Distribution

The address holdings distribution chart for QBX reveals a highly concentrated token ownership structure. The top five addresses collectively hold 68.62% of the total QBX supply, with the largest holder controlling 21.18%. This concentration level raises concerns about potential market manipulation and price volatility.

Such a concentrated distribution could lead to significant price swings if any of the major holders decide to sell their positions. It also suggests a lower degree of decentralization, which may impact the token's resilience and governance structure. The presence of a few dominant addresses could potentially influence decision-making processes and market dynamics.

While the remaining 31.38% distributed among other addresses provides some balance, the overall picture indicates a relatively centralized token economy. This concentration may pose risks to market stability and could deter some investors who prioritize more evenly distributed token ecosystems.

Click to view the current QBX Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x0529...c553b7 | 292434.56K | 21.18% |

| 2 | 0x1a49...c339ee | 222680.40K | 16.13% |

| 3 | 0x0b47...af3072 | 190618.87K | 13.80% |

| 4 | 0x15ce...c5a58b | 138304.43K | 10.01% |

| 5 | 0xe805...8d287e | 103583.22K | 7.50% |

| - | Others | 432770.68K | 31.38% |

II. Key Factors Affecting QBX's Future Price

Supply Mechanism

- Scarcity: Scarcity is one of the key factors driving price increases, which is an advantage for QBX's long-term investment potential.

- Current Impact: The limited supply of QBX is expected to have a positive impact on its price in the long run.

Institutional and Whale Dynamics

- Enterprise Adoption: While specific companies are not mentioned, the adoption of QBX by notable enterprises could significantly influence its price.

Macroeconomic Environment

- Inflation Hedging Properties: As with many cryptocurrencies, QBX may be viewed as a potential hedge against inflation, which could affect its price performance in inflationary environments.

- Geopolitical Factors: International situations and geopolitical events may impact QBX's price, as is common with many digital assets.

Technical Development and Ecosystem Building

- Market Sentiment: Investor confidence and overall market sentiment play a crucial role in determining QBX's price movements.

- Ecosystem Applications: The development of DApps and ecosystem projects related to QBX could significantly impact its value and adoption.

III. QBX Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.00313 - $0.00340

- Neutral prediction: $0.00340 - $0.00400

- Optimistic prediction: $0.00400 - $0.00435 (requires favorable market conditions and increased adoption)

2027-2028 Outlook

- Market stage expectation: Potential growth phase with increased volatility

- Price range forecast:

- 2027: $0.00255 - $0.00527

- 2028: $0.00283 - $0.00628

- Key catalysts: Technological advancements, broader market trends, and potential partnerships

2029-2030 Long-term Outlook

- Base scenario: $0.00554 - $0.00667 (assuming steady market growth and adoption)

- Optimistic scenario: $0.00667 - $0.00961 (with accelerated adoption and favorable market conditions)

- Transformative scenario: $0.00961 - $0.01200 (with breakthrough applications and mainstream acceptance)

- 2030-12-31: QBX $0.00961 (potential peak based on optimistic projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00435 | 0.0034 | 0.00313 | 0 |

| 2026 | 0.00476 | 0.00387 | 0.00279 | 14 |

| 2027 | 0.00527 | 0.00432 | 0.00255 | 27 |

| 2028 | 0.00628 | 0.00479 | 0.00283 | 41 |

| 2029 | 0.00781 | 0.00554 | 0.00415 | 63 |

| 2030 | 0.00961 | 0.00667 | 0.00547 | 97 |

IV. Professional Investment Strategies and Risk Management for QBX

QBX Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Patient investors with a high-risk tolerance

- Operation suggestions:

- Accumulate QBX tokens during market dips

- Set price targets for partial profit-taking

- Store tokens in secure non-custodial wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- Relative Strength Index (RSI): Gauge overbought/oversold conditions

- Key points for swing trading:

- Monitor trading volume for confirmation of price movements

- Set stop-loss orders to manage downside risk

QBX Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-2% of crypto portfolio

- Aggressive investors: 3-5% of crypto portfolio

- Professional investors: 5-10% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple cryptocurrencies

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for QBX

QBX Market Risks

- High volatility: Significant price swings can lead to substantial losses

- Limited liquidity: May face challenges when executing large trades

- Market sentiment: Susceptible to rapid shifts in investor perception

QBX Regulatory Risks

- Uncertain regulations: Potential for unfavorable regulatory changes

- Cross-border restrictions: Possible limitations on international transactions

- Tax implications: Evolving tax laws may impact profitability

QBX Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs

- Network congestion: High fees and slow transactions during peak times

- Technological obsolescence: Risk of being outpaced by newer projects

VI. Conclusion and Action Recommendations

QBX Investment Value Assessment

QBX presents a high-risk, high-potential investment in the loyalty currency sector. While it offers innovative solutions, investors should be cautious due to its current low market cap and limited adoption.

QBX Investment Recommendations

✅ Beginners: Allocate only a small portion of your portfolio, focusing on education ✅ Experienced investors: Consider a balanced approach with regular profit-taking ✅ Institutional investors: Conduct thorough due diligence and consider OTC options

QBX Trading Participation Methods

- Spot trading: Available on Gate.com

- Limit orders: Use to capture desired entry and exit points

- Dollar-cost averaging: Regular small purchases to mitigate volatility risk

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

How much will 1 QNT be worth in 2030?

Based on current projections, 1 QNT is expected to be worth approximately $540 by 2030. This forecast reflects ongoing market trends and growth potential in the crypto space.

What is QBX crypto?

QBX is a cryptocurrency that fluctuates in price. It can be traded on exchanges for profit. Its value changes based on market demand.

What is the price prediction for quantum coin in 2025?

Based on current projections, the price of Quantum coin is expected to reach $0.002908 in October 2025 and $0.002920 in November 2025.

Does IQ coin have a future?

IQ's future is uncertain. It trades at $0.007 with low market presence. Long-term outlook depends on broader crypto trends. Potential exists, but no guarantees.

2025 NCT Price Prediction: Expert Analysis and Market Forecast for Newton's Native Token

Where to Find Alpha in the 2025 Crypto Spot Market

why is crypto crashing and will it recover ?

Gate Launchpad Welcomes Ika (IKA): The Future of Privacy Computing on Sui

Pi to GBP: Price and Prediction

2025 LUNC Price Prediction: Analyzing Terra Luna Classic's Potential Recovery and Market Outlook in the Post-Crash Era

Understanding Key Candlestick Patterns in Crypto Trading

What Happens to Bitcoin's Price if Spot ETFs Absorb Another 1 Million BTC? AI Simulations Explained

7 Top Telegram Games for Earning Money in 2024

P2P Crypto Trading Faces New Regulations in India

What is DIMO: A Comprehensive Guide to the Decentralized IoT Mobility Network