2025 PORTAL Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: PORTAL's Market Position and Investment Value

Portal (PORTAL), a cross-chain gaming platform dedicated to onboarding more players to Web3.0, has established itself as a significant participant in the gaming and blockchain ecosystem. Since its launch in February 2024, Portal has achieved a market capitalization of $22.19 million with a circulating supply of approximately 591.81 million tokens, currently trading at $0.022187. This innovative asset is playing an increasingly vital role in bridging traditional gaming with decentralized finance and Web3 infrastructure.

This comprehensive analysis examines Portal's price trends and market dynamics through 2025, integrating historical performance data, market supply and demand fundamentals, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and actionable investment strategies.

I. PORTAL Price Historical Review and Market Status

PORTAL Historical Price Evolution Trajectory

Portal (PORTAL) reached its all-time high of $4.666 on February 29, 2024, marking the peak of its market valuation during that period. Subsequently, the token experienced significant downward pressure throughout 2024 and into 2025, reflecting broader market dynamics and project-specific developments.

On October 10, 2025, PORTAL touched its all-time low of $0.00732, representing a substantial decline from its historical peak. This marked a critical support level as the token navigated challenging market conditions.

PORTAL Current Market Status

As of December 21, 2025, PORTAL is trading at $0.022187, with a 24-hour trading volume of $86,720.16. The token has demonstrated modest price recovery over the past month, gaining 25.19% in the 30-day period, though it remains significantly below its historical highs.

Current market metrics show:

- Market Capitalization: $13,130,528.32 (circulating supply basis)

- Fully Diluted Valuation: $22,187,000

- Circulating Supply: 591,811,796 PORTAL out of 1,000,000,000 total supply (59.18% circulating)

- Market Dominance: 0.0068%

- Number of Holders: 20,469

- Exchange Listings: 28 exchanges

Short-term price movements indicate: 1-hour change of +0.51%, 24-hour change of -3.77%, and 7-day change of +1.92%. The year-to-date performance shows a substantial decline of -93.38%, reflecting the token's challenging performance throughout 2025.

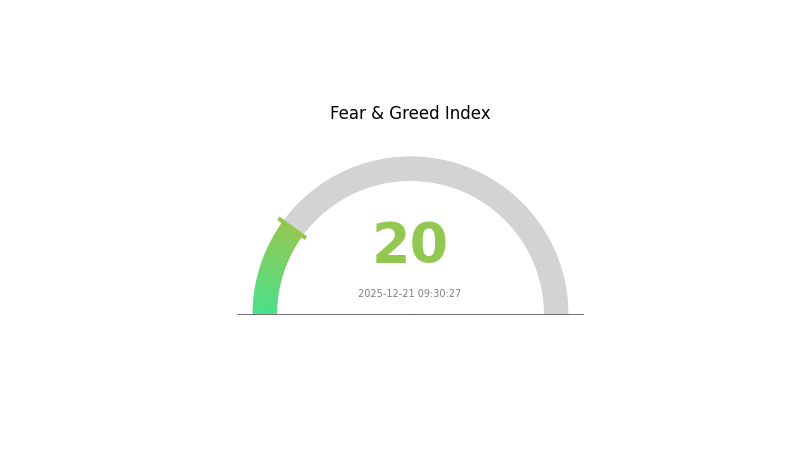

The current market sentiment indicates "Extreme Fear" (VIX reading of 20), suggesting heightened risk aversion in the broader cryptocurrency market environment.

Click to view current PORTAL market price

PORTAL Market Sentiment Index

2025-12-21 Fear and Greed Index: 20 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index at 20. This indicates heightened market anxiety and pessimism among investors. During such periods, panic selling often intensifies, creating potential opportunities for contrarian investors. Market volatility remains elevated as uncertainty dominates sentiment. Traders should exercise caution and consider risk management strategies. Monitoring this indicator on Gate.com can help you track market psychology and make more informed trading decisions during volatile market conditions.

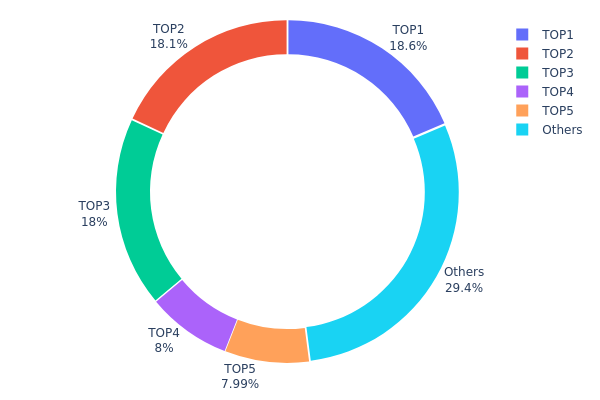

PORTAL Holdings Distribution

The address holdings distribution chart provides a comprehensive view of how PORTAL tokens are distributed across the blockchain network. This metric is crucial for assessing token concentration risk, market structure integrity, and the potential for coordinated price manipulation. By analyzing the top holders and their respective stakes, we can evaluate the decentralization level of the token ecosystem and identify structural vulnerabilities or strengths in the market.

PORTAL exhibits pronounced concentration characteristics, with the top five addresses collectively controlling 70.58% of the total token supply. The distribution is particularly skewed among the leading holders: the top three addresses each maintain stakes exceeding 17.97%, individually representing significant portions of circulating tokens. The fourth and fifth largest holders contribute 8.00% and 7.98% respectively. Notably, the remaining addresses account for only 29.42% of holdings, indicating substantial wealth consolidation. This concentration level suggests moderate-to-high centralization risk, particularly given that just three entities control over half of the token supply. Such distribution patterns typically emerge in projects with early-stage development, significant institutional participation, or protocol treasury holdings.

The current holder structure presents material implications for market dynamics. The concentration among top addresses creates potential vulnerability to coordinated selling pressure or flash liquidation scenarios that could trigger significant price volatility. However, the absence of any single address exceeding 20% suggests some degree of distributed control. The 29.42% held by dispersed addresses provides a stabilizing factor, though this decentralized portion remains relatively modest. From a governance and stability perspective, monitoring whether these top holders maintain their positions or gradually increase diversification will be essential for understanding the token's long-term sustainability and resistance to market shocks.

Click to view current PORTAL holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xc08f...c212ea | 185522.23K | 18.55% |

| 2 | 0x5a52...70efcb | 180838.41K | 18.08% |

| 3 | 0xc430...092ad4 | 179798.89K | 17.97% |

| 4 | 0xf977...41acec | 80000.00K | 8.00% |

| 5 | 0xf42a...36f173 | 79868.32K | 7.98% |

| - | Others | 293972.16K | 29.42% |

II. Core Factors Affecting PORTAL's Future Price

Macroeconomic Environment

-

Monetary Policy Impact: The Federal Reserve's interest rate decisions significantly influence cryptocurrency market sentiment. Market expectations regarding rate cuts or hikes affect capital flows into digital assets. When central banks signal monetary easing, reduced opportunity costs for holding non-yield-bearing assets like cryptocurrencies can drive increased investment demand.

-

Inflation Hedge Characteristics: Cryptocurrencies like PORTAL are increasingly viewed as potential stores of value in inflationary environments. When inflation expectations rise or traditional assets face purchasing power erosion, investors may allocate capital to digital assets as portfolio diversification and inflation protection mechanisms.

-

Geopolitical Factors: Global geopolitical tensions and economic uncertainties create risk-averse market sentiment. During periods of heightened geopolitical risk, investors often seek alternative assets and decentralized solutions, potentially increasing demand for blockchain-based tokens.

Market Sentiment and Overall Cryptocurrency Dynamics

-

Cryptocurrency Market Correlation: PORTAL's price movements are substantially influenced by the broader cryptocurrency market sentiment. During bull markets characterized by strong investor confidence and risk appetite, altcoins like PORTAL typically experience amplified gains. Conversely, bear market conditions and risk-off sentiment can result in significant price corrections.

-

Market Volatility Management: The cryptocurrency market exhibits high volatility, requiring investors to implement robust risk management strategies. Price fluctuations can occur rapidly based on news events, regulatory announcements, and shifts in market participant behavior. Investors monitoring PORTAL should maintain disciplined position sizing and stop-loss protocols.

-

Technical and Market Trends: Investors should closely monitor technical indicators, market trend formations, and trading volume patterns to better understand PORTAL's price movements and identify potential future direction shifts.

III. 2025-2030 PORTAL Price Forecast

2025 Outlook

- Conservative Forecast: $0.01197 - $0.02218

- Base Case Forecast: $0.02218

- Bullish Forecast: $0.0275 (requires sustained market recovery and increased adoption)

2026-2027 Mid-term Outlook

- Market Stage Expectations: Gradual recovery phase with increasing institutional interest and ecosystem development

- Price Range Forecast:

- 2026: $0.01714 - $0.03651 (11% upside potential)

- 2027: $0.02423 - $0.04018 (38% upside potential)

- Key Catalysts: Platform expansion, strategic partnerships, improved market liquidity on platforms like Gate.com, and growing user adoption

2028-2030 Long-term Outlook

- Base Case Scenario: $0.02940 - $0.05279 by 2028 (59% appreciation), advancing to $0.02608 - $0.06922 by 2030 (113% total growth)

- Bullish Scenario: $0.05279 - $0.06922 (assumes successful network expansion and mainstream adoption)

- Transformative Scenario: Extension beyond $0.06922 (contingent on breakthrough technological innovations, regulatory clarity, and sustained macroeconomic tailwinds)

- 2030-12-21: PORTAL reaches $0.06922 (long-term accumulation phase completion)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.0275 | 0.02218 | 0.01197 | 0 |

| 2026 | 0.03651 | 0.02484 | 0.01714 | 11 |

| 2027 | 0.04018 | 0.03067 | 0.02423 | 38 |

| 2028 | 0.05279 | 0.03543 | 0.0294 | 59 |

| 2029 | 0.05072 | 0.04411 | 0.02867 | 98 |

| 2030 | 0.06922 | 0.04741 | 0.02608 | 113 |

PORTAL Investment Strategy and Risk Management Report

IV. PORTAL Professional Investment Strategy and Risk Management

PORTAL Investment Methodology

(1) Long-term Holding Strategy

- Suitable Investors: Web3 gaming enthusiasts, long-term believers in cross-chain gaming adoption, and patient capital allocators

- Operation Recommendations:

- Accumulate during market downturns, particularly when PORTAL trades significantly below historical averages

- Maintain a dollar-cost averaging approach to mitigate volatility impact, given the token's -93.38% annual decline

- Hold through market cycles, recognizing that Platform's mission to onboard players to web3.0 represents a multi-year development trajectory

(2) Active Trading Strategy

- Technical Analysis Considerations:

- Price Action: Monitor the 24-hour range ($0.022051 - $0.023238) as immediate support and resistance levels

- Volume Analysis: The current 24-hour trading volume of $86,720.16 indicates moderate liquidity; execute larger positions with caution to minimize slippage

- Wave Trading Key Points:

- Identify entry opportunities during intraday pullbacks, leveraging the recent 1-hour gain of 0.51%

- Set profit targets based on 7-day and 30-day momentum (1.92% and 25.19% respectively), which suggest medium-term recovery potential

- Exercise heightened caution given the severe 1-year decline, ensuring strict stop-loss discipline

PORTAL Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 0.5% - 1% of portfolio

- Active Investors: 2% - 4% of portfolio

- Professional Investors: 5% - 8% of portfolio

(2) Risk Hedging Solutions

- Liquidity Risk Management: Given limited 24-hour volume relative to market cap, scale position sizing accordingly and utilize limit orders on Gate.com to control execution prices

- Volatility Protection: Implement strict stop-loss orders at 15-20% below entry price, given the token's history of extreme price movements (all-time high of $4.666 versus current $0.022187)

(3) Secure Storage Solution

- Hardware Security: Store significant PORTAL holdings offline in secure self-custody solutions

- Exchange Integration: For active trading, maintain operational balances on Gate.com with two-factor authentication enabled

- Security Best Practices: Never share private keys or recovery phrases; enable withdrawal whitelisting on Gate.com to prevent unauthorized transfers; regularly audit transaction history

V. PORTAL Potential Risks and Challenges

PORTAL Market Risk

- Extreme Price Volatility: The token has experienced a -93.38% decline over one year, indicating severe market instability and the potential for further depreciation

- Liquidity Constraints: With 24-hour trading volume of only $86,720.16 against a $22.187 million market cap, thin liquidity creates execution challenges for substantial positions

- Market Adoption Uncertainty: Success depends on Portal's ability to attract mainstream players to web3.0 gaming, an outcome that remains unproven and faces significant competition

PORTAL Regulatory Risk

- Evolving Gaming Regulations: Jurisdictions worldwide continue to develop regulatory frameworks for blockchain gaming; unfavorable classification could impact token utility and platform operations

- Securities Classification: Depending on regulatory interpretation, PORTAL tokens could face reclassification that restricts trading and ownership in certain markets

- Cross-Chain Compliance: Portal's multi-chain architecture may face regulatory scrutiny across different blockchain networks and their respective jurisdictions

PORTAL Technology Risk

- Smart Contract Vulnerability: Any critical bugs or exploits in Portal's gaming platform could result in substantial losses and loss of user confidence

- Cross-Chain Bridge Risk: Portal's cross-chain functionality introduces technical complexity; bridge failures or security breaches could compromise platform integrity

- Obsolescence Risk: Rapid innovation in web3 gaming could render Portal's technology or business model obsolete if the platform fails to adapt and evolve

VI. Conclusion and Action Recommendations

PORTAL Investment Value Assessment

Portal represents a speculative allocation within the web3 gaming sector. While the project's mission to onboard mainstream players to blockchain gaming aligns with long-term industry trends, the token's severe -93.38% annual decline and thin liquidity profile present substantial execution and valuation challenges. The current price of $0.022187 reflects significant market skepticism. Investors should recognize that Portal operates in a highly competitive, unproven market segment where success is not guaranteed. Only risk capital that investors can afford to lose completely should be allocated to this asset.

PORTAL Investment Recommendations

✅ Beginners: Avoid direct PORTAL investment until you have established experience with more established cryptocurrencies; if interested, research the gaming platform thoroughly before allocating any capital

✅ Experienced Investors: Consider PORTAL only as a small speculative position (1-2% of portfolio) with strict risk management; use this allocation to gain exposure to web3 gaming innovation while maintaining disciplined entry and exit strategies

✅ Institutional Investors: Conduct comprehensive due diligence on Portal's technology, team, and user adoption metrics before any allocation; if proceeding, structure positions to account for liquidity constraints and implement robust risk controls

PORTAL Trading Participation Methods

- Gate.com Spot Trading: Trade PORTAL/USDT pairs directly on Gate.com's spot market, leveraging the platform's liquidity and security infrastructure

- Limit Order Execution: Use limit orders rather than market orders to minimize slippage given current trading volumes

- Portfolio Tracking: Monitor PORTAL's performance through Gate.com's portfolio management tools, tracking your cost basis against current valuations to inform rebalancing decisions

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions based on their individual risk tolerance and should consult professional financial advisors. Never invest more capital than you can afford to lose completely.

FAQ

How much is the portal coin worth?

As of today, Portal coin is worth $0.02280 with a market cap of $13.49 million and trading volume of $10.16 million. The price has shown a 0.31% increase in the last 24 hours.

What crypto will 1000x prediction?

Emerging altcoins with strong fundamentals and early-stage pricing show potential for significant gains. Projects focused on innovation, adoption utility, and community support may deliver exceptional returns. Monitor market trends and project development closely for opportunities.

What is PORTAL token and what is its use case?

PORTAL is a universal gaming coin powering the ecosystem. It facilitates transactions, governance, and enhances gaming experiences across the platform, serving as the core utility token.

What factors influence PORTAL price prediction?

PORTAL price prediction is influenced by market trends, trading volume, moving averages, and ecosystem adoption. Technical indicators and future growth expectations also play key roles in determining potential price movements and long-term forecasts.

What is the price target for PORTAL in 2025?

Based on current market analysis, the price target for PORTAL in 2025 is $0.02306. This projection reflects recent market momentum and trading activity trends in the crypto market.

Is Gomble (GM) a good investment?: Analyzing the automaker's financial performance and future prospects

2025 GEMS Price Prediction: Will This Gaming Token Surge to New Heights?

2025 MBXPrice Prediction: Analyzing Market Trends and Future Valuation Prospects for MBX Token

2025 GMEE Price Prediction: Analyzing Market Trends and Potential Growth Factors

2025 WNCGPrice Prediction: Analyzing Market Trends, Technical Indicators, and Growth Potential for Wrapped NCG Token

2025 SPS Price Prediction: Analyzing Market Trends and Future Potential for Splinterlands' Native Token

Understanding Pundi X: Your Ultimate Guide to Web3 Payment Platforms

What is CTA: A Comprehensive Guide to Call-to-Action in Digital Marketing

How to Safely Purchase Memecoin (MEME) - A Comprehensive Guide

Ultimate Guide to Building a Strong Crypto Community on Telegram

Seamless Crypto Trading with EDC Wallet: Buying and Trading EDC Coins Made Easy