2025 ORAI Price Prediction: Market Analysis and Future Growth Potential for Oraichain Token

Introduction: ORAI's Market Position and Investment Value

Oraichain Token (ORAI), as a data oracle platform that integrates AI APIs with smart contracts and conventional applications, has made significant strides since its inception. As of 2025, ORAI's market capitalization has reached $39,901,162, with a circulating supply of approximately 19,109,752 tokens, and a price hovering around $2.088. This asset, often referred to as the "AI-powered oracle," is playing an increasingly crucial role in the fields of decentralized finance and artificial intelligence integration.

This article will provide a comprehensive analysis of ORAI's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors, offering professional price predictions and practical investment strategies for investors.

I. ORAI Price History Review and Current Market Status

ORAI Historical Price Evolution Trajectory

- 2021: ORAI reached its all-time high of $105.76 on February 20, 2021

- 2022: Market downturn, price dropped to its all-time low of $0.904237 on November 22, 2022

- 2025: Price recovery, currently trading at $2.088

ORAI Current Market Situation

As of October 1, 2025, ORAI is trading at $2.088, with a 24-hour trading volume of $78,826.31901. The token has shown a 3.05% increase in the last 24 hours. ORAI's market capitalization stands at $39,901,162.176, ranking it at 788th position in the cryptocurrency market. The token's circulating supply is 19,109,752 ORAI, with a total supply of 19,433,238 ORAI and a maximum supply of 19,779,272 ORAI. Over the past year, ORAI has experienced a significant decline of 68.93%, while in the last 30 days, it has decreased by 19.84%. However, the recent 24-hour performance indicates a short-term positive trend.

Click to view the current ORAI market price

ORAI Market Sentiment Indicator

2025-10-01 Fear and Greed Index: 49 (Neutral)

Click to view the current Fear & Greed Index

The cryptocurrency market sentiment remains balanced today, with the Fear and Greed Index registering a neutral reading of 49. This suggests that investors are neither overly fearful nor excessively greedy. Such equilibrium often indicates a period of stability in the market, where buying and selling pressures are relatively evenly matched. Traders and investors should remain vigilant, as neutral sentiment can sometimes precede significant market movements in either direction. As always, it's crucial to conduct thorough research and consider multiple factors before making any investment decisions.

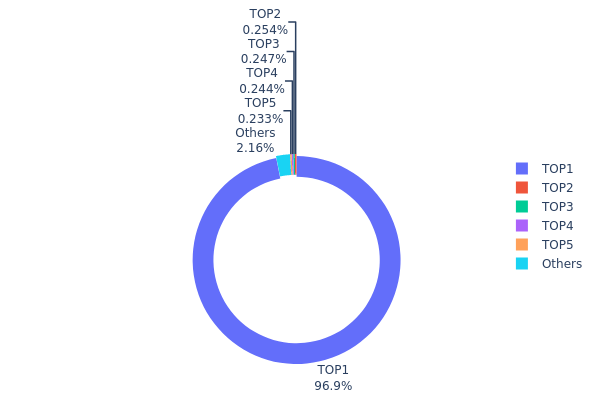

ORAI Holdings Distribution

The address holdings distribution data for ORAI reveals a highly concentrated ownership structure. The top address, identified as a "dead" or burn address, holds an overwhelming 96.86% of the total supply, equivalent to 83,300,000 ORAI tokens. This significant concentration in a burn address suggests that a large portion of the ORAI supply has been permanently removed from circulation, potentially reducing overall market supply.

The remaining top addresses hold relatively small percentages, ranging from 0.23% to 0.25% each. Collectively, all other addresses account for only 2.18% of the total supply. This extreme concentration in the burn address, combined with the dispersed nature of the remaining holdings, presents a unique market structure. While the large burn reduces circulating supply, it may also limit liquidity and increase potential price volatility for the small tradable portion. Investors should be aware that this distribution could lead to increased price sensitivity to large transactions or shifts in holder behavior among the top non-burn addresses.

Click to view the current ORAI holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x0000...00dead | 83300.00K | 96.86% |

| 2 | 0x0d07...b492fe | 218.60K | 0.25% |

| 3 | 0xc882...84f071 | 212.84K | 0.24% |

| 4 | 0xfc27...ab8610 | 210.04K | 0.24% |

| 5 | 0x5bdf...03f7ef | 200.62K | 0.23% |

| - | Others | 1857.90K | 2.18% |

II. Key Factors Influencing ORAI's Future Price

Supply Mechanism

- Token Economics: Understanding ORAI's circulating supply and tokenomics model, and their impact on future price.

Institutional and Whale Dynamics

- Enterprise Adoption: Notable companies adopting ORAI technology.

Macroeconomic Environment

- Inflation Hedging Properties: Performance in inflationary environments.

Technological Development and Ecosystem Building

- Technical Advancements: Exploring fundamental factors driving ORAI's value, including technological progress.

- Partnerships: Development of strategic partnerships influencing ORAI's adoption and utility.

- Ecosystem Applications: Major DApps and ecosystem projects built on Oraichain.

III. ORAI Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $1.10 - $1.50

- Neutral forecast: $1.80 - $2.30

- Optimistic forecast: $2.50 - $2.96 (requires strong AI adoption in crypto)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increased volatility

- Price range prediction:

- 2027: $2.16 - $3.57

- 2028: $2.41 - $4.04

- Key catalysts: AI integration in blockchain, wider ORAI ecosystem expansion

2029-2030 Long-term Outlook

- Base scenario: $3.50 - $4.50 (assuming steady market growth)

- Optimistic scenario: $4.50 - $5.25 (with accelerated AI and blockchain synergy)

- Transformative scenario: $5.25 - $6.00 (breakthrough AI applications in crypto)

- 2030-12-31: ORAI $4.31 (106% increase from 2025, indicating strong long-term growth potential)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 2.96354 | 2.087 | 1.10611 | 0 |

| 2026 | 2.87881 | 2.52527 | 2.42426 | 20 |

| 2027 | 3.56669 | 2.70204 | 2.16163 | 29 |

| 2028 | 4.04333 | 3.13437 | 2.41346 | 50 |

| 2029 | 5.02439 | 3.58885 | 2.47631 | 71 |

| 2030 | 5.25407 | 4.30662 | 2.32557 | 106 |

IV. ORAI Professional Investment Strategies and Risk Management

ORAI Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors with high risk tolerance and belief in AI-driven blockchain technologies

- Operation suggestions:

- Accumulate ORAI tokens during market dips

- Set a target holding period of 3-5 years

- Store tokens in a secure non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use 50-day and 200-day MAs to identify trends

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Set stop-loss orders to limit potential losses

- Take profits at predetermined price targets

ORAI Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple AI and oracle-related projects

- Options trading: Use put options for downside protection when available

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords, and regularly update software

V. Potential Risks and Challenges for ORAI

ORAI Market Risks

- High volatility: ORAI price can experience significant fluctuations

- Competition: Increasing number of AI-focused blockchain projects

- Market sentiment: Susceptible to overall crypto market trends

ORAI Regulatory Risks

- Uncertain regulations: Potential for stricter crypto regulations globally

- AI governance: Future AI-specific regulations may impact ORAI's use cases

- Cross-border restrictions: Possible limitations on international token transfers

ORAI Technical Risks

- Smart contract vulnerabilities: Potential for exploits in the underlying code

- Scalability challenges: Possible network congestion as adoption grows

- Oracle reliability: Dependence on accurate and timely external data feeds

VI. Conclusion and Action Recommendations

ORAI Investment Value Assessment

ORAI presents a unique value proposition in the intersection of AI and blockchain technology. While it offers significant long-term potential, short-term volatility and regulatory uncertainties pose considerable risks.

ORAI Investment Recommendations

✅ Beginners: Start with small positions and focus on education about AI in blockchain ✅ Experienced investors: Consider ORAI as part of a diversified crypto portfolio ✅ Institutional investors: Conduct thorough due diligence and consider OTC options for large positions

ORAI Trading Participation Methods

- Spot trading: Buy and sell ORAI tokens on Gate.com

- Staking: Participate in ORAI staking programs for passive income

- DeFi integration: Explore ORAI-based DeFi applications for additional utility

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance, and it is advisable to consult a professional financial advisor. Never invest more than you can afford to lose.

FAQ

What is the price prediction for Oraichain token in 2030?

Based on current trends and analysis, Oraichain token is predicted to reach approximately $185 by 2030, showing significant growth potential in the long term.

Will AI Doge reach $1?

AI Doge is unlikely to reach $1 in 2025. Predictions suggest it may take another year for the necessary price surge to occur.

Will the Orion protocol go back up?

Based on current projections, the Orion protocol is unlikely to go back up. Forecasts suggest a significant price decrease, potentially dropping by over 95% in the coming years.

How much will 1 pi coin be worth in 2025?

Based on current trends and market analysis, 1 pi coin is expected to be worth between $500 and $520 in 2025.

2025 BNKR Price Prediction: Analyzing Market Trends and Growth Potential in the Digital Asset Space

2025 ASPPrice Prediction: Market Trends and Strategic Forecast for Industry Leaders

2025 TAO Price Prediction: Analyzing Market Trends and Potential Growth Factors

2025 TAPrice Prediction: Analyzing Market Trends and Forecasting Future Values for Technical Assets

2025 TAPrice Prediction: Analyzing Market Trends and Future Valuation of Token Assets

2025 DNX Price Prediction: Analyzing Market Trends and Potential Growth Factors

Is NEM (XEM) a good investment?: A Comprehensive Analysis of Price Performance, Use Cases, and Future Prospects in the Cryptocurrency Market

Comprehensive Guide to Velodrome Finance's Decentralized Trading Protocol

Is Niza Global (NIZA) a good investment?: A Comprehensive Analysis of Tokenomics, Market Performance, and Future Potential

Is Acala (ACA) a good investment?: A Comprehensive Analysis of Token Potential, Market Position, and Risk Factors for 2024

Is Quai Network (QUAI) a good investment?: A Comprehensive Analysis of Performance, Technology, and Market Potential