2025 MOODENGETH Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

Introduction: Market Position and Investment Value of MOODENGETH

Moodeng (MOODENGETH) is a community-driven meme coin built on Ethereum, inspired by a famous Thai zoo hippo. Since its launch in October 2024, the project has established itself within the meme coin ecosystem through its emphasis on decentralization and community engagement. As of December 23, 2025, MOODENGETH boasts a market capitalization of $6,127,770.54, with a circulating supply of 420.69 billion tokens, trading at approximately $0.000014566. This unique digital asset is strengthening its presence in the meme coin space through its distinctive cultural identity and the "Moodeng Army" community movement.

This article will conduct a comprehensive analysis of MOODENGETH's price trajectory from 2025 through 2030, integrating historical price patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and practical investment strategies for investors.

MOODENGETH Market Analysis Report

I. MOODENGETH Price History Review and Current Market Status

MOODENGETH Historical Price Evolution

-

November 2024: MOODENGETH reached its all-time high of $0.00044 on November 20, 2024, marking the peak of its initial market enthusiasm following the token's launch on October 10, 2024 at $0.00002171.

-

October 2024 to Present: From its launch through December 2025, MOODENGETH experienced significant volatility, declining approximately 84.34% year-over-year from its historical highs, with the lowest point recorded at $0.00000828 on October 10, 2025.

MOODENGETH Current Market Status

As of December 23, 2025, MOODENGETH is trading at $0.000014566, reflecting a 0.96% increase over the past 24 hours. The token exhibits modest intraday momentum with a 1-hour gain of 0.03%, though it remains down 1.18% on a weekly basis and significantly down 84.34% year-over-year.

The 30-day performance shows more resilience, with a 20.79% monthly gain, suggesting some recovery phase from the significant sell-off throughout 2025. The 24-hour trading volume stands at $20,179.10, while the total market capitalization is approximately $6.13 million with full market cap dominance at 100% (indicating all supply is circulating).

MOODENGETH maintains a market ranking of #1,423 among cryptocurrencies. The token operates on the Ethereum blockchain as an ERC-20 standard token with a fixed supply cap of 420.69 billion tokens. Current holder count reaches 45,164 addresses, demonstrating community adoption of this community-driven meme coin project.

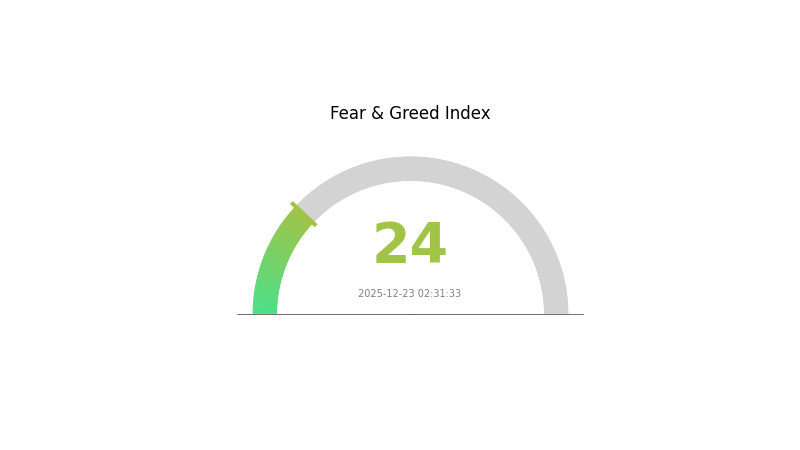

Market sentiment metrics indicate "Extreme Fear" conditions, with a VIX reading of 24, suggesting heightened market anxiety that may present both challenges and opportunities for positioning.

Click to view current MOODENGETH market price

MOODENGETH Market Sentiment Index

2025-12-23 Fear & Greed Index: 24 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is experiencing extreme fear with a reading of 24, signaling significant panic among investors. This historically low sentiment typically indicates oversold conditions and potential accumulation opportunities for long-term investors. When fear reaches such extremes, it often precedes market rebounds. However, caution remains warranted as downward pressure may persist. Traders should monitor key support levels closely while considering this heightened fear as a contrarian indicator. On Gate.com, you can track real-time market sentiment data to inform your trading decisions during this volatile period.

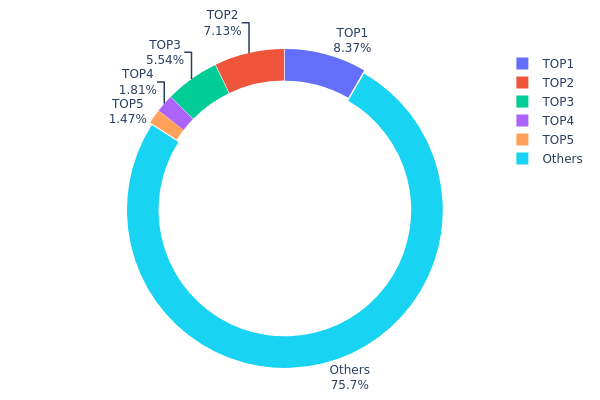

MOODENGETH Holdings Distribution

The holdings distribution chart illustrates the concentration of token ownership across addresses in the MOODENGETH ecosystem. This metric is fundamental for assessing the decentralization level, market structure stability, and potential risk factors associated with large token holders. By analyzing the percentage of tokens held by top addresses versus the broader holder base, analysts can evaluate the vulnerability of the asset to concentrated selling pressure or coordinated market movements.

MOODENGETH currently exhibits moderate concentration characteristics. The top five addresses collectively control approximately 24.29% of total token supply, with the largest holder commanding 8.36%. This distribution pattern suggests that while significant wealth concentration exists among leading addresses, the majority of tokens (75.71%) remain distributed across a diversified base of smaller holders. The fourth and fifth largest addresses hold notably smaller positions (1.80% and 1.46% respectively), indicating a relatively steep decline in concentration levels beyond the top three holders, which is generally a positive indicator for ecosystem health.

The current distribution structure presents a balanced risk profile for market stability. The absence of extreme whale dominance—where a single address would exceed 20-30% of total supply—reduces the likelihood of catastrophic price manipulation through sudden liquidation events. However, the combined 21.03% stake held by the top three addresses warrants continued monitoring, as coordinated action among these major holders could still exert meaningful influence on token velocity and market sentiment. The substantial retail participation reflected in the "Others" category suggests healthy decentralization mechanisms and provides a stabilizing foundation for price discovery.

Click to view current MOODENGETH Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x470d...56a03d | 35193990.52K | 8.36% |

| 2 | 0xd8da...a96045 | 30001218.98K | 7.13% |

| 3 | 0x0d07...b492fe | 23316327.29K | 5.54% |

| 4 | 0x9642...2f5d4e | 7604848.25K | 1.80% |

| 5 | 0x0000...00dead | 6181903.13K | 1.46% |

| - | Others | 318391711.83K | 75.71% |

II. Core Factors Affecting MOODENGETH's Future Price

Community Sentiment and Social Media Dynamics

-

Social Media Influence: Unlike blue-chip cryptocurrencies such as Bitcoin and Ethereum, MOODENGETH, as a meme coin, is primarily driven by community dynamics and lacks clear fundamental value support. Price movements are heavily dependent on social media discussions and public sentiment rather than underlying technology or adoption.

-

Market Sentiment Impact: The token's price trajectory is largely influenced by user emotions and market trends. Market participants' collective sentiment plays a decisive role in determining price volatility, with periods of optimistic sentiment potentially driving rapid price appreciation, while negative sentiment can trigger sharp declines.

Macro-Economic Environment

-

Geopolitical Factors: US-China relations have emerged as a primary macro driver for cryptocurrency markets. The direction and developments in international relations carry significant weight on market movements, potentially overshadowing other macro factors in the short to medium term.

-

Capital Inflow Dynamics: Influxes of new market capital can drive price volatility and support bullish momentum. Historical patterns demonstrate that meme coins experience cyclical periods of capital concentration, with new retail investor participation often coinciding with price surges.

III. 2025-2030 MOODENGETH Price Forecast

2025 Outlook

- Conservative Forecast: $0.00001

- Neutral Forecast: $0.00001

- Optimistic Forecast: $0.00002

2026-2027 Mid-term Outlook

- Market Stage Expectation: Gradual recovery and stabilization phase with modest growth trajectory

- Price Range Forecast:

- 2026: $0.00002 (average), with 13% upside potential

- 2027: $0.00002 (average), with 40% upside potential

- Key Catalysts: Market sentiment improvement, increased adoption, positive regulatory developments, and enhanced liquidity on major platforms such as Gate.com

2028-2030 Long-term Outlook

- Base Case Scenario: $0.00003 (assumes steady market expansion and sustained investor interest)

- Optimistic Scenario: $0.00003 (assumes accelerated ecosystem development and broader market acceptance)

- Transformational Scenario: $0.00003 (assumes major technological breakthroughs and significant mainstream adoption)

Market Analysis Note: The forecast data indicates a gradual appreciation trend across the 2025-2030 period, with cumulative gains reaching approximately 83% by 2030. The token demonstrates relative price stability with minimal volatility in the predicted ranges, suggesting consolidation and measured growth rather than explosive movements. Investors should monitor market developments and maintain positions on reliable trading platforms like Gate.com for optimal execution and security.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00002 | 0.00001 | 0.00001 | 0 |

| 2026 | 0.00002 | 0.00002 | 0.00002 | 13 |

| 2027 | 0.00002 | 0.00002 | 0.00001 | 40 |

| 2028 | 0.00003 | 0.00002 | 0.00002 | 50 |

| 2029 | 0.00003 | 0.00003 | 0.00002 | 80 |

| 2030 | 0.00003 | 0.00003 | 0.00003 | 83 |

MOODENGETH Professional Investment Strategy and Risk Management Report

IV. MOODENGETH Professional Investment Strategy and Risk Management

MOODENGETH Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Community-oriented investors and meme coin enthusiasts who believe in the cultural narrative and long-term community development

- Operation Recommendations:

- Establish a core position during market dips and hold through volatility cycles, leveraging the project's community-driven nature

- Participate actively in community initiatives to align with the "Moodeng Army" philosophy and stay informed on project developments

- Set realistic price targets based on market cycles rather than short-term fluctuations, considering the token's volatility profile (1-year decline of -84.34%)

- Maintain disciplined accumulation during bearish periods when sentiment is low

(2) Active Trading Strategy

-

Technical Analysis Tools:

- Support and Resistance Levels: Track key price points at $0.00044 (all-time high from November 20, 2024) and $0.00000828 (all-time low from October 10, 2025) to identify potential breakout or breakdown zones

- Moving Averages: Utilize 7-day and 30-day moving averages to identify trend direction, noting the recent 30-day positive performance of +20.79%

- Volume Analysis: Monitor 24-hour trading volume ($20,179.10) relative to historical averages to confirm trend strength before entering positions

-

Wave Trading Key Points:

- Capitalize on short-term volatility within the 24-hour price range of $0.000014302 to $0.000014912

- Execute buy orders during negative sentiment periods and take profits during positive momentum (24-hour change: +0.96%)

MOODENGETH Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% of portfolio allocation, with strict stop-loss orders at -10% below entry price

- Active Investors: 3-8% of portfolio allocation, with diversified entry points across multiple price levels

- Professional Investors: Up to 15% of portfolio allocation, using hedging strategies and derivatives where available

(2) Risk Hedging Solutions

- Portfolio Diversification: Balance MOODENGETH holdings with other established cryptocurrencies and traditional assets to mitigate concentration risk

- Stop-Loss Implementation: Set predetermined exit points at -15% to -20% below entry price to limit downside exposure

(3) Secure Storage Solutions

- Exchange Wallet: Keep active trading positions on Gate.com for convenient access and swift execution of trading strategies

- Self-Custody Approach: Transfer long-term holdings to Gate Web3 Wallet for enhanced security and personal control over private keys

- Security Considerations: Enable multi-layer security protocols including 2FA authentication, never share private keys or recovery phrases, and regularly verify wallet addresses before transfers

V. MOODENGETH Potential Risks and Challenges

MOODENGETH Market Risk

- High Volatility Exposure: The token has experienced extreme price swings, including an -84.34% decline over one year and a -1.18% drop over seven days, exposing investors to significant portfolio fluctuations

- Liquidity Risk: With only $20,179.10 in 24-hour volume and limited exchange listings (currently on 1 exchange), large trades may face significant slippage and difficulty exiting positions

- Market Cap Concentration: The fully diluted valuation of $6.13 million represents a very small market cap, making the project susceptible to rapid price movements from relatively modest capital flows

MOODENGETH Regulatory Risk

- Meme Coin Classification: Regulatory bodies in various jurisdictions may scrutinize meme coins due to their speculative nature and community-driven structure, potentially impacting trading availability

- Future Compliance Requirements: Changes in cryptocurrency regulations, particularly regarding token classification and trading restrictions, could affect MOODENGETH's market access

- Geographic Restrictions: Certain jurisdictions may impose trading restrictions or prohibitions on meme coins, limiting market accessibility

MOODENGETH Technical Risk

- Smart Contract Vulnerability: As an ERC-20 token on Ethereum, any undiscovered smart contract vulnerabilities could pose significant risks to token holders

- Network Dependency: MOODENGETH relies entirely on Ethereum network stability; network congestion or failures could impact trading capabilities and transaction speed

- Limited Technical Documentation: The absence of published white papers or detailed technical specifications increases uncertainty regarding long-term development roadmap and technical foundations

VI. Conclusion and Action Recommendations

MOODENGETH Investment Value Assessment

MOODENGETH represents a speculative community-driven meme coin opportunity with significant volatility and limited fundamental utility. While the project emphasizes community spirit and decentralization through its "Moodeng Army" narrative, the extreme price fluctuations (-84.34% annually), minimal trading volume, and single exchange listing indicate high speculation levels. The token's fixed supply of 420.69 billion tokens provides scarcity mechanics typical of meme coins, but this alone does not guarantee long-term viability. Investors should approach this asset as a high-risk, high-reward speculation rather than a stable investment.

MOODENGETH Investment Recommendations

✅ Beginners: Start with minimal allocation (0.5-1% of portfolio), focus on understanding community dynamics through social channels, and use only capital you can afford to lose entirely without impacting financial stability.

✅ Experienced Investors: Implement strict technical trading rules with predetermined stop-losses, utilize Gate.com's trading tools for active management, and maintain disciplined position sizing between 3-8% of total portfolio.

✅ Institutional Investors: Conduct thorough due diligence on smart contract security, evaluate community sentiment metrics, and consider MOODENGETH as a tactical speculative position rather than a core holding, while monitoring regulatory developments continuously.

MOODENGETH Trading Participation Methods

- Exchange Trading: Access MOODENGETH directly on Gate.com, which provides real-time price data, advanced charting tools, and secure trading infrastructure for spot trading

- Community Participation: Engage with the project community through official channels to stay informed on developments, participate in community governance initiatives, and assess long-term sentiment

- Dollar-Cost Averaging: Implement scheduled purchases at regular intervals to reduce timing risk and average entry prices across multiple market conditions

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions based on their individual risk tolerance and should consult professional financial advisors. Never invest more capital than you can afford to lose completely.

FAQ

Does MOODENG coin have a future?

Yes. MOODENG coin has strong potential driven by its wildlife conservation mission and growing community support. The hippo-themed token's unique branding and charitable focus position it well for long-term growth in the crypto market.

What is MOODENG coin price prediction?

MOODENG coin price prediction estimates future value based on market trends and analysis. Current forecasts suggest MOODENG may reach $0.05018 by December 31, 2025, reflecting market dynamics and technical indicators.

Is MOODENG a good buy?

MOODENG presents strong community momentum and viral potential as a meme token. With growing adoption and trading volume, it offers attractive opportunities for traders seeking high-growth assets in the current market cycle.

What are the risks of investing in MOODENG coin?

MOODENG carries risks including limited trading history, high price volatility, and low liquidity. These factors may cause significant price fluctuations and challenges when exiting positions. Conduct thorough research before investing.

2025 TURBO Price Prediction: Analyzing Market Trends and Future Valuation Prospects in the Evolving Cryptocurrency Ecosystem

2025 WOJAK Price Prediction: Analyzing Market Trends and Future Valuation Prospects for the Popular Meme Token

2025 WHYPrice Prediction: Market Analysis and Growth Potential for Investors

2025 DON Price Prediction: Analyzing Market Trends and Potential Growth Factors

2025 QUACK Price Prediction: Will This Meme Coin Soar or Crash in the Crypto Market?

2025 COQ Price Prediction: Expert Analysis and Market Outlook for the Coming Year

What are the major security risks and smart contract vulnerabilities in ICNT crypto ecosystem in 2025?

# How to Analyze ICNT On-Chain Data: Active Addresses, Transaction Volume, and Whale Movements

Understanding UMA: A Beginner's Guide to the Protocol

How to Use MACD, RSI, and Bollinger Bands for Crypto Price Prediction?

What is Vision (VSN) token? A complete fundamentals analysis of whitepaper logic, use cases, and team background