2025 FDUSD Price Prediction: Expert Analysis and Market Forecast for the Year Ahead

Introduction: FDUSD's Market Position and Investment Value

First Digital USD (FDUSD) as a fiat-backed stablecoin has established itself as a significant player in the digital asset market since its inception. As of 2025, FDUSD's market capitalization has reached $1,450,432,499, with a circulating supply of approximately 1,452,465,952.2 tokens, maintaining a price close to $0.9986. This asset, known as a "stable digital dollar alternative," is playing an increasingly crucial role in facilitating efficient financial transactions and cross-border payments.

This article will provide a comprehensive analysis of FDUSD's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. FDUSD Price History Review and Current Market Status

FDUSD Historical Price Evolution

- 2023: FDUSD launched, price stabilized around $1

- 2024: Reached all-time high of $1.0093 on December 24

- 2025: Experienced low of $0.8799 on April 2, later recovered

FDUSD Current Market Situation

As of December 16, 2025, FDUSD is trading at $0.9986, showing a 0.02% increase in the past 24 hours. The current market cap stands at $1,450,432,499, ranking FDUSD 61st among all cryptocurrencies. The 24-hour trading volume is $13,278,664, indicating moderate market activity. FDUSD has maintained its peg relatively well, with a 52-week price range between $0.8799 and $1.0093. The current price is very close to its intended $1 peg, demonstrating stability in recent trading.

Click to view the current FDUSD market price

FDUSD Market Sentiment Indicator

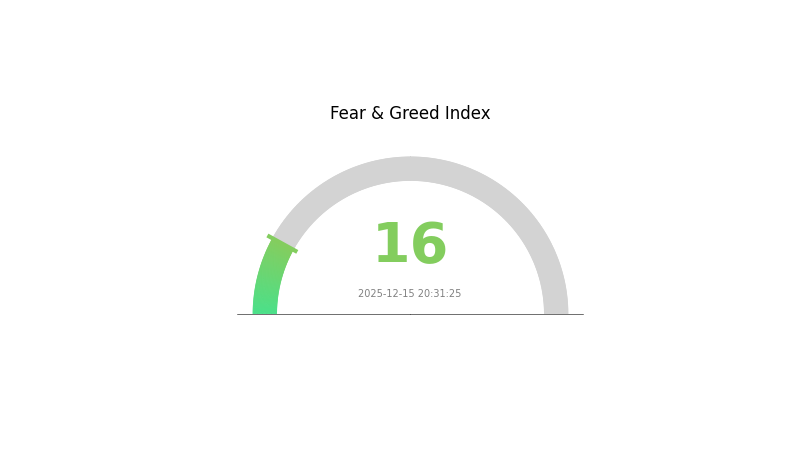

2025-12-15 Fear and Greed Index: 16 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is currently experiencing a period of extreme fear, with the sentiment indicator plummeting to 16. This suggests investors are highly cautious and risk-averse. Such extreme fear often precedes potential market bottoms, presenting opportunities for contrarian investors. However, it's crucial to approach with caution and conduct thorough research. Gate.com offers comprehensive market data to help traders navigate these volatile conditions and make informed decisions.

FDUSD Holdings Distribution

The address holdings distribution data reveals a highly concentrated ownership structure for FDUSD. The top address holds a staggering 53.27% of the total supply, followed by the second and third largest holders with 22.21% and 12.08% respectively. Collectively, the top three addresses control 87.56% of all FDUSD tokens.

This extreme concentration raises concerns about market stability and potential price manipulation. With such a significant portion of tokens held by a few addresses, any large-scale movement or liquidation could cause substantial price volatility. Moreover, this centralized distribution contradicts the principles of decentralization often associated with cryptocurrencies.

The current distribution pattern suggests a relatively immature market structure for FDUSD, with limited circulation among a broader user base. This concentration may impede liquidity and could potentially deter new investors due to concerns over market fairness and susceptibility to large holder actions.

Click to view the current FDUSD Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x47ac...a6d503 | 253891.38K | 53.27% |

| 2 | 0x5a52...70efcb | 105847.89K | 22.21% |

| 3 | 0x28c6...f21d60 | 57580.86K | 12.08% |

| 4 | 0xf51b...6fad48 | 15427.58K | 3.23% |

| 5 | 0x4368...26f042 | 12866.22K | 2.69% |

| - | Others | 30916.01K | 6.52% |

II. Key Factors Affecting Future FDUSD Price

Supply Mechanism

-

Market Arbitrage: FDUSD's stability relies on market arbitrage. When the price deviates from its $1 peg, arbitrageurs can profit by minting or redeeming FDUSD directly from First Digital Labs, pushing the market price back to the peg.

-

Historical Pattern: The supply changes have historically helped maintain FDUSD's price stability around $1.

-

Current Impact: The effectiveness of this mechanism continues to play a crucial role in FDUSD's price stability.

Institutional and Whale Dynamics

-

Institutional Holdings: Major institutions, including Gate.com, have shown support for FDUSD, which has contributed to its rapid growth and market position.

-

Corporate Adoption: FDUSD has gained traction as a payment method for cross-border e-commerce and global supply chain management.

Macroeconomic Environment

-

Monetary Policy Impact: Central bank policies, especially those of the Federal Reserve, can influence demand for stablecoins like FDUSD as investors seek alternatives to traditional fiat currencies.

-

Inflation Hedging Properties: In high-inflation countries, FDUSD has become an important tool for wealth preservation, similar to other USD-pegged stablecoins.

-

Geopolitical Factors: Global economic uncertainties and geopolitical tensions can drive demand for stablecoins like FDUSD as a safe haven asset.

Technical Development and Ecosystem Building

-

Regulatory Compliance: FDUSD's development is closely tied to regulatory frameworks, particularly in Hong Kong where it has entered the regulatory sandbox.

-

Ecosystem Applications: FDUSD is expanding its use cases in DeFi, cross-border payments, and as a trading pair on crypto exchanges, enhancing its utility and demand.

III. FDUSD Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.71899 - $0.9986

- Neutral prediction: $0.9986 - $1.36808

- Optimistic prediction: $1.36808 - $1.5 (requires strong market recovery and increased adoption)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increased volatility

- Price range forecast:

- 2027: $0.77 - $1.72537

- 2028: $1.27627 - $2.26893

- Key catalysts: Broader cryptocurrency market trends, regulatory developments, and FDUSD ecosystem expansion

2029-2030 Long-term Outlook

- Base scenario: $1.92229 - $2.24908 (assuming steady market growth and adoption)

- Optimistic scenario: $2.57587 - $3.21618 (assuming favorable market conditions and widespread FDUSD usage)

- Transformative scenario: $3.5 - $4.0 (assuming exceptional market performance and FDUSD becoming a leading stablecoin)

- 2030-12-31: FDUSD $3.21618 (potential peak price based on optimistic projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 1.36808 | 0.9986 | 0.71899 | 0 |

| 2026 | 1.66851 | 1.18334 | 1.11234 | 18 |

| 2027 | 1.72537 | 1.42593 | 0.77 | 42 |

| 2028 | 2.26893 | 1.57565 | 1.27627 | 57 |

| 2029 | 2.57587 | 1.92229 | 1.36483 | 92 |

| 2030 | 3.21618 | 2.24908 | 1.88923 | 125 |

IV. FDUSD Professional Investment Strategies and Risk Management

FDUSD Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Conservative investors seeking stable value preservation

- Operation suggestions:

- Allocate a portion of portfolio to FDUSD as a hedge against fiat currency volatility

- Regularly monitor FDUSD's peg stability and reserve backing

- Store FDUSD in secure, non-custodial wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Monitor short-term price movements and trend reversals

- Relative Strength Index (RSI): Identify overbought or oversold conditions

- Key points for swing trading:

- Focus on short-term deviations from the $1 peg

- Set tight stop-losses to manage risk

FDUSD Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 5-10%

- Moderate investors: 10-20%

- Aggressive investors: 20-30%

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple stablecoins and asset classes

- Collateralization: Use FDUSD as collateral for low-risk lending strategies

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for large holdings

- Security precautions: Enable two-factor authentication, use unique passwords, and regularly update software

V. Potential Risks and Challenges for FDUSD

FDUSD Market Risks

- Depegging: Temporary loss of 1:1 peg with USD

- Liquidity issues: Potential difficulty in large-scale redemptions

- Market sentiment shifts: Sudden loss of confidence in stablecoins

FDUSD Regulatory Risks

- Increased scrutiny: Potential new regulations on stablecoin issuers

- Cross-border restrictions: Limitations on FDUSD usage in certain jurisdictions

- Reserve audit requirements: Stricter oversight on backing assets

FDUSD Technical Risks

- Smart contract vulnerabilities: Potential exploits in the token's code

- Blockchain congestion: Transaction delays during high network activity

- Integration issues: Compatibility problems with new DeFi protocols

VI. Conclusion and Action Recommendations

FDUSD Investment Value Assessment

FDUSD offers a stable store of value with potential for efficient cross-border transactions. However, investors should remain vigilant about regulatory developments and market risks associated with stablecoins.

FDUSD Investment Recommendations

✅ Beginners: Allocate a small portion (5-10%) of crypto portfolio to FDUSD for stability

✅ Experienced investors: Use FDUSD for liquidity management and short-term trading opportunities

✅ Institutional investors: Consider FDUSD for treasury management and as a base currency for crypto operations

FDUSD Participation Methods

- Direct purchase: Buy FDUSD on Gate.com

- DeFi integration: Use FDUSD in decentralized finance protocols for lending or liquidity provision

- Payment solution: Utilize FDUSD for international remittances or e-commerce transactions

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is FDUSD a good investment?

FDUSD shows promising potential in 2025. Market trends and expert predictions suggest it could be a favorable investment option for those seeking stability in the crypto market.

What is the future of the Fdusd coin?

FDUSD has a promising future as a stablecoin, potentially reaching $0.997711 by 2028. It's expected to maintain its peg to the US dollar, offering stability in the volatile crypto market.

Is FDUSD a stable coin?

Yes, FDUSD is a stablecoin. It's backed 1:1 by USD, designed to maintain a stable value and reduce cryptocurrency market volatility.

Who is behind FDUSD?

First Digital Labs, a Hong Kong-based company, is behind FDUSD. They are expanding FDUSD's presence on various exchanges.

XZXX: A Comprehensive Guide to the BRC-20 Meme Token in 2025

Bitcoin Fear and Greed Index: Market Sentiment Analysis for 2025

Top Crypto ETFs to Watch in 2025: Navigating the Digital Asset Boom

5 ways to get Bitcoin for free in 2025: Newbie Guide

Bitcoin Market Cap in 2025: Analysis and Trends for Investors

2025 Bitcoin Price Prediction: Trump's Tariffs' Impact on BTC

Is Aethir (ATH) a good investment?: A Comprehensive Analysis of Tokenomics, Market Potential, and Risk Factors for 2024

Is Axie Infinity (AXS) a good investment?: A Comprehensive Analysis of Risks, Rewards, and Market Prospects in 2024

Is Beam (BEAMX) a good investment?: A Comprehensive Analysis of Its Market Potential, Technology, and Risk Factors for 2024

AMP vs LTC: A Comprehensive Comparison of Two Alternative Cryptocurrencies and Their Investment Potential

FORM vs ARB: A Comprehensive Comparison of Two Powerful Financial Analysis Tools