2025 DEP Price Prediction: Expert Analysis and Market Forecast for Deeper Network Token

Introduction: DEP's Market Position and Investment Value

DEAPCOIN (DEP) serves as the native utility token for the PlayMining entertainment platform, which enables users to earn cryptocurrency rewards while enjoying free access to gaming and comic resources. Since its launch in 2020, DEP has established itself as a key component of a decentralized digital asset ecosystem. As of December 2025, DEP maintains a market capitalization of approximately $33.99 million, with a circulating supply of around 27.53 billion tokens trading at $0.001137 per unit. This innovative asset, recognized for its integration of entertainment and blockchain technology, continues to play an increasingly important role in the digital asset and content creation space.

This article provides a comprehensive analysis of DEP's price trajectory and market dynamics, integrating historical price patterns, market supply and demand factors, ecosystem developments, and macroeconomic conditions to deliver professional price forecasts and practical investment strategies for the period through 2030.

DEAPCOIN (DEP) Market Analysis Report

I. DEP Price History Review and Current Market Status

DEP Historical Price Evolution

- 2021: ATH (All-Time High) reached on November 25, 2021 at $0.07894, marking the peak of market enthusiasm during the early entertainment platform expansion phase.

- 2023: ATL (All-Time Low) recorded on October 18, 2023 at $0.00068582, reflecting significant market correction and sentiment downturn.

- December 2025: Current trading price at $0.0011372, representing a recovery from historical lows with 30-day gains of 20.34%.

DEP Current Market Status

Price Performance:

- Current Price: $0.0011372

- 24-Hour Change: +0.34% ($0.000003853378513056)

- 1-Hour Change: +0.75% ($0.000008465508684864)

- 7-Day Change: -1.15% ($0.000013229944360142)

- 30-Day Change: +20.34% ($0.000192210802725611)

- 1-Year Change: -37.64% ($0.000686404874919821)

Market Capitalization & Supply Metrics:

- Market Cap (Circulating): $31,302,945.06

- Fully Diluted Valuation: $33,994,205.88

- Circulating Supply: 27,526,332,268.33 DEP

- Total Supply: 29,892,900,001.33 DEP

- Maximum Supply: 30,000,000,000 DEP

- Circulation Ratio: 91.75%

- Market Dominance: 0.0010%

Trading Activity:

- 24-Hour Volume: $44,709.12

- 24-Hour High: $0.001511

- 24-Hour Low: $0.0010454

- Total Holders: 22,186

- Available on 3 major exchanges

Market Sentiment:

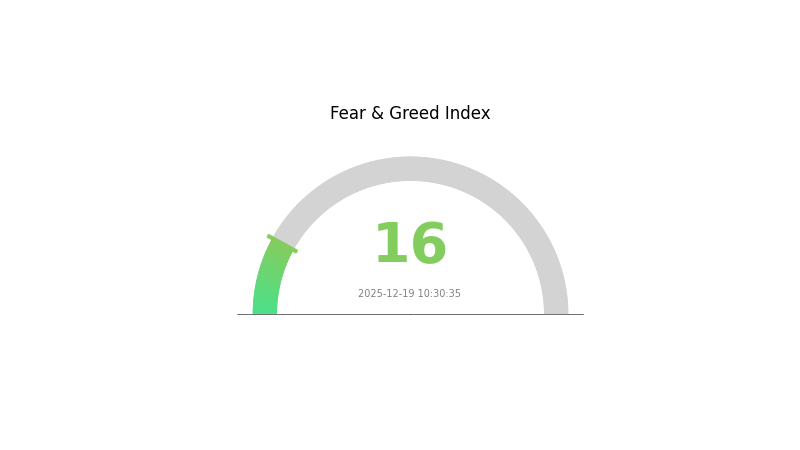

- Current Market Emotion Index: Extreme Fear (VIX: 16)

Click to view current DEP market price

DEP Market Sentiment Indicator

2025-12-19 Fear and Greed Index: 16 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear with a fear and greed index of 16. This exceptionally low reading suggests intense market pessimism and panic selling pressure. When fear reaches such extreme levels, it often signals potential buying opportunities for contrarian investors, as markets tend to recover from oversold conditions. However, investors should exercise caution and conduct thorough research before making investment decisions. Monitor market developments closely and consider your risk tolerance carefully during this volatile period.

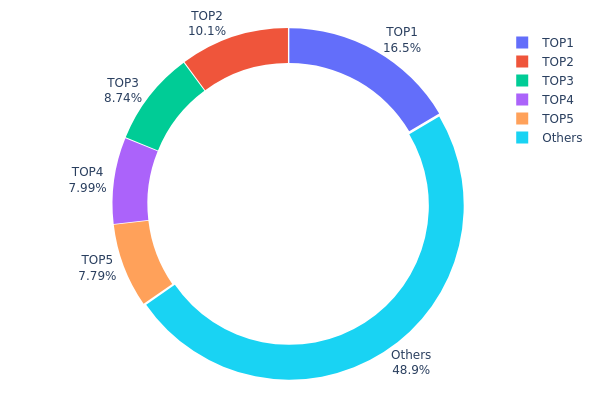

DEP Holdings Distribution

The address holdings distribution map illustrates the concentration of DEP tokens across blockchain addresses, revealing the degree of wealth centralization and potential market influence among major token holders. By analyzing the top addresses and their proportional share of total supply, this metric provides critical insights into the token's decentralization status and susceptibility to coordinated market movements.

DEP exhibits moderate concentration characteristics in its current holder landscape. The top five addresses collectively control approximately 51.08% of the token supply, with the leading address commanding 16.46% alone. This distribution pattern indicates a meaningful level of concentration, though not extraordinarily severe by industry standards. The largest holder maintains a significant but not dominant position, while the remaining 48.92% of tokens dispersed among other addresses suggests a reasonably distributed secondary market. The gap between the top holder and subsequent positions is notable, with the first address holding substantially more than the second (16.46% versus 10.11%), reflecting asymmetric influence within the holder base.

From a market structure perspective, this concentration pattern presents both stabilizing and destabilizing dynamics. The substantial holdings concentrated in a limited number of addresses create potential for significant price volatility should large-scale liquidations or coordinated movements occur. However, the absence of extreme single-entity dominance (no holder exceeding 20%) mitigates catastrophic manipulation risks. The 48.92% allocation to dispersed addresses indicates genuine retail and institutional participation, which provides liquidity depth and reduces the likelihood of complete market control. The current distribution reflects a moderately decentralized token ecosystem with balanced governance potential, though continued monitoring of top holder intentions remains prudent for comprehensive market assessment.

Click to view current DEP Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xf8ef...58445a | 4939800.05K | 16.46% |

| 2 | 0x2a45...926a1d | 3034653.49K | 10.11% |

| 3 | 0xed2a...176684 | 2621436.58K | 8.73% |

| 4 | 0xd242...7d5ebd | 2397538.05K | 7.99% |

| 5 | 0x0864...c75e6b | 2338222.00K | 7.79% |

| - | Others | 14668349.83K | 48.92% |

II. Core Factors Influencing DEP's Future Price

Macroeconomic Environment

-

Monetary Policy Impact: Global central bank policy expectations will profoundly influence DEP price movements. Changes in interest rates and monetary policy directly affect capital flows and market sentiment. As central banks adjust their policy stances in 2025, these decisions will be critical in determining the direction of cryptocurrency markets and investor risk appetite.

-

Inflation Hedge Properties: In an inflationary environment, DEP's performance becomes a focal point for investors. Traditional fiat currencies face depreciation pressures during inflationary periods, making digital assets like DEP increasingly attractive as potential stores of value and hedges against currency debasement.

Market Supply and Demand Dynamics

- Data Asset Demand: Market supply-demand relationships directly influence DEP's price volatility. Changes in demand for data assets significantly impact valuation. When the number of data demand sources increases, the value of data assets responds accordingly. Additionally, when data asset ownership transfers occur, the asset's value performance is affected by shifts in holder composition and market expectations.

III. 2025-2030 DEP Price Forecast

2025 Outlook

- Conservative Forecast: $0.00066 - $0.00114

- Neutral Forecast: $0.00114

- Bullish Forecast: $0.00146 (requires sustained market sentiment and increased adoption)

2026-2028 Medium-term Outlook

- Market Stage Expectation: Gradual recovery phase with accumulation opportunities as DEP establishes stronger market fundamentals

- Price Range Predictions:

- 2026: $0.00066 - $0.00146 (14% upside potential)

- 2027: $0.00079 - $0.00203 (21% year-over-year growth)

- 2028: $0.00087 - $0.00244 (49% year-over-year growth)

- Key Catalysts: Ecosystem expansion, strategic partnerships, increased institutional interest, and improved market liquidity on platforms like Gate.com

2029-2030 Long-term Outlook

- Base Case Scenario: $0.00143 - $0.00259 (assuming moderate ecosystem growth and stable market conditions)

- Bullish Scenario: $0.00175 - $0.00303 (82-104% cumulative growth through 2029-2030 driven by mainstream adoption and DeFi integration)

- Transformative Scenario: $0.00303+ (extreme favorable conditions including major protocol upgrades, breakthrough partnerships, and significant increase in Total Value Locked)

- 2030-12-19: DEP $0.00303 (projected highest price point amid favorable market maturation)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00146 | 0.00114 | 0.00066 | 0 |

| 2026 | 0.00146 | 0.0013 | 0.00066 | 14 |

| 2027 | 0.00203 | 0.00138 | 0.00079 | 21 |

| 2028 | 0.00244 | 0.00171 | 0.00087 | 49 |

| 2029 | 0.00259 | 0.00207 | 0.00143 | 82 |

| 2030 | 0.00303 | 0.00233 | 0.00175 | 104 |

DEAPCOIN (DEP) Professional Investment Strategy and Risk Management Report

I. Executive Summary

DEAPCOIN (DEP) is the native utility token of the PlayMining entertainment platform, an ecosystem designed to reward users with cryptocurrency while they engage with games and manga content. As of December 19, 2025, DEP is trading at $0.001137 with a market capitalization of approximately $31.3 million, ranking 679th by market cap. The token has experienced significant volatility, having peaked at $0.07894 in November 2021 and currently trading 85.6% below its all-time high.

II. Market Overview and Current Status

Current Price Metrics

| Metric | Value |

|---|---|

| Current Price | $0.001137 |

| 24H Change | +0.34% |

| 7D Change | -1.15% |

| 30D Change | +20.34% |

| 1Y Change | -37.64% |

| Market Cap | $31.30 million |

| Fully Diluted Valuation | $33.99 million |

| Circulating Supply | 27.53 billion DEP |

| Total Supply | 29.89 billion DEP |

| Maximum Supply | 30 billion DEP |

Price Volatility Analysis

DEP demonstrates concerning long-term performance with a -37.64% decline over the past year. However, the 30-day period shows recovery momentum at +20.34%, suggesting potential consolidation patterns. The token's 24-hour range of $0.001045 to $0.001511 indicates moderate intraday volatility, typical for mid-cap tokens.

III. Project Analysis and Use Cases

Platform Overview

PlayMining is an entertainment ecosystem that integrates gaming, manga content, and cryptocurrency rewards. The platform operates through the following mechanisms:

- Free-to-Earn Model: Users access games and manga content without upfront costs while earning DEP tokens as rewards

- Digital Assets Marketplace: In-game characters and items are tokenized as NFTs using ERC-721 standard technology

- Digital Art Auction System: A secondary trading platform enabling peer-to-peer transactions of digital assets

- Revenue Sharing: A portion of transaction proceeds returns to content creators, creating economic incentive alignment

Token Economics

DEP functions as an ERC-20 based utility token serving multiple roles:

- Transaction currency for marketplace exchanges

- Reward mechanism for user participation

- Governance and value accrual within the ecosystem

- Medium of exchange between players and content creators

The token's circulation ratio of 91.75% indicates substantial liquidity in the market, with 27.53 billion tokens circulating against a maximum supply cap of 30 billion.

IV. DEP Professional Investment Strategy and Risk Management

DEP Investment Methodology

(1) Long-Term Holding Strategy

Suitable Investors: Speculative investors with high risk tolerance and extended investment horizons (2-5 years), who believe in the long-term viability of play-to-earn gaming models.

Operational Recommendations:

- Dollar-Cost Averaging (DCA): Deploy capital in fixed-interval purchases over extended periods to reduce timing risk and average acquisition costs during market volatility

- Position Building: Establish initial positions representing no more than 2-3% of total portfolio value, with capability to add on 30-50% price retracements

- Secure Custody: Store tokens in secure wallets with private key control; consider Gate web3 wallet for convenient access with strong security protocols

(2) Active Trading Strategy

Technical Analysis Tools:

- Moving Average Crossovers (MA 20/50/200): Identify trend reversals when shorter-term averages cross above or below longer-term moving averages; use 4-hour or daily timeframes for DEP due to lower liquidity

- Relative Strength Index (RSI): Monitor overbought (>70) and oversold (<30) conditions to time entry and exit points; DEP's historical volatility suggests RSI bands warrant tighter monitoring

Wave Trading Considerations:

- Entry Points: Target purchases during oversold conditions when RSI falls below 30 or at identified support levels

- Exit Discipline: Implement profit-taking at predetermined resistance levels; consider trailing stop-losses at 15-20% below entry to protect against sharp reversals

- Time Frame Optimization: Focus on 4-hour to daily charts given DEP's moderate liquidity; weekly analysis for trend confirmation

DEP Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: Maximum 1-2% portfolio allocation; suitable for investors primarily seeking portfolio diversification rather than aggressive growth

- Moderate Investors: 3-5% portfolio allocation; appropriate for investors with balanced risk tolerance and medium-term growth objectives

- Aggressive Investors: 5-10% portfolio allocation; suited for speculators and traders with significant risk capital and experience managing volatile assets

(2) Risk Hedging Strategies

- Portfolio Rebalancing: Quarterly rebalancing to maintain target allocation percentages; automatically enforces disciplined buying weakness and selling strength

- Stop-Loss Implementation: Set hard stops at 25-30% below average acquisition price to prevent catastrophic losses; adjust based on individual risk tolerance

(3) Secure Storage Solutions

- Hot Wallet Option: Gate Web3 Wallet provides optimal balance between accessibility and security for active traders; enables immediate transaction execution and portfolio monitoring

- Cold Storage Alternative: For long-term holdings exceeding 6 months, transfer significant portions to hardware-secured wallets to minimize exchange counterparty risk and hack exposure

- Security Critical Practices: Enable two-factor authentication on all exchange accounts; use hardware security keys where available; regularly audit wallet addresses and transaction history; never share private keys or seed phrases; maintain encrypted backups in geographically distinct locations

V. Potential Risks and Challenges

DEP Market Risks

- Severe Historical Underperformance: The token has declined 85.6% from its all-time high of $0.07894, indicating fundamental challenges or market sentiment deterioration regarding the play-to-earn model; recovery risk remains substantial

- Limited Trading Volume and Liquidity: 24-hour volume of $44,709 is extremely low, creating significant slippage risk on purchases/sales exceeding $100,000; potential for price manipulation on thin order books

- Market Saturation in Play-to-Earn Sector: The broader play-to-earn gaming category has experienced declining user engagement and market enthusiasm post-2022 boom; DEP faces intense competition and user retention challenges

DEP Regulatory Risks

- Cryptocurrency Classification Uncertainty: Potential reclassification of DEP or gaming tokens as securities in major jurisdictions could trigger delisting from exchanges, regulatory scrutiny, or staking restrictions

- Cross-Border Compliance: PlayMining's global user base creates complex regulatory exposure across multiple countries with divergent crypto policies; regulatory actions in major markets (EU, US, Asia) could materially impact platform operations

- Rewards Program Scrutiny: Free-to-earn reward systems may attract scrutiny from gaming regulators and tax authorities; potential changes to reward distribution mechanisms could negatively impact token demand

DEP Technology Risks

- Private Blockchain Scalability: Reliance on a private blockchain infrastructure creates centralization risks and potential technical vulnerabilities; updates or maintenance could result in trading halts or asset access restrictions

- ERC-721 Smart Contract Vulnerabilities: NFT marketplace exposure to smart contract bugs, exploits, or security breaches could result in user asset loss and ecosystem damage

- Platform Dependency: Token value is entirely dependent on PlayMining platform adoption and user engagement; platform downtime, content removal, or decline in user activity directly threatens token utility and value

VI. Conclusion and Action Recommendations

DEP Investment Value Assessment

DEAPCOIN represents a speculative investment in the play-to-earn gaming segment, which remains deeply challenged following the 2022 market correction. The token's severe depreciation from peak levels, combined with extremely limited trading liquidity, creates both opportunity and significant risk. The PlayMining platform's fundamental value proposition depends on sustained user engagement and ecosystem growth, factors not yet demonstrated at scale. While the 30-day recovery of +20.34% suggests potential bottoming dynamics, the broader market environment for gaming tokens remains unfavorable. DEP should be considered only within a diversified portfolio where capital loss would not materially impact financial objectives.

DEP Investment Recommendations

✅ Beginners: Avoid direct DEP investment until establishing foundational knowledge of crypto markets and risk tolerance. If interested, limit exposure to <1% of portfolio as educational speculation only; use Gate.com for controlled entry with minimal position size.

✅ Experienced Investors: Consider 3-5% portfolio allocation only if you maintain conviction in play-to-earn ecosystem recovery; employ strict technical analysis discipline and implement 25-30% stop-losses; prepare multi-year holding horizon with quarterly rebalancing discipline.

✅ Institutional Investors: Not recommended as core holding due to insufficient liquidity, unresolved regulatory status, and market concentration risk; potential use case limited to small tactical positions for thematic gaming token exposure research.

DEP Trading Participation Methods

- Spot Trading on Gate.com: Direct purchasing and selling of DEP tokens; suitable for position building during identified technical levels; enables immediate execution of trading signals

- Limit Orders Strategy: Place orders at predetermined support/resistance levels rather than market orders to minimize slippage impact; particularly important given DEP's thin liquidity profile

- Dollar-Cost Averaging Programs: Establish recurring purchases on monthly intervals to systematically build positions while reducing exposure to short-term volatility spikes

Cryptocurrency investment carries extreme risk, and this report does not constitute investment advice. Investors must make decisions based on their individual risk tolerance and financial circumstances. Professional financial consultation is strongly recommended. Never invest capital you cannot afford to lose completely.

FAQ

What is a dep coin?

DEP (Deapcoin) is a cryptocurrency integrated into the PlayMining platform, enabling users to earn rewards through mining activities. It's designed for gaming and play-to-earn ecosystems, supported by Tangem Wallet integration.

What factors affect DEP token price?

DEP token price is influenced by cryptocurrency market trends, project development progress, investor sentiment, and supply-demand dynamics. Trading volume and token utility also significantly impact price movements.

What is the price prediction for DEP in 2025?

Based on current market analysis, DEP is predicted to reach approximately $0.003292 in 2025. This forecast reflects potential growth driven by ecosystem development and increased adoption within the platform.

Is DEP a good investment for long-term holders?

DEP has demonstrated strong upside potential for long-term holders. Despite market volatility, historical performance shows significant gains for investors with extended holding periods. DEP's utility and ecosystem growth support bullish long-term prospects.

What is the current market cap and trading volume of DEP?

DEP's current market cap is 34.54 million USD, with a 24-hour trading volume of 173.6 million USD.

2025 RON Price Prediction: Analyzing Growth Potential in the Play-to-Earn Gaming Ecosystem

2025 IMT Price Prediction: Bullish Trends and Market Factors Driving Potential Growth

2025 MBS Price Prediction: Analyzing Market Trends and Potential Impacts on Mortgage-Backed Securities

2025 PVU Price Prediction: Analyzing Market Trends and Growth Potential for Plant vs Undead Token

What is the PIXEL price prediction for 2030 based on current market trends?

2025 ZENT Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Understanding Altcoin Season: Timing, Trends, and Impact

Ethereum Shanghai Upgrade: How to Manage Staking Withdrawals Safely

Exploring the Advantages and Features of Core DAO's Blockchain Platform

Exploring HOLD Token: Future Prospects and Web3 Insights

Simplify Web3 Wallet Connections with WalletConnect