2025 CTSI Price Prediction: Expert Analysis and Market Forecast for Cartesi Token's Performance in the Coming Year

Introduction: CTSI's Market Position and Investment Value

Cartesi (CTSI) is a Layer 2 infrastructure solution designed to enable complex and computationally intensive operations to run in a Linux environment outside the blockchain without compromising decentralization or security. Since its inception in 2021, Cartesi has established itself as a pioneering platform that bridges the gap between traditional software development and blockchain technology. As of December 2025, CTSI has achieved a market capitalization of approximately $28.94 million, with a circulating supply of approximately 890.89 million tokens, trading at around $0.0325 per token. This innovative infrastructure, recognized for its "off-chain computation with on-chain security" paradigm, is playing an increasingly vital role in enabling developers to build high-performance, user-friendly, and economically sustainable decentralized applications.

This article will conduct a comprehensive analysis of CTSI's price trajectory from 2025 through 2030, integrating historical performance patterns, market supply and demand dynamics, ecosystem development prospects, and macroeconomic factors to provide investors with professional price forecasts and practical investment strategies.

Cartesi (CTSI) Market Analysis Report

I. CTSI Price History Review and Current Market Status

CTSI Historical Price Evolution Trajectory

- May 2021: Project reached its all-time high (ATH) of $1.74, marking peak market enthusiasm during the broader cryptocurrency bull market.

- October 2025: Price declined to its all-time low (ATL) of $0.02606722, reflecting significant bearish pressure in the market.

- 2025 Year-to-Date Performance: CTSI has experienced substantial depreciation, declining approximately 80.38% over the past year.

CTSI Current Market Status

As of December 19, 2025, CTSI is trading at $0.03249, with a 24-hour trading volume of $38,481.19. The token demonstrates recent price weakness, declining 0.85% over the past 24 hours and 14.41% over the past 7 days. The 30-day performance shows a 20.05% decline, while the year-to-date performance reflects an 80.38% depreciation from higher valuation levels.

Current market metrics indicate:

- Market Capitalization: $28,944,864.43

- Fully Diluted Valuation: $32,490,000

- Circulating Supply: 890,885,331.79 CTSI out of 1,000,000,000 total supply (89.09% circulation ratio)

- Market Dominance: 0.0010%

- 24-Hour Price Range: $0.02974 (low) to $0.03297 (high)

- Total Holders: 20,438

- Listed on: 30 exchanges

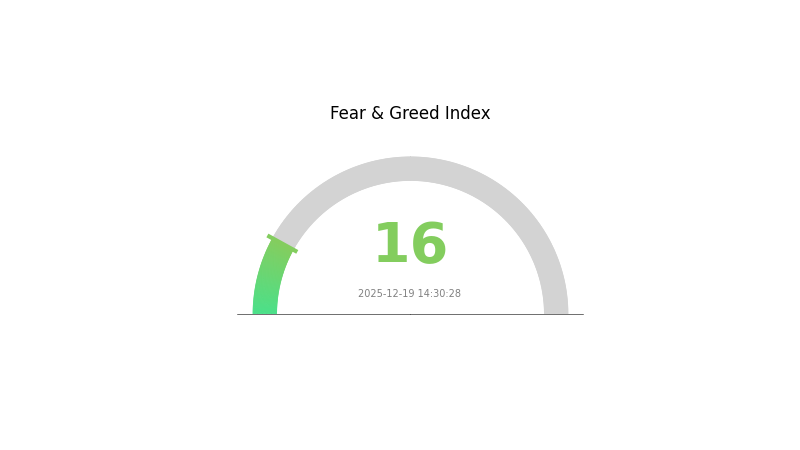

Market sentiment reflects extreme fear with a VIX reading of 16, indicating heightened risk aversion in the broader market environment.

Click to view current CTSI market price

Crypto Market Sentiment Indicator

2025-12-19 Fear and Greed Index: 16 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is experiencing extreme fear with an index reading of 16. This exceptionally low sentiment indicator suggests investors are highly pessimistic about market conditions. Extreme fear periods often present contrarian opportunities, as such heightened panic can lead to oversold conditions. However, cautious risk management remains essential. Experienced traders may consider this a potential accumulation phase, while conservative investors should wait for stabilization signals before increasing exposure. Monitor market developments closely and trade according to your risk tolerance.

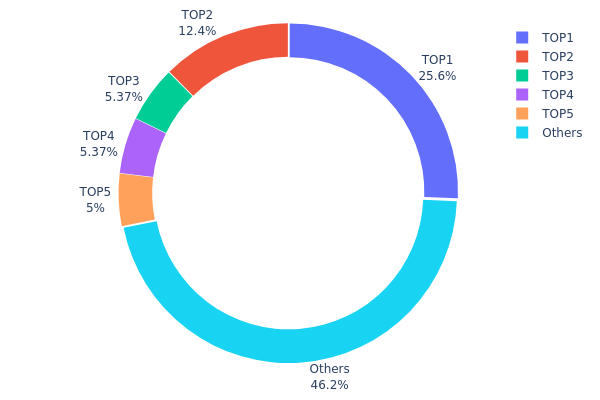

CTSI Holdings Distribution

The address holdings distribution chart illustrates the concentration of CTSI tokens across wallet addresses on the blockchain, serving as a key metric for assessing token decentralization and market structure. By analyzing the top holders and their respective percentages of total supply, this data reveals the degree of wealth concentration and potential systemic risks associated with token ownership dynamics.

Current analysis of CTSI's holdings distribution reveals moderate concentration characteristics. The top five addresses collectively control approximately 53.74% of the token supply, with the largest holder (0x9ede...764a69) commanding 25.61% of total circulation. The second-largest address (0xf977...41acec) holds 12.41%, while the third and fourth addresses each maintain 5.36% stakes. This distribution pattern indicates a degree of concentration, though not to levels typically considered severely problematic. The remaining 46.26% of tokens dispersed across other addresses suggests a reasonably fragmented holder base that mitigates excessive centralization risks.

The current address distribution presents mixed implications for market dynamics and structural stability. While the top holder's significant 25.61% position could theoretically influence price movements through large transactions, the presence of a substantial distributed holder base (46.26%) provides a stabilizing counterbalance. This configuration suggests moderate decentralization levels, wherein coordinated manipulation becomes less feasible due to the need for consensus among multiple stakeholders. However, the cumulative 53.74% concentration among top five addresses warrants continued monitoring, as concentrated holdings can amplify volatility during periods of uncertainty or significant market movements, particularly if major holders execute large sell-offs or strategic positioning adjustments.

Click to view current CTSI Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x9ede...764a69 | 256102.32K | 25.61% |

| 2 | 0xf977...41acec | 124169.92K | 12.41% |

| 3 | 0x17fe...a0e9dd | 53684.57K | 5.36% |

| 4 | 0xc4ce...e8971e | 53684.57K | 5.36% |

| 5 | 0xc783...eee11a | 50000.00K | 5.00% |

| - | Others | 462358.62K | 46.26% |

II. Core Factors Influencing CTSI's Future Price

Market Supply and Demand Dynamics

-

Market Supply-Demand Relationship: The primary factor determining CTSI's price is the market supply and demand dynamics among cryptocurrency enthusiasts and investors. As market participants adjust their positions based on perceived value and market sentiment, price movements reflect these collective trading decisions.

-

Current Market Impact: CTSI's price trajectory is significantly influenced by broader cryptocurrency market fluctuations and investor confidence levels. The token's valuation remains sensitive to overall market conditions and sentiment shifts within the crypto ecosystem.

Technology Development and Ecosystem Building

-

Development Tools Potential: CTSI possesses considerable potential through its development tools and infrastructure offerings. The platform's capabilities to support developer communities and blockchain applications create utility-driven demand for the token.

-

Technology Innovation: CTSI's future price is fundamentally determined by technological innovation and the practical demand for its solutions. As the platform evolves and expands its technical capabilities, user adoption and token utility are expected to increase accordingly.

Market Confidence and Risk Management

-

Investor Sentiment: Market confidence and investor conviction in CTSI's long-term viability play crucial roles in price determination. Positive developments in the project roadmap and ecosystem expansion can enhance investor sentiment and support price appreciation.

-

Market Adjustment Caution: Investors should remain vigilant regarding potential market adjustments. Broader cryptocurrency market corrections and volatility can negatively impact CTSI's price performance, regardless of fundamental developments.

III. CTSI Price Forecast for 2025-2030

2025 Outlook

- Conservative Estimate: $0.03022

- Neutral Estimate: $0.03249

- Bullish Estimate: $0.04419

2026-2027 Medium-term Outlook

- Market Phase Expectation: Recovery and consolidation phase with gradual upward momentum

- Price Range Forecast:

- 2026: $0.02070 - $0.05559

- 2027: $0.02818 - $0.04884

- Key Catalysts: Ecosystem expansion, protocol upgrades, increasing institutional adoption, and enhanced market liquidity through platforms like Gate.com

2028-2030 Long-term Outlook

- Base Case Scenario: $0.02587 - $0.05988 (assuming moderate adoption and steady protocol development)

- Bullish Scenario: $0.03287 - $0.05659 (contingent upon successful smart contract integrations and growing developer community engagement)

- Transformational Scenario: $0.02928 - $0.06463 (predicated on breakthrough technological innovations and mainstream enterprise adoption)

Key Observations: The forecast data suggests CTSI demonstrating resilience with a projected cumulative appreciation of 70% through 2030, reflecting potential value accumulation across the mid-to-long term horizon. Average price trajectory indicates sustained growth momentum, with volatility expected to stabilize as market maturation progresses.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.04419 | 0.03249 | 0.03022 | 0 |

| 2026 | 0.05559 | 0.03834 | 0.0207 | 18 |

| 2027 | 0.04884 | 0.04696 | 0.02818 | 44 |

| 2028 | 0.05988 | 0.0479 | 0.02587 | 47 |

| 2029 | 0.05659 | 0.05389 | 0.03287 | 65 |

| 2030 | 0.06463 | 0.05524 | 0.02928 | 70 |

Cartesi (CTSI) Professional Investment Strategy and Risk Management Report

IV. CTSI Professional Investment Strategy and Risk Management

CTSI Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: Developers and technology-focused investors who believe in the long-term potential of Layer 2 infrastructure and off-chain computation

- Operational Recommendations:

- Accumulate CTSI during market downturns, particularly when prices deviate significantly below the historical average

- Maintain a 2-3 year holding horizon to allow the Cartesi ecosystem to mature and demonstrate technical adoption

- Reinvest staking rewards to compound returns over time through the Proof-of-Stake mechanism

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Identify trading opportunities between $0.02974 (24-hour low) and $0.03297 (24-hour high) to establish entry and exit points

- Moving Averages: Monitor the significant downtrend indicated by the 7-day decline of -14.41% and 30-day decline of -20.05% to identify potential reversal patterns

- Wave Trading Key Points:

- Execute buy positions during major support level breaks with volume confirmation

- Establish profit-taking targets at identified resistance levels to secure gains during volatile periods

CTSI Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of total portfolio

- Active Investors: 2-5% of total portfolio

- Professional Investors: 5-10% of total portfolio

(2) Risk Hedging Solutions

- Position Sizing: Limit individual position sizes to no more than 5% of total trading capital to mitigate single-asset concentration risk

- Diversification Strategy: Combine CTSI holdings with established Layer 1 assets to reduce exposure to second-layer infrastructure volatility

(3) Secure Storage Solutions

- Hot Wallet Option: Gate.com Web3 Wallet for active trading and frequent transactions with enhanced security protocols

- Cold Storage Approach: Transfer long-term holdings to offline storage solutions to minimize exposure to exchange risks and hacking vulnerabilities

- Security Precautions: Enable two-factor authentication on all exchange accounts, use strong unique passwords, never share private keys or seed phrases, and regularly audit wallet addresses for suspicious activity

V. CTSI Potential Risks and Challenges

CTSI Market Risk

- Severe Long-term Depreciation: The token has experienced an 80.38% decline over the past year, indicating sustained market pessimism regarding the project's commercial viability

- Low Trading Volume: Daily volume of $38,481 represents insufficient liquidity, potentially causing significant price slippage during large trades

- Market Dominance Concerns: With only 0.001% market share and a relatively modest market capitalization of $32.49 million, CTSI faces intense competition from larger Layer 2 solutions

CTSI Regulatory Risk

- Evolving Regulatory Environment: Changes in global cryptocurrency regulations could impact the legal status and operational framework of decentralized applications built on Cartesi

- Compliance Uncertainty: Regulatory bodies may impose new requirements for off-chain computation services that could necessitate substantial protocol modifications

- Jurisdictional Challenges: Different regulatory approaches across regions may create operational complexities for Cartesi ecosystem participants

CTSI Technology Risk

- Adoption Risk: The ecosystem relies on developer adoption and dApp deployment; insufficient market interest could undermine the platform's value proposition

- Scalability Limitations: While designed for off-chain computation, Cartesi must continuously compete with alternative Layer 2 solutions that may offer superior performance metrics

- Smart Contract Vulnerabilities: Any critical security flaws discovered in the Cartesi infrastructure could result in significant financial losses and loss of user confidence

VI. Conclusion and Action Recommendations

CTSI Investment Value Assessment

Cartesi presents a technically innovative approach to Layer 2 infrastructure by enabling complex Linux-based computations off-chain while maintaining decentralization and security. However, the project faces significant headwinds: the token has suffered substantial long-term depreciation (-80.38% annually), maintains minimal market liquidity, and operates in an increasingly competitive Layer 2 ecosystem. The current price of $0.03249 reflects market skepticism regarding near-term commercial adoption. Success depends critically on achieving meaningful developer adoption and dApp deployment on the platform. Investors should recognize this as a speculative, early-stage infrastructure play suitable only for those with high risk tolerance.

CTSI Investment Recommendations

✅ Beginners: Start with micro-position sizing (0.5-1% of portfolio) if interested in Layer 2 infrastructure exposure, using Gate.com for secure trading and holding through the platform's custody features during the learning phase

✅ Experienced Investors: Consider strategic accumulation during significant price declines below $0.03, implementing disciplined profit-taking at identified resistance levels, and maintaining strict position size limits relative to overall portfolio value

✅ Institutional Investors: Evaluate Cartesi as a complementary Layer 2 infrastructure component only after conducting comprehensive technical audits and ecosystem analysis; maintain exposure below 3% of allocation to speculative technology assets

CTSI Trading Participation Methods

- Direct Purchase on Gate.com: Utilize the platform's spot trading functionality to acquire CTSI with immediate settlement and direct wallet control

- Dollar-Cost Averaging: Execute fixed-amount purchases at regular intervals to reduce timing risk and average entry prices over extended periods

- Staking Participation: Engage with the Proof-of-Stake mechanism where available to generate additional yield while maintaining long-term conviction in the project

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions based on their personal risk tolerance and are strongly encouraged to consult professional financial advisors. Never invest funds you cannot afford to lose completely.

FAQ

What is the future price of Cartesi?

Based on market analysis, Cartesi price projections estimate S$0.07 by 2035, S$0.09 by 2040, and potentially S$0.14 thereafter. Long-term growth depends on network adoption and ecosystem development.

What is CTSI crypto?

CTSI is the native cryptocurrency of the Cartesi network, a Proof of Stake blockchain platform. It powers network security, enables transactions, and facilitates smart contract execution on the Cartesi platform ecosystem.

What are the key factors that could influence CTSI price in 2025?

CTSI price in 2025 will be influenced by market trends, developer activity, and breaking key resistance levels. Ongoing security improvements and community support are also critical factors.

How does Cartesi compare to other Layer 2 scaling solutions in terms of adoption and price potential?

Cartesi demonstrates strong adoption momentum with increasing integration in blockchain applications. CTSI shows solid price potential, with analysts projecting values between $0.2239 and $0.2637. Its unique approach to scaling positions it competitively among Layer 2 solutions.

What is the historical price performance of CTSI and what price targets do analysts predict for the next 5 years?

CTSI has experienced price fluctuations over time. Analysts predict the token may reach approximately $0.041419 within the next 5 years based on consensus forecasts and market analysis.

2025 APT Price Prediction: Key Factors That Could Drive Aptos Token to New Heights

2025 KAS Price Prediction: Analyzing Key Factors Driving the Future Value of Kaspa

2025 MOVE Price Prediction: Analyzing Growth Factors and Market Trends in the Evolving Cryptocurrency Landscape

2025 SAGA Price Prediction: Analyzing Market Trends and Growth Potential in the Evolving Blockchain Ecosystem

Is Kaspa (KAS) a good investment?: Analyzing the potential of this high-throughput blockchain project

FOXY vs APT: Comparing Modern Threat Detection Systems in Enterprise Security Environments

Exploring the Cheems Meme Coin: What Makes It Unique?

Dropee Question of the Day for 20 december 2025

Guide to Obtaining DeFi Loans: A Deep Dive into Crypto Decentralized Lending

Spur Protocol Daily Quiz Answer Today 20 december 2025

Profitable Bitcoin Day Trading Techniques