2025 BLOCKST Price Prediction: Expert Analysis and Market Outlook for the Upcoming Year

Introduction: BLOCKST's Market Position and Investment Value

Block (BLOCKST) serves as the core connective token of the Blockstreet ecosystem, empowering the next generation of builders driving USD1 adoption. Since its launch in November 2025, Block has established itself as a pivotal asset within a growing DeFi infrastructure network. As of December 23, 2025, BLOCKST commands a market capitalization of approximately $6.27 million with a circulating supply of 470 million tokens, currently trading at $0.013335 per token. This token, recognized as the "connective tissue of the Blockstreet ecosystem," is playing an increasingly critical role in facilitating multichain expansion and enabling holders to gain direct exposure to USD1-driven innovation across DeFi, payments, gaming, and real-world asset tokenization.

This comprehensive analysis examines BLOCKST's price trajectory through 2025-2030, integrating historical price patterns, market supply dynamics, ecosystem development milestones, and broader macroeconomic conditions to deliver professional price forecasts and actionable investment guidance for participants seeking exposure to the Blockstreet ecosystem.

BLOCKST Market Analysis Report

I. BLOCKST Price History Review and Current Market Status

BLOCKST Historical Price Evolution Trajectory

- August 30, 2025: All-time high reached at $0.2032

- November 16, 2025: All-time low established at $0.00637

- December 2025: Price consolidation phase with recent trading activity

BLOCKST Current Market Position

As of December 23, 2025, BLOCKST is trading at $0.013335, reflecting a 24-hour decline of 1.17%. The token has experienced significant volatility over its trading history, with a 47% circulating supply ratio against its 1 billion total maximum supply.

The 24-hour trading volume stands at $79,127.46, with price movement confined between $0.013068 (24-hour low) and $0.013701 (24-hour high). Over the past seven days, BLOCKST has declined 20.49%, while the 30-day performance shows a positive adjustment of 7.38%. However, the one-year metric reveals a substantial 61.67% depreciation from earlier valuation levels.

The token commands a fully diluted valuation of $13,335,000 with a current market capitalization of $6,267,450. With 15,682 token holders across 5 exchanges, BLOCKST maintains a market dominance of 0.00041%.

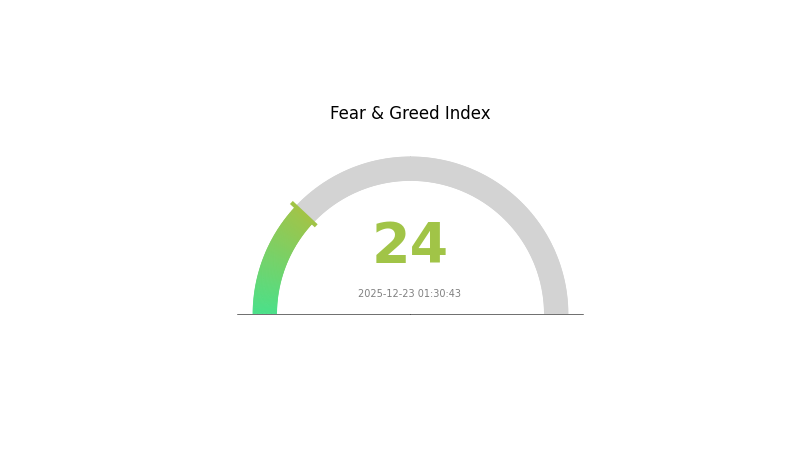

Current market sentiment indicates extreme fear conditions (VIX at 24), which typically characterizes heightened volatility and risk aversion in broader market dynamics.

View current BLOCKST market price

BLOCKST Market Sentiment Indicator

2025-12-23 Fear and Greed Index: 24 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the Fear and Greed Index at 24. This indicates significant market pessimism and investor anxiety. During such periods, volatility tends to increase as participants reassess their positions. Extreme fear often presents opportunities for contrarian investors, as assets may be oversold. However, caution is advised, as further downside pressure could persist. Monitor key support levels and macroeconomic factors closely. Consider dollar-cost averaging strategies to mitigate timing risk during high-fear environments.

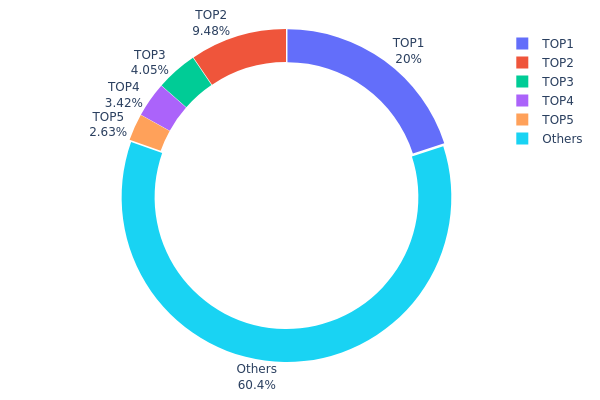

BLOCKST Holdings Distribution

The address holdings distribution map illustrates the concentration of token ownership across the blockchain network by tracking the top wallet addresses and their proportional stake in the total circulating supply. This metric serves as a critical indicator for assessing decentralization levels, market structure integrity, and potential vulnerability to coordinated price movements or market manipulation.

BLOCKST currently exhibits moderate concentration characteristics, with the top five addresses collectively controlling approximately 39.56% of the total token supply. The largest holder (0xd9ec...7718ef) maintains a dominant position at 20.00%, while the second-largest address (0x28fb...e320f9) holds 9.47%, indicating a meaningful disparity in individual wallet sizes. The subsequent three addresses hold progressively smaller allocations between 4.05% and 2.62%, reflecting a relatively gradual decline in holdings magnitude. Notably, the remaining addresses classified as "Others" collectively account for 60.44% of the supply, suggesting that while top holders maintain significant influence, ownership is sufficiently dispersed to prevent extreme centralization.

The current distribution presents a balanced market structure with respect to concentration risk. While the single largest holder's 20% stake warrants monitoring for potential flash-sell scenarios, the substantial "Others" category demonstrates that BLOCKST maintains reasonable decentralization characteristics. This distribution pattern suggests moderate resilience against coordinated manipulation attempts, though price volatility could intensify during periods of concentrated selling activity from the top tier holders. The chain-on structure reflects a nascent but maturing token ecosystem with emerging institutional or significant stakeholder participation alongside a diversified retail holder base.

Click to view current BLOCKST holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xd9ec...7718ef | 200000.00K | 20.00% |

| 2 | 0x28fb...e320f9 | 94778.88K | 9.47% |

| 3 | 0x9642...2f5d4e | 40535.68K | 4.05% |

| 4 | 0xdabc...48938e | 34219.03K | 3.42% |

| 5 | 0xd193...2ebd51 | 26298.96K | 2.62% |

| - | Others | 604167.44K | 60.44% |

Core Factors Influencing BLOCKST's Future Price

Macroeconomic Environment

-

Monetary Policy Impact: Cryptocurrency markets, including BLOCKST, are highly sensitive to global monetary policy shifts. Tightening monetary policies have historically led to broad-based declines across all cryptocurrency sectors, while potential monetary easing could provide support for asset prices. Current market dynamics suggest that macroeconomic conditions remain a primary driver of price movements for digital assets.

-

Inflation Hedge Attributes: As institutional interest in cryptocurrency continues to grow, digital assets increasingly serve as alternative stores of value in inflationary environments. The broader cryptocurrency market's adoption by institutional players and corporations indicates growing recognition of these assets' potential role in hedging strategies.

Market Demand and Trading Dynamics

-

Trading Volume and Liquidity: BLOCKST's price movements are influenced by market demand, trading volume, and overall cryptocurrency market trends. The token's availability on Gate.com Launchpool demonstrates accessible liquidity channels for participants seeking exposure to the asset.

-

Current Market Sentiment: Regulatory changes and technological advancements play significant roles in determining price trajectories. Market sentiment, shaped by both macro factors and token-specific developments, remains crucial for short-to-medium term price performance.

III. 2025-2030 BLOCKST Price Forecast

2025 Outlook

- Conservative Estimate: $0.00679

- Neutral Estimate: $0.01332

- Optimistic Estimate: $0.01945

2026-2027 Mid-term Outlook

- Market Stage Expectation: Gradual recovery and accumulation phase with steady upward momentum

- Price Range Forecast:

- 2026: $0.01229 - $0.02114

- 2027: $0.01501 - $0.02608

- Key Catalysts: Ecosystem development progress, increased adoption across decentralized platforms, and market sentiment recovery

2028-2030 Long-term Outlook

- Base Case Scenario: $0.02242 - $0.03341 (assuming stable market conditions and moderate adoption growth)

- Optimistic Scenario: $0.03294 - $0.03469 (assuming accelerated ecosystem expansion and institutional interest)

- Transformative Scenario: Up to $0.03469+ (contingent on breakthrough technological developments and mainstream market integration)

Note: Price predictions are based on historical data analysis and market trend modeling. Investors should conduct thorough due diligence before making investment decisions. Consider trading BLOCKST on Gate.com with appropriate risk management strategies.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.01945 | 0.01332 | 0.00679 | 0 |

| 2026 | 0.02114 | 0.01639 | 0.01229 | 22 |

| 2027 | 0.02608 | 0.01876 | 0.01501 | 40 |

| 2028 | 0.03341 | 0.02242 | 0.01143 | 68 |

| 2029 | 0.03294 | 0.02791 | 0.02708 | 109 |

| 2030 | 0.03469 | 0.03043 | 0.02708 | 128 |

BLOCKST Professional Investment Strategy and Risk Management Report

IV. BLOCKST Professional Investment Strategy and Risk Management

BLOCKST Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: Believers in USD1 adoption narrative and LayerZero multichain ecosystem development

- Operational Recommendations:

- Accumulate during price pullbacks, particularly when 24-hour volatility exceeds 2% downside

- Maintain position through Blockstreet Launchpad project launches to capture ecosystem gains

- Reinvest any distributed project yields back into BLOCKST holdings to compound returns

(2) Active Trading Strategy

- Technical Analysis Tools:

- 24-hour price movements: Monitor the current -1.17% trend and support levels at $0.013068

- 7-day performance tracking: Assess the -20.49% correction for potential bounce opportunities

- Wave Trading Key Points:

- Entry signals: Accumulate near 30-day moving average during oversold conditions

- Exit signals: Take partial profits during 3-5% intraday rallies from support levels

BLOCKST Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of total portfolio allocation

- Active Investors: 3-5% of total portfolio allocation

- Professional Investors: 5-10% of total portfolio allocation, with active rebalancing

(2) Risk Hedging Solutions

- Portfolio diversification: Balance BLOCKST position with established cryptocurrencies and stablecoins like USD1

- Dollar-cost averaging: Deploy capital in equal tranches across multiple entry points to reduce timing risk

(3) Safe Storage Solutions

- Custodial Option: Gate.com platform storage with institutional-grade security infrastructure

- Self-custody Recommendation: Transfer holdings to secure wallet solutions with multi-signature capabilities

- Security Considerations: Never share private keys; enable two-factor authentication on all exchange accounts; regularly audit wallet access logs

V. BLOCKST Potential Risks and Challenges

BLOCKST Market Risk

- Price Volatility: Experienced -61.67% decline over the past year, indicating extreme volatility susceptible to market sentiment shifts

- Liquidity Risk: Daily trading volume of approximately $79,127 creates potential slippage during large position executions

- Market Saturation: Token circulating supply represents 47% of maximum supply, with expansion potential creating future dilution pressure

BLOCKST Regulatory Risk

- Evolving USD1 Regulatory Framework: Regulatory treatment of USD1 and associated ecosystems remains uncertain across jurisdictions

- Securities Classification Uncertainty: Blockstreet Launchpad project distributions may trigger regulatory scrutiny regarding token utility classification

- Compliance Requirements: International regulatory bodies may impose restrictions on USD1-ecosystem tokens

BLOCKST Technology Risk

- LayerZero Protocol Dependency: Multichain functionality relies on third-party LayerZero infrastructure; protocol vulnerabilities could impact BLOCKST utility

- Smart Contract Vulnerabilities: ERC-20 implementation and Blockstreet ecosystem contracts may contain undiscovered security flaws

- Ecosystem Adoption Risk: USD1 adoption failure would directly undermine BLOCKST's core value proposition

VI. Conclusions and Action Recommendations

BLOCKST Investment Value Assessment

BLOCKST operates within an emerging ecosystem centered on USD1 adoption and LayerZero-enabled multichain interoperability. The token's valuation reflects early-stage project characteristics with significant volatility. The project's connection to World Liberty Financial's broader vision provides potential upside, but execution risks remain substantial. Current market conditions show correction phase dynamics (-20.49% over 7 days), suggesting accumulation opportunities for conviction-based investors, though the -61.67% year-to-date decline warrants cautious position sizing.

BLOCKST Investment Recommendations

✅ New Investors: Begin with minimal allocation (1-2%) through dollar-cost averaging on Gate.com; prioritize education on USD1 ecosystem and LayerZero technology before increasing exposure

✅ Experienced Traders: Implement swing trading strategies targeting the $0.013068-$0.013701 range; set stop-losses at 15% below entry to manage downside risk while maintaining upside exposure

✅ Institutional Investors: Evaluate position sizing based on blockchain ecosystem thesis; consider Blockstreet Launchpad project participation as complementary exposure mechanism

BLOCKST Trading Participation Methods

- Gate.com Spot Trading: Direct purchase and holding for yield-generating ecosystem participation

- Dollar-Cost Averaging Program: Automated weekly or monthly purchases through Gate.com to reduce timing risk

- Launchpad Participation: Engage with Blockstreet ecosystem projects to capture direct utility value beyond token appreciation

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions based on their individual risk tolerance and financial situation. Consult qualified financial advisors before making investment decisions. Never invest capital you cannot afford to lose completely.

FAQ

Where will Block stock be in 5 years?

Block stock is projected to reach approximately $176.66 by 2027, reflecting strong growth momentum. This forecast is based on current market trends and historical performance data, with potential for 113% appreciation from current levels.

How high will Block stock go?

Analysts predict Block stock could reach $80.06, representing a 23.06% increase from current levels. This consensus forecast is based on 31 covering analysts' average price target as of December 2025.

What factors influence Block stock price predictions?

Block price predictions are influenced by supply and demand dynamics, market sentiment, trading volume, regulatory developments, technological innovations, and macroeconomic conditions affecting the broader cryptocurrency market.

Is Block stock a good investment for the long term?

Yes. Block demonstrates strong gross profit growth and attractive valuation metrics. With solid fundamentals and improving ratios, long-term investors may find Block a worthwhile opportunity for sustained growth.

What is the current price target for Block stock among analysts?

The average price target for Block stock among analysts is $83.11, based on 37 analyst forecasts. Price targets range from $45.00 to higher levels, reflecting varied market perspectives on the stock's future performance.

Avalanche (AVAX) 2025 Price Analysis and Market Trends

SEI Staking Analysis: 60-70% Supply Locked and Its Price Impact

Latest Analysis and Investment Outlook for Chainlink Price in June 2025

FTT Explained

next crypto to hit $1 in 2025

2025 PUMP Price Prediction: Analyzing Market Trends and Growth Potential for Cryptocurrency Investors

What are the regulatory and compliance risks of Pi Network in 2025?

Ethereum Mining Profitability Guide: Hardware Requirements, ROI Calculator and 2024 Staking Rewards Comparison

# What is Exchange Net Inflow and Outflow in Cryptocurrency: Understanding Holdings and Capital Flow

Understanding Wicks in Crypto Candlestick Trading

Catcoin (CAT) là gì? Khám phá tiền mã hóa trong hệ sinh thái Web3