2025 ALT Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: Market Position and Investment Value of ALT

AltLayer (ALT) is an open and decentralized protocol designed for rollups, bringing the novel concept of Restaked Rollups to the blockchain ecosystem. Since its launch in January 2024, AltLayer has emerged as a significant infrastructure solution for enhancing the security, decentralization, and interoperability of rollup-based layer-2 networks. As of December 2025, ALT maintains a market capitalization of approximately $110.9 million, with a circulating supply of 4.96 billion tokens currently trading at $0.01109. This innovative protocol is playing an increasingly critical role in the multi-rollup ecosystem by leveraging restaking mechanisms to provide crypto-economic fast finality across various rollup stacks including OP Stack, Arbitrum Orbit, Polygon CDK, and ZK Stack.

This article will provide a comprehensive analysis of ALT's price trajectory from 2025 through 2030, integrating historical patterns, market supply-demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and practical investment strategies for investors.

AltLayer (ALT) Market Analysis Report

I. ALT Price History Review and Current Market Status

ALT Historical Price Development Trajectory

AltLayer (ALT) was launched on January 25, 2024, with an initial public offering price of $0.018. The token experienced significant price appreciation in its early trading period, reaching its all-time high (ATH) of $0.6948 on March 27, 2024, representing an extraordinary gain of approximately 3,760% from the launch price within just two months.

Following this peak, ALT entered a prolonged correction phase. The token declined substantially throughout 2024 and into 2025, eventually reaching its all-time low (ATL) of $0.00831 on October 10, 2025. This represents a decline of approximately 98.8% from its historical peak, reflecting the significant market headwinds faced by the project.

ALT Current Market Status

Price and Market Capitalization:

- Current Price: $0.01109 (as of December 18, 2025)

- 24-Hour Price Change: -6.8%

- 7-Day Price Change: -12.04%

- 30-Day Price Change: -23.08%

- 1-Year Price Change: -92.65%

Market Metrics:

- Market Capitalization: $54,997,543.37

- Fully Diluted Valuation (FDV): $110,900,000

- Market Cap to FDV Ratio: 49.59%

- 24-Hour Trading Volume: $137,160.64

- Global Market Dominance: 0.0035%

- Current Market Ranking: #476

Supply Dynamics:

- Circulating Supply: 4,959,201,386 ALT (49.59% of total supply)

- Total Supply: 10,000,000,000 ALT

- Maximum Supply: 10,000,000,000 ALT

- Token Holders: 73,720

Price Range (24-Hour):

- 24-Hour High: $0.01209

- 24-Hour Low: $0.011

ALT is currently trading significantly below both its ATH and initial offering price. The token demonstrates consistent downward pressure across multiple timeframes, with the most severe losses occurring over the 1-year period. The current circulating supply represents approximately half of the total supply, indicating potential dilution pressure from token unlocks. The project maintains presence across 33 cryptocurrency exchanges and operates on both Ethereum (ETH) and Binance Smart Chain (BSC) networks.

Click to view current ALT market price

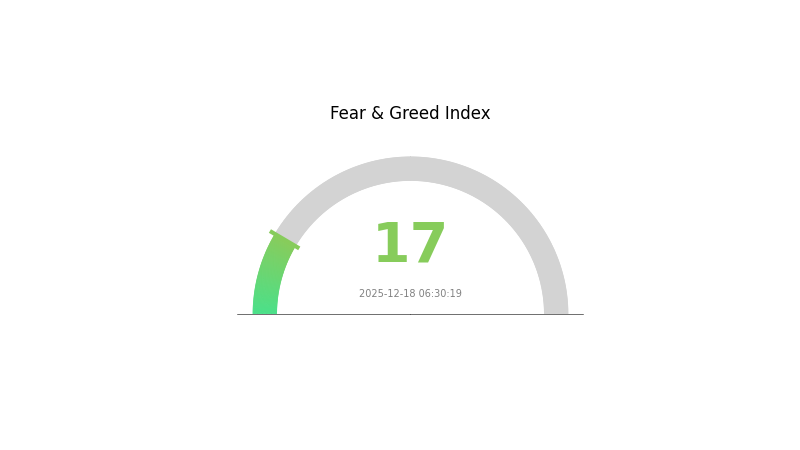

ALT Market Sentiment Index

2025-12-18 Fear and Greed Index: 17 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index standing at 17. This indicates significant pessimism and heightened risk aversion among investors. Market participants are showing considerable caution, and asset valuations have become increasingly depressed. During such periods, opportunities often emerge for contrarian investors. However, extreme fear also signals elevated volatility and potential further downside risks. Traders should exercise prudence, maintain adequate risk management strategies, and avoid panic-driven decisions. Consider this phase as a potential accumulation opportunity while remaining vigilant about market developments and broader economic indicators.

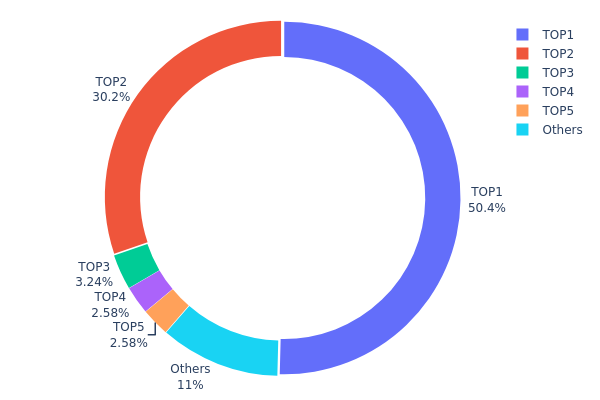

ALT Holdings Distribution

The holdings distribution map illustrates how ALT tokens are allocated across different blockchain addresses, providing critical insight into the concentration of token ownership and the overall decentralization structure of the asset. By analyzing the top holders and their respective percentages, analysts can assess the distribution pattern, identify potential concentration risks, and evaluate the market's vulnerability to price manipulation or sudden liquidity events.

The current distribution of ALT exhibits a notably concentrated structure, with the top two addresses commanding 80.61% of total supply. The largest holder (0x12a6...97b1c0) maintains a dominant position with 50.40% of all tokens, while the second-largest holder (0xabf2...f840b0) controls an additional 30.21%. This duopoly represents a significant concentration that deviates substantially from a decentralized distribution model. The third through fifth positions hold relatively modest shares ranging from 2.57% to 3.23%, while the remaining addresses collectively account for just 11.02% of the supply. Such a distribution pattern suggests that decision-making power and price action are concentrated in a limited number of stakeholders.

This extreme concentration poses considerable implications for market dynamics and structural stability. The high degree of token centralization creates potential vulnerability to price volatility, as large holders possess the capacity to execute substantial transactions that could significantly impact market pricing and liquidity conditions. The imbalanced distribution raises questions regarding decentralization principles and suggests that ALT's on-chain governance and market structure remain heavily dependent on a small group of major stakeholders, potentially constraining organic price discovery and limiting the token's resilience to destabilizing events.

Click to view current ALT Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x12a6...97b1c0 | 5040798.61K | 50.40% |

| 2 | 0xabf2...f840b0 | 3021581.50K | 30.21% |

| 3 | 0xf721...72def7 | 323782.27K | 3.23% |

| 4 | 0xf977...41acec | 257646.13K | 2.57% |

| 5 | 0xb6d1...35890b | 257559.38K | 2.57% |

| - | Others | 1098632.11K | 11.02% |

II. Core Factors Influencing ALT's Future Price

Supply Mechanism

-

Total Supply: ALT has a total supply of 10 billion tokens, with an initial circulating supply of approximately 1.1 billion ALT (11% of total supply). This large supply base directly impacts price formation and market value.

-

Token Distribution: The allocation structure significantly influences market dynamics. Investors received 18.5% of tokens, team and advisors 20%, protocol development 20%, treasury and ecosystem/community 21.5% and 15% respectively. This distribution reflects the project's long-term vision and commitment to ecosystem development.

-

Unlocking Pressure: Beginning in July 2024, ALT experienced large-scale token unlocking events that may create supply pressure on the market, potentially affecting price stability.

Institutional and Major Holder Dynamics

-

Institutional Holdings: ALT's address distribution is extremely concentrated. The top address holds 52.81% of tokens, the second-largest holds 27.99%, with the top two collectively controlling over 80% of ALT. The top five addresses combined hold 89.76%, while the remaining circulation represents only 10.24%. This extreme concentration presents significant centralization risks.

-

Strategic Investors: AltLayer has secured backing from prominent investment institutions including Polychain Capital, Jump Crypto, Breyer Capital, and Binance Labs through two funding rounds totaling over $22.8 million. These investors bring valuable resources, industry connections, and credibility to the project.

-

Strategic Partnerships: AltLayer has established collaboration agreements with major players including Arbitrum, Orbiter Finance, Celestia, and EigenLayer, facilitating deeper ecosystem integration and expanding network effects.

Macroeconomic Environment

-

Market Volatility Impact: ALT demonstrates significant short-term price volatility. Over a one-week period, ALT declined 16.07%, with a 30-day cumulative decline of 23.41%, and year-to-date losses reaching 86.79%. This volatility reflects broader cryptocurrency market uncertainty and investor sentiment fluctuations.

-

Inflation Hedge Properties: As a protocol token linked to blockchain scalability infrastructure, ALT's long-term value proposition depends on widespread adoption of Rollup-as-a-Service solutions and increasing demand for Layer 2 scaling, which could provide resilience during inflationary periods through technological value creation.

Technology Development and Ecosystem Construction

-

Restaked Rollup Technology: AltLayer's core innovation uses active validator sets (AVS) to enhance network security. This technology enables flexible, secure scaling solutions by allowing validators to provide cross-chain validation services while maintaining economic security through restaking mechanisms.

-

Rollup-as-a-Service (RaaS) Platform: Developers can deploy customized Rollups through a no-code platform supporting both EVM and WASM virtual machines, with options for temporary (Flash Layer) or persistent Rollup modes. This accessibility accelerates dApp deployment and reduces technical barriers to entry.

-

Multi-Chain Compatibility: AltLayer supports mainstream Rollup frameworks including OP Stack and Arbitrum Orbit, with deep integration into Ethereum and Celestia. This multi-chain design enhances interoperability and positions ALT as a universal scaling solution across multiple blockchain ecosystems.

-

Core Products: AltLayer's product suite includes Restaked Rollup, VITAL, MACH, and SQUAD, each designed to enhance network scalability and security. These solutions address specific blockchain pain points while leveraging restaking and active validation mechanisms.

III. 2025-2030 ALT Price Forecast

2025 Outlook

- Conservative Forecast: $0.00643 - $0.01275

- Base Case Forecast: $0.01109

- Bullish Forecast: $0.01275 (pending positive market sentiment and adoption acceleration)

2026-2028 Mid-term Perspective

- Market Phase Expectation: Gradual recovery and accumulation phase with steady adoption growth

- Price Range Forecasts:

- 2026: $0.0093 - $0.01395 (7% upside potential)

- 2027: $0.00931 - $0.01901 (16% upside potential)

- 2028: $0.00847 - $0.01853 (44% upside potential)

- Key Catalysts: Ecosystem development maturation, institutional interest accumulation, protocol upgrades, and increased utility adoption across decentralized applications

2029-2030 Long-term Outlook

- Base Case Scenario: $0.01156 - $0.02467 by 2029 (55% growth trajectory; assumes steady market conditions and moderate adoption expansion)

- Bullish Scenario: $0.01593 - $0.02411 by 2030 (89% cumulative growth; assumes accelerated institutional adoption and breakthrough ecosystem applications)

- Transformational Scenario: Potential for further upside if protocol achieves significant technological breakthroughs, achieves mainstream adoption, or benefits from broader digital asset market expansion

Note: These forecasts are predictive in nature and subject to significant market volatility, regulatory changes, and unforeseen macroeconomic factors. Investors should conduct independent research and risk assessment before making investment decisions.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.01275 | 0.01109 | 0.00643 | 0 |

| 2026 | 0.01395 | 0.01192 | 0.0093 | 7 |

| 2027 | 0.01901 | 0.01294 | 0.00931 | 16 |

| 2028 | 0.01853 | 0.01597 | 0.00847 | 44 |

| 2029 | 0.02467 | 0.01725 | 0.01156 | 55 |

| 2030 | 0.02411 | 0.02096 | 0.01593 | 89 |

AltLayer (ALT) Professional Investment Report

I. Executive Summary

AltLayer is an open and decentralized protocol designed for rollups. It introduces the innovative concept of Restaked Rollups, which leverages restaking mechanisms to provide enhanced security, decentralization, interoperability, and crypto-economic fast finality for rollups derived from various rollup stacks including OP Stack, Arbitrum Orbit, Polygon CDK, and ZK Stack.

Key Metrics (As of December 18, 2025):

- Current Price: $0.01109

- Market Cap: $54,997,543.37

- Fully Diluted Valuation: $110,900,000

- Circulating Supply: 4,959,201,386 ALT (49.59% of total supply)

- Total Supply: 10,000,000,000 ALT

- 24H Trading Volume: $137,160.64

- Market Rank: #476

II. Token Performance Analysis

Price Dynamics

| Timeframe | Price Change | Change Amount |

|---|---|---|

| 1 Hour | -0.44% | -$0.000049 |

| 24 Hours | -6.8% | -$0.000809 |

| 7 Days | -12.04% | -$0.001518 |

| 30 Days | -23.08% | -$0.003328 |

| 1 Year | -92.65% | -$0.139794 |

Historical Price Performance

- All-Time High (ATH): $0.6948 (March 27, 2024)

- All-Time Low (ATL): $0.00831 (October 10, 2025)

- 24H High: $0.01209

- 24H Low: $0.011

- Distance from ATH: -84.04% (significant pullback from peak)

- Distance from ATL: +33.38% (recovery from recent lows)

Market Positioning

- Market Dominance: 0.0035%

- Market Cap to FDV Ratio: 49.59%

- Active Holders: 73,720

- Exchange Listings: 33 exchanges

- Token Standard: BEP20, ERC20

III. Project Fundamentals

Core Technology & Innovation

AltLayer addresses a critical infrastructure gap in the rollup ecosystem by providing:

- Enhanced Security: Leverages restaking mechanisms to strengthen security guarantees beyond individual rollup implementations

- Decentralization: Open protocol enabling multiple rollup stacks to participate

- Interoperability: Facilitates cross-rollup communication and coordination

- Fast Finality: Provides crypto-economic guarantees for rapid transaction settlement

Blockchain Integration

AltLayer is deployed across multiple blockchain networks:

- Ethereum (ETH): Contract: 0x8457CA5040ad67fdebbCC8EdCE889A335Bc0fbFB

- Binance Smart Chain (BSC): Contract: 0x8457CA5040ad67fdebbCC8EdCE889A335Bc0fbFB

IV. ALT Professional Investment Strategy and Risk Management

ALT Investment Methodology

(1) Long-Term Holding Strategy

- Target Investors: Infrastructure-focused investors with high risk tolerance, believing in Layer 2 scaling solutions and restaking mechanisms

- Operational Recommendations:

- Dollar-cost averaging (DCA) during periods of high volatility to reduce entry point risk

- Accumulating during significant market pullbacks to maximize long-term returns

- Holding through ecosystem development cycles and protocol upgrades

(2) Active Trading Strategy

-

Key Trading Considerations:

- Monitor 24-hour and 7-day price trends for momentum indicators

- Track volume patterns relative to the 30-day average ($137,160.64)

- Observe recovery trends from recent ATL ($0.00831) as resistance/support levels

-

Price Action Key Levels:

- Support: Recent ATL at $0.00831

- Resistance: $0.01209 (24H high)

- Psychological Level: $0.018 (launch price reference)

ALT Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 0.5-2% of portfolio allocation maximum

- Aggressive Investors: 2-5% of portfolio allocation

- Professional Investors: Position sizing based on volatility metrics and portfolio correlation analysis

(2) Risk Hedging Approaches

- Volatility Hedge: Maintain stable coins as reserves to capitalize on price corrections

- Diversification Strategy: Combine ALT holdings with other Layer 2 and infrastructure tokens to reduce concentration risk

(3) Secure Storage Solutions

- Hot Wallet: Gate.com Web3 Wallet for active trading and frequent transactions

- Cold Storage: Hardware wallet solutions for long-term holdings exceeding 3-6 months

- Security Precautions:

- Enable two-factor authentication (2FA) on all trading accounts

- Never share private keys or seed phrases

- Use hardware wallets for holdings exceeding your comfortable daily transaction value

- Regularly update wallet software to latest security versions

V. ALT Potential Risks and Challenges

ALT Market Risks

- High Volatility: ALT has experienced -92.65% decline over 12 months, indicating extreme price volatility and limited historical stability

- Low Trading Liquidity: 24-hour volume of $137,160.64 is relatively modest, potentially causing slippage on large orders

- Market Sentiment: Current negative 24H (-6.8%), 7D (-12.04%), and 30D (-23.08%) trends suggest bearish market conditions

ALT Regulatory Risks

- DeFi Regulation Uncertainty: Rollup protocols and restaking mechanisms face evolving regulatory frameworks globally

- Protocol Classification: Regulatory treatment of infrastructure tokens remains ambiguous in many jurisdictions

- Compliance Changes: Potential shifts in securities law interpretation could affect token utility and trading status

ALT Technical Risks

- Restaking Mechanism Complexity: Novel restaking infrastructure introduces unproven economic models and potential smart contract vulnerabilities

- Smart Contract Risk: Protocol integration across multiple rollup stacks increases attack surface area and bug potential

- Ecosystem Dependency: Success relies on adoption by OP Stack, Arbitrum, Polygon, and other major rollup ecosystems

VI. Conclusion and Action Recommendations

ALT Investment Value Assessment

AltLayer presents a technically innovative solution addressing a genuine infrastructure need in the Layer 2 ecosystem. The protocol's focus on enhanced security and fast finality through restaking represents a valuable advancement. However, the token has experienced severe depreciation (-92.65% YoY) from its ATH, and current market conditions remain bearish. The project's success depends heavily on ecosystem adoption and the viability of the restaking mechanism, which remains relatively untested at scale. Investors should view ALT as a high-risk, speculative position rather than a core holding.

ALT Investment Recommendations

✅ Beginners: Start with minimal positions (0.5% portfolio allocation) using dollar-cost averaging strategy. Prioritize learning about restaking mechanisms and rollup infrastructure before significant capital allocation.

✅ Experienced Investors: Consider tactical accumulation during key support levels (around $0.00831-$0.011 range) with strict stop-loss orders. Monitor ecosystem partnership announcements as potential catalysts.

✅ Institutional Investors: Conduct thorough due diligence on protocol security audits, team credentials, and adoption metrics. Position sizing should reflect protocol maturity and smart contract risk assessment.

ALT Trading Participation Methods

- Spot Trading: Direct purchase of ALT tokens on Gate.com and 32 other supported exchanges for long-term holding or short-term trading

- Staking/Protocol Participation: Engage with restaking mechanisms once available to potentially generate additional yield (monitor protocol documentation for details)

- Portfolio Diversification: Combine ALT holdings with established Layer 2 tokens to manage concentrated risk exposure

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must carefully consider their risk tolerance and financial situation before making investment decisions. Consulting with professional financial advisors is strongly recommended. Never invest more capital than you can afford to lose completely.

FAQ

What crypto will 1000x prediction?

DeepSnitch AI (DSNT) is a strong candidate for 1000x returns. Currently priced at $0.02846, it only needs to reach $28.46 to achieve those gains. As an early-stage altcoin with live utility, DSNT shows significant growth potential in the current market cycle.

Are alt coins a good investment?

Altcoins offer significant growth potential with emerging technologies and use cases. Many show strong fundamentals and trading volumes. Success depends on selecting quality projects and strategic timing in this dynamic market.

How high can AltLayer go?

AltLayer's price potential depends on market adoption and ecosystem growth. With strong fundamentals and increasing trading volume, ALT could reach $0.05-$0.10 in the medium term, though higher levels remain possible with broader market expansion.

Does API3 have a future?

Yes, API3 has strong long-term potential. Its innovative first-party oracle model addresses real industry needs, and with increasing blockchain adoption, API3 is well-positioned for sustained growth and relevance in the Web3 ecosystem.

ATS vs LRC: Comparing Automated Tracking Systems and Learning Resource Centers in Modern Education

DEEP vs OP: Unveiling the Power of Neural Networks in Competitive Gaming

Is Netswap (NETT) a good investment?: Analyzing the Potential and Risks of this DeFi Token

ONX vs LRC: Comparing Two Promising Blockchain Projects in the DeFi Space

Is Netswap (NETT) a good investment?: Analyzing the potential and risks of this decentralized exchange token

2025 DYDX Price Prediction: Analyzing Market Trends and Potential Growth Factors for the DeFi Token

Guide to Starting Your Journey as an NFT Creator

Top Anticipated NFT Launches for 2024

Top Exciting NFT Projects to Watch in the Coming Months

Guide to Integrating Polygon Network with Your Crypto Wallet

Mastering the Art of NFTs: A Beginner's Guide