Post content & earn content mining yield

placeholder

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

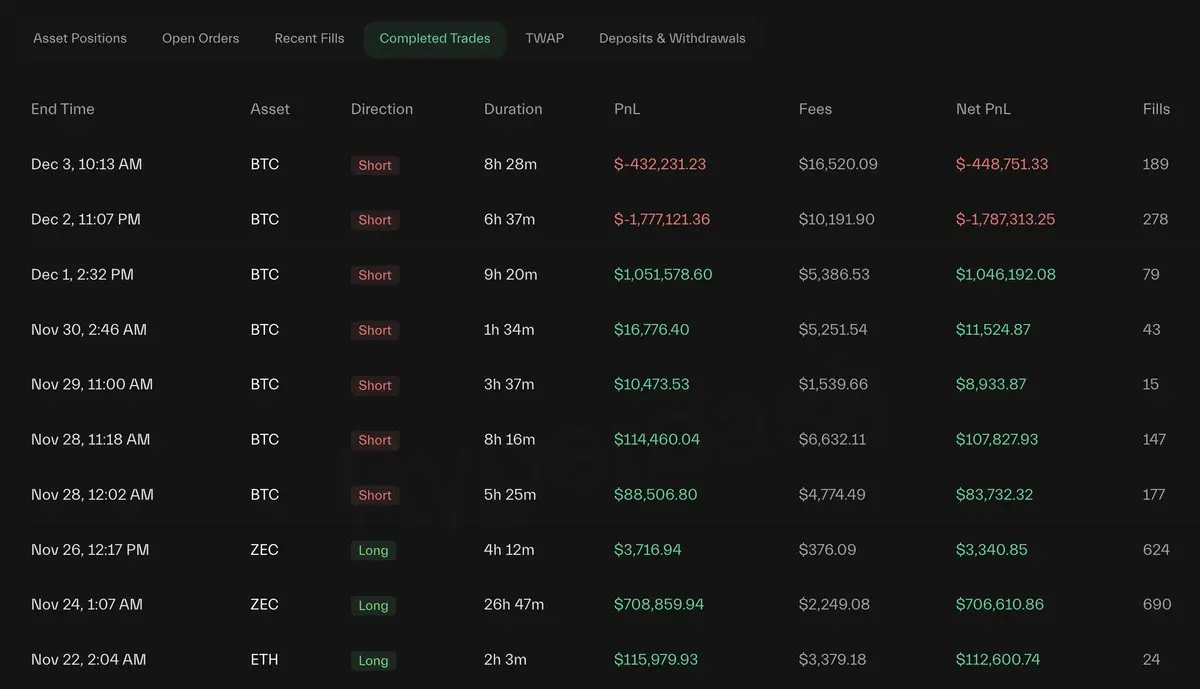

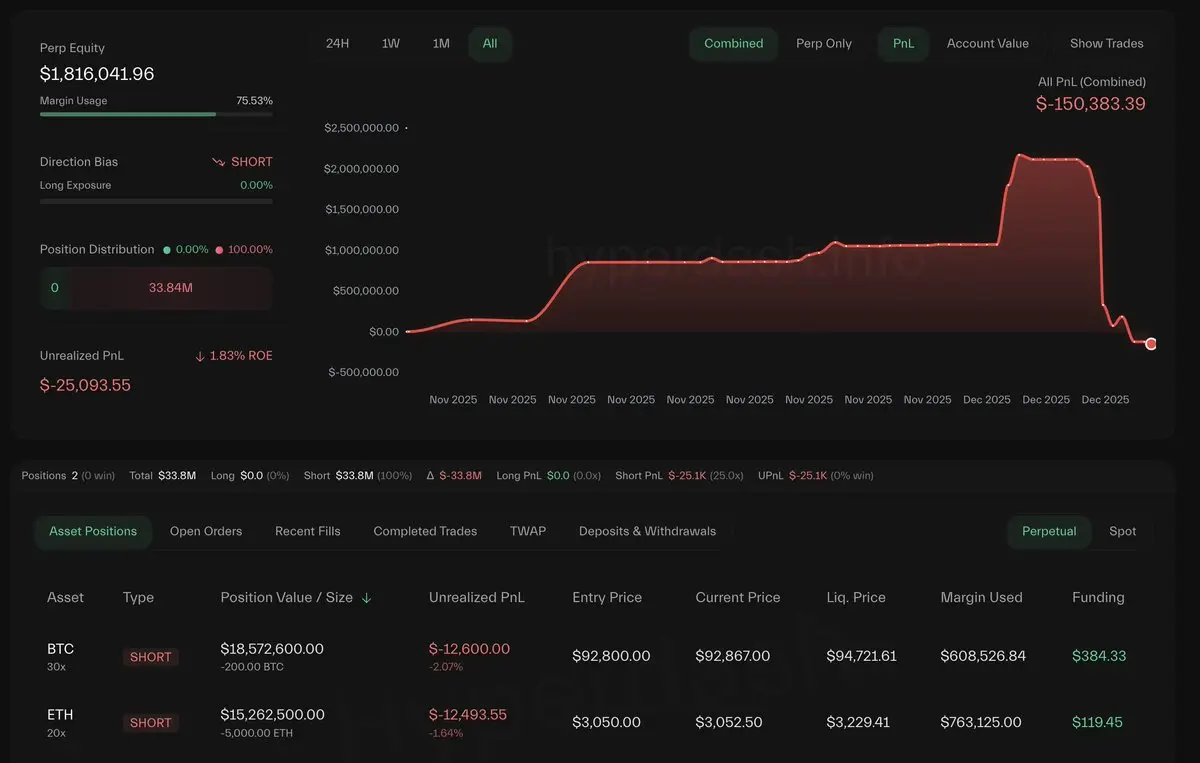

The 9-win streak trader 0xFC78 has now lost his last two trades — wiping out all $1.78M+ in profits and even dipping $117K into his principal.

He now seems to be revenge trading, opening a 30x short on 200 $BTC($18.75M) and a 20x short on 5,000 $ETH($15.26M).

Liquidation prices:

• BTC: $94,721.61

• ETH: $3,229.41

He now seems to be revenge trading, opening a 30x short on 200 $BTC($18.75M) and a 20x short on 5,000 $ETH($15.26M).

Liquidation prices:

• BTC: $94,721.61

• ETH: $3,229.41

- Reward

- like

- Comment

- Repost

- Share

🚀 Gate Alpha $GT Points Airdrop is Going Live!

Claim your free GT based on your Alpha Points tier — first come, first served!

🔹 Tier 1

130–172 Points

➡️ 11 points per claim

➡️ Reward: 0.58 GT

🔹 Tier 2

173+ Points

➡️ 14 points per claim

➡️ Reward: 2.2 GT

🗓 Claim Time: Dec 05, 18:00 – 23:59 (UTC+8)

📲 Make sure your app is updated to v7.20.0+ (Web version works too)

🔗 Details: https://www.gate.com/announcements/article/48533

Claim your free GT based on your Alpha Points tier — first come, first served!

🔹 Tier 1

130–172 Points

➡️ 11 points per claim

➡️ Reward: 0.58 GT

🔹 Tier 2

173+ Points

➡️ 14 points per claim

➡️ Reward: 2.2 GT

🗓 Claim Time: Dec 05, 18:00 – 23:59 (UTC+8)

📲 Make sure your app is updated to v7.20.0+ (Web version works too)

🔗 Details: https://www.gate.com/announcements/article/48533

GT-1.35%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Bitcoin’s Latest Drop Isn’t Just Another Correction, But A Clear Capitulation Event - Here’s Why | Bitcoinist.com

Trusted Editorial content, reviewed by leading industry experts and seasoned editors. Ad Disclosure

After a brief moment of bullish performance in Bitcoin, the price experienced a sudden pullback due to a broader market shakedown, which caused BTC to revisit the $90,000 threshold. While this pullb

After a brief moment of bullish performance in Bitcoin, the price experienced a sudden pullback due to a broader market shakedown, which caused BTC to revisit the $90,000 threshold. While this pullb

BTC-1.77%

- Reward

- like

- Comment

- Repost

- Share

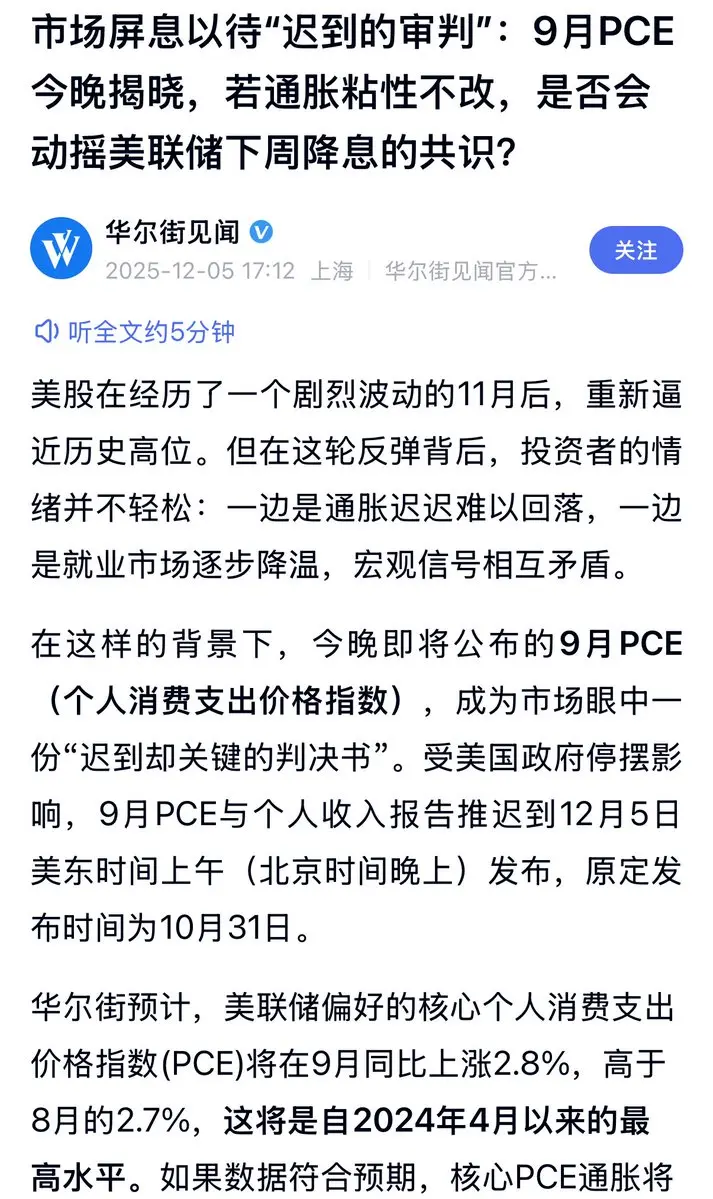

To be honest, staring at the screen waiting for this “delayed” inflation report has me feeling pretty anxious. The market is already like an overinflated balloon, just waiting for the Fed to pop it with a rate cut next week. But now, whether this balloon can take off nicely all depends on whether tonight’s PCE data pours cold water on things.

Frankly, I feel a bit uneasy about the current “early celebration” atmosphere. Everyone’s way too optimistic—the CME shows a nearly 90% chance of a rate cut, as if the Fed has no other choice. This kind of consensus actually feels very fragile to me—if th

Frankly, I feel a bit uneasy about the current “early celebration” atmosphere. Everyone’s way too optimistic—the CME shows a nearly 90% chance of a rate cut, as if the Fed has no other choice. This kind of consensus actually feels very fragile to me—if th

BTC-1.77%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

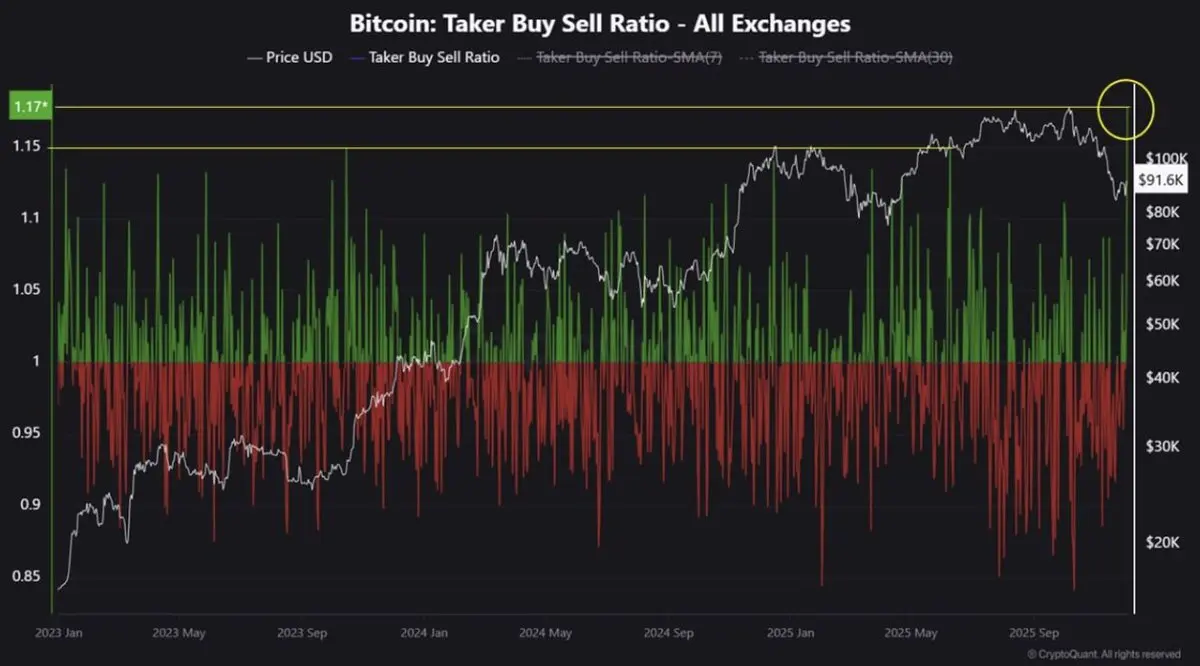

CryproQuant: the BTC buy-to-sell ratio on all exchanges rose to 1.17 yesterday, the highest since the start of the current cycle in January 2023. A value above 1 indicates a stronger initiative from buyers.

Taken together, the data indicates that the current bull cycle is unlikely close to completion. However, risks remain.

- by CoinCare

Taken together, the data indicates that the current bull cycle is unlikely close to completion. However, risks remain.

- by CoinCare

BTC-1.77%

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

- Trending TopicsView More

273.68K Popularity

69.87K Popularity

9.61K Popularity

10.58K Popularity

11.18K Popularity

- Hot Gate FunView More

- MC:$0.1Holders:00.00%

- MC:$3.49KHolders:10.00%

- MC:$3.57KHolders:10.79%

- MC:$3.49KHolders:10.00%

- MC:$3.52KHolders:10.00%

- Pin