# StrategyToIssueMorePerpetualPreferreds

4.33K

User_any

#StrategyToIssueMorePerpetualPreferreds

The company's CEO, Phong Le, stated that this move aims to address investors' concerns about share price volatility. "We've developed a product that will give investors access to digital capital without volatility," Le said in an interview with Bloomberg. This strategy involves focusing on preferred shares to prevent fluctuations in Bitcoin price from affecting MSTR shares. The company's perpetual preferred shares, called "Stretch," currently offer a variable dividend rate of 11.25% and encourage trading near a nominal value of $100 with a monthly reset

The company's CEO, Phong Le, stated that this move aims to address investors' concerns about share price volatility. "We've developed a product that will give investors access to digital capital without volatility," Le said in an interview with Bloomberg. This strategy involves focusing on preferred shares to prevent fluctuations in Bitcoin price from affecting MSTR shares. The company's perpetual preferred shares, called "Stretch," currently offer a variable dividend rate of 11.25% and encourage trading near a nominal value of $100 with a monthly reset

BTC-2,79%

- Reward

- 3

- 6

- Repost

- Share

CryptoChampion :

:

2026 GOGOGO 👊View More

🚀 TAKE/USDT +68.92% — Massive Breakout Alert!

TAKE is on fire today, currently trading at $0.03294 after a huge +68% surge. Strong momentum, high volatility, and clear breakout structure — but this is where smart traders stay disciplined.

After a move like this, chasing can be dangerous. The key now is reaction at support and breakout levels.

📌 Bullish Setup (Continuation Play):

If price holds above $0.030 zone:

Entry: $0.030 – $0.0315

Targets: $0.035 / $0.038

SL: Below $0.0285

📌 Bearish Setup (Rejection Play):

If price loses $0.031 with volume:

Short target: $0.027 – $0.025

SL: Above $0.03

TAKE is on fire today, currently trading at $0.03294 after a huge +68% surge. Strong momentum, high volatility, and clear breakout structure — but this is where smart traders stay disciplined.

After a move like this, chasing can be dangerous. The key now is reaction at support and breakout levels.

📌 Bullish Setup (Continuation Play):

If price holds above $0.030 zone:

Entry: $0.030 – $0.0315

Targets: $0.035 / $0.038

SL: Below $0.0285

📌 Bearish Setup (Rejection Play):

If price loses $0.031 with volume:

Short target: $0.027 – $0.025

SL: Above $0.03

- Reward

- 1

- Comment

- Repost

- Share

💼📈 #StrategyToIssueMorePerpetualPreferreds

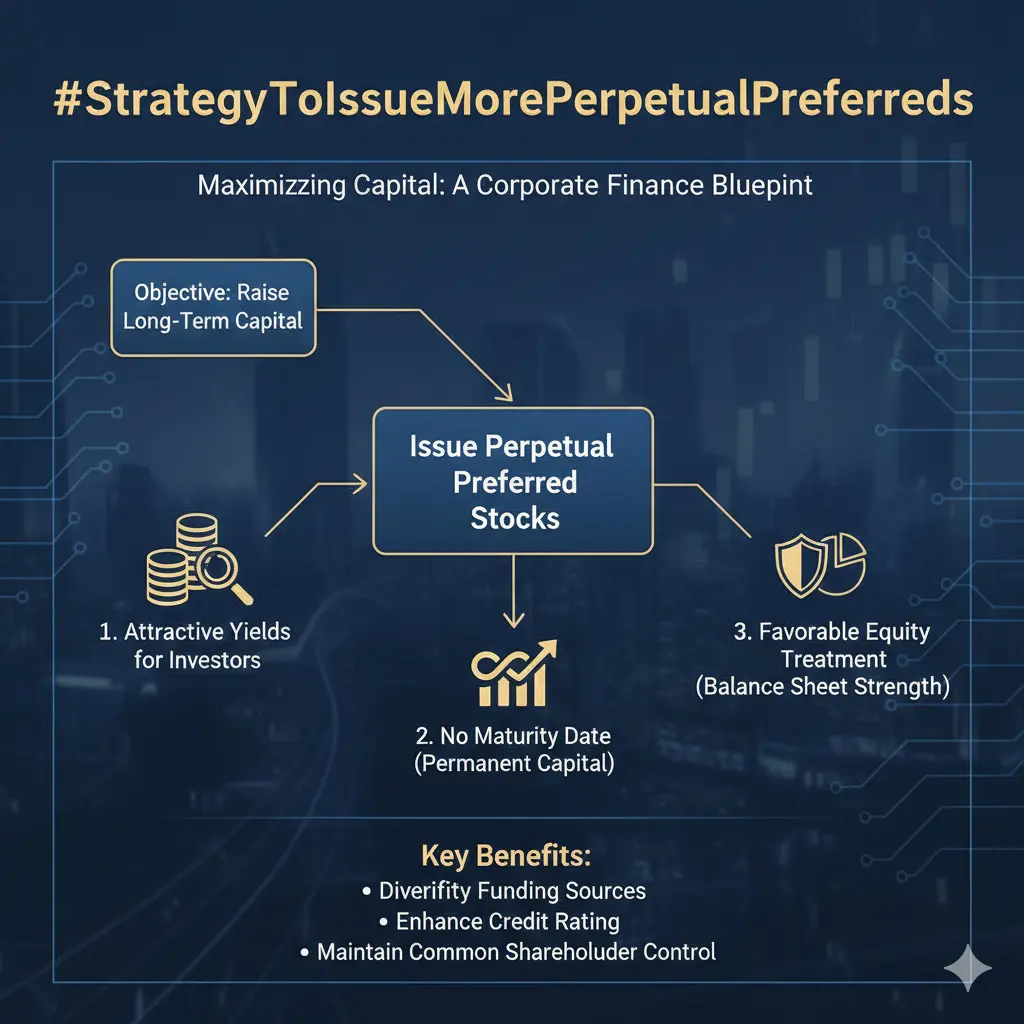

Strategy has announced plans to issue more perpetual preferred shares, signaling a push to strengthen its balance sheet and fund expansion.

🔎 Why It Matters:

• Perpetual preferreds provide long-term capital without diluting common shareholders

• Can support corporate growth or crypto accumulation strategies

• May influence market sentiment, especially if tied to BTC or other crypto holdings

📊 Market Impact:

• Could signal continued bullish intent by institutional players

• Traders should monitor for potential liquidity shifts

• Price action may re

Strategy has announced plans to issue more perpetual preferred shares, signaling a push to strengthen its balance sheet and fund expansion.

🔎 Why It Matters:

• Perpetual preferreds provide long-term capital without diluting common shareholders

• Can support corporate growth or crypto accumulation strategies

• May influence market sentiment, especially if tied to BTC or other crypto holdings

📊 Market Impact:

• Could signal continued bullish intent by institutional players

• Traders should monitor for potential liquidity shifts

• Price action may re

BTC-2,79%

- Reward

- 5

- 10

- Repost

- Share

xxx40xxx :

:

To The Moon 🌕View More

#我在Gate广场过新年 #StrategyToIssueMorePerpetualPreferreds

MicroStrategy (which has largely rebranded its corporate identity as Strategy Inc.) is indeed changing its capital raising strategy. On February 12, 2026, the company confirmed its plan to shift from the sale of common stock to the issuance of perpetual preferred stock as the primary way to finance its aggressive Bitcoin purchase strategy.

This change is designed to address two main issues: dilution of the holdings of existing common shareholders and the excessive volatility of the MSTR stock price.

The New Strategy: "Stretch" Preferred S

MicroStrategy (which has largely rebranded its corporate identity as Strategy Inc.) is indeed changing its capital raising strategy. On February 12, 2026, the company confirmed its plan to shift from the sale of common stock to the issuance of perpetual preferred stock as the primary way to finance its aggressive Bitcoin purchase strategy.

This change is designed to address two main issues: dilution of the holdings of existing common shareholders and the excessive volatility of the MSTR stock price.

The New Strategy: "Stretch" Preferred S

BTC-2,79%

- Reward

- 9

- 11

- Repost

- Share

xxx40xxx :

:

2026 GOGOGO 👊View More

#StrategyToIssueMorePerpetualPreferreds

👇

📊🏦 #StrategyToIssueMorePerpetualPreferreds

Strategy’s move to issue more perpetual preferred shares is sending a clear signal to the market 📢

This approach helps raise long-term capital without immediate dilution, while locking in flexible financing during uncertain macro conditions.

💡 Why This Matters for Markets & Crypto:

Shows institutions are planning long-term liquidity, not short-term exits

Highlights confidence in balance-sheet strength 🧱

Signals continued institutional participation, even during volatility

For crypto investors, these kin

👇

📊🏦 #StrategyToIssueMorePerpetualPreferreds

Strategy’s move to issue more perpetual preferred shares is sending a clear signal to the market 📢

This approach helps raise long-term capital without immediate dilution, while locking in flexible financing during uncertain macro conditions.

💡 Why This Matters for Markets & Crypto:

Shows institutions are planning long-term liquidity, not short-term exits

Highlights confidence in balance-sheet strength 🧱

Signals continued institutional participation, even during volatility

For crypto investors, these kin

- Reward

- 2

- 4

- Repost

- Share

AYATTAC :

:

2026 GOGOGO 👊View More

#StrategyToIssueMorePerpetualPreferreds Solana Distribution Pattern Keeps $190 in Focus for Bulls

Solana extended its decline this week as selling pressure pushed the token toward a critical technical zone. The asset trades near $80 after losing over 12% in seven days. Daily volume exceeds $4.3 billion, showing active positioning from both bulls and bears.

With a market cap above $45 billion, Solana remains a major large-cap asset. However, analysts now debate whether this level marks a short-term floor or signals further downside.

🔸 Support at $72 and $64 Faces Early Pressure

Morecryptoonl n

Solana extended its decline this week as selling pressure pushed the token toward a critical technical zone. The asset trades near $80 after losing over 12% in seven days. Daily volume exceeds $4.3 billion, showing active positioning from both bulls and bears.

With a market cap above $45 billion, Solana remains a major large-cap asset. However, analysts now debate whether this level marks a short-term floor or signals further downside.

🔸 Support at $72 and $64 Faces Early Pressure

Morecryptoonl n

SOL-2,87%

- Reward

- 3

- 3

- Repost

- Share

HighAmbition :

:

thank you for information about cryptoView More

#StrategyToIssueMorePerpetualPreferreds

Strategy Inc., widely recognized for its aggressive Bitcoin treasury strategy, is reportedly preparing to issue additional perpetual preferred shares as part of its ongoing capital-raising framework. This move signals a continued commitment to strengthening its balance sheet while maintaining flexibility in funding long-term strategic initiatives.

Perpetual preferred shares are hybrid financial instruments that combine elements of equity and fixed income. Unlike traditional bonds, they do not have a maturity date, and unlike common stock, they typically

Strategy Inc., widely recognized for its aggressive Bitcoin treasury strategy, is reportedly preparing to issue additional perpetual preferred shares as part of its ongoing capital-raising framework. This move signals a continued commitment to strengthening its balance sheet while maintaining flexibility in funding long-term strategic initiatives.

Perpetual preferred shares are hybrid financial instruments that combine elements of equity and fixed income. Unlike traditional bonds, they do not have a maturity date, and unlike common stock, they typically

BTC-2,79%

- Reward

- 5

- 6

- Repost

- Share

CryptoChampion :

:

2026 GOGOGO 👊View More

#StrategyToIssueMorePerpetualPreferreds

As of February 12, 2026, the crypto ecosystem continues to evolve rapidly, and platforms like Gate Square are becoming central hubs for community engagement, innovation, and financial strategy discussions. The hashtag #我在Gate广场过新年 reflects the growing trend of celebrating global cultural moments within the digital asset space. This New Year celebration on Gate Square represents more than just a festive event it highlights how blockchain platforms are building strong user communities by combining technology, culture, and financial participation. Users ac

As of February 12, 2026, the crypto ecosystem continues to evolve rapidly, and platforms like Gate Square are becoming central hubs for community engagement, innovation, and financial strategy discussions. The hashtag #我在Gate广场过新年 reflects the growing trend of celebrating global cultural moments within the digital asset space. This New Year celebration on Gate Square represents more than just a festive event it highlights how blockchain platforms are building strong user communities by combining technology, culture, and financial participation. Users ac

- Reward

- 1

- 1

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊#StrategyToIssueMorePerpetualPreferreds

The news about Strategy planning to issue more perpetual preferred shares immediately caught my attention, because it says a lot about how serious institutions are becoming about capital structure and long-term positioning. In today’s market environment, companies are not just raising money randomly they are carefully choosing financial instruments that give them flexibility while protecting long-term strategy.

Perpetual preferreds are interesting because they don’t have a maturity date like traditional bonds. That means the company can secure capital

The news about Strategy planning to issue more perpetual preferred shares immediately caught my attention, because it says a lot about how serious institutions are becoming about capital structure and long-term positioning. In today’s market environment, companies are not just raising money randomly they are carefully choosing financial instruments that give them flexibility while protecting long-term strategy.

Perpetual preferreds are interesting because they don’t have a maturity date like traditional bonds. That means the company can secure capital

- Reward

- 4

- 5

- Repost

- Share

Ryakpanda :

:

2026 Go Go Go 👊View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

21.93K Popularity

9.82K Popularity

4.33K Popularity

36.5K Popularity

251.15K Popularity

152.33K Popularity

5.14K Popularity

4.66K Popularity

2.85K Popularity

4.66K Popularity

121.05K Popularity

26.06K Popularity

22.42K Popularity

19.61K Popularity

625 Popularity

News

View MoreNasdaq ends the session down more than 2%

2 m

Traditional Finance Alert: VIX Has Risen Over 3%

55 m

Anthropic completes $30 billion funding, company valuation reaches $380 billion

1 h

Aave Labs proposes to allocate 100% of product revenue to the DAO treasury, aiming to confirm Aave V4 as the core architecture.

1 h

Traditional Finance Drop Alert: XTIUSD Falls Over 2%

1 h

Pin