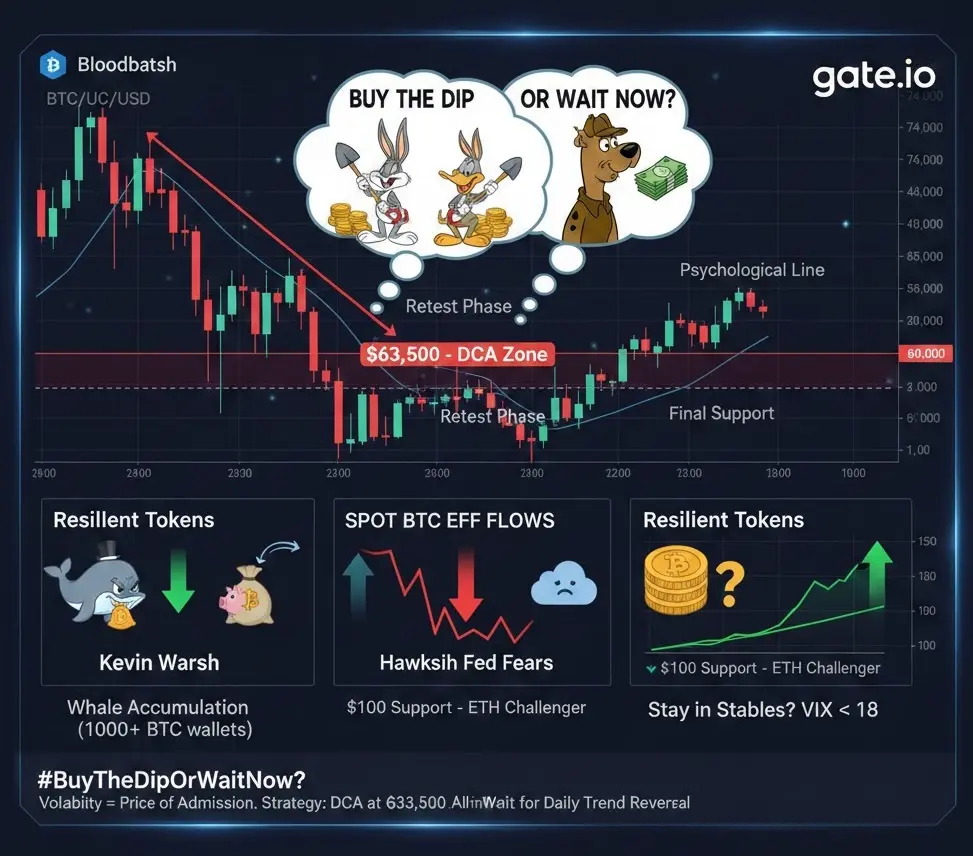

#BuyTheDipOrWaitNow?

Navigating Market Uncertainty with Strategy, Not Emotion

In volatile markets, one question echoes louder than any other: Should you buy the dip, or wait for a better entry? This dilemma becomes especially intense when prices pull back sharply, headlines turn bearish, and social media fills with fear. While “buy the dip” has become a popular mantra, successful investing requires more than blind optimism it demands timing, discipline, and strategy.

Historically, buying market dips has been a profitable strategy during long-term uptrends. In bull markets, temporary corrections often present discounted entry points before the next leg higher. However, not every dip is created equal. Some are healthy retracements, while others mark the beginning of deeper corrections or even trend reversals. Knowing the difference is what separates smart capital from emotional money.

Understanding the Market Context

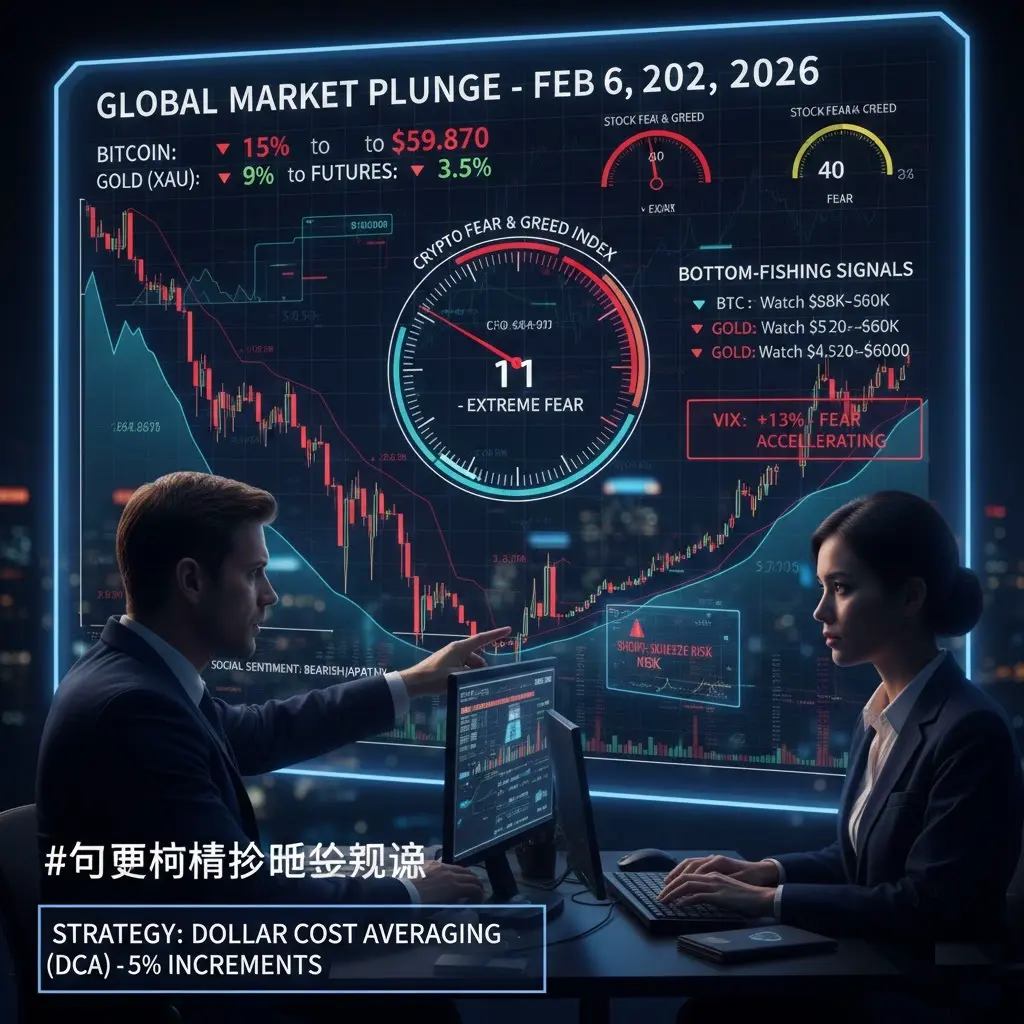

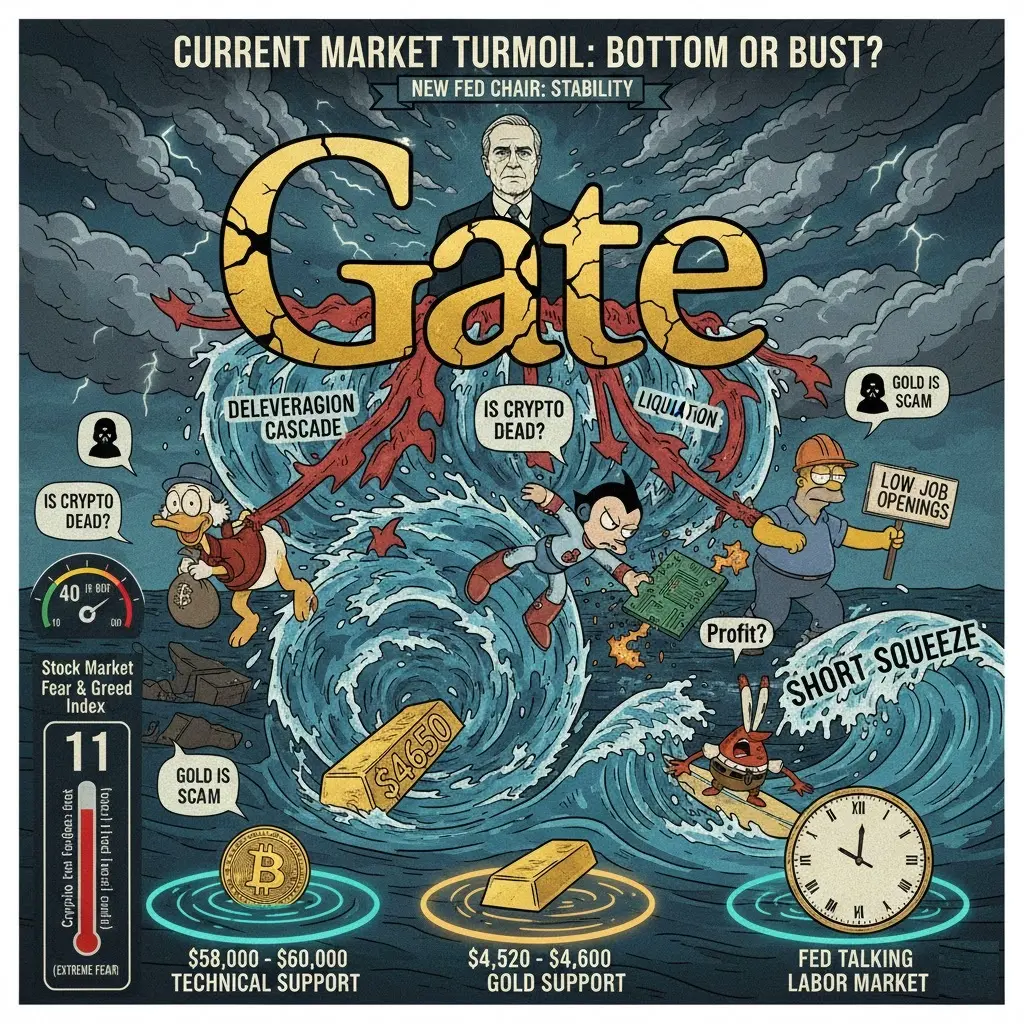

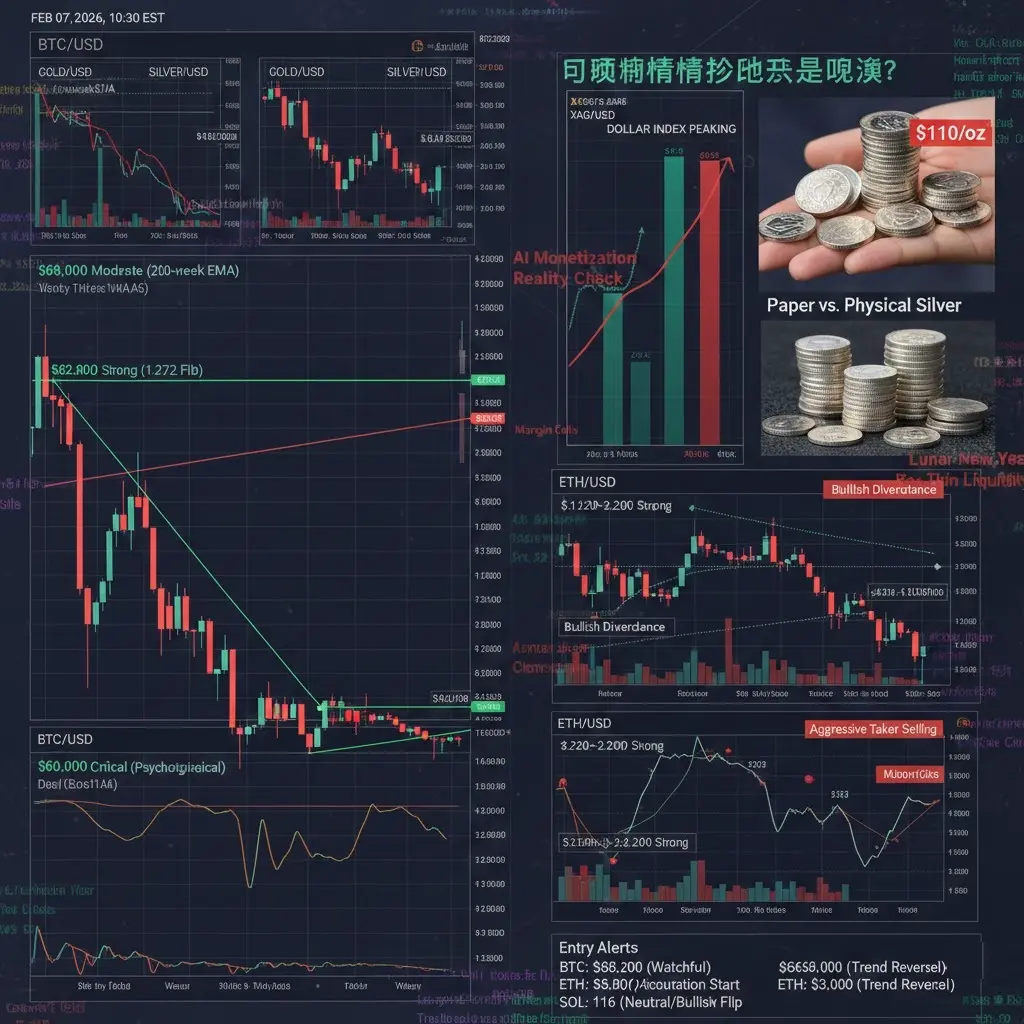

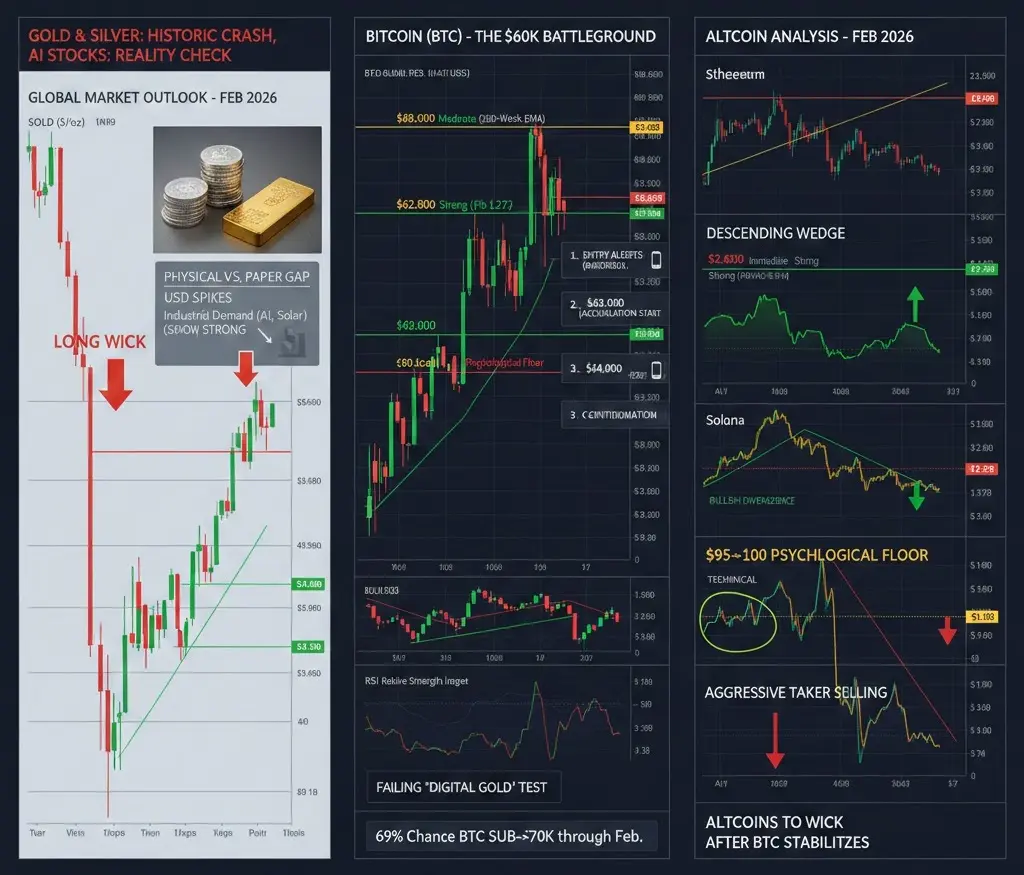

Before buying any dip, the first step is to assess market structure. Is the broader trend bullish, bearish, or sideways? In a strong uptrend, dips are often short-lived and aggressively bought. In contrast, during downtrends, what appears to be a dip can quickly turn into a falling knife. Looking at higher-timeframe charts helps determine whether price is holding key support levels or breaking below them.

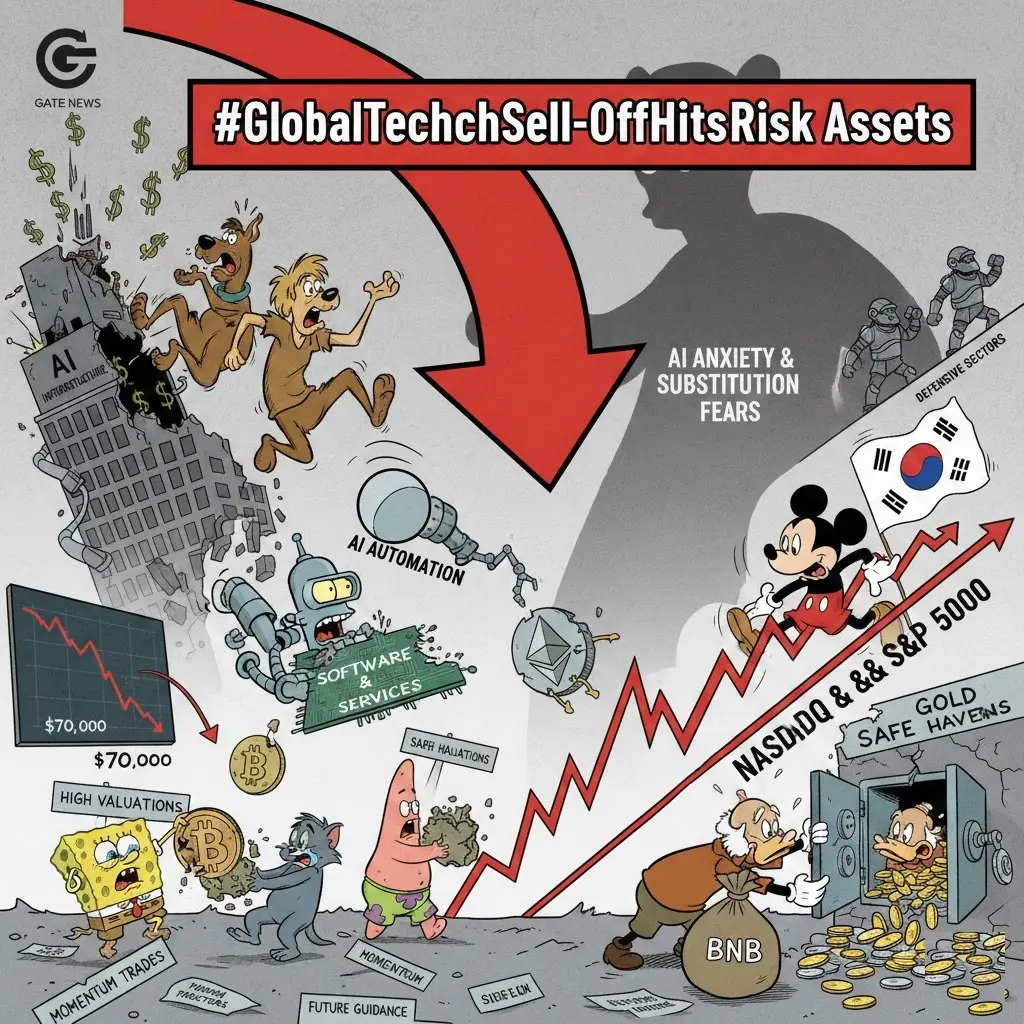

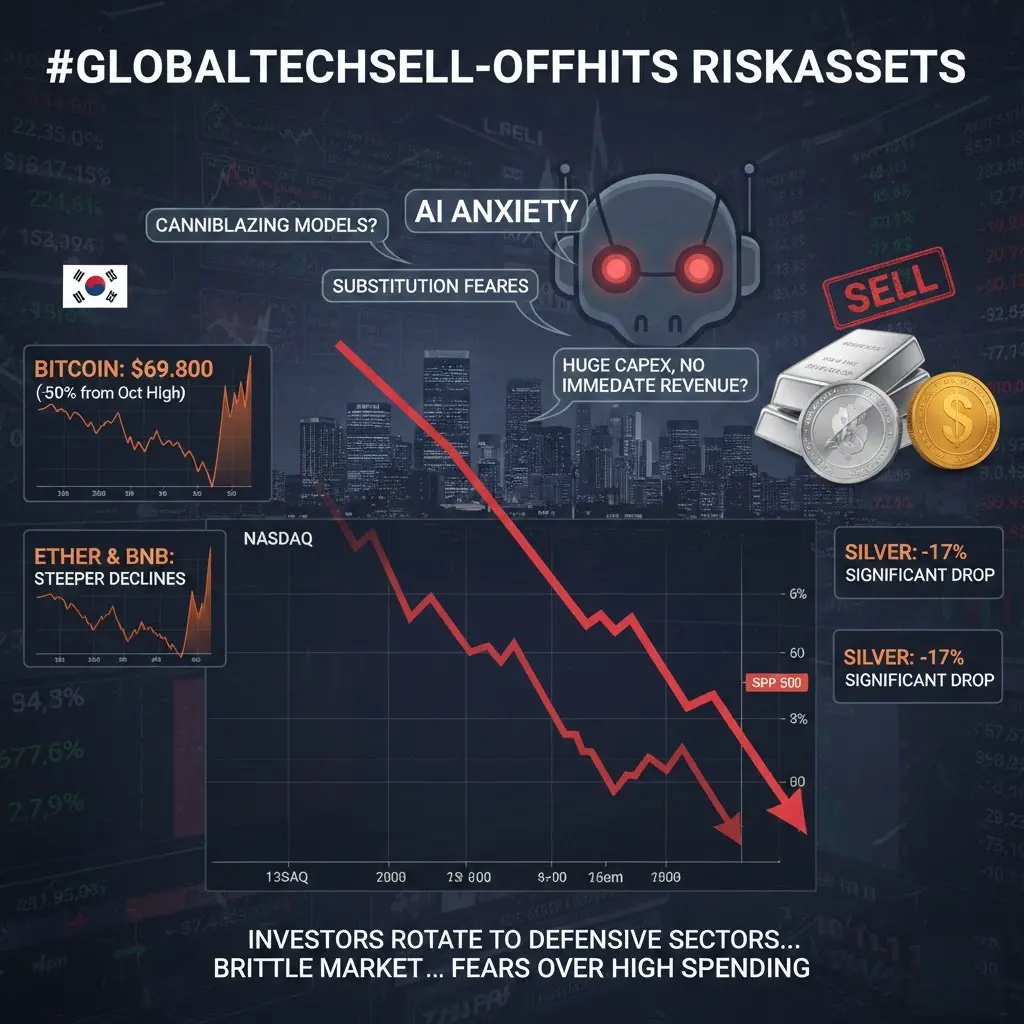

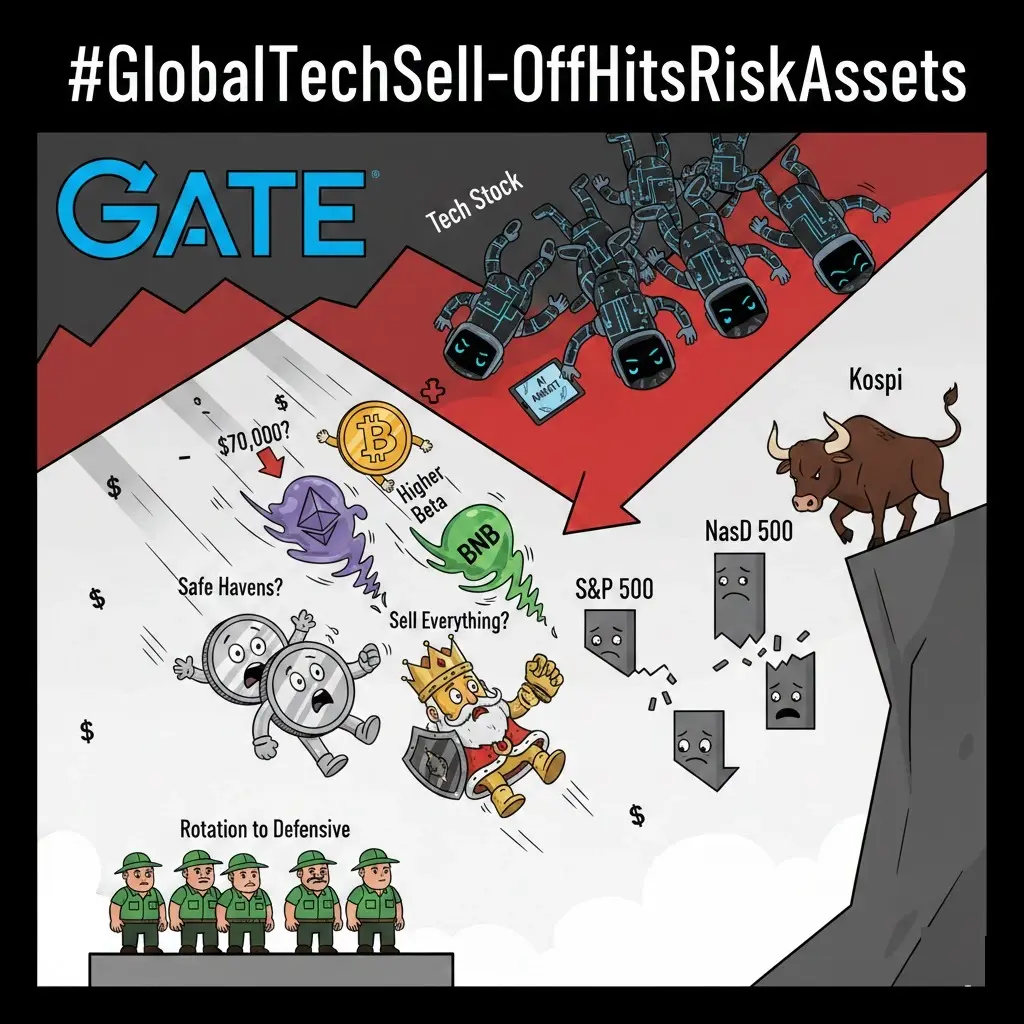

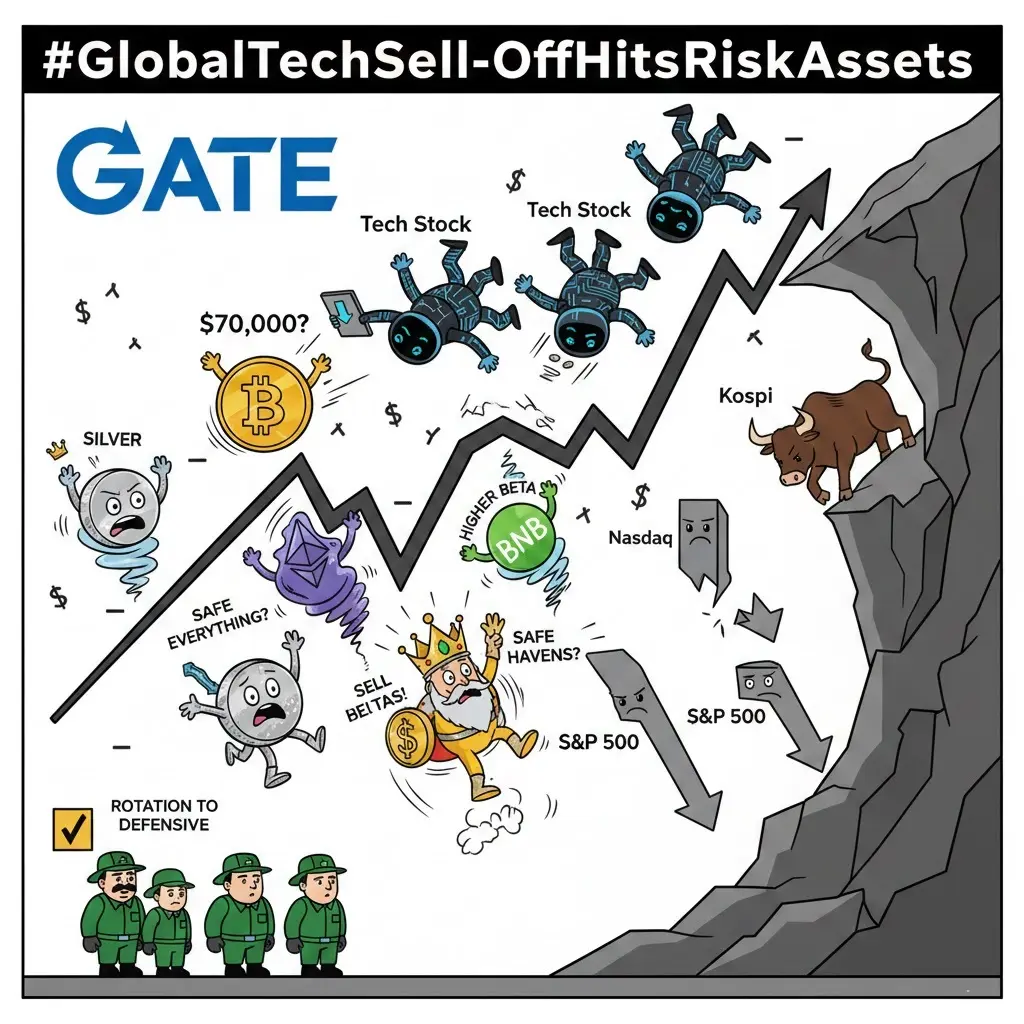

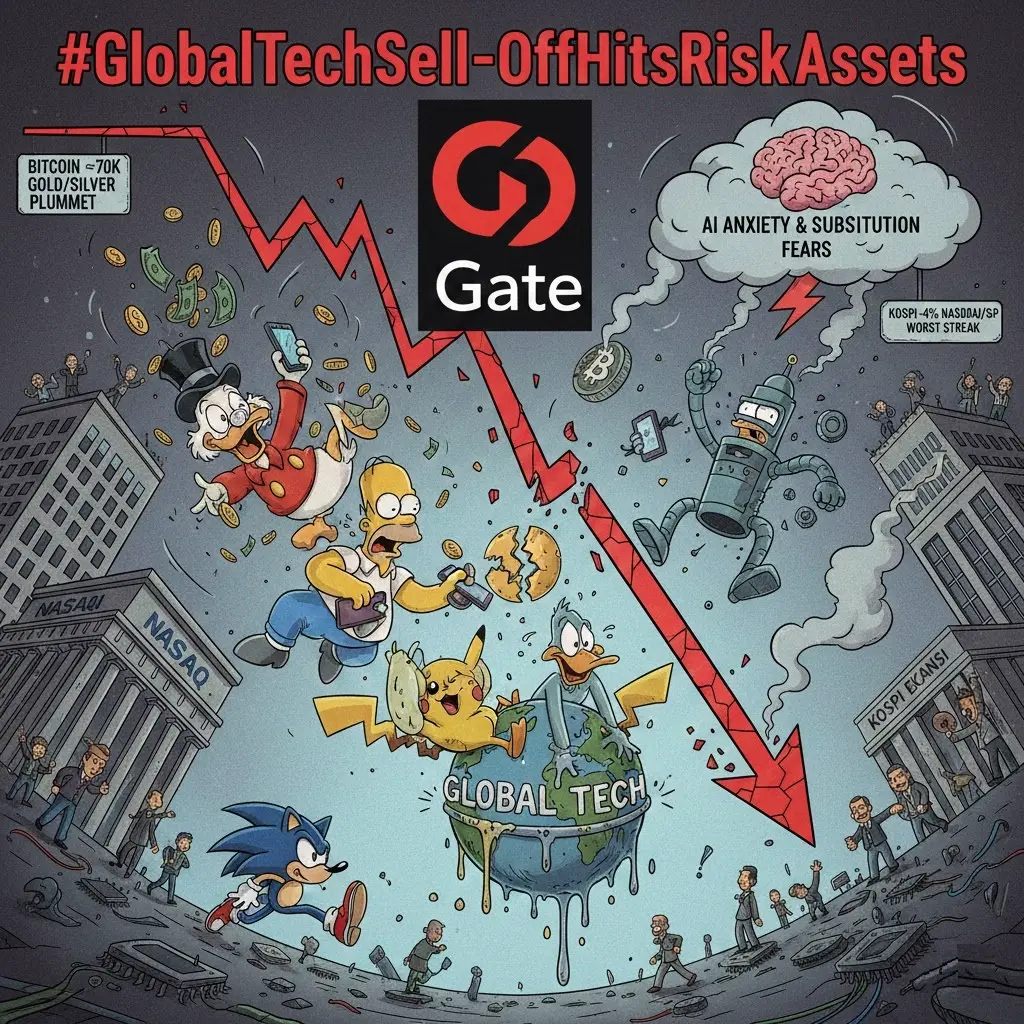

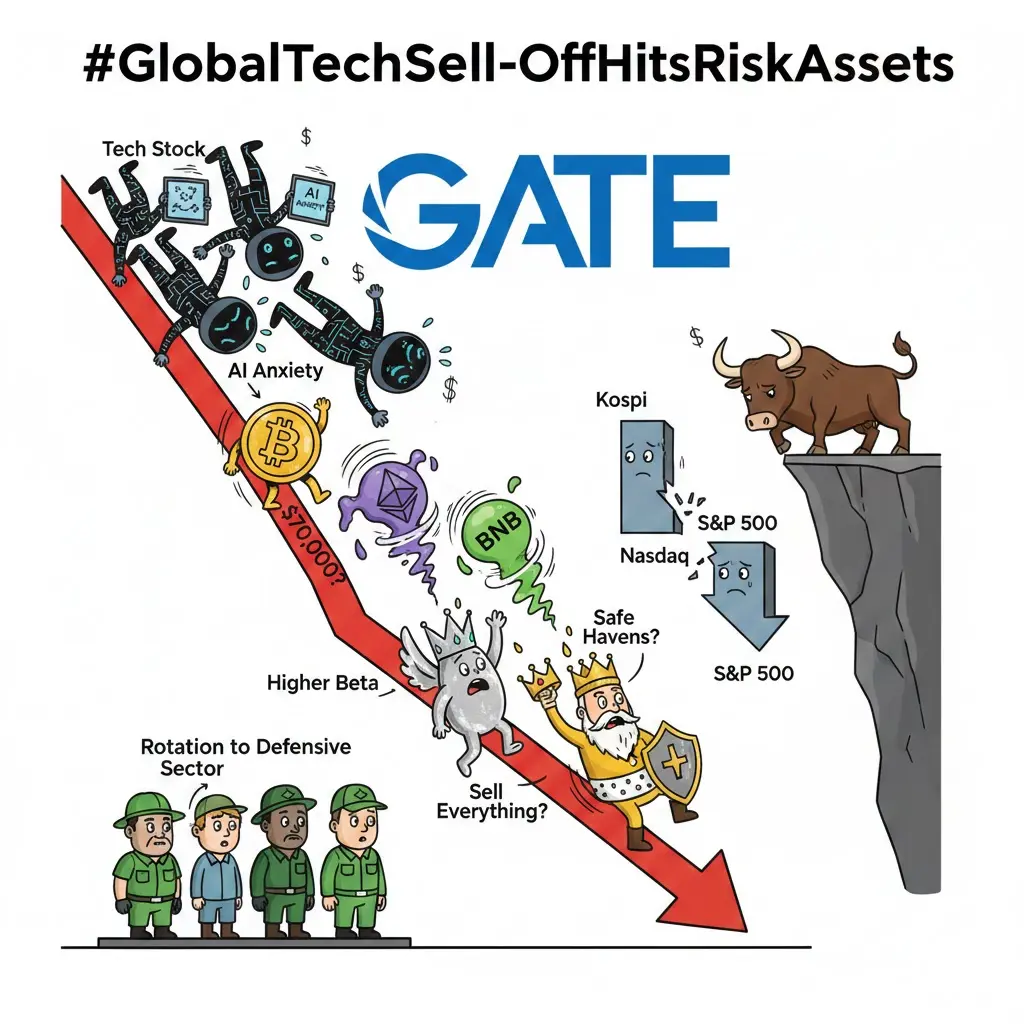

Macro conditions also play a crucial role. Interest rate expectations, inflation data, central bank policy, and geopolitical tensions heavily influence risk assets. If markets are facing tightening liquidity or economic uncertainty, patience often pays better than rushing in. Buying the dip without considering the macro backdrop can expose traders to unnecessary downside.

Key Signals That Favor Buying the Dip

Not all pullbacks are bad opportunities. Some clear signals suggest a dip may be worth buying:

Strong support zones: Price bouncing from historically important levels increases the probability of a reversal.

High-volume selling exhaustion: When heavy selling slows down, it may indicate capitulation.

Bullish divergence: Momentum indicators like RSI showing higher lows while price makes lower lows can hint at weakening bearish pressure.

Healthy corrections: Pullbacks of 20–40% in crypto during bull cycles are common and often reset the market.

When these factors align, buying the dip gradually rather than all at once can be a smart strategy.

When Waiting Is the Smarter Move

Sometimes, the best trade is no trade. If the market is breaking major support levels, forming lower highs and lower lows, or reacting negatively to bad macro news, waiting becomes essential. Catching bottoms is extremely difficult, even for professionals. Waiting for confirmation such as trend reversal, consolidation, or reclaiming key levels reduces risk significantly.

Another mistake traders make is deploying all capital at the first sign of a dip. Smart investors preserve liquidity. Having cash on the sidelines allows flexibility and protects against deeper drawdowns if the market continues lower.

Strategy Over Emotion

Emotional trading is the enemy of long-term success. Fear makes traders sell at the bottom, while greed pushes them to buy too early. A rules-based approach using predefined entry zones, position sizing, and stop-loss levels removes emotion from decision-making.

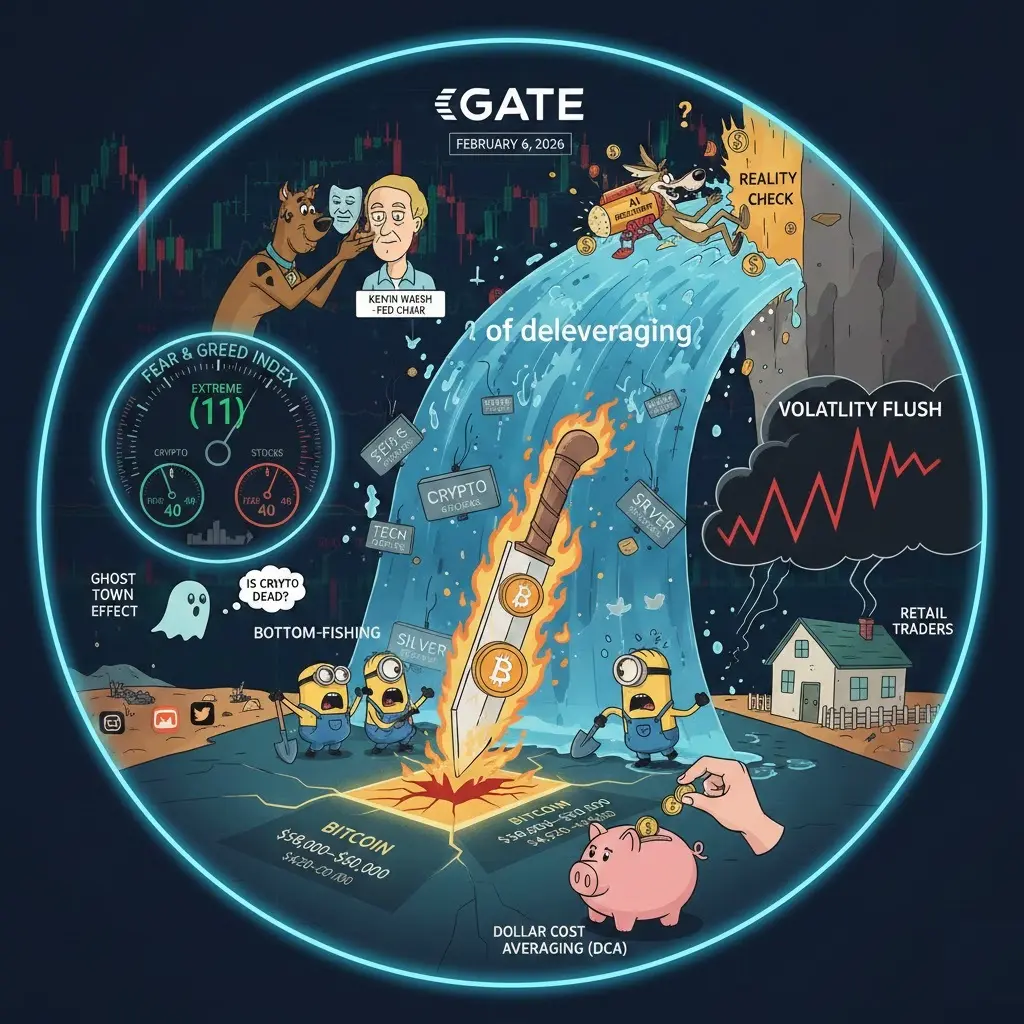

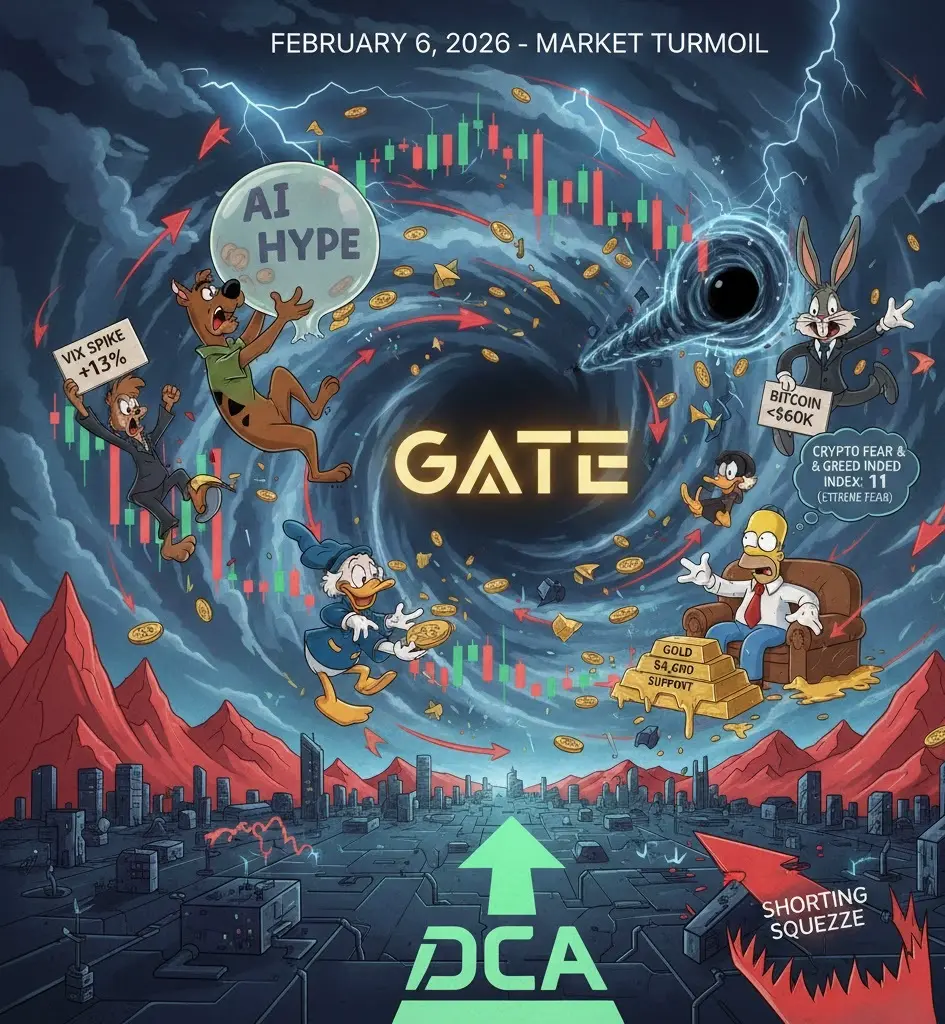

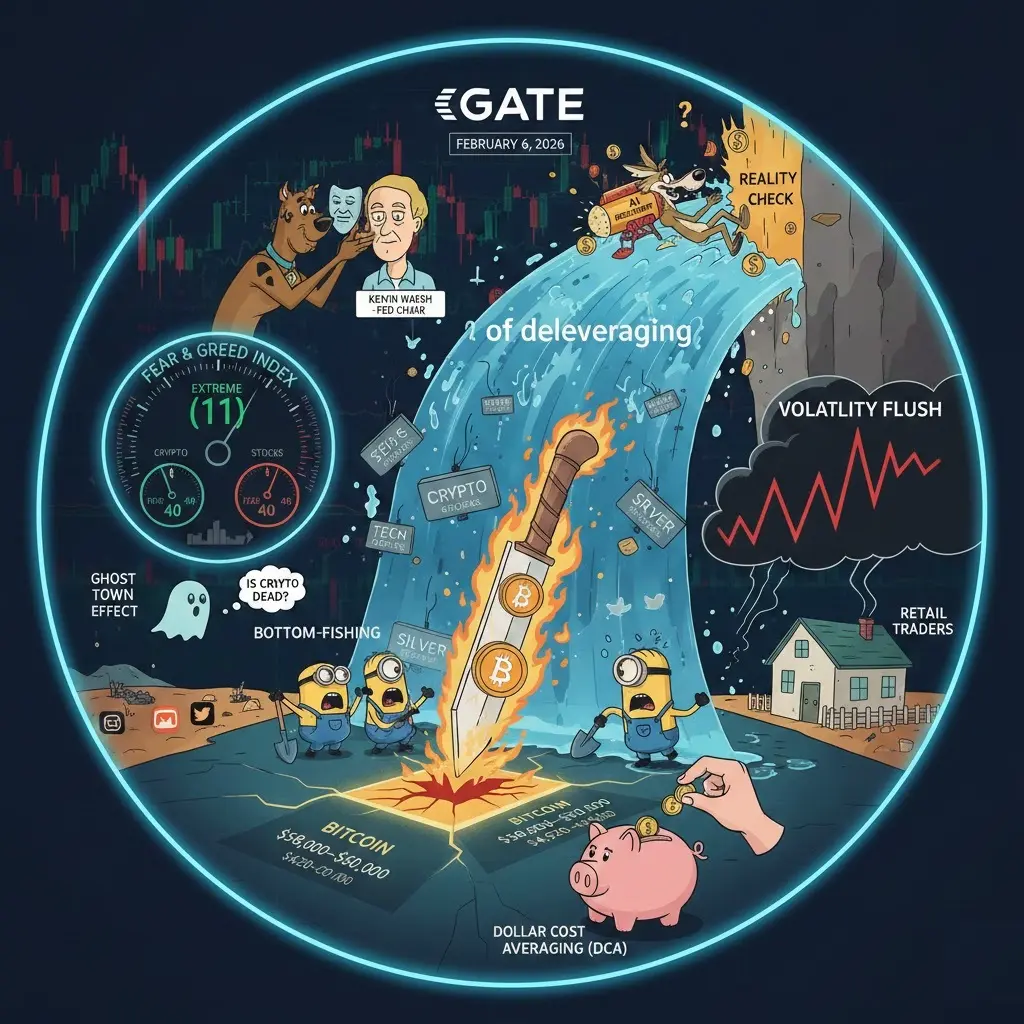

Dollar-cost averaging (DCA) is another powerful approach during uncertain markets. Instead of trying to time the exact bottom, investors spread entries over time, reducing timing risk while still participating in potential upside.

Final Thoughts

The question #BuyTheDipOrWaitNow? has no universal answer. The right decision depends on market trend, macro conditions, technical signals, and personal risk tolerance. In strong markets, dips can be opportunities. In weak markets, patience is a weapon.

Successful traders don’t chase hype they follow structure, manage risk, and stay flexible. Whether you buy the dip or wait, the goal remains the same: protect capital first, profits second. Markets will always offer opportunities, but only for those disciplined enough to survive long enough to take them.

Navigating Market Uncertainty with Strategy, Not Emotion

In volatile markets, one question echoes louder than any other: Should you buy the dip, or wait for a better entry? This dilemma becomes especially intense when prices pull back sharply, headlines turn bearish, and social media fills with fear. While “buy the dip” has become a popular mantra, successful investing requires more than blind optimism it demands timing, discipline, and strategy.

Historically, buying market dips has been a profitable strategy during long-term uptrends. In bull markets, temporary corrections often present discounted entry points before the next leg higher. However, not every dip is created equal. Some are healthy retracements, while others mark the beginning of deeper corrections or even trend reversals. Knowing the difference is what separates smart capital from emotional money.

Understanding the Market Context

Before buying any dip, the first step is to assess market structure. Is the broader trend bullish, bearish, or sideways? In a strong uptrend, dips are often short-lived and aggressively bought. In contrast, during downtrends, what appears to be a dip can quickly turn into a falling knife. Looking at higher-timeframe charts helps determine whether price is holding key support levels or breaking below them.

Macro conditions also play a crucial role. Interest rate expectations, inflation data, central bank policy, and geopolitical tensions heavily influence risk assets. If markets are facing tightening liquidity or economic uncertainty, patience often pays better than rushing in. Buying the dip without considering the macro backdrop can expose traders to unnecessary downside.

Key Signals That Favor Buying the Dip

Not all pullbacks are bad opportunities. Some clear signals suggest a dip may be worth buying:

Strong support zones: Price bouncing from historically important levels increases the probability of a reversal.

High-volume selling exhaustion: When heavy selling slows down, it may indicate capitulation.

Bullish divergence: Momentum indicators like RSI showing higher lows while price makes lower lows can hint at weakening bearish pressure.

Healthy corrections: Pullbacks of 20–40% in crypto during bull cycles are common and often reset the market.

When these factors align, buying the dip gradually rather than all at once can be a smart strategy.

When Waiting Is the Smarter Move

Sometimes, the best trade is no trade. If the market is breaking major support levels, forming lower highs and lower lows, or reacting negatively to bad macro news, waiting becomes essential. Catching bottoms is extremely difficult, even for professionals. Waiting for confirmation such as trend reversal, consolidation, or reclaiming key levels reduces risk significantly.

Another mistake traders make is deploying all capital at the first sign of a dip. Smart investors preserve liquidity. Having cash on the sidelines allows flexibility and protects against deeper drawdowns if the market continues lower.

Strategy Over Emotion

Emotional trading is the enemy of long-term success. Fear makes traders sell at the bottom, while greed pushes them to buy too early. A rules-based approach using predefined entry zones, position sizing, and stop-loss levels removes emotion from decision-making.

Dollar-cost averaging (DCA) is another powerful approach during uncertain markets. Instead of trying to time the exact bottom, investors spread entries over time, reducing timing risk while still participating in potential upside.

Final Thoughts

The question #BuyTheDipOrWaitNow? has no universal answer. The right decision depends on market trend, macro conditions, technical signals, and personal risk tolerance. In strong markets, dips can be opportunities. In weak markets, patience is a weapon.

Successful traders don’t chase hype they follow structure, manage risk, and stay flexible. Whether you buy the dip or wait, the goal remains the same: protect capital first, profits second. Markets will always offer opportunities, but only for those disciplined enough to survive long enough to take them.