Post content & earn content mining yield

placeholder

CEO

🇺🇸 President Trump says the U.S. economy will surge by 15% or more if Kevin Warsh cuts interest rates.

- Reward

- 2

- Comment

- Repost

- Share

Viewing the Top Market Coins Spot Chart and comparing them

- Reward

- 8

- 5

- Repost

- Share

ybaser :

:

Happy New Year! 🤑View More

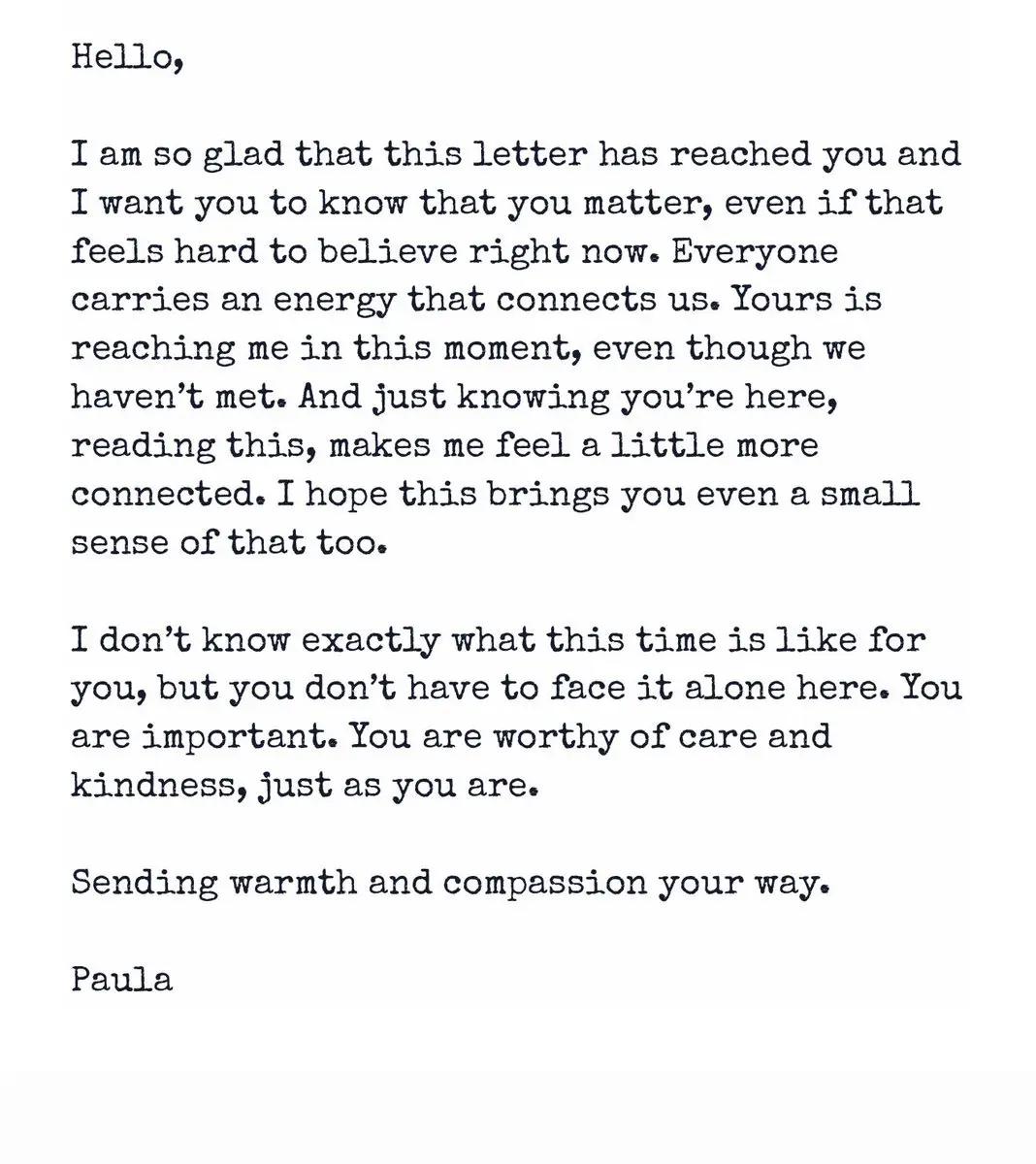

A guy went viral for creating a website called “reasons to stay” where anonymous people write letters to people who need a moment of hope. He did this in honour of his little brother who took his own life 8 years ago.

If you are struggling, I highly recommend checking it out.

If you are struggling, I highly recommend checking it out.

- Reward

- like

- Comment

- Repost

- Share

p小将

p小将

Created By@DreamJourney

Listing Progress

100.00%

MC:

$1.76K

More Tokens

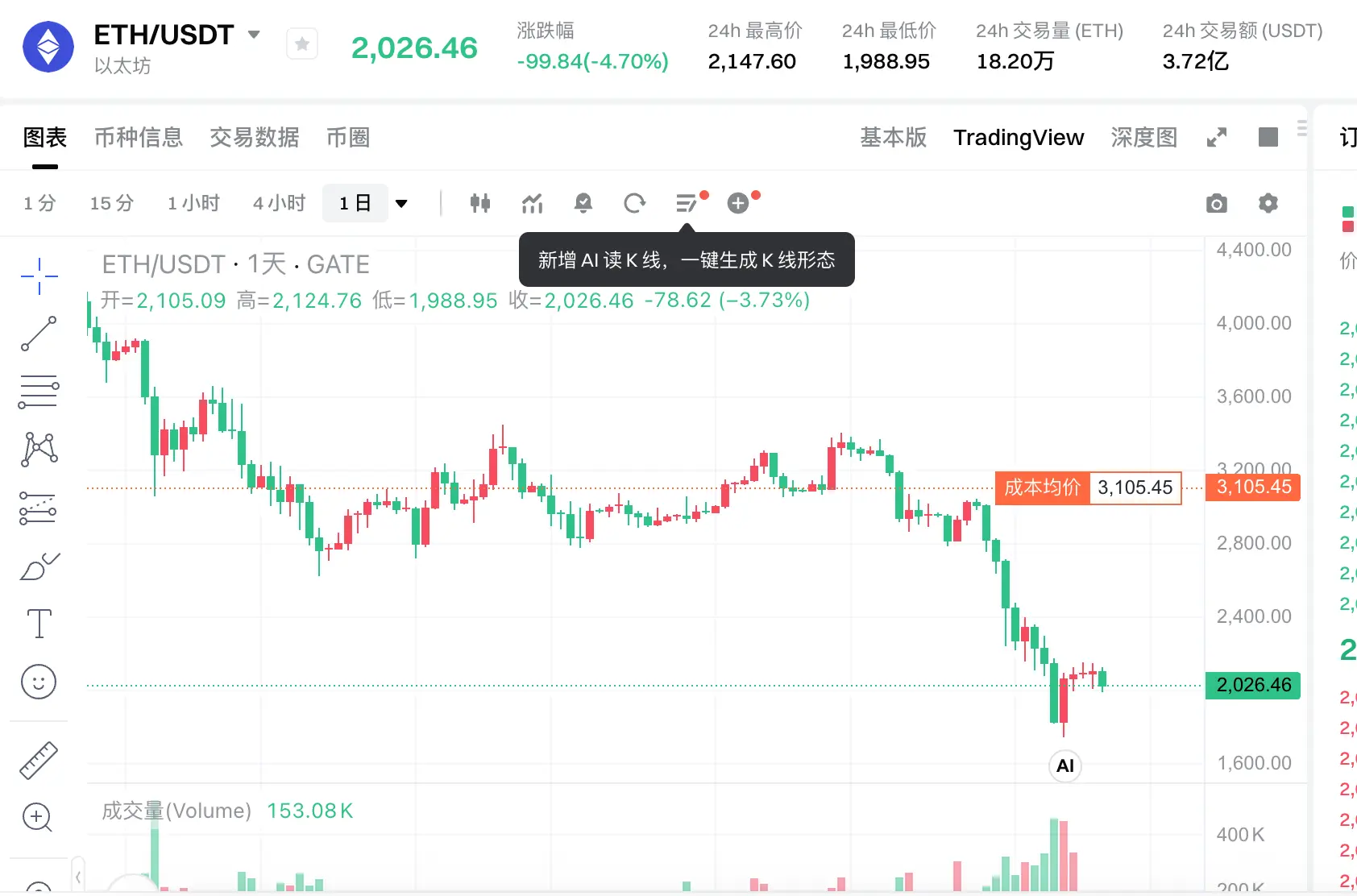

Currently, Bitcoin and ETH are: declining with increased volume, and rebounding with decreased volume!

This is a typical bearish market structure!

The main reason for this phenomenon is that a large amount of capital is actively selling, including long stop-losses/forced liquidations, big players selling, and trapped positions being unwound—all essentially capital fleeing the market.

The rebound with decreased volume is mainly short covering, small-scale bottom fishing, and technical repairs, but no large funds are entering.

It can be said that currently, declining with increased volume = genu

View OriginalThis is a typical bearish market structure!

The main reason for this phenomenon is that a large amount of capital is actively selling, including long stop-losses/forced liquidations, big players selling, and trapped positions being unwound—all essentially capital fleeing the market.

The rebound with decreased volume is mainly short covering, small-scale bottom fishing, and technical repairs, but no large funds are entering.

It can be said that currently, declining with increased volume = genu

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 1

- Comment

- Repost

- Share

- Reward

- like

- 1

- Repost

- Share

Changmin :

:

In the future, avoid these kinds of sharp fluctuations. Avoid them.- Reward

- like

- Comment

- Repost

- Share

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VGCVBG9AUW

View Original

- Reward

- 1

- Comment

- Repost

- Share

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=BVBNAw8

View Original

- Reward

- like

- Comment

- Repost

- Share

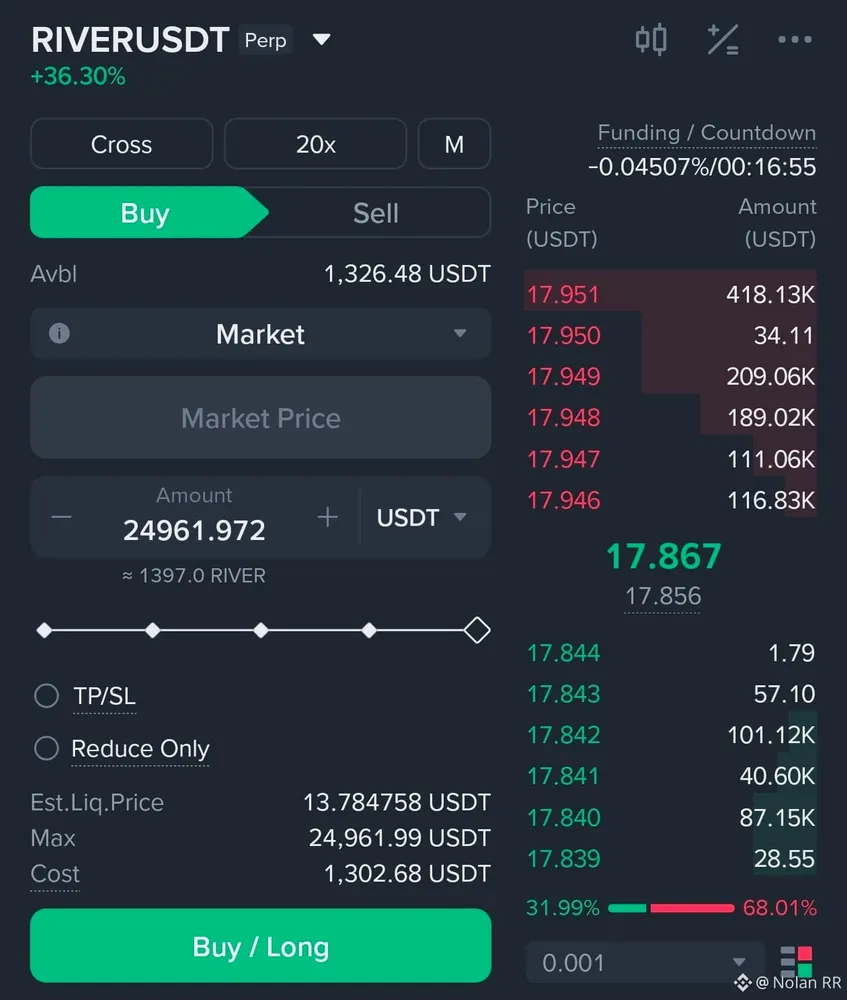

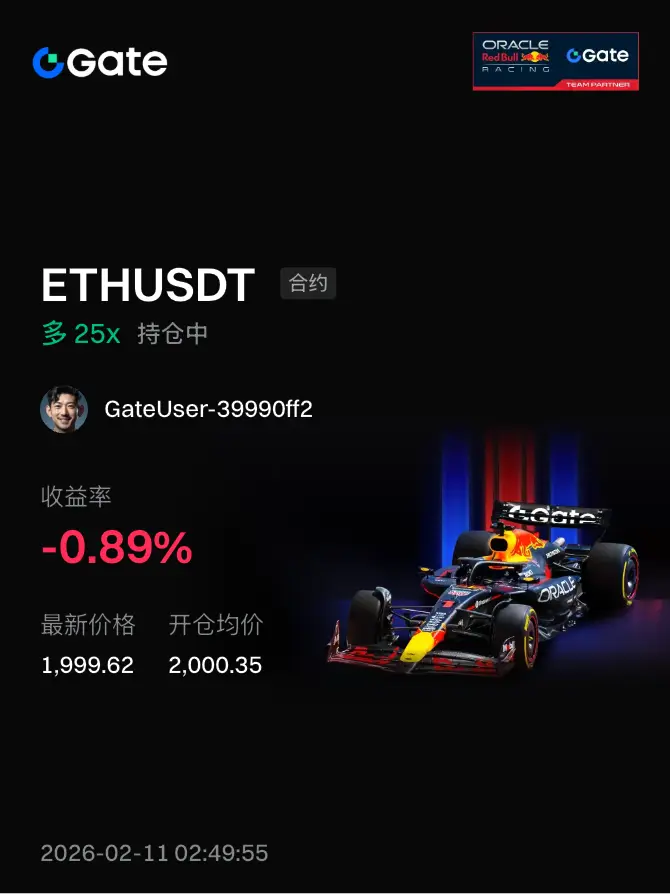

#Show my holdings' profit#当前行情抄底还是观望?

In this market, don't be ambitious. Just take a few points steadily and then run away.

View OriginalIn this market, don't be ambitious. Just take a few points steadily and then run away.

- Reward

- like

- Comment

- Repost

- Share

XAMD

XAMD

Created By@ViP2

Subscription Progress

0.00%

MC:

$0

More Tokens

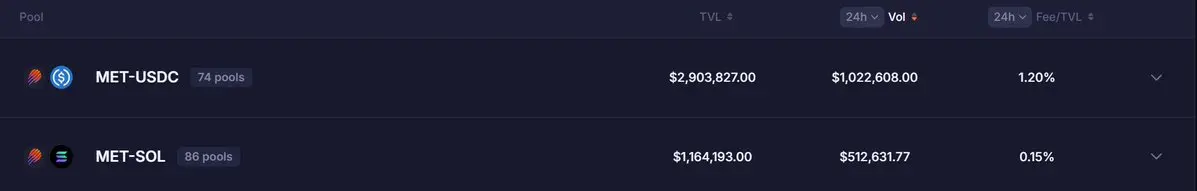

Honest question:

Would it make more sense to incentivize with farms $MET liquidity primarily through a stable pair (MET/USDC) rather than MET/SOL?

My concern lately has been SOL downside risk spilling over into Meteora LPs. Even if MET fundamentals stay unchanged, SOL volatility directly impacts LP performance and impermanent loss.

From a market-structure perspective, anchoring the main liquidity pool to USDC could:

• Reduce exposure to SOL-driven volatility

• Make MET pricing more predictable

• Improve capital efficiency for LPs who want MET exposure without directional SOL risk

Notably, the

Would it make more sense to incentivize with farms $MET liquidity primarily through a stable pair (MET/USDC) rather than MET/SOL?

My concern lately has been SOL downside risk spilling over into Meteora LPs. Even if MET fundamentals stay unchanged, SOL volatility directly impacts LP performance and impermanent loss.

From a market-structure perspective, anchoring the main liquidity pool to USDC could:

• Reduce exposure to SOL-driven volatility

• Make MET pricing more predictable

• Improve capital efficiency for LPs who want MET exposure without directional SOL risk

Notably, the

- Reward

- like

- Comment

- Repost

- Share

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VQRDUQHZUG

View Original

- Reward

- like

- Comment

- Repost

- Share

🚨 BITCOIN UPDATE:

THERE IS NO BID.

WE COULDN'T HOLD PREVIOUS ATH.

FIRST STOP: $65K

SECOND STOP: $62.5K

IF THERE'S STILL NO BID... WE'LL SEE SUB $60K VERY QUICKLY.

THERE IS NO BID.

WE COULDN'T HOLD PREVIOUS ATH.

FIRST STOP: $65K

SECOND STOP: $62.5K

IF THERE'S STILL NO BID... WE'LL SEE SUB $60K VERY QUICKLY.

BTC-2,4%

- Reward

- 1

- Comment

- Repost

- Share

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VLJHVW0OCA

View Original

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

【$I'm coming, signal】Hold cash and observe - Bull trap under volume-price divergence

$I'm coming, after a surge with high volume, the price is consolidating at a high level, but there is dangerous resonance in the data.

🎯Direction: Hold cash

Market analysis: A single massive bullish candle on the 4H chart surged 16%, but the latest candlestick shows a long upper shadow, indicating heavy selling pressure around 0.0245. The key issue is: although the price has risen, the open interest trend (OI) remains "Stable" without synchronized increase, and the funding rate is as high as 0.0392%, indicati

View Original$I'm coming, after a surge with high volume, the price is consolidating at a high level, but there is dangerous resonance in the data.

🎯Direction: Hold cash

Market analysis: A single massive bullish candle on the 4H chart surged 16%, but the latest candlestick shows a long upper shadow, indicating heavy selling pressure around 0.0245. The key issue is: although the price has risen, the open interest trend (OI) remains "Stable" without synchronized increase, and the funding rate is as high as 0.0392%, indicati

- Reward

- like

- Comment

- Repost

- Share

Are you seeing what I’m seeing? All I see is green.

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More210.98K Popularity

7.39K Popularity

10.15K Popularity

10.78K Popularity

5.08K Popularity

Hot Gate Fun

View More- MC:$0.1Holders:10.00%

- MC:$0.1Holders:10.00%

- MC:$0.1Holders:10.48%

- MC:$2.41KHolders:10.00%

- MC:$0.1Holders:10.00%

News

View MoreData: In the past 24 hours, the entire network has liquidated $227 million, with long positions liquidated at $156 million and short positions at $71.47 million.

7 m

Data: 2012.8 BTC transferred from an anonymous address, routed through a middle address, and then sent to another anonymous address

37 m

Data: If BTC breaks through $72,308, the total liquidation strength of mainstream CEX short positions will reach $1.117 billion.

1 h

Data: If ETH breaks through $2,103, the total liquidation strength of short positions on mainstream CEXs will reach $679 million.

1 h

Bitcoin Hashrate Drops 20% as Mining Profitability Collapses

1 h

Pin