Bitcoin (BTC) News Today

Latest crypto news and price forecasts for BTC: Gate News brings together the latest updates, market analysis, and in-depth insights.

Crypto Wallet MetaMask Expands From Ethereum and Solana to Bitcoin

In brief

MetaMask rolled out support for Bitcoin, allowing users to buy, sell, and send BTC in-wallet.

The network expansion is the latest in feature enhancements that include in-wallet perps, prediction market trading, and more.

MetaMask recently added support for Monad and Sei, and will add a

Decrypt·1h ago

How Bitcoin whales move markets, and the signals to ignore

For more than a decade, Bitcoin’s largest holders have acted as the unseen forces behind many of the market’s biggest surges and deepest crashes.

These so-called whales have always held outsized influence, but their behavior throughout 2025 suggests that a major shift is underway that could

BTC-3.13%

Cointelegraph·2h ago

Bitcoin sees ‘pure manipulation’ as US sell-off liquidates $200M in an hour

This article emphasizes the risks associated with investments and declares that Cointelegraph does not offer financial advice. It advises readers to do their own research and clarifies that it is not responsible for any losses incurred.

BTC-3.13%

Cointelegraph·3h ago

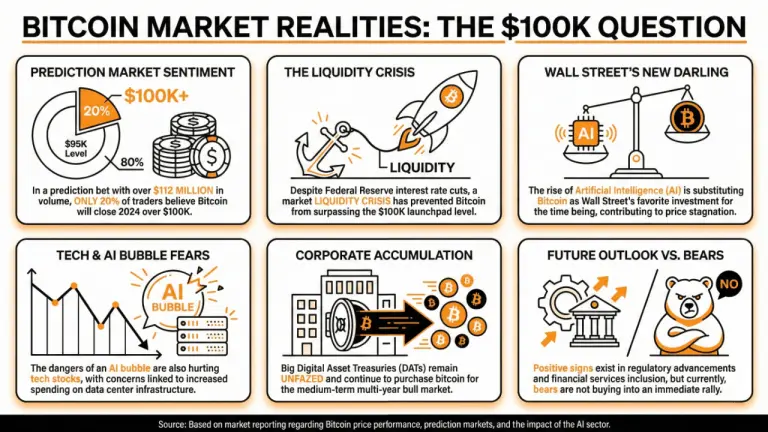

Bears Everywhere: Polymarket Traders Believe Bitcoin Won't Reach $100K Before Year End

The cryptocurrency market exudes a pervasive bearish sentiment, with even crypto-focused platforms expressing pessimism about bitcoin’s price trajectory throughout 2025. Reflecting this skepticism, merely 20% of Polymarket traders anticipate bitcoin surpassing $100,000 by year’s end.

A Bearish

BTC-3.13%

Coinpedia·4h ago

Market Shake-Out Done? Rover Bets On Bitcoin Boom

YouTube analyst Crypto Rover delivers a measured bullish call, forecasting renewed upside for Bitcoin following this week’s market correction — predicting all-time highs could be back on the horizon.

Crypto Rover, one of YouTube’s most followed Bitcoin chart analysts, has released a new market

DailyCoin·5h ago

Strategy Adds Nearly a Billion Dollars in Bitcoin for Second Straight Week

In brief

Leading Bitcoin treasury firm Strategy bought $980 million worth of Bitcoin last week.

It's the second straight week that the company added nearly $1 billion in BTC.

The company holds $60 billion in Bitcoin and its stock price has fallen 53% over the past six months.

Decrypt's

BTC-3.13%

Decrypt·5h ago

Metaplanet Shares Waver as CEO Hints at Crucial Bitcoin Buy Decision

Metaplanet CEO urges shareholders to vote at EGM on Bitcoin strategy as stock wavers and Bitcoin trades near $89,000.

Metaplanet stock wavered ahead of its extraordinary general meeting (EGM) scheduled for December 22. CEO Simon Gerovich urged shareholders to vote on key proposals that could

BTC-3.13%

LiveBTCNews·6h ago

MicroStrategy invests another $980 million to buy 10,000 Bitcoin, with total holdings surpassing 670,000 BTC, maintaining its position as the global leader.

MicroStrategy once again increased its Bitcoin holdings by 10,645 BTC from December 8 to 14, 2025, with a total investment of approximately $980.3 million, bringing its total Bitcoin holdings to 671,268 BTC, making it the largest publicly traded company holder worldwide. Its cumulative investment cost is approximately $50.33 billion, and it continues to raise funds through ATM issuance plans, maintaining strong financial flexibility.

BTC-3.13%

動區BlockTempo·6h ago

Bhutan deepens green Bitcoin strategy with Cumberland-backed infrastructure

Bhutan signed a multi-year memorandum of understanding (MoU) with crypto market maker Cumberland DRW to collaborate on building digital asset infrastructure in the Gelephu Mindfulness City (GMC), deepening the country’s long-term, sustainability-focused crypto strategy

In an announcement sent to C

BTC-3.13%

Cointelegraph·7h ago

2025 Bitcoin Market Forecast Highlights: Why Are Institutions Collapsing Collectively

At the beginning of 2025, the Bitcoin (BTC) market was filled with rampant optimism, with institutions and analysts collectively betting that the year-end price would surge to over $150,000, or even head towards $200,000+ or higher. However, reality unfolded a different story: BTC plummeted more than 33% from its peak of approximately $126,000 in early October, entered a "bloodbath" mode in November (a monthly decline of 28%), and as of December 10th, the current price stabilized in the $92,000 range.

This collective crash warrants an in-depth review: Why was the early-year prediction so unanimously optimistic? Why did almost all mainstream institutions get it wrong?

1. Early-Year Predictions vs. Current Situation Comparison

1.1 The Three Pillars of Market Consensus

At the beginning of 2025, the Bitcoin market was engulfed in unprecedented optimism. Almost all mainstream institutions set a year-end target price of over $150,000, with some...

BTC-3.13%

PANews·8h ago

What does the return of the Bart Simpson pattern in December mean for Bitcoin?

Bitcoin (BTC) price once again fell below the $90,000 support level over the past weekend, as intense volatility continued to dominate the market in December.

Many traders have noted

BTC-3.13%

TapChiBitcoin·8h ago

2025 Bitcoin Market Forecast Highlights: Why Are Institutions Collapsing Collectively

Author: Nikka, WolfDAO

At the beginning of 2025, the Bitcoin (BTC) market was filled with wild optimism, with institutions and analysts collectively betting that the year-end price would soar above $150,000, possibly heading towards $200,000+ or higher. However, reality played out a "counter" drama: BTC plummeted over 33% from its peak of approximately $126,000 in early October, entered a "bloodbath" mode in November (a 28% decline in a single month), and as of December 10th, the current price stabilizes around the $92,000 range.

This collective crash warrants an in-depth review: Why were the early predictions so consistent? Why did almost all mainstream institutions get it wrong?

1. Early Predictions vs. Current Situation

1.1 The Three Pillars of Market Consensus

At the beginning of 2025, the Bitcoin market was infused with unprecedented optimism. Almost all mainstream institutions

金色财经_·8h ago

Bitcoin investor loses retirement fund in AI-fueled romance scam

A Bitcoin investor lost his retirement savings to a “pig butchering” scam after ignoring repeated warnings from his advisory firm, according to an account shared by a Bitcoin wealth adviser.

Terence Michael, an adviser and author who works with The Bitcoin Adviser, said in a post on X that an

BTC-3.13%

Cointelegraph·9h ago

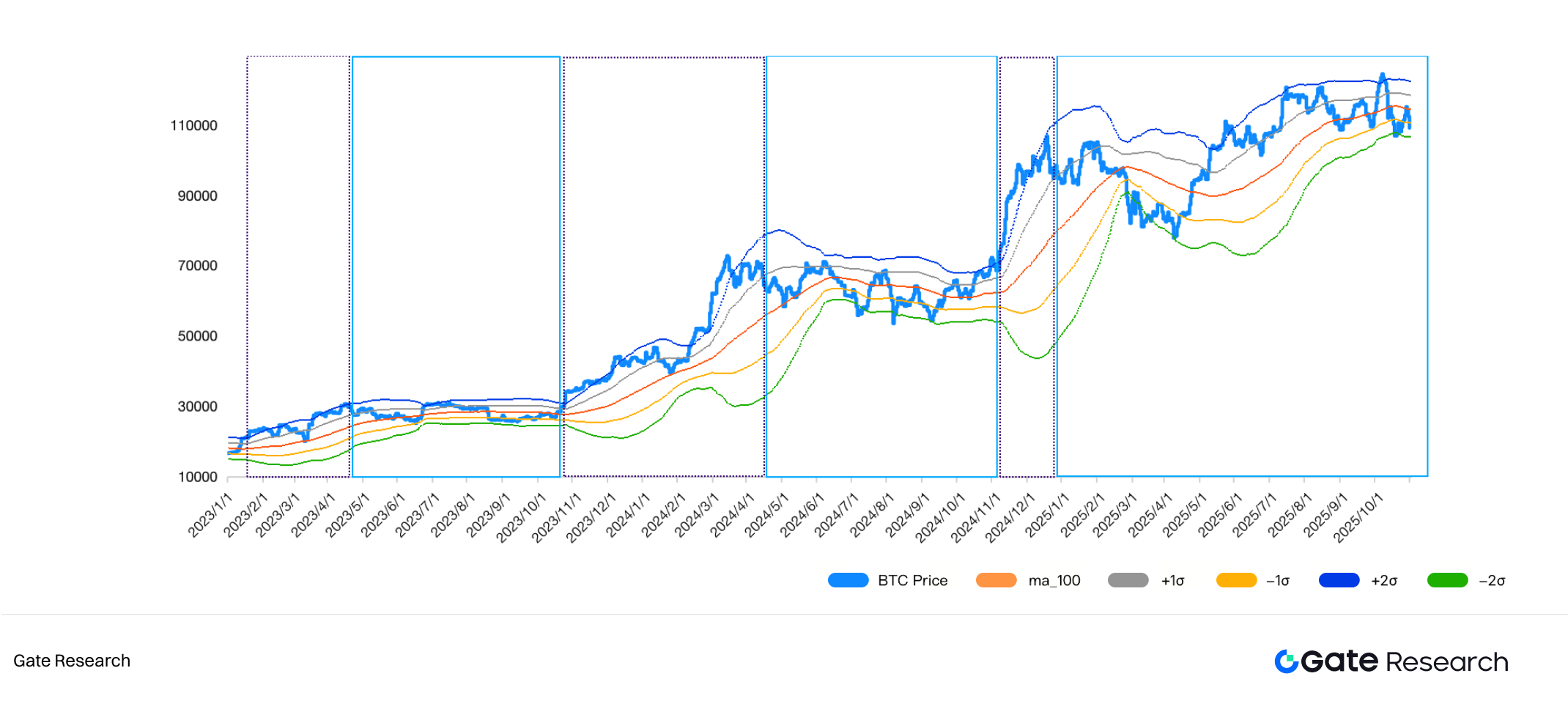

Gate Research Institute: Becoming an Options Seller, Bitcoin Dual-Currency Investment Trading Strategy

Summary

- Introduction to Dual-Currency Investment Mechanism: Dual-currency investment is a structured product centered around "holding coins for interest + conditional currency exchange." Investors receive a fixed return within the lock-up period. Whether to exchange currency upon maturity depends on whether the underlying asset price hits the preset target price. Essentially, investors sell short-term options through the platform, with returns derived from the conversion of option premiums. Dual-currency investments exhibit behaviors similar to option Greek letters and are productized return structures of "option premiums + principal lock-in compensation."

- Bitcoin Market Cycle Classification: The Bitcoin market is divided into bull markets, consolidation phases, and bear markets using technical indicators to illustrate the risk-return characteristics of dual-currency investments as "selling options" strategies in different cycles. The specific method uses MA100 and its ±1σ, ±2σ rolling standard deviations for visualization, showing that since 2023, the market has mainly been in a bull phase.

BTC-3.13%

GateResearch·10h ago

Price prediction for the top 3 cryptocurrencies: BTC, ETH, and XRP enter a sensitive phase at key technical levels

Bitcoin (BTC), Ethereum (ETH), and Ripple (XRP) are hovering around key technical levels in Monday's trading session, after a slight correction last week. The three largest market cap cryptocurrencies are facing the risk of deeper downward pressure, as signals indicate market movement.

TapChiBitcoin·10h ago

Market Liquidity Survey: Retail Investors "Buy Lottery Tickets" Amid Liquidity Deterioration, Major Players "Purchase Insurance"

Author: Frank, PANews

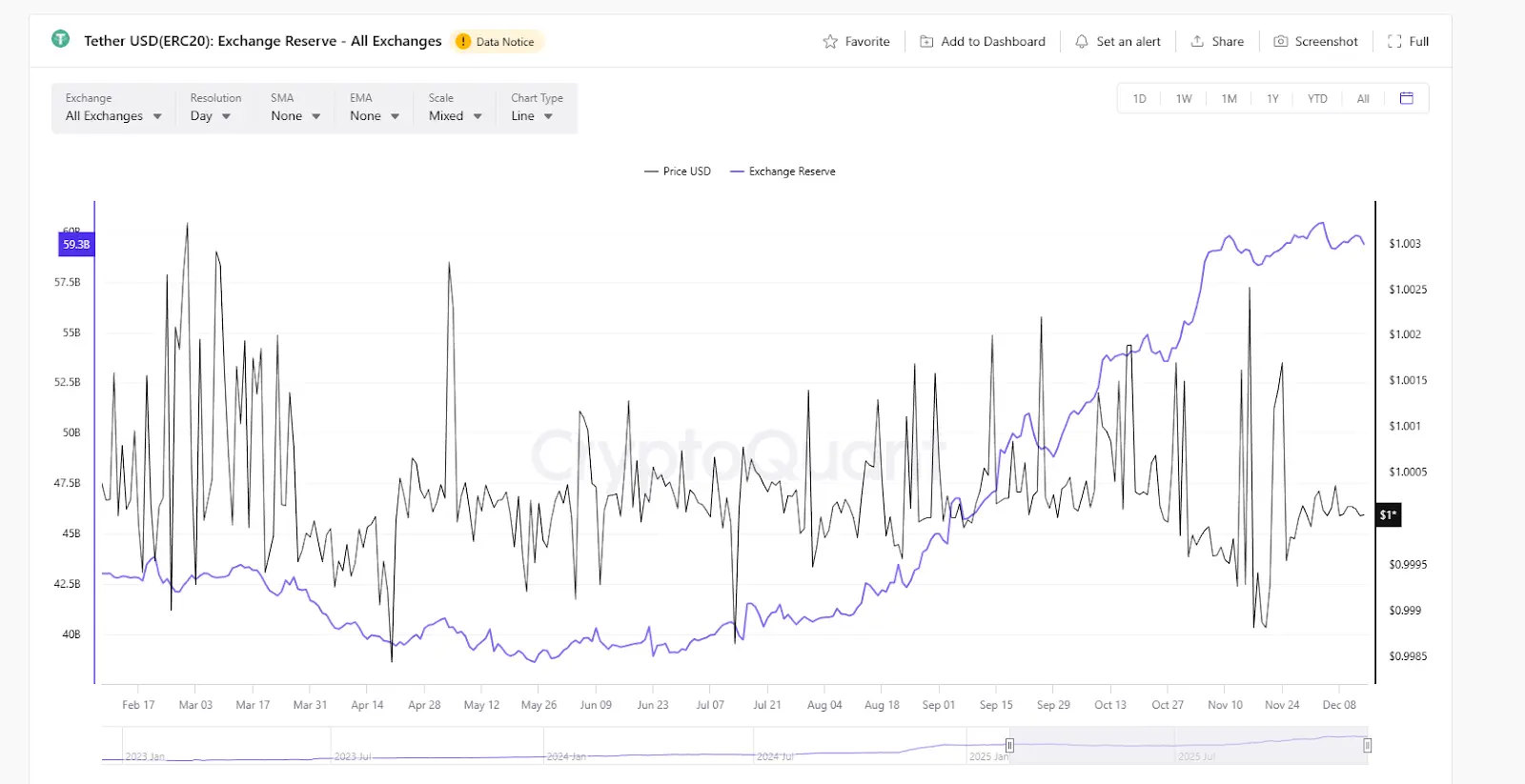

After experiencing a sharp decline on October 11th, the crypto market seems to have entered a long "calm period." For most investors, understanding how market liquidity has recovered since the heavy blow on 10.11 might be more important than predicting price movements. Additionally, how do the dominant market funds view the future trend?

In this regard, PANews attempts to analyze the current capital landscape of the market through data such as order book depth, options market, and stablecoins. The final conclusion is: the market does not appear to have truly recovered but is instead trapped in a structural split characterized by continuous liquidity decline and accelerated defensive positioning by institutional funds.

Micro Liquidity: Fragile Balance and Disappearing Support Orders

To understand the current liquidity situation, the order book depth difference is one of the most direct indicators that can explain the issue.

Using Binance

PANews·10h ago

Latest In-Depth Bitcoin Market Analysis Leaves One Analyst Expecting Bearish Targets Soon

A crypto analyst predicts Bitcoin could drop to $54,000-$60,000 by Q4 2026, despite current trading at around $89,000. He anticipates a long-term bull target of $550,000-$650,000 by 2030, amid worsening economic conditions.

CryptoNewsLand·11h ago

Small-cap tokens fall to four-year lows. Is the "Shanzhai Bull" completely hopeless?

Author: Gino Matos Translation: Luffy, Foresight News

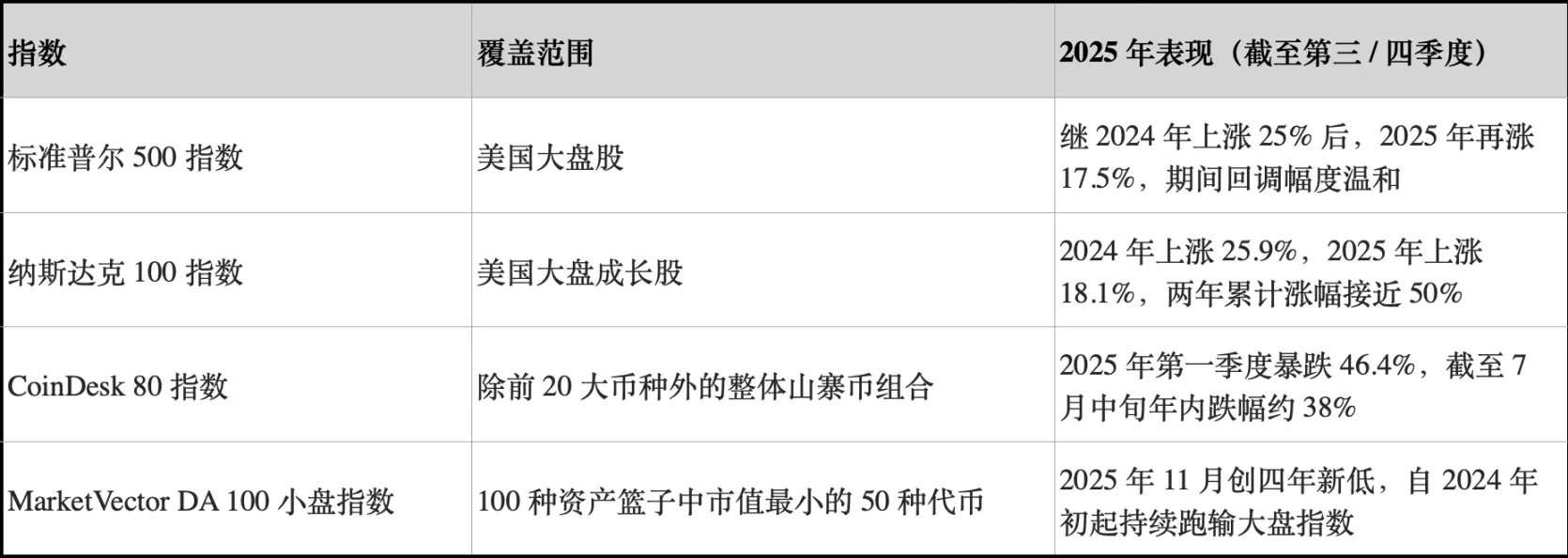

Since January 2024, the performance comparison between cryptocurrencies and stocks indicates that the so-called new "Shanzhai coin trading" is essentially just an alternative to stock trading.

In 2024, the S&P 500 index return is about 25%, and in 2025, it reaches 17.5%, with a two-year cumulative increase of approximately 47%. During the same period, the Nasdaq 100 index increased by 25.9% and 18.1%, respectively, with a cumulative gain of nearly 49%.

The CoinDesk 80 index, which tracks 80 assets outside the top 20 by cryptocurrency market cap, plummeted 46.4% in the first quarter of 2025 alone. As of mid-July, the year-to-date decline is about 38%.

By the end of 2025, MarketVe

金色财经_·12h ago

Trading Time: Super Central Bank Week Approaching, Bitcoin Faces Direction Choice; Short-term Requires Clear Breakthrough Signal

Daily Market Highlights and Trend Analysis, produced by PANews.

1. Market Observation

According to the latest analysis from Wall Street, the global economy and financial markets are undergoing profound structural changes. By 2026, the core risk facing the U.S. economy may shift from a traditional recession to an economic downturn directly caused by a stock market crash. Approximately 2.5 million people who retired early due to the stock market boom after the pandemic are a "surplus retirement" group whose consumption capacity is closely linked to stock market performance, forming a highly sensitive demand side for the market. The Federal Reserve is caught between combating stubborn inflation and maintaining financial stability. Analysts believe that the Fed may prioritize avoiding a market crash, tolerate higher inflation, and adopt aggressive rate cuts during economic weakness. Meanwhile, global central bank policies are becoming more divergent, with the Bank of Japan expected to raise interest rates by 25 basis points to 0.75% at the December 19 meeting, reaching a 30-year high, which may change the entire

PANews·13h ago

Middle East Capital Is Quietly Reshaping Bitcoin’s Liquidity Landscape

Bitcoin markets have previously reacted mainly to stories in North America and Europe, but now, with a greater focus on events in the Middle East, there is another underlying trend emerging. Because of changing expectations in international energy markets, oil-exporting countries are beginning to re

BTC-3.13%

Coinfomania·13h ago

Opendoor Bitcoin Homes Now Accepted for Real Estate Payments

Opendoor's decision to accept Bitcoin for home purchases marks a shift in real estate, enabling cryptocurrency transactions. This innovation could attract younger buyers, streamline processes, and signal a broader acceptance of crypto in everyday transactions, despite potential risks.

BTC-3.13%

Coinfomania·13h ago

The Case for Solana As Crypto’s Most Complete Chain After the “Bitcoin 3.0” Claim

Justin Bons stirred debate again with a long post arguing that Solana represents a technological step beyond Bitcoin. His claim is bold but familiar. Strip away the emotion, and the argument rests on measurable differences rather than price action or narratives.

Bons frames Solana as “Bitcoin 3.0,”

CaptainAltcoin·13h ago

What Is MicroStrategy's Status in the Nasdaq 100? Bitcoin Holdings Secure Its Spot Amid Debate

MicroStrategy (MSTR)—widely known as the largest corporate Bitcoin holder—successfully retained its position in the Nasdaq 100 index (.NDX) during the annual rebalancing review, extending its year-long inclusion in the benchmark.

BTC-3.13%

CryptopulseElite·14h ago

What Is Happening with Bitcoin Institutional Holdings? Why Has BTC Dropped Below $100K?

Institutional demand for Bitcoin (BTC) has indeed surged over the past two years, driven by greater regulatory clarity—particularly in the U.S. with spot ETF approvals—and its perceived role as an inflation hedge amid macroeconomic shifts.

BTC-3.13%

CryptopulseElite·14h ago

Gate Research Institute: Mainstream coins fluctuate at low levels | Options selling pressure continues to suppress BTC upward movement

Cryptocurrency Asset Overview

BTC (-2.01% | Current price 88,558.7 USDT)

In the past 24 hours, BTC has fallen from above $90,000 to a low of $87,581, showing an overall weak downward trend. In the short term, it is in a low-volatility consolidation phase after technical oversold conditions. MA5 < MA10 < MA30, a typical bearish alignment, indicating that market sentiment remains weak; meanwhile, the price continues to stay below MA30, demonstrating that both short-term and medium-term trends are dominated by bears. During the decline, trading volume did not significantly increase, suggesting sustained selling pressure rather than panic selling, but bullish buying has not yet appeared prominently. Short-term traders can watch for support signals in the $87,500–$88,000 range; if $87,500 is effectively broken, the price may decline further to the $86,500–$86,000 zone.

GateResearch·14h ago

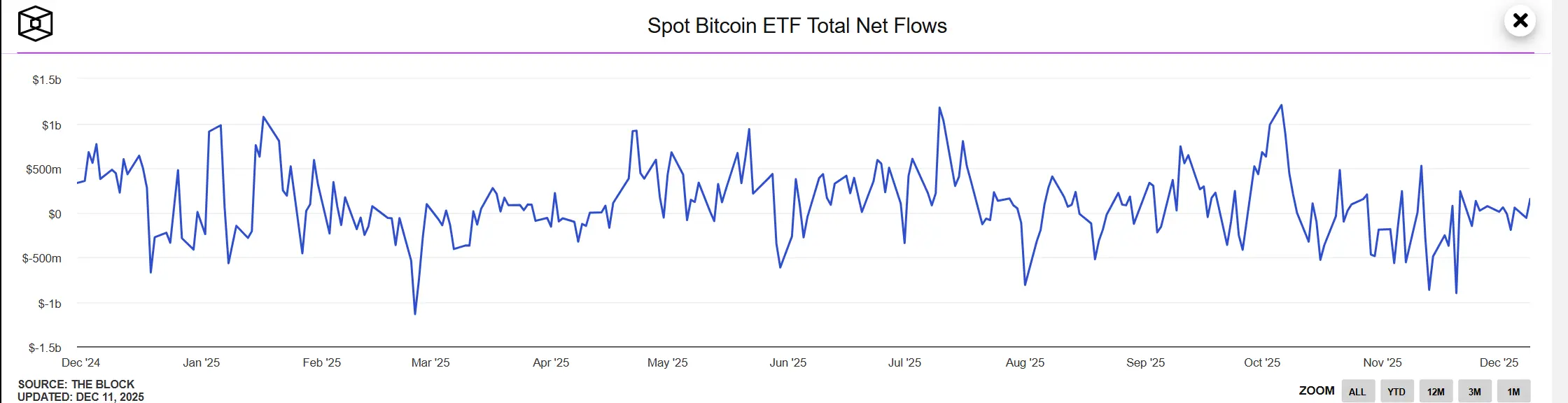

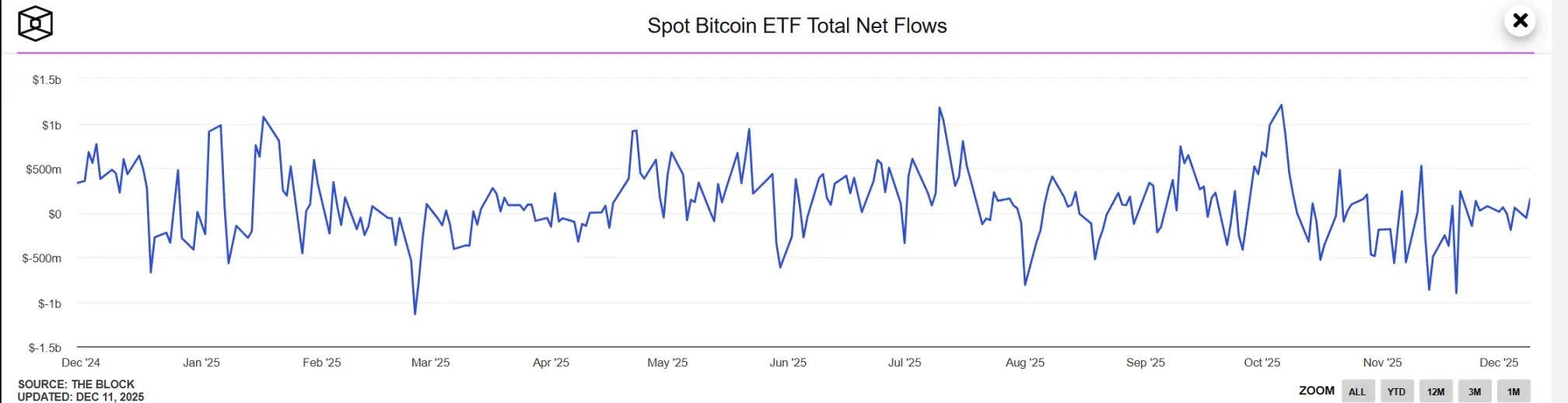

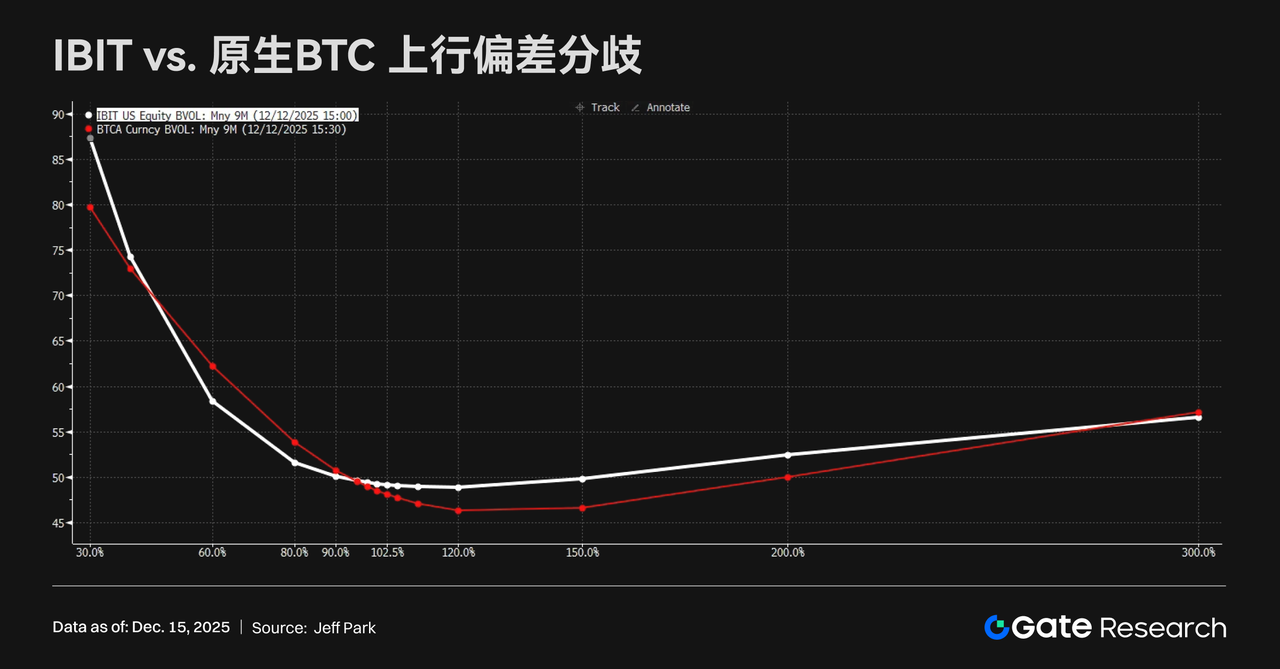

Gate Research Institute: Market Under Pressure and Consolidation | BTC Upward Momentum Restricted by Options Structure

Gate Research Institute Daily Report: December 15 — The overall crypto market continues to face pressure, with BTC and ETH maintaining low-level consolidation, while GT shows relative resilience. Under the weak performance of mainstream coins, tokens such as FHE, ICE, and BAS have reversed trends and strengthened amid catalysts like privacy computing collaborations with Chainlink, token migrations and mainnet transitions, as well as ERC-8004 protocol upgrades, reflecting a concentrated battle for structural opportunities among funds. The structural selling pressure in the options market still suppresses BTC upside momentum. The divergence between ETF bullish demand and OG holders selling volatility suggests that BTC is more likely to remain in short-term consolidation rather than make rapid breakthroughs; Ant International is reconstructing corporate treasury management systems through blockchain, AI, and tokenized deposits; after the mainnet launch of Stable, on-chain activity has been below expectations, highlighting ongoing challenges for the differentiated implementation of stablecoin public chains.

GateResearch·14h ago

Institutional Demand Stays Strong as Bitcoin, Ethereum, Solana, ETFs Add $530M

Institutional demand for crypto stayed strong last week. From December 8 to December 12, spot ETFs tracking Bitcoin, Ethereum, and Solana pulled in a combined $530 million. The steady inflows came despite choppy prices and cautious market sentiment

Bitcoin led the pack. U.S. spot Bitcoin ETFs

Coinfomania·14h ago

Has the Halving Narrative Ended? 10x Research, Cathie Wood, and Arthur Hayes Debate the Life and Death of Bitcoin's Four-Year Cycle

The narrative of Bitcoin's classic "four-year halving cycle" is facing unprecedented challenges. Recently, influential analysts such as Markus Thielen, Head of 10x Research, Cathie Wood, CEO of ARK Invest, and Arthur Hayes, co-founder of BitMEX, have spoken out, believing that the core driving forces behind the cycle have undergone a fundamental shift. They point out that with the advent of spot ETFs bringing in massive institutional funds, Bitcoin's market structure has been completely transformed. Its price volatility is now more closely tied to global liquidity, the US election cycle, and macroeconomic policies rather than solely to supply halving events. This ongoing debate about whether the "cycle is dead" marks Bitcoin's shift from an exclusively tech-driven scarcity experiment to an accelerated integration into the pricing logic of global macro assets.

BTC-3.13%

MarketWhisper·14h ago

Bitcoin (BTC) To Soar Higher? Key Pattern Formation Suggests Potential Upside Move

Date: Mon, Dec 15, 2025 | 05:10 AM GMT

The cryptocurrency market is attempting to stabilize after weekend volatility dragged Bitcoin (BTC) down to a low of $87,634 before buyers stepped in. Over the past 24 hours, BTC has rebounded above the $89,600 mark, signaling early signs of

BTC-3.13%

CoinsProbe·14h ago

Cathie Wood Ranks Her Top Crypto Winners for the Next 3–5 Years: BTC, ETH, SOL

Bitcoin leads due to liquidity, institutional adoption, and declining volatility.

Ethereum attracts institutions building scalable, structured blockchain infrastructure.

Solana targets consumers with speed, simplicity, and direct real-world usage.

Cathie Wood has never shied away from bold

CryptoNewsLand·15h ago

66% of 2025 BTC Short-Term Holders in Profit – Surprising Market Insight

Bitcoin Short-Term Holders Maintain Profits Despite Negative Year-to-Date Performance

Despite Bitcoin’s significant decline this year, with prices struggling to sustain above $100,000 and registering negative returns, short-term holders have demonstrated resilience by remaining profitable for the m

BTC-3.13%

CryptoBreaking·15h ago

Shanzhai Season Index drops to a new low. Has the market really changed?

Over the past year, the cryptocurrency market has shown a stark contrast to the US stock market. The S&P 500 and Nasdaq 100 indices have gained 47% and 49% respectively over two years, while the Altcoin index has been deeply in a downtrend. The crypto market is now experiencing a structural shift as capital concentrates into high-quality assets.

The S&P 500 is projected to rise by 25% and 17.5% in 2024 and 2025 respectively, with the Nasdaq 100 increasing by 25.9% and 18.1% during the same period, and the maximum drawdown is only around 15%.

In contrast, the altcoin market saw the CoinDesk 80 Index (tracking 80 cryptocurrencies outside the top 20) plummet by 46.4% in the first quarter of 2025, and as of mid-July, it has declined by 38% since the beginning of the year.

The MarketVector Digital Asset 100 Small Cap Index even fell to its lowest point since November 2020 by the end of 2025, with the total crypto market capitalization evaporating over $1 trillion.

This反

金色财经_·15h ago

Load More

Hot Tags

Hot Topics

MoreCrypto Calendar

MoreHayabusa Yükseltmesi

VeChain, Aralık ayında planlanan Hayabusa yükseltmesini duyurdu. Bu yükseltmenin, protokol performansını ve tokenomi'yi önemli ölçüde artırmayı hedeflediği belirtiliyor ve ekip, bu güncellemeyi bugüne kadarki en çok fayda odaklı VeChain sürümü olarak nitelendiriyor.

2025-12-27

Litewallet Gün Batımları

Litecoin Vakfı, Litewallet uygulamasının 31 Aralık'ta resmi olarak sona ereceğini duyurdu. Uygulama artık aktif olarak korunmamakta olup, bu tarihe kadar yalnızca kritik hata düzeltmeleri yapılacaktır. Destek sohbeti de bu tarihten sonra sona erecektir. Kullanıcıların Nexus Cüzdan'a geçiş yapmaları teşvik edilmektedir; Litewallet içinde geçiş araçları ve adım adım bir kılavuz sağlanmıştır.

2025-12-30

OM Token Göçü Sona Erdi

MANTRA Chain, kullanıcıları OM token'larını 15 Ocak'tan önce MANTRA Chain ana ağına taşımaları için bir hatırlatma yayınladı. Taşıma işlemi, $OM'nin yerel zincirine geçişi sırasında ekosistemdeki katılıma devam edilmesini sağlar.

2026-01-14

CSM Fiyat Değişikliği

Hedera, Ocak 2026'dan itibaren KonsensüsSubmitMessage hizmeti için sabit USD ücretinin $0.0001'den $0.0008'e yükseleceğini duyurdu.

2026-01-27

Vesting Kilidi Gecikti

Router Protocol, ROUTE tokeninin Hakediş kilidinin 6 aylık bir gecikme ile açılacağını duyurdu. Ekip, projenin Open Graph Architecture (OGA) ile stratejik uyum sağlamak ve uzun vadeli ivmeyi koruma hedefini gecikmenin başlıca nedenleri olarak belirtiyor. Bu süre zarfında yeni kilit açılımları gerçekleşmeyecek.

2026-01-28