Xamanap

No content yet

xamanap

gm☕️ im tired boss 😮💨

- Reward

- like

- Comment

- Repost

- Share

whale exchange inflows have dried up fast. after the November panic, large holders stopped sending size to .

selling pressure from whales has materially eased, with flows down roughly 3x.

this looks more like waiting and absorbing, not active distribution.

selling pressure from whales has materially eased, with flows down roughly 3x.

this looks more like waiting and absorbing, not active distribution.

- Reward

- like

- Comment

- Repost

- Share

VIX gap up🤔

- Reward

- like

- Comment

- Repost

- Share

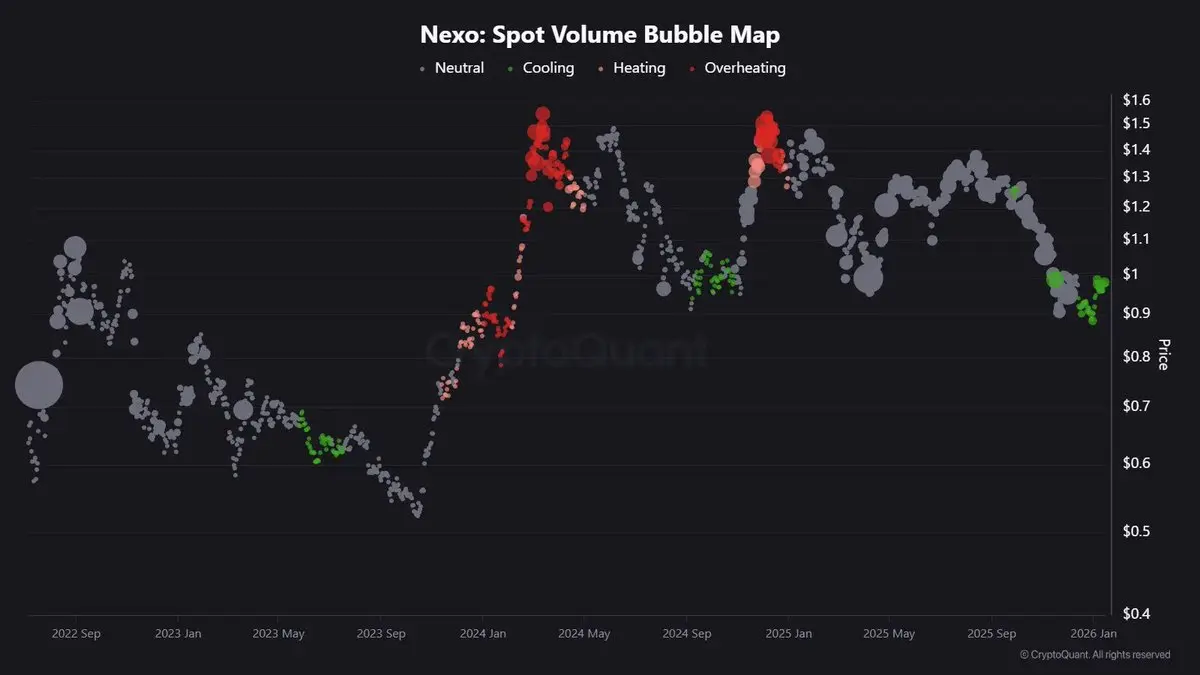

spot volume has cooled off and the froth is gone. smart money accumulating is quietly.

- Reward

- like

- Comment

- Repost

- Share

gm☕️ enjoy the w

- Reward

- like

- Comment

- Repost

- Share

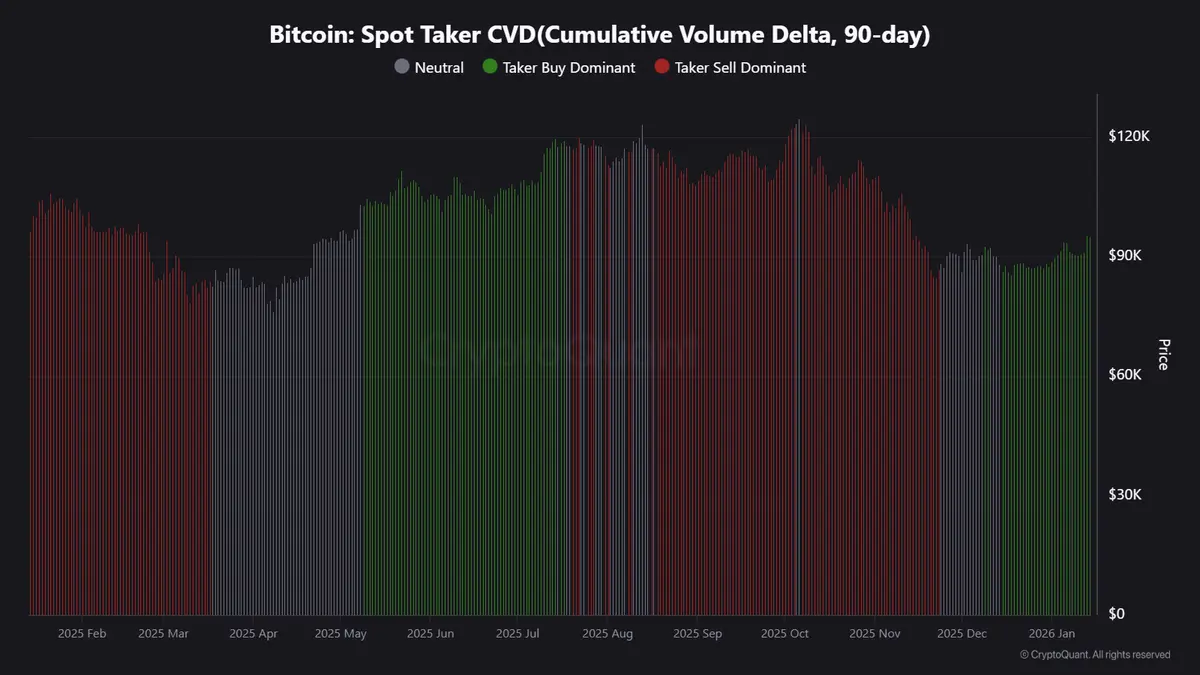

spot led this move, not leverage.

BTC spot taker Cumulative Volume Delta flipped positive near 86k and stayed there, with whale-sized spot orders stepping in first. futures and retail followed later, mostly on leverage.

not a crowd chase, but larger spot buyers setting the pace.

BTC spot taker Cumulative Volume Delta flipped positive near 86k and stayed there, with whale-sized spot orders stepping in first. futures and retail followed later, mostly on leverage.

not a crowd chase, but larger spot buyers setting the pace.

BTC0,66%

- Reward

- like

- Comment

- Repost

- Share

historically, this STH behavior aligns with what has previously marked BTFD zone.

short-term holders are still underwater. retail keeps selling red into volatility as STH SOPR stays below 1.

price structure hasn’t broken yet, and fear is doing it's work, chop chop!

short-term holders are still underwater. retail keeps selling red into volatility as STH SOPR stays below 1.

price structure hasn’t broken yet, and fear is doing it's work, chop chop!

- Reward

- like

- Comment

- Repost

- Share

me watching my team play every time. lfg #BillsMafia

- Reward

- like

- Comment

- Repost

- Share

insane NFL playoffs game yesterday, lets hope for the same today 🙏🏼💪🏽#BillsMafia

- Reward

- like

- Comment

- Repost

- Share

glad took most of the day off, so lame price action.

- Reward

- like

- Comment

- Repost

- Share