We have always been chasing several times or even dozens of times annualized returns. I remember in 2021, when I first came into contact with position arbitrage, quantitative trading, and institutional portfolio allocation, I would always listen quietly, taking the perspective of an audience member during conversations with them. The annualized return they expected was only 5-20%. When I heard that, I actually wanted to mock them in my heart—damn, with such low returns, are there really any clients willing to give you their money? Even a pig would do better just buying and playing on their own

View OriginalTomorrowInvestmentDiar

No content yet

TomorrowInvestmentDiar

When I go out, I carry two packs of cigarettes in my pocket;

On the left, when I'm alone, I smoke by myself;

On the right, when everyone's hanging out together, everyone smokes;

Nothing wrong with that!

View OriginalOn the left, when I'm alone, I smoke by myself;

On the right, when everyone's hanging out together, everyone smokes;

Nothing wrong with that!

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

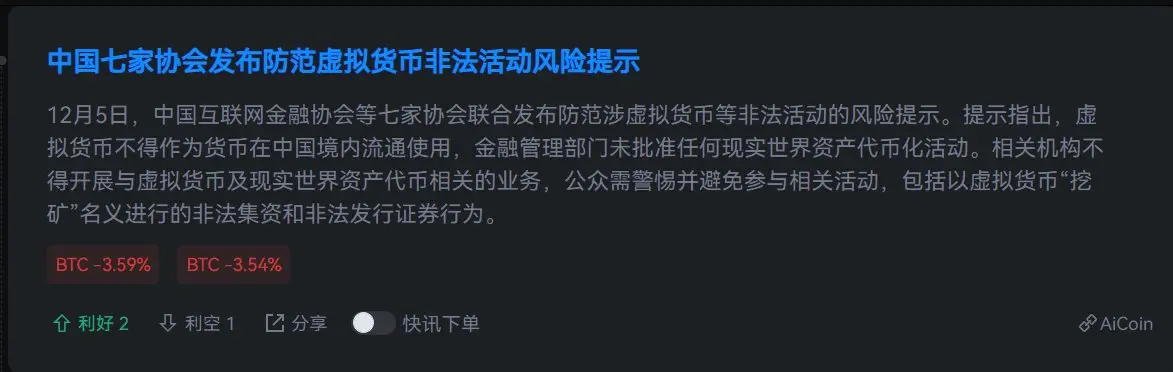

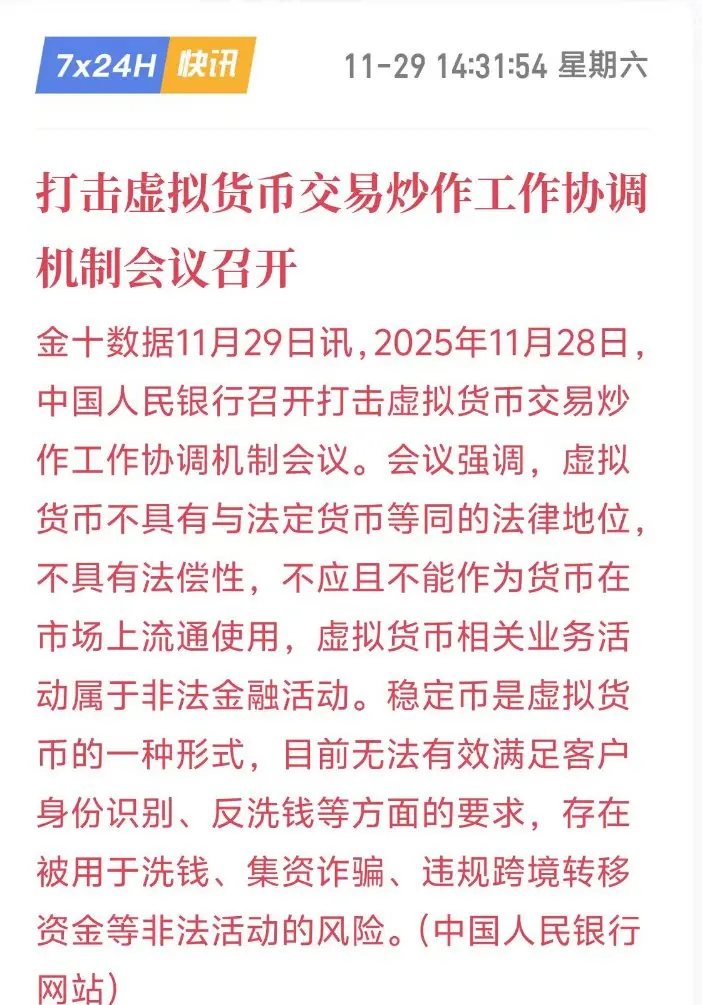

If we're not allowed to do it, we absolutely won't do it. The crackdown is still ongoing.

View Original

- Reward

- like

- Comment

- Repost

- Share

After reading the latest annual report of Tiger Brokers, it's clear that crypto conversion to US and Hong Kong stocks has become a popular growth area for brokerages;

However;

Hong Kong cards opened by Chinese people overseas for trading foreign stocks are also gradually being frozen. Brothers, take care—A-shares are our last safe haven;

Recommend a few A-shares, and the Captain will follow your lead;

View OriginalHowever;

Hong Kong cards opened by Chinese people overseas for trading foreign stocks are also gradually being frozen. Brothers, take care—A-shares are our last safe haven;

Recommend a few A-shares, and the Captain will follow your lead;

- Reward

- like

- Comment

- Repost

- Share

The only two narratives left in the crypto space are: BTC hyped as digital gold, and the expansion of stablecoins. That's it. RAW, which you all have been longing for, was actually hyped back in 2017 but ended in failure. As for stablecoins, who can benefit from this trend? Please help me analyze.

BTC0.58%

- Reward

- like

- Comment

- Repost

- Share

Today I was chatting with a friend in Beijing, and he told me that in the current crypto space, even quant trading can’t operate anymore. A year ago, we discussed that it was still possible to make a 5% profit per quarter, but since May this year, there have been losses for four consecutive quarters. The only strategy still running is BTC, but the funds have been withdrawn as well. People are still hoping for an altcoin bull market or a rebound, but even the liquidity market makers have disappeared. This shows just how brutal the crypto industry has become.

BTC0.58%

- Reward

- like

- Comment

- Repost

- Share

Sharing is only suitable for those who resonate on the same frequency. Sharing across classes is purely nonsense. If someone can truly manage their own time, agreeing with your investment mindset and following your investment philosophy indicates that you are on the same frequency. They have already entered a state of financial freedom. A normal and positive person knows to learn by themselves; they don't need you to teach them, and you can't teach them. We don't coerce anyone, nor do we speak of wealth secrets. We only share with those on the same frequency. As long as it's su

View Original- Reward

- like

- Comment

- Repost

- Share

You said to him: Learning, apart from the past, is the best time in the present.

You said to him: Buffett, Duan Yongping's investment thinking;

You said to him: You need to get rid of some XXX bad habits and start being self-disciplined;

You said to him: When you fall down, don't be discouraged, get up and try again;

He said to you, "Bro, I work 10 hours a day, then I have to go home to take care of the kids, do laundry for my wife, cook, and after that, I have to help the kids with their homework. I know this is the best time to learn, I know about Buffett and Duan Yongping's inve

View OriginalYou said to him: Buffett, Duan Yongping's investment thinking;

You said to him: You need to get rid of some XXX bad habits and start being self-disciplined;

You said to him: When you fall down, don't be discouraged, get up and try again;

He said to you, "Bro, I work 10 hours a day, then I have to go home to take care of the kids, do laundry for my wife, cook, and after that, I have to help the kids with their homework. I know this is the best time to learn, I know about Buffett and Duan Yongping's inve

- Reward

- like

- Comment

- Repost

- Share

We anticipated this situation in September, and it is impossible for us to embrace it. Since we are not allowed to touch it, let's not touch it. Sell all the coins and comfortably go back to A-shares to play.

View Original

- Reward

- like

- Comment

- Repost

- Share

In the financial market, very few people do not use leverage, but pros really don’t use leverage; one is never satisfied, and the other is always content.

View Original- Reward

- like

- Comment

- Repost

- Share

The end of 2025 is approaching, and the crypto market is in a fall in 2025, while the US stock market still has a 40% profit to date. If one stubbornly invests in encryption, by the end of this year, the new year's money won't even be available.

Where there is liquidity, there is opportunity. One must not be stubborn; they are all branches of finance, and they are interconnected.

View OriginalWhere there is liquidity, there is opportunity. One must not be stubborn; they are all branches of finance, and they are interconnected.

- Reward

- like

- Comment

- Repost

- Share

What a load of crap, I bought the dip on CRC at 66, but I don't plan to increase the position, even though I've made a 20% profit, it takes at least 1-2 months to confirm its bottom;

View Original

- Reward

- like

- Comment

- Repost

- Share

The only hard currency in the crypto market is BTC. I don't want to analyze the short-term BTC trend anymore, because even if BTC falls to 20,000 USD, my brothers will still think it's too expensive to buy. The only time you can exchange the most amount of BTC is when you first enter this industry and see the price of BTC. Human nature only remembers past highs, and once you can no longer buy back that amount, you will never buy again. Everything else besides BTC is just garbage.

BTC0.58%

- Reward

- like

- Comment

- Repost

- Share

The only two stocks in Chinese concept stocks that you can hold for three to five years and sleep soundly with a Heavy Position are Tencent and Alibaba, and there are no others; (of course, the entry point must be appropriate);

The only ones in the Shanghai Stock Exchange that can allow you to take a Heavy Position and sleep peacefully are the four major banks: Industrial, Agricultural, Construction, and Communication; (of course, the entry point must be appropriate);

2 to 5 years, continuously looking for new highs;

This is the core asset of the villagers;

View OriginalThe only ones in the Shanghai Stock Exchange that can allow you to take a Heavy Position and sleep peacefully are the four major banks: Industrial, Agricultural, Construction, and Communication; (of course, the entry point must be appropriate);

2 to 5 years, continuously looking for new highs;

This is the core asset of the villagers;

- Reward

- like

- Comment

- Repost

- Share

Today I want to share with you a trading variable term: (structural premium)

Structural premium arises from two aspects;

A market consensus point, a technical K-line point, due to commonality there is reflexivity, resulting in a premium expectation for these points.

The premium generated by the market due to FOMO or excessive panic.

Whether it's A or B, exceeding a portion of market expectations is called structural premium. This portion of the premium may be caused by retail investor sentiment, or it may be because the market purely aims to harvest chips from one side.

If it is A, it is g

View OriginalStructural premium arises from two aspects;

A market consensus point, a technical K-line point, due to commonality there is reflexivity, resulting in a premium expectation for these points.

The premium generated by the market due to FOMO or excessive panic.

Whether it's A or B, exceeding a portion of market expectations is called structural premium. This portion of the premium may be caused by retail investor sentiment, or it may be because the market purely aims to harvest chips from one side.

If it is A, it is g

- Reward

- like

- Comment

- Repost

- Share

9:10 AM, SPCAE content; (Market depersonalization, encryption disappearing cycle bull)

View Original- Reward

- like

- Comment

- Repost

- Share

In May 2024, I mentioned the liquidity issue for the first time.

In November 2025, I mentioned the issue of de-retailization for the first time.

The issue of de-risking retail investors is not something that has just started; looking back, we see that it is already too late.

Decentralization is also a manifestation of a mature financial sector, and both A-shares and cryptocurrencies are experiencing decentralization.

View OriginalIn November 2025, I mentioned the issue of de-retailization for the first time.

The issue of de-risking retail investors is not something that has just started; looking back, we see that it is already too late.

Decentralization is also a manifestation of a mature financial sector, and both A-shares and cryptocurrencies are experiencing decentralization.

- Reward

- like

- Comment

- Repost

- Share

In May 2024, I mentioned the liquidity issue for the first time;

In November 2025, I mentioned the issue of retail disintermediation for the first time.

View OriginalIn November 2025, I mentioned the issue of retail disintermediation for the first time.

- Reward

- like

- Comment

- Repost

- Share

Recently, I have been trying to find the undervalued zones in the US stock market. The sectors related to AI, such as electricity, chips, storage, and energy storage, are basically all at high levels. The only sector that is expected to perform poorly in 2025 is the pharmaceutical zone. Apart from Johnson & Johnson and Eli Lilly, which have been continually hitting new highs, others have basically fallen for an entire year. The price-to-earnings ratio is generally around 10-15 times, but I really don't understand this industry.

However, the movement of this zone made me understand a phenom

However, the movement of this zone made me understand a phenom

BTC0.58%

- Reward

- like

- Comment

- Repost

- Share

The crypto market led by BTC continues to bleed, with over 25 billion positions in liquidity drained from the futures market due to liquidation since 2025. Retail investors have even lost the money to increase their positions, and the market has truly entered a phase of taking a break, stop loss, and recuperation.

Come on, crypto friends, get liquidated early or late, it's a matter of time;

Come on, crypto friends, get liquidated early or late, it's a matter of time;

BTC0.58%

- Reward

- like

- Comment

- Repost

- Share