Ninisweet

No content yet

Ninisweet

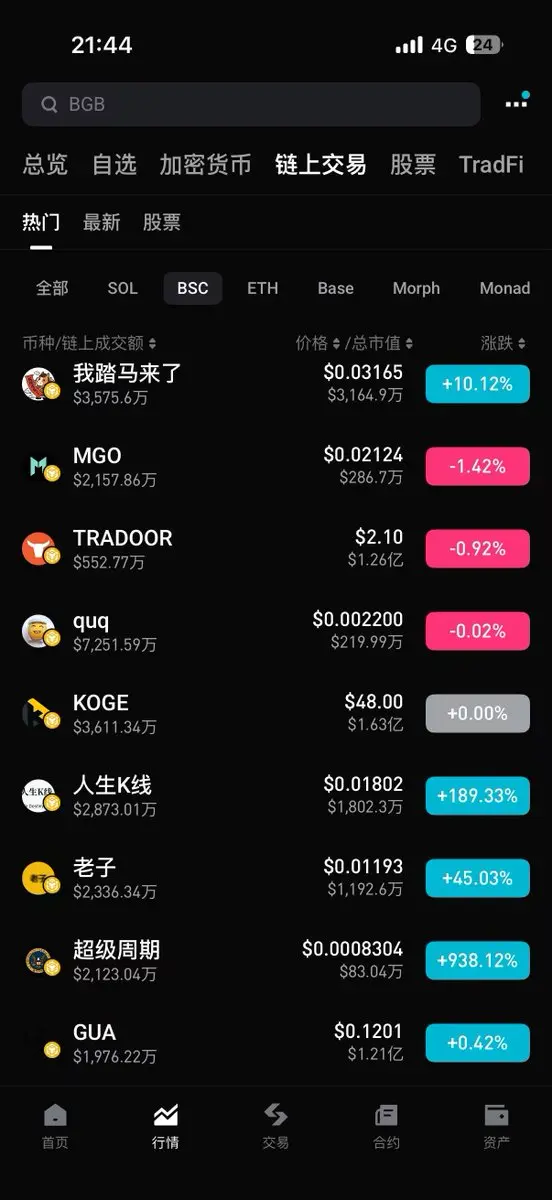

This.\n\nJust about to say I missed today's Golden Dog\n\nHow did it just crash directly\n#bsc #memes

View Original

- Reward

- like

- Comment

- Repost

- Share

Yesterday, the NYSE officially announced that Wall Street is actually going on-chain.

This could be the most important signal in the crypto world in 2026.

The NYSE and its parent company ICE officially announced that they are developing a tokenized securities trading platform, which has already been submitted to the SEC for approval.

This platform offers 24/7 trading + instant settlement, so you can buy NVIDIA in the middle of the night or bottom out on weekends. Traditional US stocks require T+1 to access funds, but on-chain US stocks settle in seconds.

Fragmented trading + stablecoin payment

View OriginalThis could be the most important signal in the crypto world in 2026.

The NYSE and its parent company ICE officially announced that they are developing a tokenized securities trading platform, which has already been submitted to the SEC for approval.

This platform offers 24/7 trading + instant settlement, so you can buy NVIDIA in the middle of the night or bottom out on weekends. Traditional US stocks require T+1 to access funds, but on-chain US stocks settle in seconds.

Fragmented trading + stablecoin payment

- Reward

- like

- Comment

- Repost

- Share

Seeing the SEC delay two more crypto ETF decisions

One is the $PENGU filed by Cboe, and the other is the T. Rowe Price actively managed crypto ETF filed with NYSE.

The SEC's reason is very official, requiring more time to evaluate, extending the decision period by 45 days.

In fact, it just means the SEC hasn't decided how to handle it yet. Previously, spot Bitcoin and Ethereum ETFs were approved, and the market once thought the door to crypto ETFs was open.

But it now appears that the SEC's approval pace remains cautious, especially for this type of actively managed crypto ETF, which involves

View OriginalOne is the $PENGU filed by Cboe, and the other is the T. Rowe Price actively managed crypto ETF filed with NYSE.

The SEC's reason is very official, requiring more time to evaluate, extending the decision period by 45 days.

In fact, it just means the SEC hasn't decided how to handle it yet. Previously, spot Bitcoin and Ethereum ETFs were approved, and the market once thought the door to crypto ETFs was open.

But it now appears that the SEC's approval pace remains cautious, especially for this type of actively managed crypto ETF, which involves

- Reward

- like

- Comment

- Repost

- Share

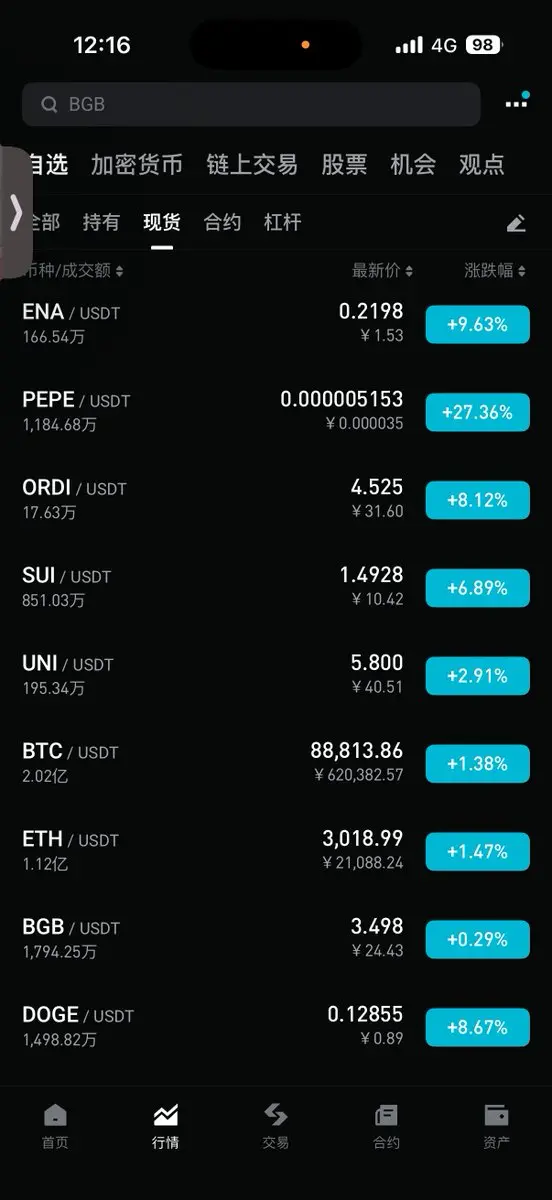

#bsc Everyone has been pumping for two days, and now it seems like everyone is pulling back.

Do you still have any 😐 left?

View OriginalDo you still have any 😐 left?

- Reward

- like

- Comment

- Repost

- Share

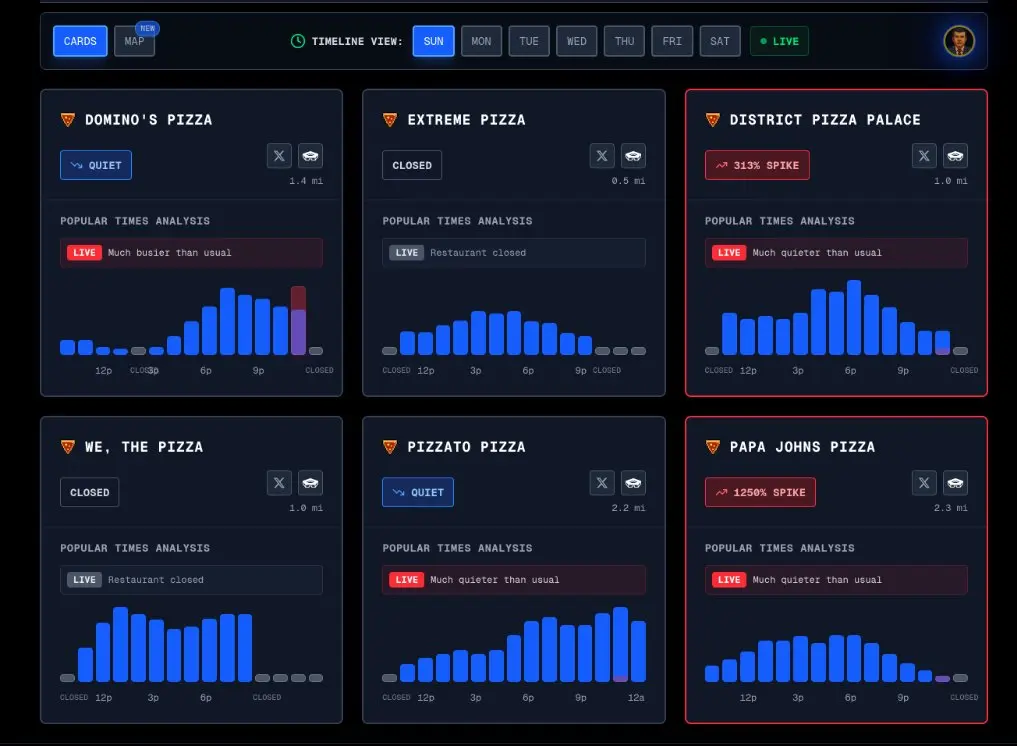

Pizza shop near the Pentagon sees a 1250% surge in foot traffic?

Historically, every time the "Pizza Index" soars, it means people at the Pentagon are working overnight. Before the Iraq War, before the Russia-Ukraine conflict erupted, and when Maduro was arrested, the pattern was the same.

Now it's happening again—what big news is about to break?

The Pizza Index feels like a modern-day war warning.

View OriginalHistorically, every time the "Pizza Index" soars, it means people at the Pentagon are working overnight. Before the Iraq War, before the Russia-Ukraine conflict erupted, and when Maduro was arrested, the pattern was the same.

Now it's happening again—what big news is about to break?

The Pizza Index feels like a modern-day war warning.

- Reward

- like

- Comment

- Repost

- Share

I saw some data indicating that the proportion of individual investors holding coins is decreasing, while the shares of institutions and ETFs are increasing.

The US government has reduced 9,177 coins $BTC , and retail investors' confidence is also waning.

This trend makes me think of one thing: when retail investors panic and flee, it's often institutions quietly accumulating.

BlackRock's iShares added 210,000 BTC in a year, and Strategy also added 220,000.

Of course, they are not fools. They gradually build positions when retail investors are panicking.

Could this be another classic case of “

The US government has reduced 9,177 coins $BTC , and retail investors' confidence is also waning.

This trend makes me think of one thing: when retail investors panic and flee, it's often institutions quietly accumulating.

BlackRock's iShares added 210,000 BTC in a year, and Strategy also added 220,000.

Of course, they are not fools. They gradually build positions when retail investors are panicking.

Could this be another classic case of “

BTC-1,35%

- Reward

- like

- Comment

- Repost

- Share

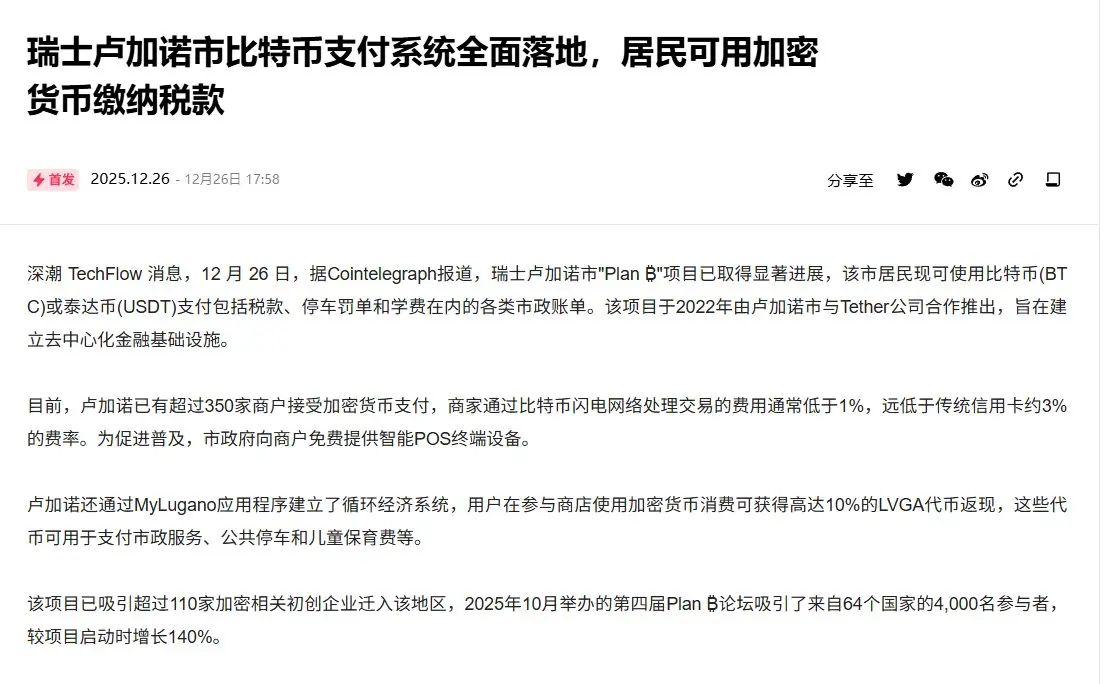

Unexpectedly, in Lugano, Switzerland, paying taxes with $BTC has become a daily operation.

Over 300 merchants support cryptocurrency payments, which can be used for taxes, parking fees, and tuition.

The transaction fees are more than half lower than credit cards, and consumers earn a 10% token cashback. Since 2022, the number of participating merchants has increased by 140%.

This is not a pilot program or a concept; it is truly implemented citywide.

Seeing this news, I suddenly remembered another recent story: New Zealand announced that starting in 2027, cryptocurrencies and blockchain will b

Over 300 merchants support cryptocurrency payments, which can be used for taxes, parking fees, and tuition.

The transaction fees are more than half lower than credit cards, and consumers earn a 10% token cashback. Since 2022, the number of participating merchants has increased by 140%.

This is not a pilot program or a concept; it is truly implemented citywide.

Seeing this news, I suddenly remembered another recent story: New Zealand announced that starting in 2027, cryptocurrencies and blockchain will b

BTC-1,35%

- Reward

- like

- Comment

- Repost

- Share

Trust Wallet hundreds of user wallets emptied overnight, millions lost.

Hackers embedded malicious code in the plugin, updated on December 24th, and started harvesting on Christmas Day, December 25th.

You think you're protecting your assets, but actually you're just waiting to be caught.

Among these victims, how many chose Trust Wallet because they believed "decentralization = security"?

As a result, trust was given to others, and wallets were handed over to hackers.

Good news is, CZ has already promised to compensate affected users.

If you used Trust Wallet browser plugin version 2.68, even i

View OriginalHackers embedded malicious code in the plugin, updated on December 24th, and started harvesting on Christmas Day, December 25th.

You think you're protecting your assets, but actually you're just waiting to be caught.

Among these victims, how many chose Trust Wallet because they believed "decentralization = security"?

As a result, trust was given to others, and wallets were handed over to hackers.

Good news is, CZ has already promised to compensate affected users.

If you used Trust Wallet browser plugin version 2.68, even i

- Reward

- like

- Comment

- Repost

- Share

The domestic regulation of Web3 is becoming increasingly strict, especially regarding deposits and withdrawals. Everyone should be able to feel this.

Cases of C2C accounts being frozen or blocked happen almost every day, and I also had friends who got caught before.

So in the past six months, I have mainly been using the BG Wallet's U card.

I recently tested it out, and the exchange rate was even slightly better than C2C, which was quite surprising at the time.

But besides the exchange rate, there are many other benefits: directly linking Alipay for spending, eliminating the risk of receiving

View OriginalCases of C2C accounts being frozen or blocked happen almost every day, and I also had friends who got caught before.

So in the past six months, I have mainly been using the BG Wallet's U card.

I recently tested it out, and the exchange rate was even slightly better than C2C, which was quite surprising at the time.

But besides the exchange rate, there are many other benefits: directly linking Alipay for spending, eliminating the risk of receiving

- Reward

- like

- Comment

- Repost

- Share

Recently, everyone has been watching how much $BTC rises or falls, and the founders and communities of DeFi projects are tearing each other apart.

$ETH has secured the spot ETF, ending a five-year battle with the SEC and attracting $1 billion in institutional funds.

Five years ago, the SEC sued Ripple, $XRP was delisted, and everyone thought it was dead. As a result, in 2025, the SEC dropped the lawsuit, and the court confirmed that $XRP trading on exchanges does not count as a security, and Ripple paid a fine of 125 million to settle the matter.

More importantly, from November to December

View Original$ETH has secured the spot ETF, ending a five-year battle with the SEC and attracting $1 billion in institutional funds.

Five years ago, the SEC sued Ripple, $XRP was delisted, and everyone thought it was dead. As a result, in 2025, the SEC dropped the lawsuit, and the court confirmed that $XRP trading on exchanges does not count as a security, and Ripple paid a fine of 125 million to settle the matter.

More importantly, from November to December

- Reward

- 1

- Comment

- Repost

- Share

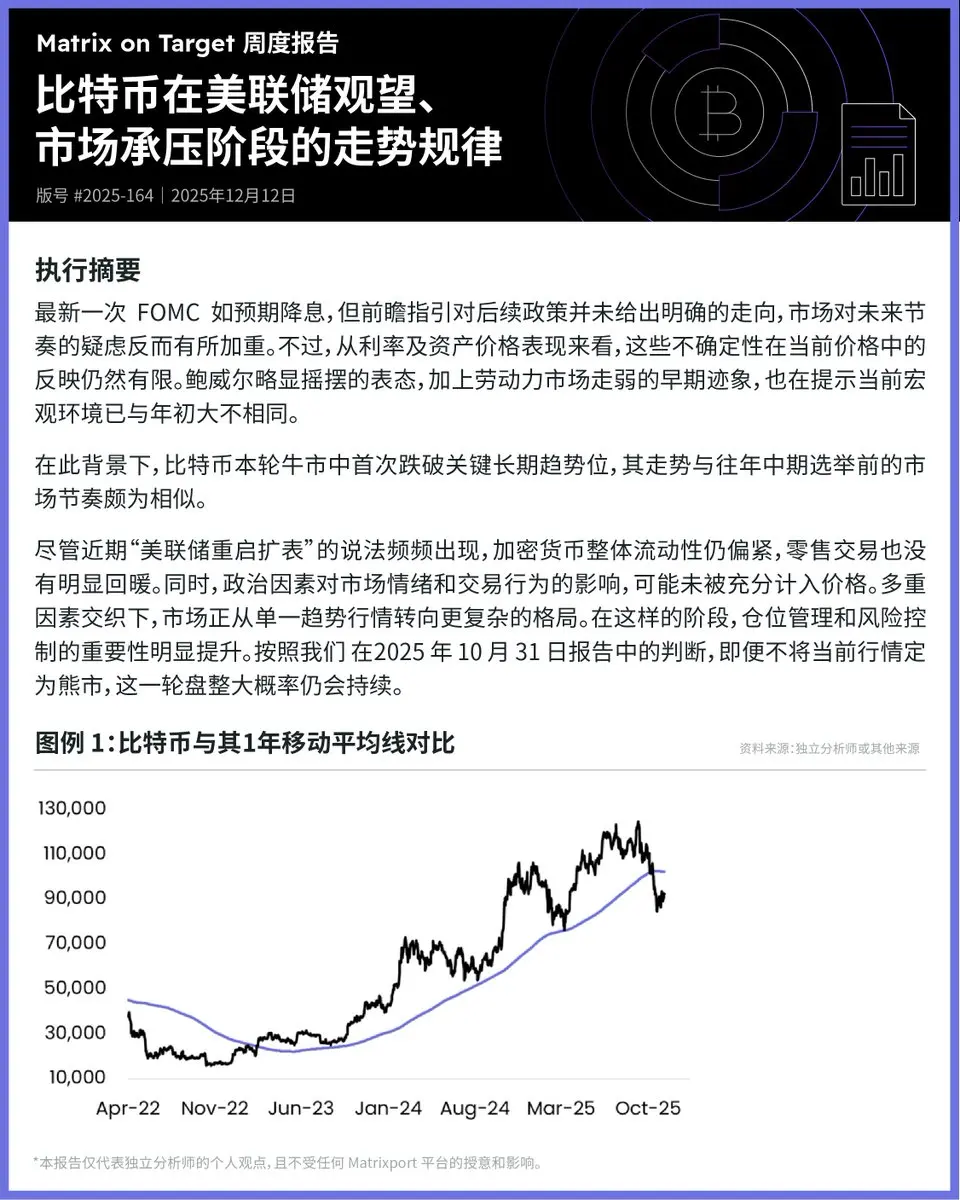

Seeing the weekly report from Matrixport, there's a phrase that really resonated: $BTC has first broken below the long-term trend line, and the market is shifting from a single trend to a more complex pattern.

In fact, it means that the previous phase where just identifying the right direction could lead to profits might be temporarily over.

The current situation is a bit complicated. While interest rate cuts have been made, Powell's attitude remains vague, labor data is weakening, liquidity hasn't loosened, and retail investors haven't entered the market.

All these signals are mixed, making

In fact, it means that the previous phase where just identifying the right direction could lead to profits might be temporarily over.

The current situation is a bit complicated. While interest rate cuts have been made, Powell's attitude remains vague, labor data is weakening, liquidity hasn't loosened, and retail investors haven't entered the market.

All these signals are mixed, making

BTC-1,35%

- Reward

- 1

- Comment

- Repost

- Share

I want to know why Brother Maji never runs out of losses?

No matter how much he loses, he can still confidently continue to recharge and add positions.

View OriginalNo matter how much he loses, he can still confidently continue to recharge and add positions.

- Reward

- like

- Comment

- Repost

- Share