Lucaa

No content yet

Lucaa

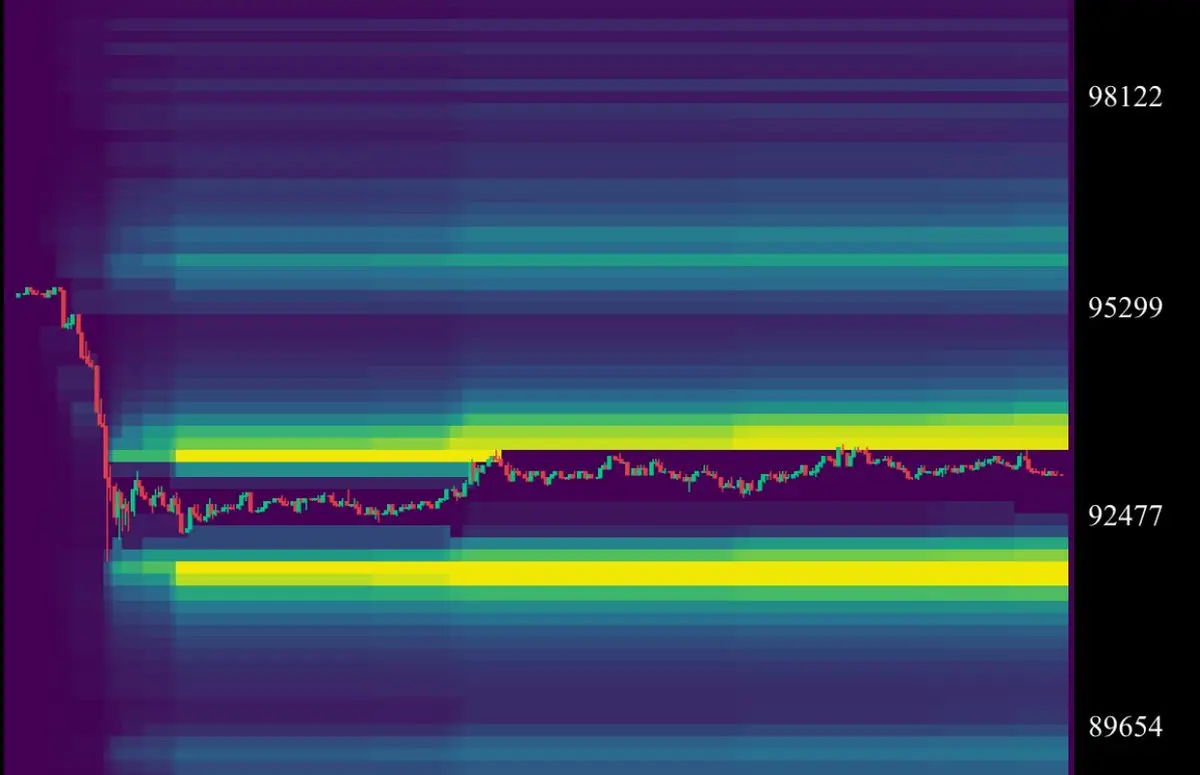

$BTC - The base case is playing out on the low-timeframes, as I covered in some of my prior updates, with a short-term pullback now unfolding.

That said, the price is currently testing the bottom of the 2D Bull Market Support Band, which has been a strong reversal spot over the last couple of months.

Because of this, if the price fails to hold above it in the next couple of hours or days, I’ll be looking to once again scale into partial hedges in order to mitigate the short-term downside risk, since a breakdown would open the door for a deeper pullback on the low-timeframes.

For now though, wi

That said, the price is currently testing the bottom of the 2D Bull Market Support Band, which has been a strong reversal spot over the last couple of months.

Because of this, if the price fails to hold above it in the next couple of hours or days, I’ll be looking to once again scale into partial hedges in order to mitigate the short-term downside risk, since a breakdown would open the door for a deeper pullback on the low-timeframes.

For now though, wi

BTC1,07%

- Reward

- like

- Comment

- Repost

- Share

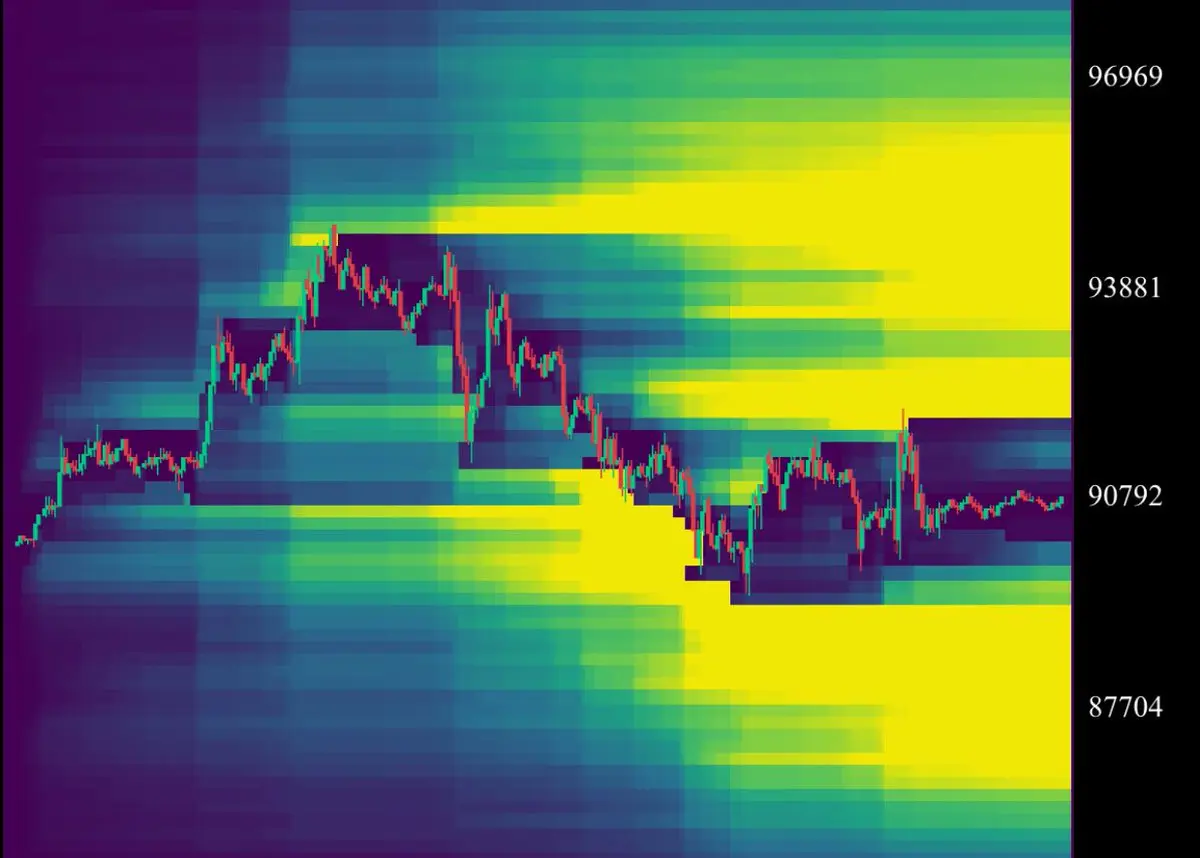

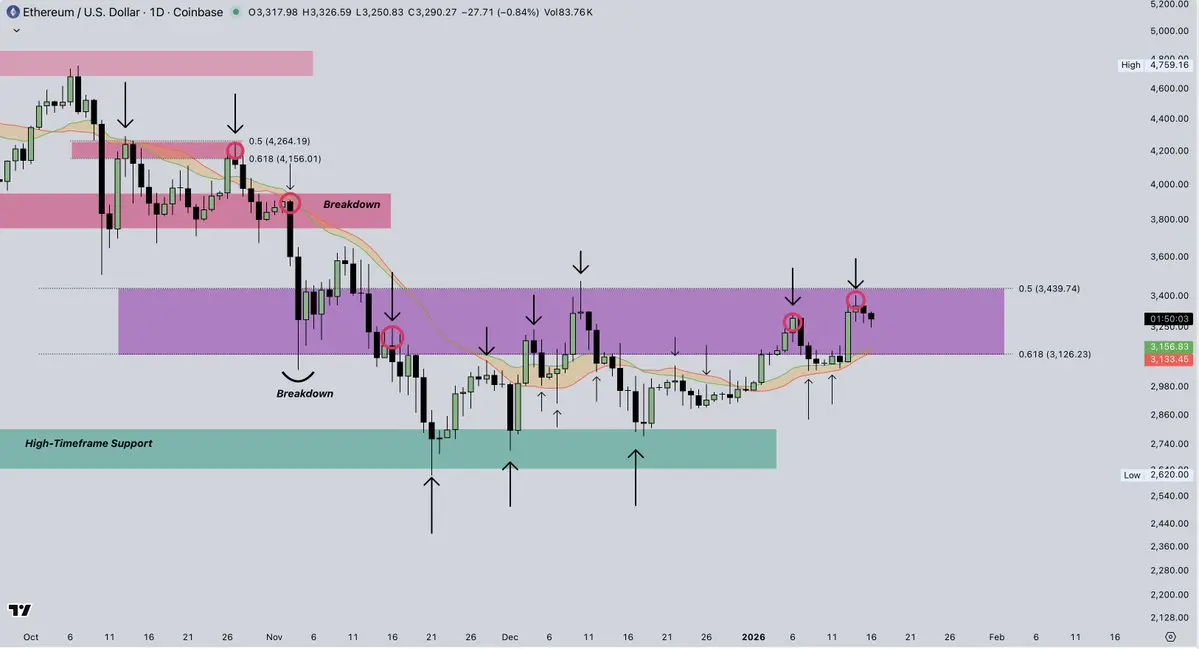

$ETH - The market structure has improved a lot over the last couple of days, as the price has managed to durably hold above the 1D Bull Market Support Band, which has been a strong reversal spot over the last couple of months, and also break above the 0.618 Fibonacci POI around ~$3.1K.

That said, the price has now rejected at the 0.5 Fibonacci POI near ~$3.4K, which was expected, given that this level has been an important POI in the past as well.

Going forward, I believe that as long as the price continues to hold above the 1D Bull Market Support Band and the 0.618 Fibonacci POI, the most lik

That said, the price has now rejected at the 0.5 Fibonacci POI near ~$3.4K, which was expected, given that this level has been an important POI in the past as well.

Going forward, I believe that as long as the price continues to hold above the 1D Bull Market Support Band and the 0.618 Fibonacci POI, the most lik

ETH2,09%

- Reward

- like

- Comment

- Repost

- Share

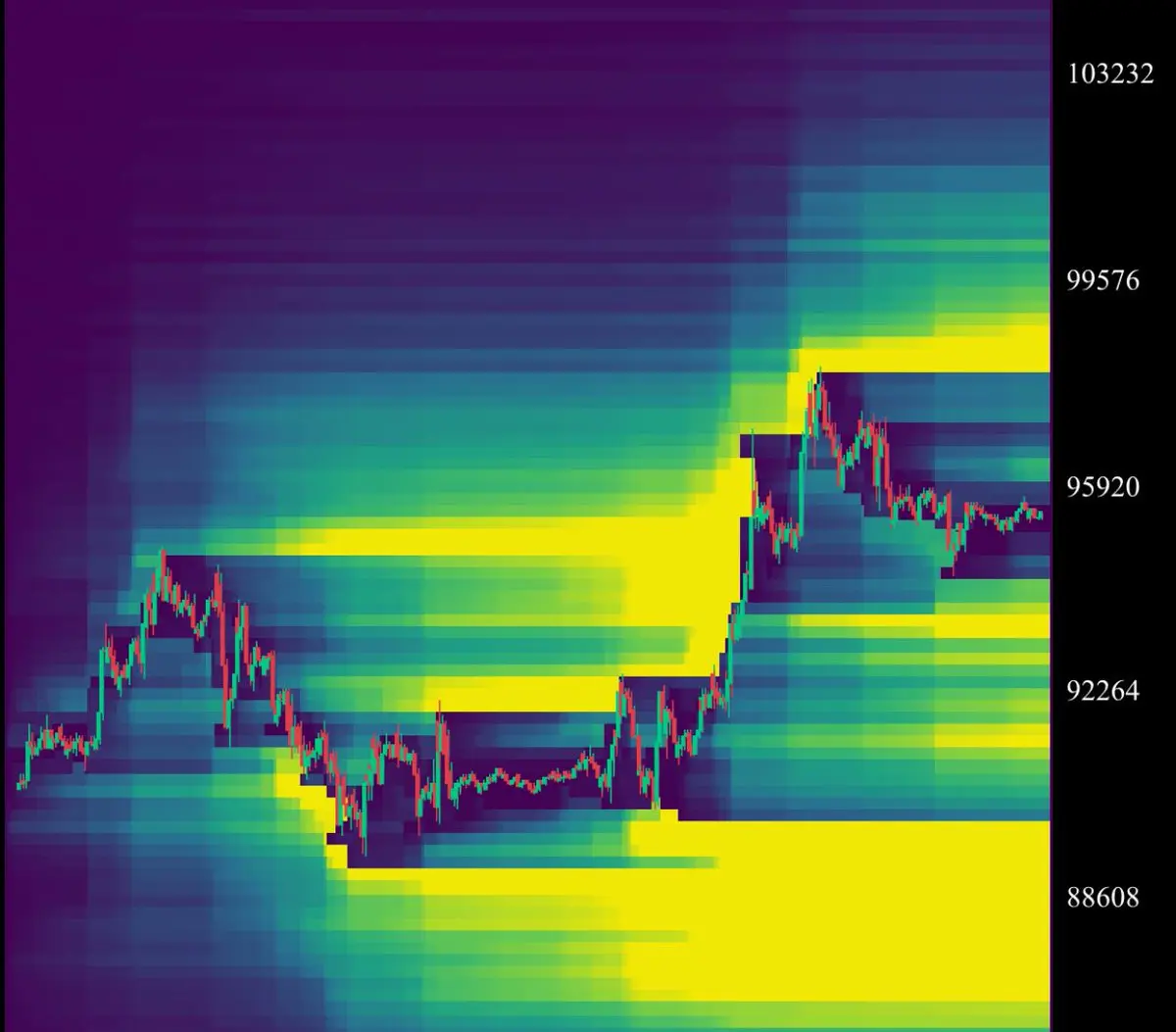

$BTC - I really like the market structure here, as the price has managed to break above and reclaim the lost high-timeframe support range marked in purple, which is a clear sign of strength.

Tomorrow, I’ll be sharing an in-depth video on Bitcoin, as this is the first major development we’ve had in months. Until now, the price repeatedly failed to break above this range and kept rejecting there.

At this point, I believe we could see a quick retrace back toward this range, followed by a more durable reversal and continuation to the upside, essentially a fakeout before expansion.

We can already s

Tomorrow, I’ll be sharing an in-depth video on Bitcoin, as this is the first major development we’ve had in months. Until now, the price repeatedly failed to break above this range and kept rejecting there.

At this point, I believe we could see a quick retrace back toward this range, followed by a more durable reversal and continuation to the upside, essentially a fakeout before expansion.

We can already s

BTC1,07%

- Reward

- like

- Comment

- Repost

- Share

Market makers want your money.

Don’t give it to them by using leverage.

Don’t give it to them by using leverage.

- Reward

- like

- Comment

- Repost

- Share

Dead Internet Theory.

- Reward

- like

- Comment

- Repost

- Share

This call on $MU belongs in my Hall of Fame.

Up over 250% since I made this call and bought up shares a couple of months ago.

The amount of alpha I share publicly is only a fraction of what I share inside.

Don’t miss out.

Up over 250% since I made this call and bought up shares a couple of months ago.

The amount of alpha I share publicly is only a fraction of what I share inside.

Don’t miss out.

- Reward

- like

- Comment

- Repost

- Share

GM ☕️

Updates dropping soon. Stay tuned! 😁🔥

Updates dropping soon. Stay tuned! 😁🔥

- Reward

- like

- Comment

- Repost

- Share

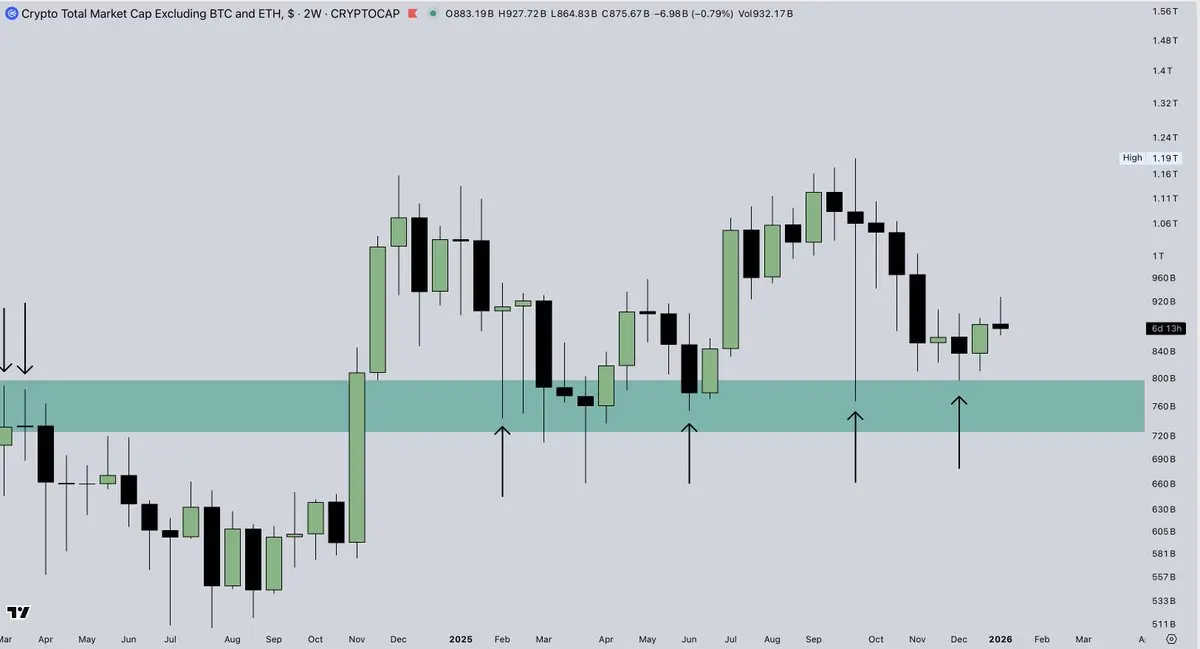

The TOTAL3 has been in a high-timeframe accumulation phase, backtesting the prior high from March 2024 for the past 12 months.

And you're bearish?

And you're bearish?

- Reward

- like

- Comment

- Repost

- Share

When I look at the $USDT.D chart, all I see is a high-timeframe distributive phase at a high-timeframe resistance that precedes a large reversal to the downside.

Yet so many are currently fearful, exactly like the last times this range got tested in this bull market.

Yet so many are currently fearful, exactly like the last times this range got tested in this bull market.

- Reward

- like

- Comment

- Repost

- Share

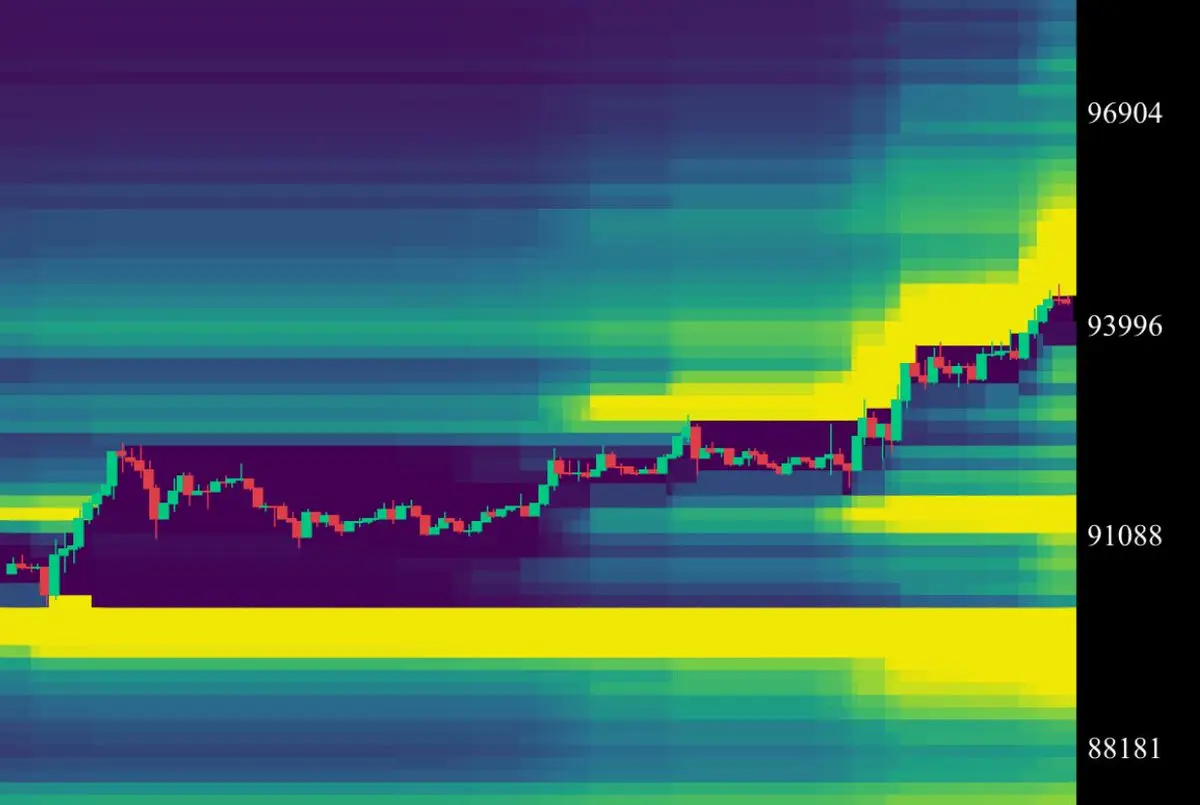

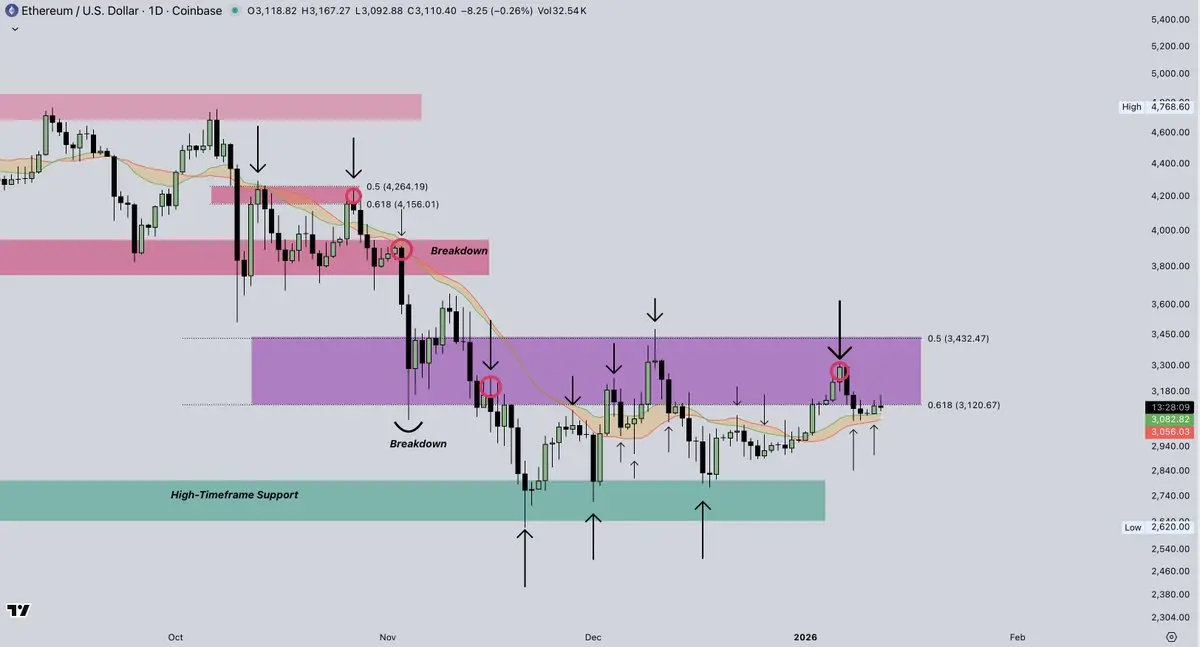

$ETH - I’m still not a big fan of the market structure on the low-timeframes, but it is improving.

A couple of days ago, the price rejected at the lost high-timeframe support range marked in purple, aligning with the golden pocket between the 0.5 and 0.618 Fibonacci POIs, which I covered in some of my prior updates.

That said, the price tapped into the 1D Bull Market Support Band, a strong reversal spot over the last couple of months, and has since bounced off of it.

As long as the price continues to hold above this range, I believe the most likely outcome remains further upside from here, eve

A couple of days ago, the price rejected at the lost high-timeframe support range marked in purple, aligning with the golden pocket between the 0.5 and 0.618 Fibonacci POIs, which I covered in some of my prior updates.

That said, the price tapped into the 1D Bull Market Support Band, a strong reversal spot over the last couple of months, and has since bounced off of it.

As long as the price continues to hold above this range, I believe the most likely outcome remains further upside from here, eve

ETH2,09%

- Reward

- like

- Comment

- Repost

- Share

$IWM - As I’ve mentioned in some of my prior PAT Updates, I believe our main focus should be on the 1D Bull Market Support Band, which has been a strong reversal spot over the last couple of months, and on Fibonacci extension levels, specifically the 1.414 and 1.618 POIs at $275–$290, where I’ll be looking to de-risk part of my spot holdings in small-caps and rotate capital into other asset classes, as we’re currently in price discovery.

I believe that as long as the price holds above the support band, the most likely outcome remains further upside.

However, if the price were to break below it

I believe that as long as the price holds above the support band, the most likely outcome remains further upside.

However, if the price were to break below it

- Reward

- like

- Comment

- Repost

- Share

Trending Topics

View More41.53K Popularity

24.04K Popularity

10.45K Popularity

59.59K Popularity

344.41K Popularity

Pin