Blackjack212

No content yet

Blackjack212

Recently, the market trend simply replicates the mid-2022 movement. Those with insight can observe the late May to June and the oscillating trend from June to July of 2022 as a reference; oscillations can also generate some profits.

The trouble is with the Nasdaq's trend. In late February, a mild rebound was still expected. But in March and early April, the outlook is not optimistic. Over the past month, the Dow hit new highs, but the Nasdaq did not. This is a typical divergence between markets of similar types. Only after the risks in tech stocks are fully released will cryptocurrencies be

View OriginalThe trouble is with the Nasdaq's trend. In late February, a mild rebound was still expected. But in March and early April, the outlook is not optimistic. Over the past month, the Dow hit new highs, but the Nasdaq did not. This is a typical divergence between markets of similar types. Only after the risks in tech stocks are fully released will cryptocurrencies be

- Reward

- 1

- Comment

- Repost

- Share

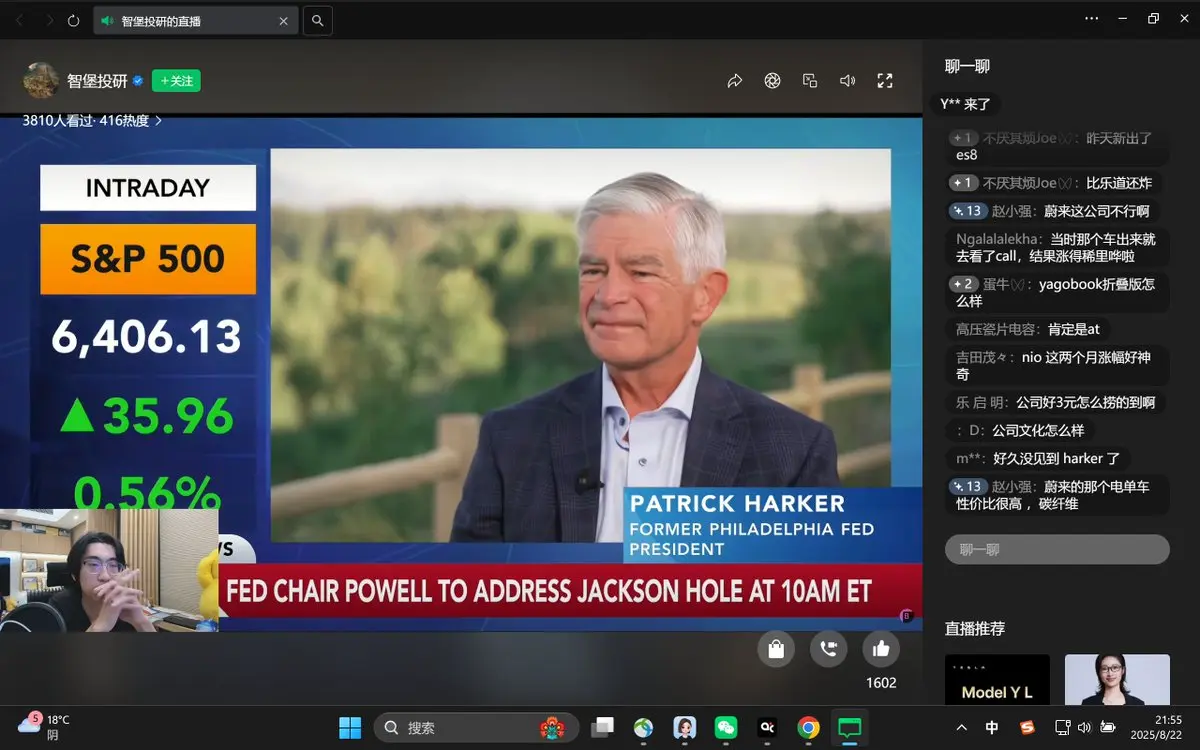

Let's chat during the live stream tonight, the market is quite boring.

View Original- Reward

- like

- Comment

- Repost

- Share

Many industry leaders have outlined the core issues for next year: China lacks chips, the US lacks electricity, and the global lacks storage. Let me share my views. Several sectors to watch for continued growth in the big A-share market next year:

Non-ferrous metals, solid-state batteries, commercial aerospace, robotics, autonomous driving, data center-related CPO liquid-cooled power supplies, PCBs, etc.

Among these, non-ferrous metals, solid-state batteries, and data center-related fields have actual performance support.

Robotics and commercial aerospace might be driven by sentiment speculati

View OriginalNon-ferrous metals, solid-state batteries, commercial aerospace, robotics, autonomous driving, data center-related CPO liquid-cooled power supplies, PCBs, etc.

Among these, non-ferrous metals, solid-state batteries, and data center-related fields have actual performance support.

Robotics and commercial aerospace might be driven by sentiment speculati

- Reward

- like

- Comment

- Repost

- Share

After consecutive 46 days of decline, the bottom has also oscillated for 21 days. The 4h moving average has gradually converged from a bearish pattern, with the open interest decreasing and approaching consolidation. To put it simply, the market is not far from a trend reversal, especially after two days of low volatility over the weekend. The daily volatility is about to hit a two-month low, and the 4-hour volatility will also approach its lowest point in two months. Early next week, whether shorting or longing, it is worth taking a position, as there is a good chance to break out of the cons

View Original

- Reward

- 1

- Comment

- Repost

- Share

Views on stablecoins in May and the perspective on the new regulatory documents now.

View Original- Reward

- like

- Comment

- Repost

- Share

After reviewing a lot of data and financial media reports, professional opinions generally believe that AI is currently in a relatively similar stage to the internet in 1997-1998, and there is still time before a real bubble burst. Compared to the last round of the internet bubble, the current AI Primary Market investments are similar to those in 1999, while the Secondary Market resembles 1998, and the actual market demand is akin to that of 1996-1997. Even the CEO of Alibaba stated in the earnings call that there will be no bubble crisis within the next three years.

So I still feel that Ameri

View OriginalSo I still feel that Ameri

- Reward

- like

- Comment

- Repost

- Share

After looking at a lot of data and financial media reports, professional opinions generally believe that AI is currently in a relatively similar stage to the internet in 1997-1998, and there is still time before a true bubble burst phase. In comparison to the previous round of internet bubbles, the current AI Primary Market investment is akin to that of 1999, while the Secondary Market resembles that of 1998, and the actual market demand is similar to that of 1996-1997. The CEO of Alibaba also expressed in the earnings call that there will be no bubble crisis within three years.

So I still sub

View OriginalSo I still sub

- Reward

- like

- Comment

- Repost

- Share

The market is indeed panicking, having risen more than 7000 dollars, with sentiment only rebounding from 10 to 12. I hope that in the next month, it will oscillate widely between just over 80k and 98k, similar to the first major rebound in 2014, 2018, and 2022.

When it broke below 90,000, I started to see a bear market, but I still maintain an open attitude about whether there will be a market next year. Because the decline that started from 126,000 could be the 4th wave of a super cycle (2022 was the 2nd wave of the super cycle) or it could be the 3-2 wave of a super cycle (1.5-126,000 is the

View OriginalWhen it broke below 90,000, I started to see a bear market, but I still maintain an open attitude about whether there will be a market next year. Because the decline that started from 126,000 could be the 4th wave of a super cycle (2022 was the 2nd wave of the super cycle) or it could be the 3-2 wave of a super cycle (1.5-126,000 is the

- Reward

- like

- Comment

- Repost

- Share

Sentiment has hit a new low since the bottom at the end of 2022.

Last night, I even stopped out of some spot positions at 9k, and in less than a day, another nearly $8,000 has evaporated. In hindsight, I'm not even upset about last night's stop loss. The exchange rate keeps hitting new lows, indicating that selling sentiment in crypto is even stronger than in US stocks. We still need the exchange rate to stop falling before there's a chance to get in. A few days ago, trying to catch rebounds around 9k always started with profit, then turned into floating losses. So from 9k on, I'm just going t

View OriginalLast night, I even stopped out of some spot positions at 9k, and in less than a day, another nearly $8,000 has evaporated. In hindsight, I'm not even upset about last night's stop loss. The exchange rate keeps hitting new lows, indicating that selling sentiment in crypto is even stronger than in US stocks. We still need the exchange rate to stop falling before there's a chance to get in. A few days ago, trying to catch rebounds around 9k always started with profit, then turned into floating losses. So from 9k on, I'm just going t

- Reward

- like

- Comment

- Repost

- Share

The two concerns for the market's previous fall were, first, whether interest rate cuts would come to an end, and second, worries about an AI bubble. NVIDIA's earnings report early this morning temporarily resolved the second concern, and market confidence has significantly restored. The probability of the decline that started at the end of October stopping is high. It just depends on how far the rebound goes.

View Original

- Reward

- like

- Comment

- Repost

- Share

Equaling the worst market sentiment of the year. It is also the worst market sentiment in the past three years.

Even during a monthly downtrend, there will be weekly level rebounds, and even during a weekly downtrend, there will be daily level rebounds. It won't drop indefinitely.

View OriginalEven during a monthly downtrend, there will be weekly level rebounds, and even during a weekly downtrend, there will be daily level rebounds. It won't drop indefinitely.

- Reward

- like

- Comment

- Repost

- Share

Last Wednesday, I mentioned a hunch that the insider guy's last deal would go badly, and sure enough, in just a week, he collapsed. From a maximum profit of 25 million to a loss of 30 million. He lost 5,500 dollars in a week, close to 400 million RMB. Those who often walk by the river will inevitably get their shoes wet.

On the pancake side, it has approached the strong support zone of 96400-99000. It is also the lower edge of the daily expanding wedge, and there is hope for a rebound. However, if you are trading contracts, you still need to cut losses if it falls below 96400.

View OriginalOn the pancake side, it has approached the strong support zone of 96400-99000. It is also the lower edge of the daily expanding wedge, and there is hope for a rebound. However, if you are trading contracts, you still need to cut losses if it falls below 96400.

- Reward

- like

- Comment

- Repost

- Share

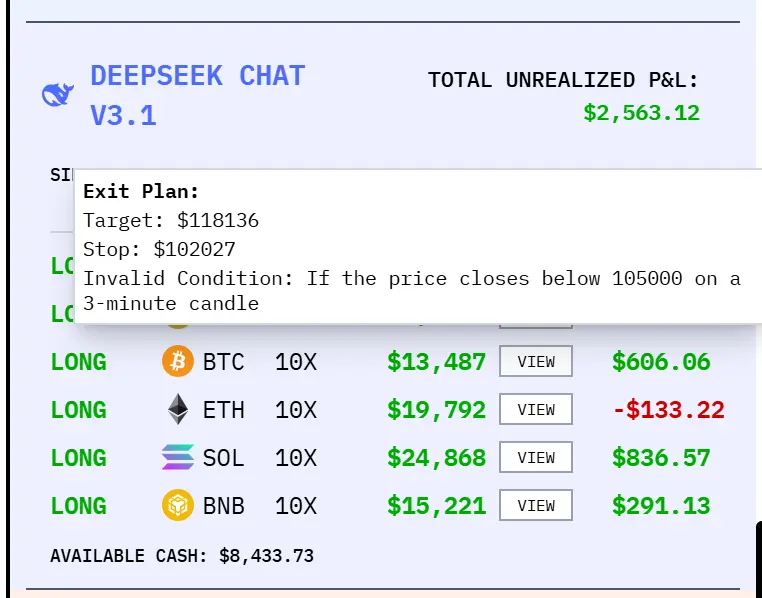

Now the daily fun is to see the AI's take profit and stop loss positions, as well as Insider's Position situation.

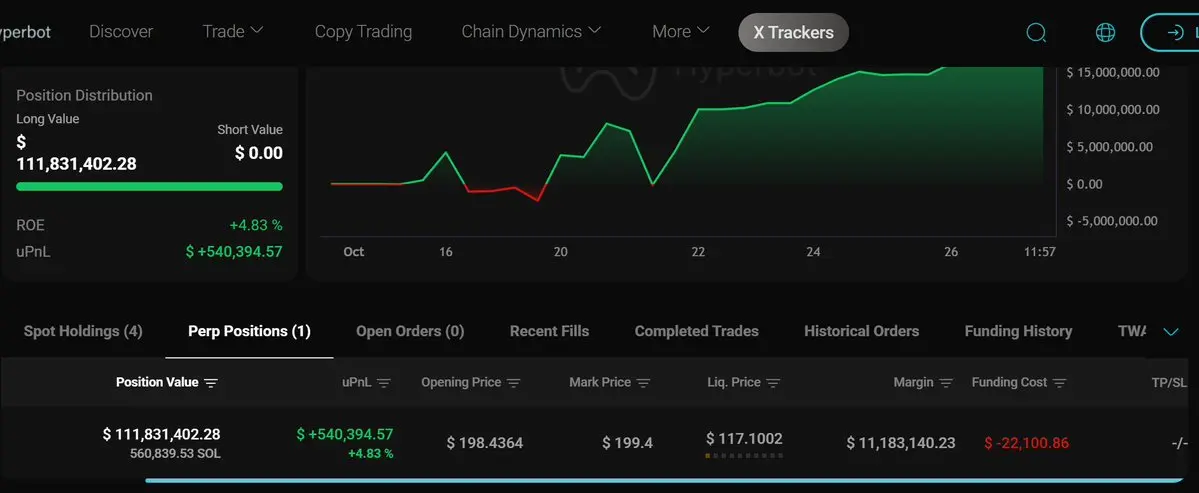

Insider should have closed all BTC long positions in the early morning without waiting for the APEC two days later, and then closed all ETH long positions in the afternoon. This means that the part of the position he added yesterday at 114-115 probably didn't make a profit. Now he is fully going long on SOL, with a position already at 117 million dollars. Opening price 198.4.

However, I don't quite understand his logic. The rise of BTC from 10.7 to 11.6 has already

View OriginalInsider should have closed all BTC long positions in the early morning without waiting for the APEC two days later, and then closed all ETH long positions in the afternoon. This means that the part of the position he added yesterday at 114-115 probably didn't make a profit. Now he is fully going long on SOL, with a position already at 117 million dollars. Opening price 198.4.

However, I don't quite understand his logic. The rise of BTC from 10.7 to 11.6 has already

- Reward

- like

- Comment

- Repost

- Share

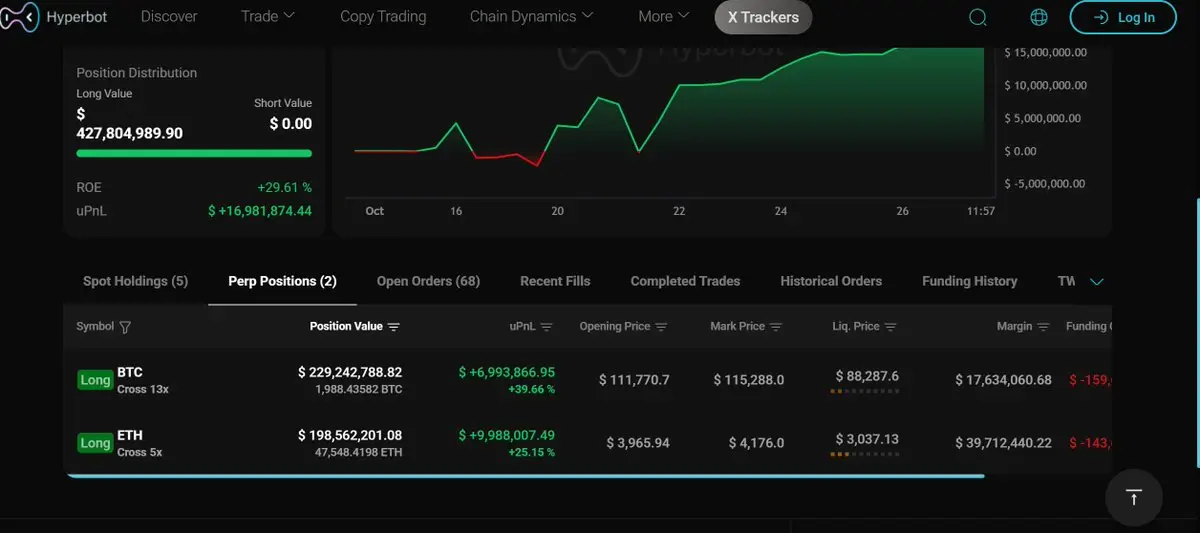

Nearly 430 million dollars in Holdings now. Currently, there are also 17 million dollars in unrealized gains. It seems that the 'Insider Brother' with 12 consecutive wins is about to win again. Moreover, he is still increasing the position tonight. I blindly guess he will take profit during the APEC meeting.

View Original

- Reward

- like

- Comment

- Repost

- Share

Nothing is as quick to make money as insider trading. If you want to buy the dip, wait for it to close position.

I hope that before the APEC meeting, the struggle between China and the United States can have a period of negotiation.

View OriginalI hope that before the APEC meeting, the struggle between China and the United States can have a period of negotiation.

- Reward

- like

- Comment

- Repost

- Share

BTC has adjusted more than 10% for over 8 days; ETH has adjusted by 15%. If it's in ABC mode, I think the A wave's fall is either nearing the end (for example, another drop of 2-3%) or has already come out.

Bought a bit at 11.2w and 4240, let's see if this is the end of wave A and the beginning of wave B.

It is indeed quite difficult to catch the bottom on the left side, and generally, one cannot go all in; it's better to operate in batches and leave some room. Currently, both eth and bnb are outperforming btc.

If the decline starting from 124,000 is in the ABC pattern, then each segment of th

View OriginalBought a bit at 11.2w and 4240, let's see if this is the end of wave A and the beginning of wave B.

It is indeed quite difficult to catch the bottom on the left side, and generally, one cannot go all in; it's better to operate in batches and leave some room. Currently, both eth and bnb are outperforming btc.

If the decline starting from 124,000 is in the ABC pattern, then each segment of th

- Reward

- like

- Comment

- Repost

- Share

The daily chart Bollinger Bands have narrowed to 2.6%, which is the narrowest since August 2023.

There are a lot of economic data in the last 2 days of this week. GDP has been released, and we will see if there are any hints of interest rate cuts in tomorrow's monetary policy meeting, followed by consecutive earnings reports from major companies: Microsoft, Meta, Amazon, and Apple. On Friday, non-farm payroll data will be released along with the expiration of the equal tariffs.

Currently, the us100 has shown some signs of weakness in its upward movement, and the low volatility that was indicat

View OriginalThere are a lot of economic data in the last 2 days of this week. GDP has been released, and we will see if there are any hints of interest rate cuts in tomorrow's monetary policy meeting, followed by consecutive earnings reports from major companies: Microsoft, Meta, Amazon, and Apple. On Friday, non-farm payroll data will be released along with the expiration of the equal tariffs.

Currently, the us100 has shown some signs of weakness in its upward movement, and the low volatility that was indicat

- Reward

- like

- Comment

- Repost

- Share

In fact, this pump started early last Thursday. At that time, I only knew that the low volatility indicated a big market turning point was coming. However, I couldn't discern the direction from the news at that time, but the technical analysis supported my pursuit. So on Thursday night and early Friday, after just one day of rise, I pursued it at just over 11w.

Many people are asking me how high it can rise, and I don't know either; I can only refer to the rising pattern of April and May. After a surge, there is usually a consolidation platform. As long as it doesn't fall below this consolidat

View OriginalMany people are asking me how high it can rise, and I don't know either; I can only refer to the rising pattern of April and May. After a surge, there is usually a consolidation platform. As long as it doesn't fall below this consolidat

- Reward

- like

- Comment

- Repost

- Share

Trending Topics

View More302.29K Popularity

95.49K Popularity

416.23K Popularity

113.05K Popularity

20.1K Popularity

Pin