#GlobalTechSell-OffHitsRiskAssets #GlobalTechSell-OffHitsRiskAssets The global technology sell-off has marked a pivotal moment in financial markets, signaling the rise of risk aversion and the recalibration of investor priorities. Over recent weeks, high-growth technology stocks, particularly in software, AI, and semiconductor sectors, have faced unprecedented downward pressure. This sell-off is not merely a reflection of short-term volatility but rather an inflection point where investors are reassessing valuations, profitability, and long-term sustainability. As major indices dipped, risk assets across equities, cryptocurrencies, and emerging markets experienced a correlated decline, demonstrating the interconnectedness of modern markets and the speed at which sentiment can shift globally. Institutional investors and hedge funds, previously bullish on AI-driven growth, have begun rotating capital toward safer, undervalued sectors, prompting a widespread reevaluation of portfolio allocations. The market reaction underscores the delicate balance between technological optimism and financial prudence, where speculative enthusiasm meets fundamental reality.

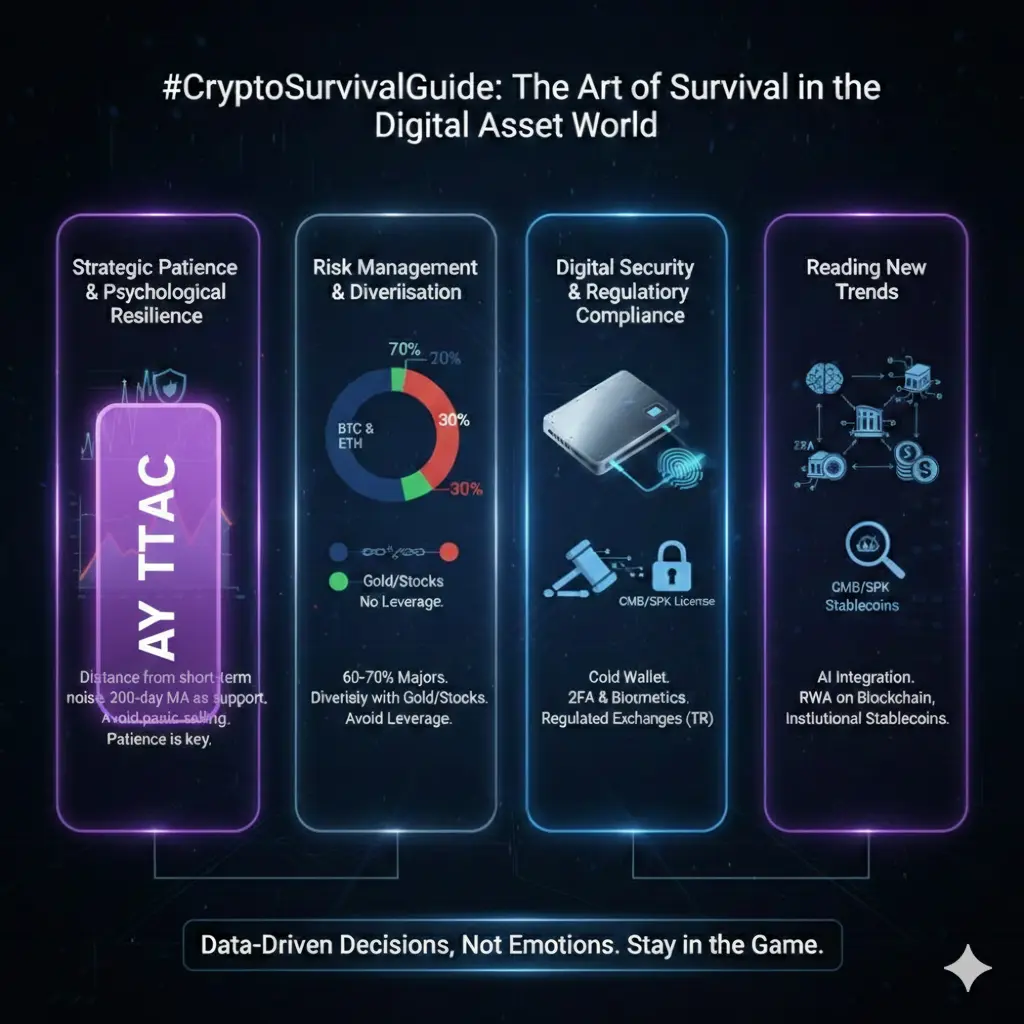

Cryptocurrencies, long viewed as an alternative or uncorrelated asset class, have now shown a pronounced sensitivity to equity market sentiment. Bitcoin, Ethereum, and major altcoins have experienced sharp declines as risk appetite diminished, and liquidity constraints intensified. The linkage between crypto and traditional equities is increasingly evident, with movements in tech indices often mirrored in digital assets. This correlation challenges prior assumptions about crypto independence and reinforces the need for diversified strategies that account for cross-asset volatility. Investors are now more conscious of timing entry points, hedging strategies, and the role of stablecoins and decentralized finance platforms as mechanisms to manage exposure during turbulent periods.

At the heart of this sell-off lies the broader debate over AI and technology valuations. Companies that were previously buoyed by hype around artificial intelligence are facing scrutiny over actual revenue generation, adoption timelines, and regulatory pressures. Market participants are no longer solely focused on potential breakthroughs; instead, they are weighing tangible metrics such as earnings growth, cash flow sustainability, and competitive moat. Analysts note that the sell-off reflects a collective recalibration of expectations, where speculative excess is being corrected by disciplined evaluation. This shift in sentiment is expected to persist as investors demand clearer proof of concept and profitability before committing additional capital.

Global macroeconomic factors compound the complexity of this sell-off. Interest rate expectations, inflation trends, geopolitical tensions, and trade dynamics continue to influence market psychology. Central banks’ messaging around monetary policy directly impacts risk appetite, particularly in technology and growth-focused sectors that rely heavily on cheap capital for expansion. Emerging market equities, while offering growth potential, have also been caught in the crossfire, illustrating how global liquidity flows and investor confidence are intertwined. The convergence of macroeconomic pressures with sector-specific reassessments creates a multi-dimensional environment where strategic foresight, adaptability, and risk management are essential for survival and growth

Investor behavior during this period highlights the importance of psychological discipline. Fear of missing out during the preceding tech rally has been replaced by fear-driven exits and panic selling. Market participants are grappling with the tension between long-term conviction and short-term risk mitigation. Those who navigate these dynamics successfully are employing a combination of technical analysis, fundamental research, and scenario planning, recognizing that volatility is both a risk and an opportunity. The ability to discern between transient market noise and structural shifts defines the difference between opportunistic gains and avoidable losses.

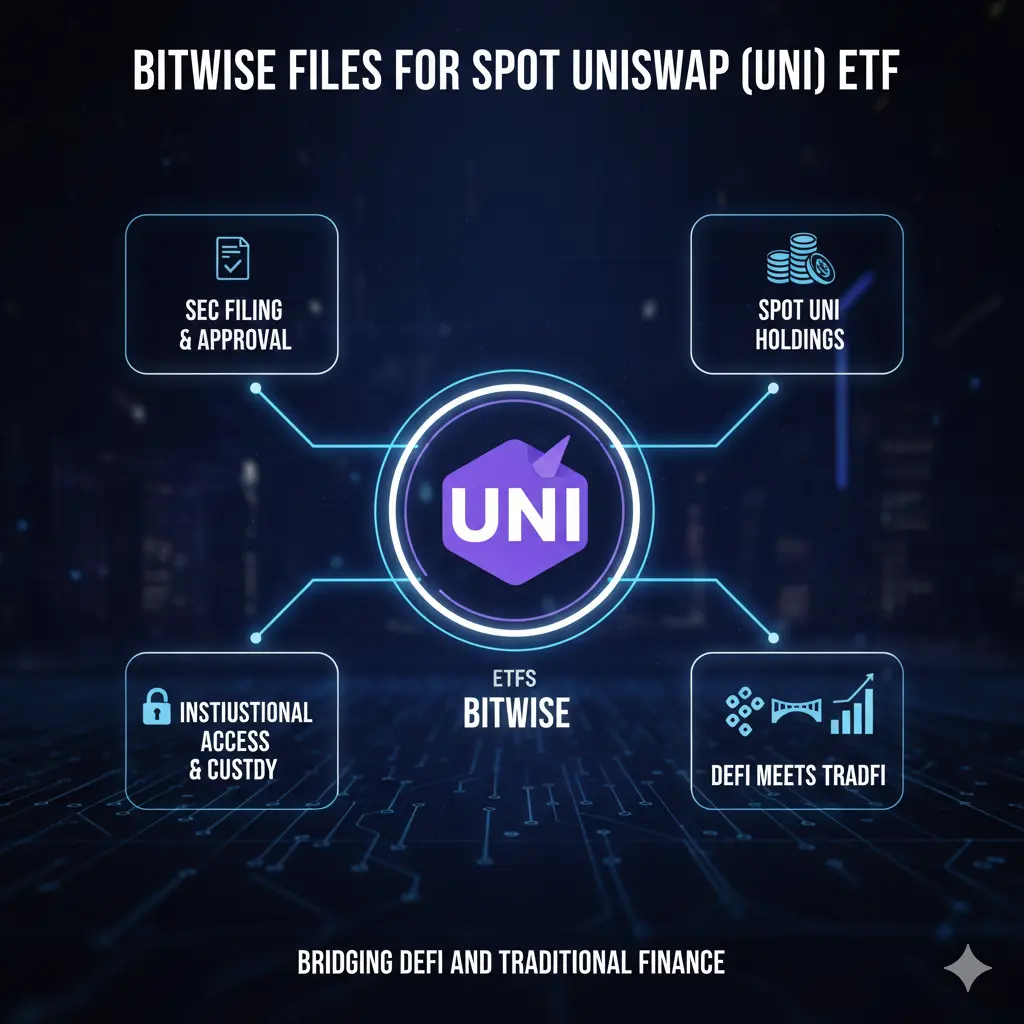

Sector rotation has become a defining characteristic of the current market environment. Funds are reallocating from high-beta technology stocks to more defensive areas such as consumer staples, healthcare, and utilities. Smaller-cap equities and underappreciated value stocks are receiving renewed attention, as investors seek stability amidst market turbulence. This rotation reflects a broader strategy to preserve capital while maintaining exposure to potential upside, acknowledging that market recoveries may favor fundamentally sound companies with resilient business models. In parallel, digital assets are increasingly scrutinized for intrinsic value, network adoption, and security resilience, with participants differentiating between speculative tokens and established blockchain platforms with real-world use cases.

Liquidity management has emerged as a central concern for both institutional and retail investors. Margin calls, leveraged positions, and highly concentrated holdings have amplified the effects of selling pressure. Participants are reassessing position sizing, stop-loss strategies, and risk-adjusted returns to navigate the heightened uncertainty. This period serves as a stark reminder that liquidity is as vital as valuation in market stability and that overexposure to correlated assets can exacerbate downturns. Risk management frameworks are evolving to include stress testing across multiple scenarios, emphasizing proactive decision-making rather than reactive measures.

Looking ahead, market participants anticipate a period of heightened volatility and selective opportunity. While headline risks and macro uncertainty may dominate short-term sentiment, the fundamental case for technology and innovation remains intact. Companies that demonstrate sustainable growth, robust governance, and adaptive strategies are expected to emerge stronger, providing long-term value for discerning investors. Similarly, cryptocurrencies with clear utility, security protocols, and adoption momentum may recover alongside broader market stabilization, offering a window for strategic accumulation. The interplay between caution and calculated risk will define the next phase of market evolution.

Education and continuous research have become indispensable tools for survival in this environment. Investors are increasingly leveraging market data analytics, AI-driven insights, and expert commentary to inform decision-making. Understanding the drivers of risk, assessing asset correlations, and monitoring liquidity conditions are essential to navigating the evolving landscape. Those who combine analytical rigor with emotional discipline are positioned to identify opportunities amid dislocation, avoiding the pitfalls of herd behavior and reactionary trading.

Ultimately, the global tech sell-off and its ripple effects across risk assets represent both a challenge and a learning opportunity. It underscores the necessity of holistic market awareness,

strategic diversification, and adaptive thinking. Survival and growth in such a dynamic environment are contingent upon a measured approach that integrates fundamental analysis, technical insights, macroeconomic awareness, and psychological resilience. Investors who internalize these lessons, maintain discipline, and remain forward-looking are likely to not only endure the current turbulence but also capitalize on the opportunities that emerge as markets recalibrate.

#GlobalTechSell-OffHitsRiskAssets is more than a trending hashtag; it encapsulates a paradigm shift in investor behavior, asset valuation, and market interconnectedness. Those who navigate it successfully will set the blueprint for resilient portfolio management and strategic growth in an era of unprecedented technological change.