The ultimate goal of making money is "compound interest," and the trump card for turning things around is "cutting losses."

Brothers, let's skip the talk about cycles and get straight to the point.

Let's talk about two words: making money.

No, actually, it's four words: compound interest and cutting losses.

If you truly understand these two things, it'll be hard for you to stay poor in this lifetime.

For these two terms, you either haven't heard of them, or you've misunderstood them.

Dreaming about getting rich overnight is gambling, not making money.

Real money-making experts are single-minded: find what works, then repeat it.

That, my friend, is compound interest.

1. Admit you’re ordinary, then copy like crazy

99% of innovation in this world is a dead end; only copying leads to survival. The same goes for trading—the way is simple.

A lot of people's biggest problem is that after doing something right once, they dismiss it as luck and immediately go chasing the next “hot trend.”

That’s just plain stupid.

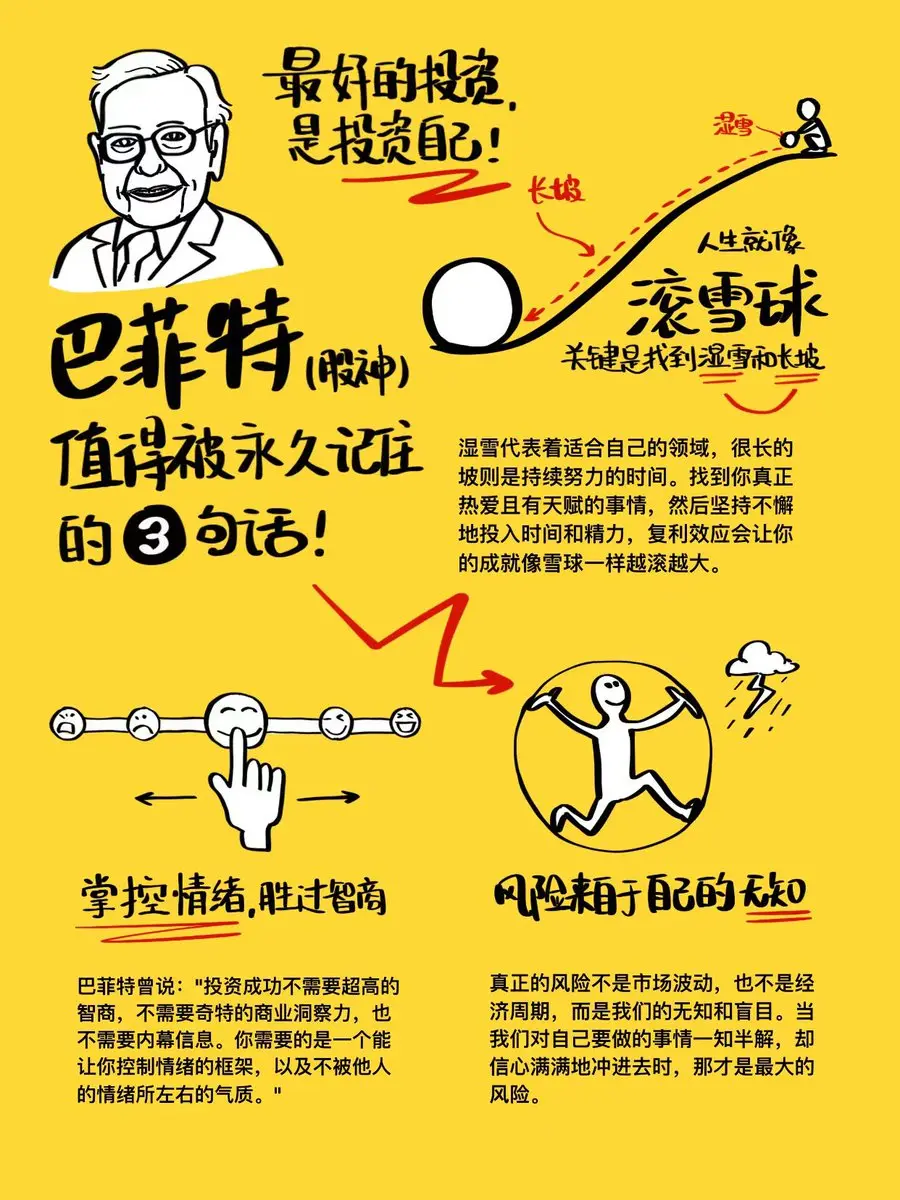

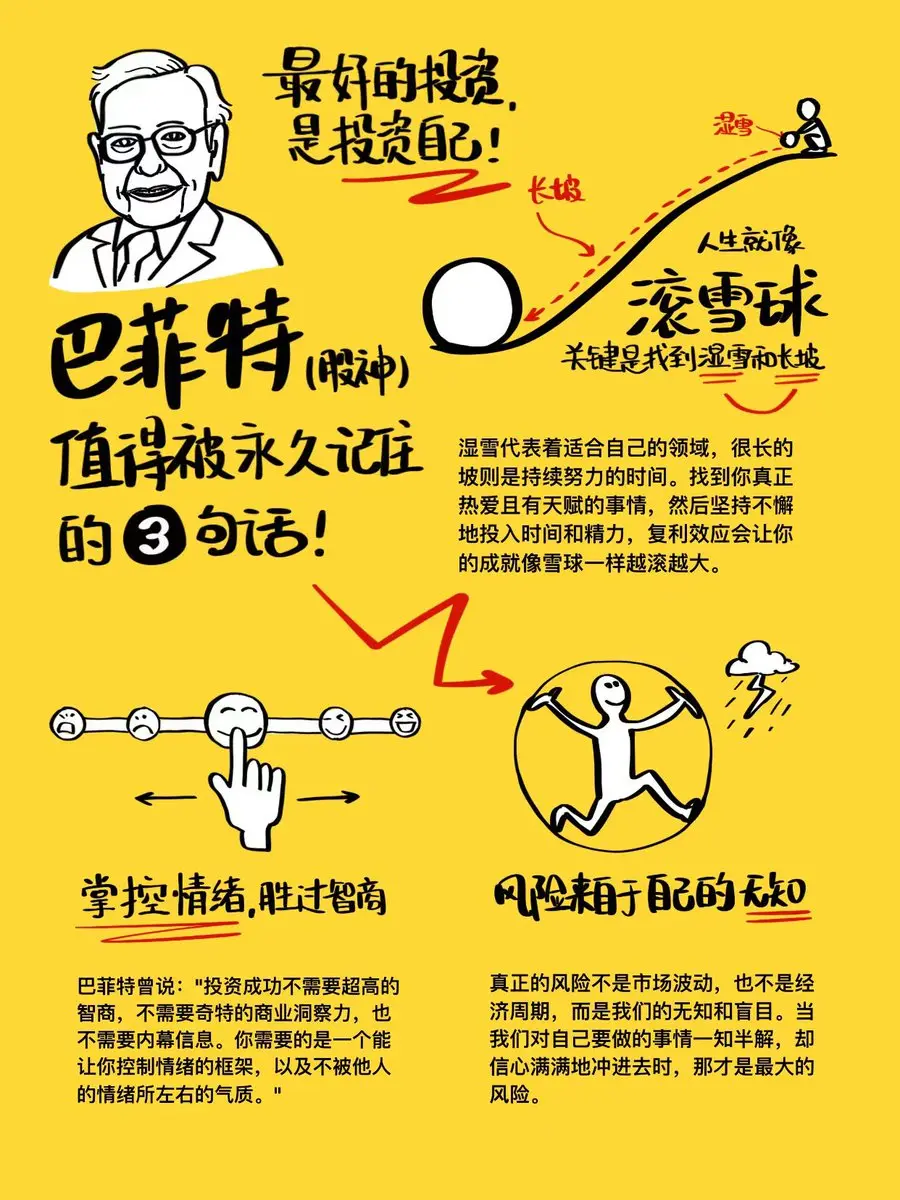

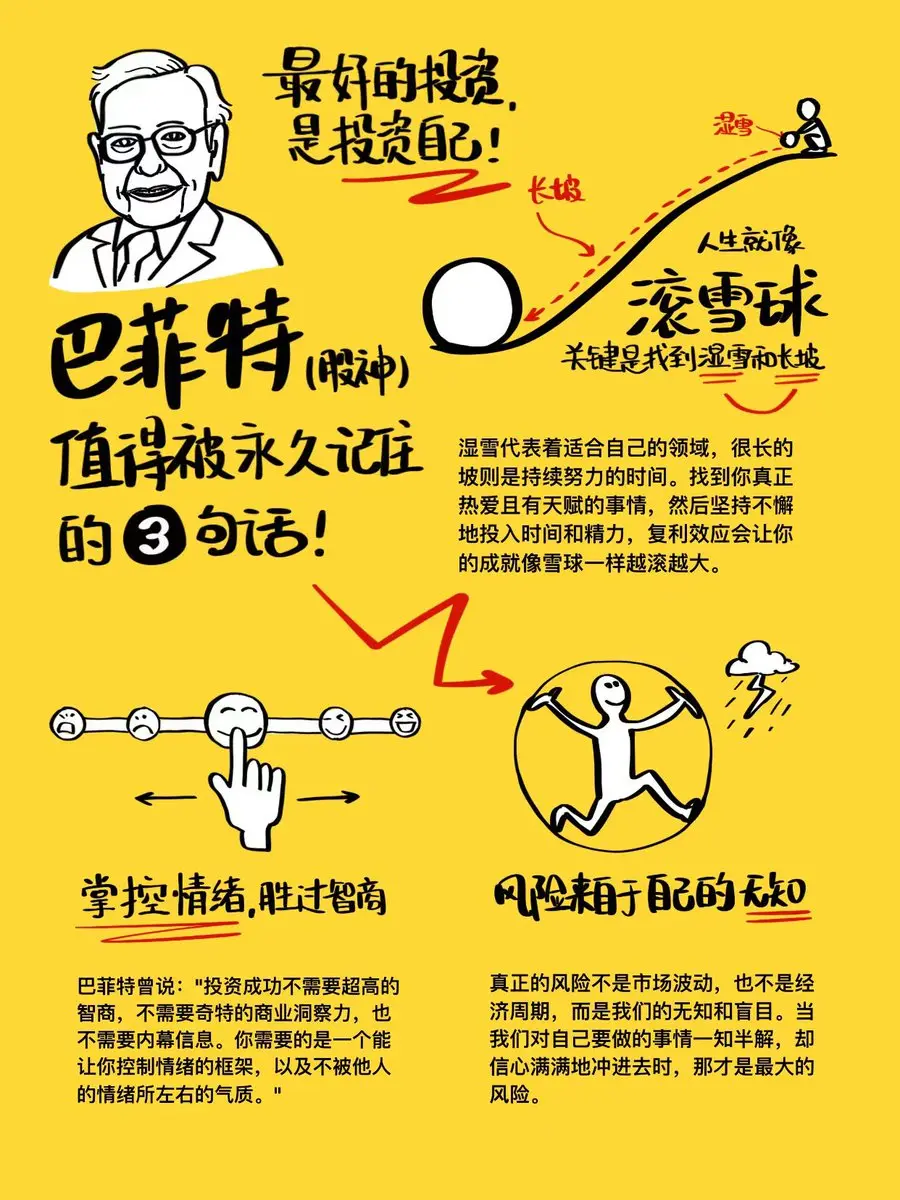

Think about it—how did Buffett become the god of stocks? Wasn’t it just value investing, finding what works and repeating it for a lifetime?

Look at the successful people around you—didn’t they all hit on something and then dig deep for years?

Compound interest sounds like a finance term, but it’s really just a dumb grind. You don’t need to be smart, but you need to be persistent.

Compound interest isn’t about putting your money in the bank to earn interest. In your life, when you discover an action, a product, a sales pitch, or anything that brings positive feedback or makes you a dollar,

No matter how small, repeat it to death.

Immediately, without hesitation—repeat it.

Don’t change it, don’t try to optimize it at first, just copy it exactly. Do it a thousand times, ten thousand times.

Talent is a poor man’s fig leaf; repetition is the rich man’s basic skill.

Even if the action is boring, tedious, or seems dumb, as long as it works, treat it like a lifeline and never let go. Turn one success into ten thousand successes—that’s called scaling.

Even if you’re just selling pancakes, if you perfect the most popular filling recipe, you’ll become the king of pancakes.

That’s the law of nature.

That’s the ordinary person’s chance to overtake on the curve. Don’t envy pigs flying in the wind; be the pig that keeps digging in the dirt—one day you’ll dig up your own gold mine.

Being truly skilled just means making a simple thing a habit through repetition.

2. Even if your heart bleeds, throw away the trash

Knowing how to hit the gas isn’t enough; you need to know how to brake.

That’s cutting losses.

What’s scarier than “not knowing what to do”? It’s “knowing it’s useless, but stubbornly sticking with it.”

That’s self-inflicted pain for the sake of feeling moved.

This second point is even harder than the first, because human nature resists it.

We always have fantasies about the effort we’ve already put in.

Too many people are like this.

Just like in trading, you set a stop-loss in advance, but when your position drops below it, you panic—thinking, “If I hold on a bit longer, it’ll bounce back.” You refuse to cut your losses, and end up going from a 5% loss to a 50% loss, or even blowing up your account—losing all the capital you could’ve saved. That’s not fighting the market, that’s fighting your own money.

For a project that’s proven to lose money, you just can’t let go, always thinking, “What if?” and end up losing more.

In a relationship, even if the other person is clearly trash, you can’t break up, always thinking, “He’ll change,” and end up completely broken.

With a crappy job, working overtime every day for no money, you’re afraid to quit, always thinking, “Maybe I can endure a bit longer,” and end up draining all your energy and passion.

Brother, wake up! Your time, energy, and money are your most valuable assets—they’re not for feeding to the dogs.

Cutting your losses in time means pulling your precious assets out of worthless, draining messes as soon as possible.

How?

Two words: review.

Every night before bed, stop scrolling. Grab a notebook or open your memo app,

and write down three things:

What did I do today?

Which thing made me feel great or accomplished? (That’s effective—do it again tomorrow.)

Which thing made me feel like an idiot, a complete waste of time? (That’s ineffective—stop it immediately tomorrow.)

When I first started reviewing, I was shocked. I realized I spent at least 4 hours a day on totally meaningless crap.

Like arguing over things that have no outcome, or endlessly refreshing an unimportant app.

Find those things and quit them, just like quitting drugs, one at a time.

Identify what’s ineffective, then stop it. This action is more important than doing a hundred right things.

Cutting losses isn’t admitting defeat—it’s a smarter new beginning.

Growth isn’t just about how much new stuff you learn; it’s also about how much old baggage you finally dare to throw away.

Reviewing isn’t about crying and regretting; it’s about seeing where you went wrong, cutting out the rotten part, and preventing it from infecting the rest. Cutting losses in time is the highest form of self-discipline for adults.

This world is simple—it’s a game of “effective repetition” and “ineffective termination.”

The endgame of making money is finding an action that makes money and repeating it ten thousand times—that’s compound interest.

The trump card for turning things around is cutting out all the crap that drains you and keeping yourself alive—that’s cutting losses.

Simplicity is the ultimate sophistication.

Life is a filter.

Keep what’s useful and repeat it to death; eliminate what’s useless and clear it out completely.

One grows your value, the other keeps you alive.

For young people, applying this “filter logic” to assets,

the most reliable choice is to DCA into BTC and gold.

— This isn’t jumping on the crypto bandwagon, it’s about seeing the long-term depreciation of fiat and building yourself a safety net for the future.

BTC’s decentralized nature lets you hedge against central banks’ reckless money printing;

Gold, as a hard currency for millennia, has always been a safe haven against inflation.

You don’t have to watch the market every day or worry about “buying at the top.” Just put in a fixed amount of spare cash every month. The essence is applying the logic of “compound interest” to your assets—using time to counter volatility and regular investing to avoid timing risks.

This is the right way for young people to bet on fiat depreciation—not gambling for short-term windfalls, but earning “time + trend” money.

Brothers, stop running around blindly. Don’t overthink it—just go do it~