Sachin1104

No content yet

Pin

Sachin1104

Ripple Labs gets green light to boost payments in #Singapore 🚀

Singapore's Monetary Authority (MAS) has approved #Ripple Markets APAC to expand payment services under its Major Payment Institution (MPI) license. This means Ripple can now offer more services, including using digital tokens like RLUSD and $XRP for cross-border transactions.

Ripple's President, Monica Long, praised Singapore's forward-thinking approach, while Fiona Murray highlighted the region's 70% year-over-year growth in on-chain activity.

This approval cements Ripple's position as a leading blockchain institution in Singa

Singapore's Monetary Authority (MAS) has approved #Ripple Markets APAC to expand payment services under its Major Payment Institution (MPI) license. This means Ripple can now offer more services, including using digital tokens like RLUSD and $XRP for cross-border transactions.

Ripple's President, Monica Long, praised Singapore's forward-thinking approach, while Fiona Murray highlighted the region's 70% year-over-year growth in on-chain activity.

This approval cements Ripple's position as a leading blockchain institution in Singa

XRP0,9%

- Reward

- 8

- 7

- Repost

- Share

HighAmbition :

:

Buy To Earn 💎View More

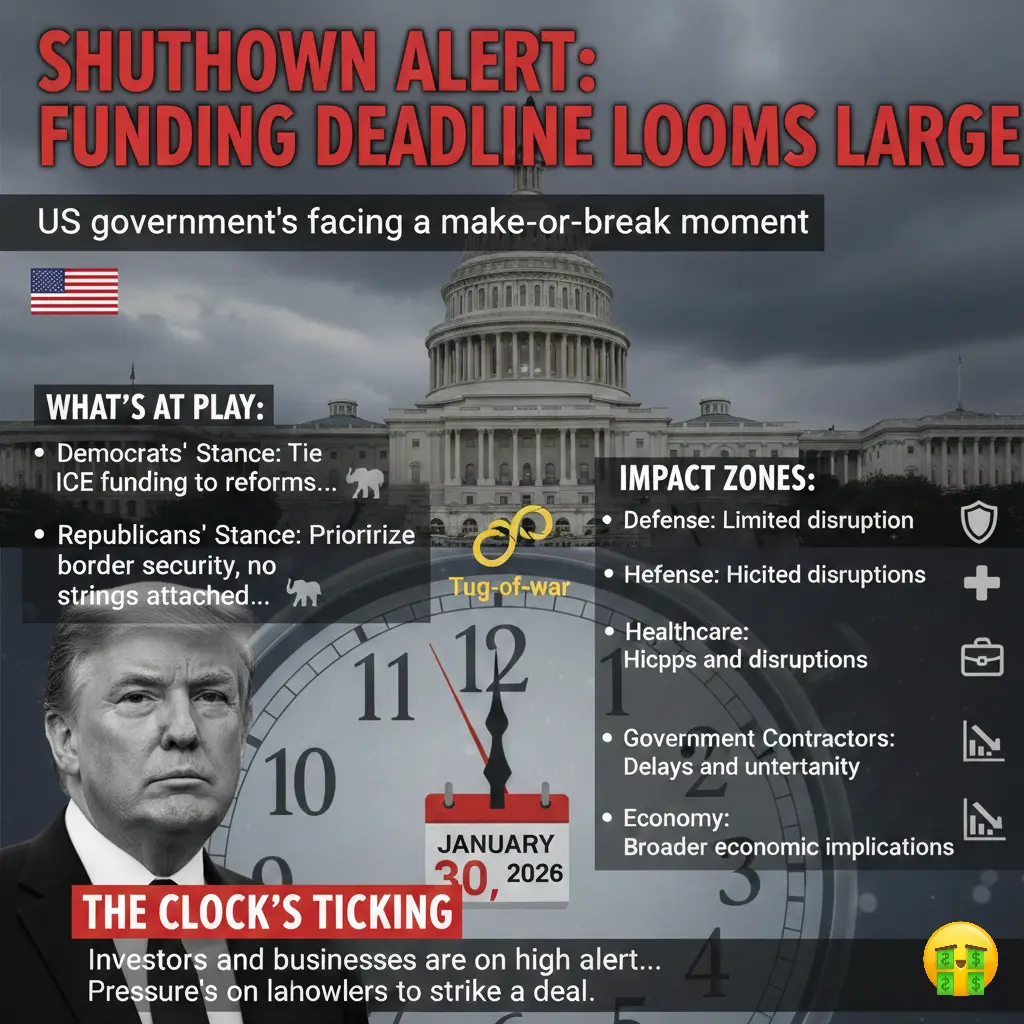

The #US government is on the brink of a potential #shutdown, with funding for key agencies like #DHS and #ICE expiring on January 30, 2026. The partisan divide over ICE funding reforms is escalating, putting critical services at risk.

Key Issues:

- Democrats are pushing for ICE funding reforms, citing concerns over the agency's actions

- Republicans prioritize border security and are reluctant to attach conditions to funding

- Bipartisan talks are ongoing, but a breakthrough is uncertain

Potential Fallout:

- Defense: Limited disruption, but some contracts may continue

- Healthcare: Medicare an

Key Issues:

- Democrats are pushing for ICE funding reforms, citing concerns over the agency's actions

- Republicans prioritize border security and are reluctant to attach conditions to funding

- Bipartisan talks are ongoing, but a breakthrough is uncertain

Potential Fallout:

- Defense: Limited disruption, but some contracts may continue

- Healthcare: Medicare an

- Reward

- 1

- 1

- Repost

- Share

Sachin1104 :

:

Watching Closely 🔍️Walrus: Unlocking the Future of #Decentralized Storage for Blockchain 🌐

The #blockchain space is witnessing a paradigm shift with Walrus, a cutting-edge decentralized storage protocol that's revolutionizing data management for blockchain applications. Designed to provide high durability, availability, and scalability, Walrus is perfect for AI agents, onchain applications, and enterprises dealing with large-scale data.

Key Features: The Building Blocks of Walrus

- Decentralized Storage: Data is stored across a network of independent nodes, ensuring resilience and security 🔒. This approach not

The #blockchain space is witnessing a paradigm shift with Walrus, a cutting-edge decentralized storage protocol that's revolutionizing data management for blockchain applications. Designed to provide high durability, availability, and scalability, Walrus is perfect for AI agents, onchain applications, and enterprises dealing with large-scale data.

Key Features: The Building Blocks of Walrus

- Decentralized Storage: Data is stored across a network of independent nodes, ensuring resilience and security 🔒. This approach not

WAL0,32%

- Reward

- 1

- 1

- Repost

- Share

Sachin1104 :

:

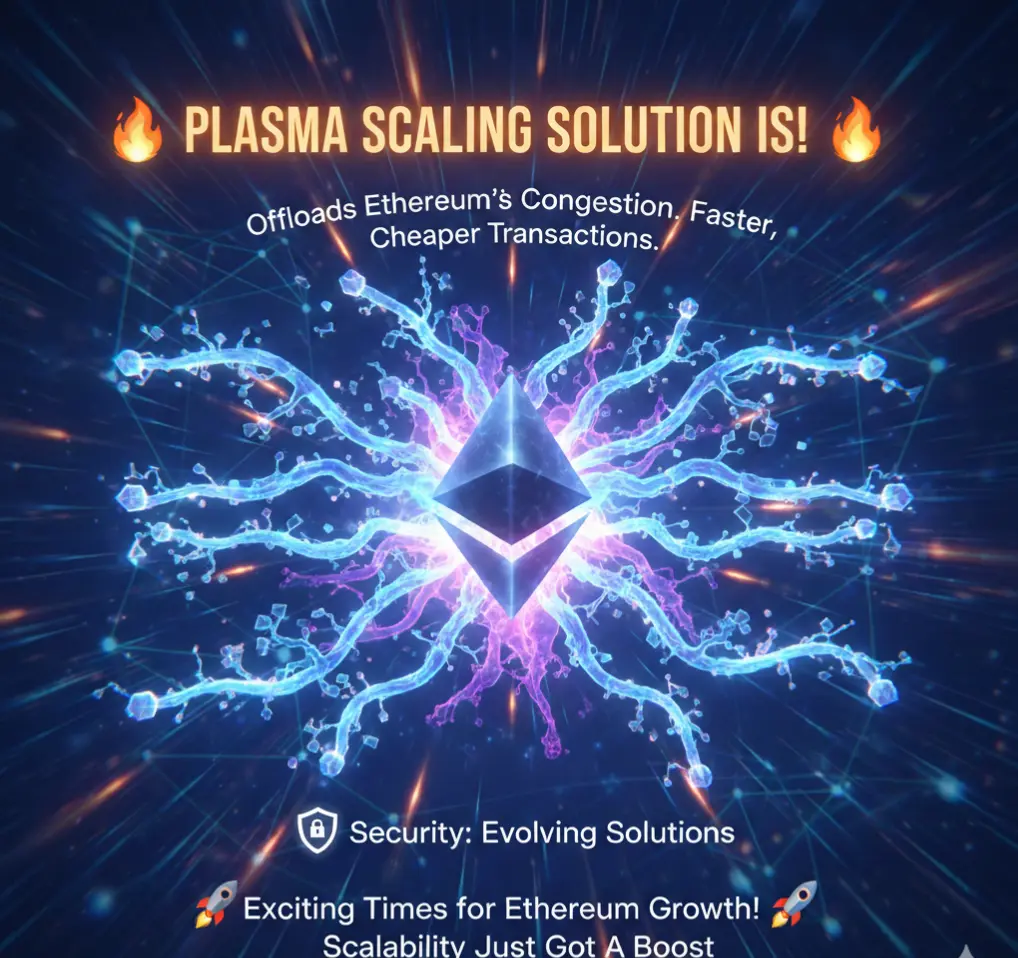

Watching Closely 🔍️#Plasma scaling solution is 🔥! It offloads Ethereum's congestion, enabling faster, cheaper transactions. Child chains handle the load, settling on the mainnet. Security's a consideration, but solutions are evolving. Exciting times for Ethereum's growth! 🚀 Scalability just got a boost. $XPL

XPL7,34%

- Reward

- 2

- 3

- Repost

- Share

HighAmbition :

:

Buy To Earn 💎View More

$WAL look good 👍 👍 👍 👍 👍

- Current Price: $0.1282 with a 1.42% gain.

- 24h Range: High $0.1298, Low $0.1230.

- Support: Around $0.1230 (24h low) and the MA(25) zone at ~$0.1256.

- Resistance: Near $0.1298 (24h high) and the recent peak of $0.1302.

The price is testing the resistance at $0.1298 with bullish momentum.

$WAL

- Current Price: $0.1282 with a 1.42% gain.

- 24h Range: High $0.1298, Low $0.1230.

- Support: Around $0.1230 (24h low) and the MA(25) zone at ~$0.1256.

- Resistance: Near $0.1298 (24h high) and the recent peak of $0.1302.

The price is testing the resistance at $0.1298 with bullish momentum.

$WAL

WAL0,32%

- Reward

- 2

- 1

- Repost

- Share

Sachin1104 :

:

Watching Closely 🔍️$SKR strong bullish trend 🚀 with a 251.03% price surge in 24 hours, reaching 0.045154 USDT. Key indicators:

- 24h High: 0.064200 USDT

- 24h Low: 0.012736 USDT

The price is above moving averages, indicating bullish momentum. Traders are watching for consolidation or pullback after such a spike. $SKR

- 24h High: 0.064200 USDT

- 24h Low: 0.012736 USDT

The price is above moving averages, indicating bullish momentum. Traders are watching for consolidation or pullback after such a spike. $SKR

SKR9,47%

- Reward

- 1

- 4

- Repost

- Share

Sazib_Akash :

:

am new plz folow me for folow back. 🤚🤚🤚🤚🤚🤚🤚🤚🤚🤚🤚🤚🤚🤚🤚🤚🤚🤚🤚🤚🤚🤚🤚🤚🤚🤚🤚🤚🤚🤚🤚🤚

🤚🤚🤚🤚🤚🤚🤚🤚🤚🤚🤚🤚🤚🤚🤚🤚

let's support each other and grow together.

View More

#Coinbase CEO Brian Armstrong is pushing for US crypto bill progress in Davos 🌟. Key points:

- Concerns: tokenized equities, DeFi, privacy, CFTC vs SEC power

- Bill aims to set clear regulatory boundaries

- Fate uncertain, possible passage by mid-Feb if smooth discussions 💡

- Concerns: tokenized equities, DeFi, privacy, CFTC vs SEC power

- Bill aims to set clear regulatory boundaries

- Fate uncertain, possible passage by mid-Feb if smooth discussions 💡

DEFI3,56%

- Reward

- 1

- 1

- Repost

- Share

Sachin1104 :

:

Happy New Year! 🤑market not gud everyone in panic. people have tention of tariff. market not gud bcoz of tariff. 😢😢😢😢😢😢😢😢😢 all the best guys 😉

#TariffTensionsHitCryptoMarket

#TariffTensionsHitCryptoMarket

- Reward

- 2

- 1

- Repost

- Share

Sachin1104 :

:

Happy New Year! 🤑$RIVER shows a strong bullish move with a 51% price gain in the last 24 hours.

Key observations:

- Price action: The last price is $26.865 with a 24h high of $29.149

Candlestick pattern: Green candles dominate the recent trend, showing buying pressure. The sharp rise indicates a potential breakout.

Indicators: Volume spikes align with price increases, supporting the bullish trend.

Analysis:

The chart suggests a strong short-term bullish trend driven by high volume and price surge. The moving averages indicate potential support around $26.390 (MA99). Watch for consolidation or pullback after

Key observations:

- Price action: The last price is $26.865 with a 24h high of $29.149

Candlestick pattern: Green candles dominate the recent trend, showing buying pressure. The sharp rise indicates a potential breakout.

Indicators: Volume spikes align with price increases, supporting the bullish trend.

Analysis:

The chart suggests a strong short-term bullish trend driven by high volume and price surge. The moving averages indicate potential support around $26.390 (MA99). Watch for consolidation or pullback after

- Reward

- 1

- 1

- Repost

- Share

Sachin1104 :

:

Happy New Year! 🤑- Reward

- 2

- Comment

- Repost

- Share

- Reward

- 2

- 1

- Repost

- Share

Sachin1104 :

:

Happy New Year! 🤑- Reward

- 1

- 3

- Repost

- Share

Sachin1104 :

:

2026 GOGOGO 👊View More

- Reward

- 2

- 1

- Repost

- Share

Sachin1104 :

:

Happy New Year! 🤑- Reward

- 1

- 1

- Repost

- Share

Sachin1104 :

:

Happy New Year! 🤑buy buy in deep somthing big is coming 🚀🚀🚀🚀🚀🚀🚀🚀🚀🚀🚀🚀🚀🚀🚀🔥🔥🔥🔥🔥🔥#MyFavouriteChineseMemecoin

- Reward

- 1

- 1

- Repost

- Share

Sachin1104 :

:

Happy New Year! 🤑$CLO 🔥🔥🔥

Price: 0.77578 USDT, up +30.28% in 24 hours.

24h High: 0.832662

24h Low: 0.58327.

Moving Averages: MA5 (0.67107), MA10 (0.52223), MA30 (0.34959) are all below the price, indicating upward momentum.

MACD: Shows positive divergence (MACD 0.04399, DIF 0.10579, DEA 0.06180), supporting bullish continuation.

Price: 0.77578 USDT, up +30.28% in 24 hours.

24h High: 0.832662

24h Low: 0.58327.

Moving Averages: MA5 (0.67107), MA10 (0.52223), MA30 (0.34959) are all below the price, indicating upward momentum.

MACD: Shows positive divergence (MACD 0.04399, DIF 0.10579, DEA 0.06180), supporting bullish continuation.

- Reward

- 2

- 1

- Repost

- Share

Sachin1104 :

:

Happy New Year! 🤑buy buy

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 1

- 1

- Repost

- Share

Sachin1104 :

:

Happy New Year! 🤑- Reward

- like

- Comment

- Repost

- Share

- Reward

- 1

- 1

- Repost

- Share

Sachin1104 :

:

Happy New Year! 🤑The chart shows a bullish move with WOD (World of Dypians) up 110% at a price of $0.05. The indicators suggest strong momentum:

MA(7) and MA(25) are above the current price, indicating short‑term support.

- Volume spike supports the upward trend.

- The price is near the recent high, showing potential for further gain if the trend holds.

$WOD

MA(7) and MA(25) are above the current price, indicating short‑term support.

- Volume spike supports the upward trend.

- The price is near the recent high, showing potential for further gain if the trend holds.

$WOD

WOD-4,75%

- Reward

- 2

- 2

- Repost

- Share

Sachin1104 :

:

Buy To Earn 💎View More