MrSunday

No content yet

MrSunday

Yesterday, President Trump had a secret meeting with NATO Secretary General Mark Rutte in Davos, and both sides reached a framework agreement related to Greenland. However, Greenland Prime Minister Jens-Frederik Nielsen confirmed that he was not involved in the negotiations and does not know the specific content of the agreement.

Prime Minister Nielsen emphasized that any agreement related to Greenland must have the consensus of the Greenland and Danish governments, and must respect sovereignty and territorial integrity, although Greenland is willing to negotiate with the US on economic and ot

View OriginalPrime Minister Nielsen emphasized that any agreement related to Greenland must have the consensus of the Greenland and Danish governments, and must respect sovereignty and territorial integrity, although Greenland is willing to negotiate with the US on economic and ot

- Reward

- like

- Comment

- Repost

- Share

Bitmine of Tom Lee has purchased an additional approximately 35.268 ETH worth over $108 million in the past week, increasing the total holdings to over 4.2 million ETH, equivalent to nearly 3.5% of the circulating Ethereum supply with a value of over $12.8 billion. The company is also holding: 192 Bitcoin worth $17.4 million + approximately $979 million in cash.

The amount of ETH the company has staked has increased from about 1.25 million to 1.83 million ETH, accounting for nearly 44% of the total portfolio, and the company expects that staking all assets could generate over $1 million per da

View OriginalThe amount of ETH the company has staked has increased from about 1.25 million to 1.83 million ETH, accounting for nearly 44% of the total portfolio, and the company expects that staking all assets could generate over $1 million per da

- Reward

- like

- Comment

- Repost

- Share

Bitcoin hashrate has dropped to its lowest level in 4 months, falling below 1 zetahash/second for the first time, despite recent signs of improved Bitcoin mining profitability.

According to Leon Lyu, CEO of StandardHash, the main reason is that many Bitcoin miners are shifting electricity and machinery to serve AI, as AI currently offers higher profits.

The year 2025 is seen as the most challenging period for Bitcoin miners to date, with declining revenue, increasing debt, and shrinking profit margins. Meanwhile, AI and high-performance computing are generating better returns, causing mining c

View OriginalAccording to Leon Lyu, CEO of StandardHash, the main reason is that many Bitcoin miners are shifting electricity and machinery to serve AI, as AI currently offers higher profits.

The year 2025 is seen as the most challenging period for Bitcoin miners to date, with declining revenue, increasing debt, and shrinking profit margins. Meanwhile, AI and high-performance computing are generating better returns, causing mining c

- Reward

- like

- Comment

- Repost

- Share

🇺🇸🇪🇺 EU REACTS STRONGLY TO PRESIDENT TRUMP'S THREAT OF TARIFFS OVER GREENLAND

🔹 The Netherlands condemns President Trump's threat to impose tariffs as "extortion," after the US announced a 10% (1 tariff starting February 1) and potentially increasing to 25% if Greenland is not allowed to be purchased.

🔹 The eight targeted countries include Denmark, Sweden, France, Germany, the Netherlands, Finland, the UK, and Norway.

🔹 The EU has convened an emergency meeting in Brussels and is calling for a coordinated response at the bloc-wide level.

🔹 France and several other countries have propose

View Original🔹 The Netherlands condemns President Trump's threat to impose tariffs as "extortion," after the US announced a 10% (1 tariff starting February 1) and potentially increasing to 25% if Greenland is not allowed to be purchased.

🔹 The eight targeted countries include Denmark, Sweden, France, Germany, the Netherlands, Finland, the UK, and Norway.

🔹 The EU has convened an emergency meeting in Brussels and is calling for a coordinated response at the bloc-wide level.

🔹 France and several other countries have propose

- Reward

- like

- Comment

- Repost

- Share

Vitalik Buterin believes that Ethereum has sacrificed too many core values such as decentralization, privacy, and financial autonomy just to attract mainstream users. He emphasizes that this must come to an end.

According to Vitalik, starting from 2026, Ethereum needs to focus on regaining the lost values by:

- Improving private payments.

- Making running nodes easier.

- Building truly decentralized applications that do not rely on centralized servers.

- Giving users better control over their data and assets.

Ethereum also needs to be resilient enough to survive for decades or centuries withou

View OriginalAccording to Vitalik, starting from 2026, Ethereum needs to focus on regaining the lost values by:

- Improving private payments.

- Making running nodes easier.

- Building truly decentralized applications that do not rely on centralized servers.

- Giving users better control over their data and assets.

Ethereum also needs to be resilient enough to survive for decades or centuries withou

- Reward

- like

- Comment

- Repost

- Share

The CEO of Bank of America warns that approximately $6 trillion in deposits (equivalent to 30-35% of total bank deposits in the US) could shift to stablecoins.

🔷 This shift would reduce the funding available for traditional banking systems, forcing banks to seek wholesale funding at higher costs.

🔷 CEO Moynihan believes that the structure of stablecoins is similar to money market funds, where reserves are held in short-term instruments like government bonds rather than being reinvested into economic loans.

🔷 The debate centers around the new crypto market structure bill by Senator Tim Scott

View Original🔷 This shift would reduce the funding available for traditional banking systems, forcing banks to seek wholesale funding at higher costs.

🔷 CEO Moynihan believes that the structure of stablecoins is similar to money market funds, where reserves are held in short-term instruments like government bonds rather than being reinvested into economic loans.

🔷 The debate centers around the new crypto market structure bill by Senator Tim Scott

- Reward

- like

- Comment

- Repost

- Share

The Trump administration allows NVIDIA to sell AI H200 chips to China, with the US government taking a 25% revenue share

🔹 President Trump confirms that the US will permit Nvidia to sell the AI H200 chip to China, with the condition that the US government collects 25% of the revenue

🔹 The H200 belongs to the Hopper series, not a reduced-performance version, but it lags two generations behind newer chips like Blackwell and Rubin

🔹 The US Department of Commerce has imposed strict controls, including confirming sufficient domestic supply, US testing and certification, and security standards fo

View Original🔹 President Trump confirms that the US will permit Nvidia to sell the AI H200 chip to China, with the condition that the US government collects 25% of the revenue

🔹 The H200 belongs to the Hopper series, not a reduced-performance version, but it lags two generations behind newer chips like Blackwell and Rubin

🔹 The US Department of Commerce has imposed strict controls, including confirming sufficient domestic supply, US testing and certification, and security standards fo

- Reward

- like

- Comment

- Repost

- Share

TSMC QUARTERLY PROFITS SURGE 35%, BEATING EXPECTATIONS THANKS TO AI CHIP DEMAND

🔹 Taiwan Semiconductor Manufacturing Company (TSMC) announced a 35% increase in Q4 profits year-over-year, reaching NT$505.7 billion (≈ $16.0 billion), surpassing the forecast (~NT$478.4 billion)

🔹 Q4 revenue reached NT$1.046 trillion (≈ $33.1 billion), exceeding expectations and up 20.5%, marking 8 consecutive quarters of year-over-year profit growth

🔹 Advanced 7nm and below chips account for 77% of total wafer revenue, reflecting strong demand from AI and high-performance servers

🔹 TSMC manufactures AI chips

View Original🔹 Taiwan Semiconductor Manufacturing Company (TSMC) announced a 35% increase in Q4 profits year-over-year, reaching NT$505.7 billion (≈ $16.0 billion), surpassing the forecast (~NT$478.4 billion)

🔹 Q4 revenue reached NT$1.046 trillion (≈ $33.1 billion), exceeding expectations and up 20.5%, marking 8 consecutive quarters of year-over-year profit growth

🔹 Advanced 7nm and below chips account for 77% of total wafer revenue, reflecting strong demand from AI and high-performance servers

🔹 TSMC manufactures AI chips

- Reward

- like

- Comment

- Repost

- Share

PRESIDENT TRUMP CALLS SENATOR ELIZABETH WARREN TO DISCUSS CREDIT CARD INTEREST RATE CAP

🔹 President Trump has called Senator Elizabeth Warren, a senior member of the Senate Banking Committee, to discuss the possibility of implementing a 10% cap on credit card interest rates.

🔹 Warren stated that she strongly supports capping interest rates and is willing to work across party lines with President Trump to “actually get something done” for consumers.

🔹 According to Warren, current credit card interest rates are excessively high and exploitative, placing significant pressure on American famili

View Original🔹 President Trump has called Senator Elizabeth Warren, a senior member of the Senate Banking Committee, to discuss the possibility of implementing a 10% cap on credit card interest rates.

🔹 Warren stated that she strongly supports capping interest rates and is willing to work across party lines with President Trump to “actually get something done” for consumers.

🔹 According to Warren, current credit card interest rates are excessively high and exploitative, placing significant pressure on American famili

- Reward

- like

- Comment

- Repost

- Share

🇯🇵🇸🇻 In a recent interview, Nick Vitalis of SBI Crypto, the crypto mining and infrastructure unit under SBI Holdings of Japan, stated that they are researching an expansion project to mine Bitcoin using volcanic energy in El Salvador.

The project includes a pilot program in collaboration with the Bitcoin Office of El Salvador to deploy container mining using geothermal energy at Ahuachapán Geothermal Power Plant, aiming to bring direct economic benefits to the country and strengthen El Salvador's position as a global hub for Bitcoin mining powered by self-sufficient energy.#GateProofOfRese

The project includes a pilot program in collaboration with the Bitcoin Office of El Salvador to deploy container mining using geothermal energy at Ahuachapán Geothermal Power Plant, aiming to bring direct economic benefits to the country and strengthen El Salvador's position as a global hub for Bitcoin mining powered by self-sufficient energy.#GateProofOfRese

BTC-0,28%

- Reward

- like

- Comment

- Repost

- Share

This week's economic event schedule (US DAILY@

This week features several notable events. Investors continue to monitor geopolitical developments, with oil remaining the focus. Additionally, the market awaits US inflation data as it directly impacts future interest rate expectations, while also keeping an eye on when the Supreme Court will issue rulings on tariffs and when President Trump will announce the next Federal Reserve Chair nominee.

🗓️ MONDAY, JANUARY 12

— Richmond Fed President Tom Barkin speaks

— Atlanta Fed President Raphael Bostic speaks

— New York Fed President John Williams spe

View OriginalThis week features several notable events. Investors continue to monitor geopolitical developments, with oil remaining the focus. Additionally, the market awaits US inflation data as it directly impacts future interest rate expectations, while also keeping an eye on when the Supreme Court will issue rulings on tariffs and when President Trump will announce the next Federal Reserve Chair nominee.

🗓️ MONDAY, JANUARY 12

— Richmond Fed President Tom Barkin speaks

— Atlanta Fed President Raphael Bostic speaks

— New York Fed President John Williams spe

- Reward

- like

- Comment

- Repost

- Share

The Supreme Court May Rule on President Trump's Tariffs, Significantly Impacting the Economy

🔸 The US Supreme Court may issue a ruling as early as Friday on whether President Trump's tariffs are lawful under emergency powers, with major implications for trade policy, government budgets, and markets.

🔸 The core issue is whether the administration can use the International Emergency Economic Powers Act to impose tariffs, and if not, whether importers should be refunded the tariffs they paid.

🔸 The court may issue a partial or mixed ruling, rather than completely blocking or fully approving th

View Original🔸 The US Supreme Court may issue a ruling as early as Friday on whether President Trump's tariffs are lawful under emergency powers, with major implications for trade policy, government budgets, and markets.

🔸 The core issue is whether the administration can use the International Emergency Economic Powers Act to impose tariffs, and if not, whether importers should be refunded the tariffs they paid.

🔸 The court may issue a partial or mixed ruling, rather than completely blocking or fully approving th

- Reward

- like

- Comment

- Repost

- Share

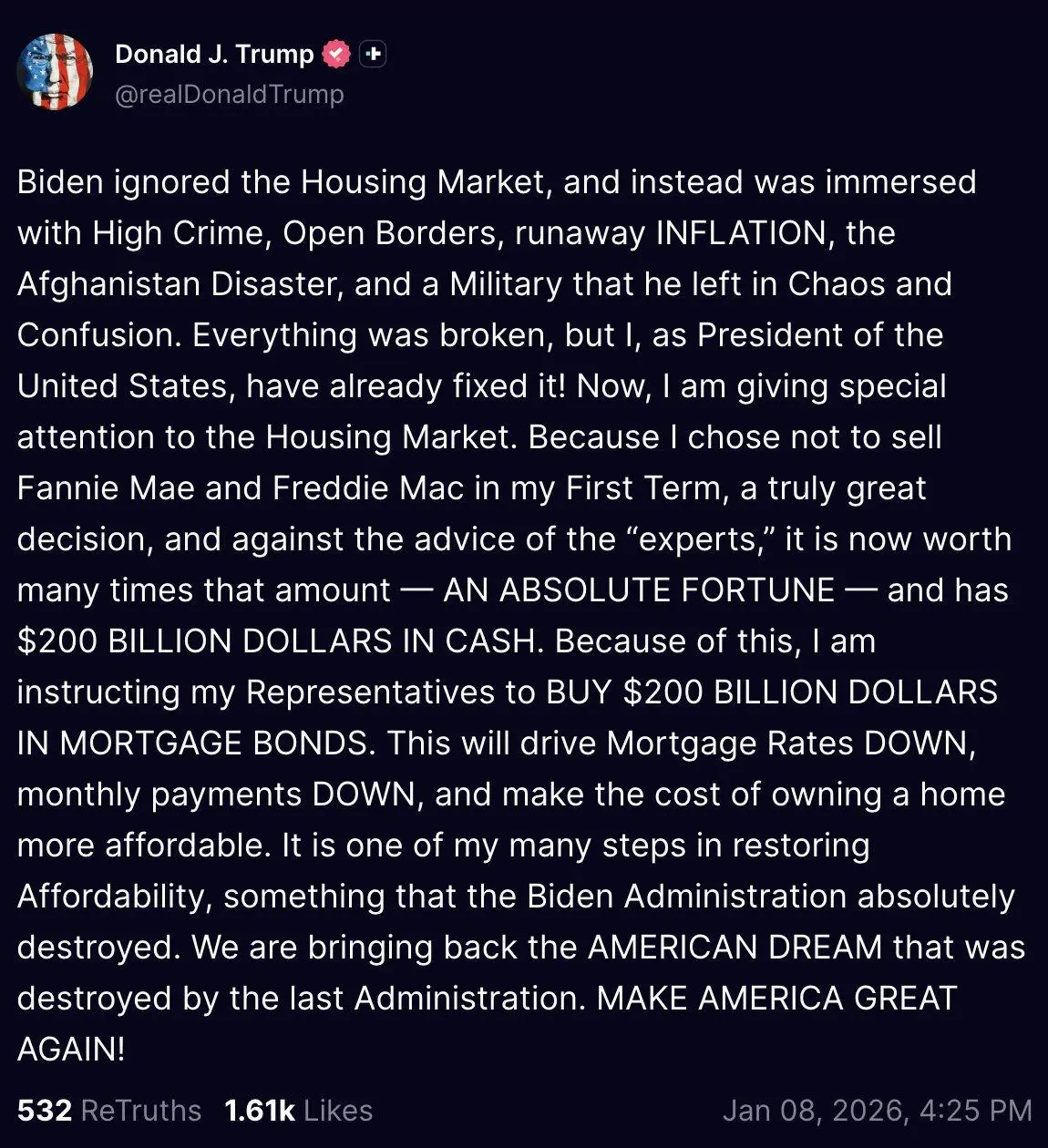

PRESIDENT TRUMP DISCUSSES PLAN TO PURCHASE $200 BILLION IN MORTGAGE-BACKED SECURITIES TO LOWER INTEREST RATES

🔸 President Trump stated that he is directing his representatives to buy $200 billion in mortgage-backed securities to help reduce mortgage interest rates and lower monthly payments.

🔸 He believes that Fannie Mae and Freddie Mac currently hold large amounts of cash and can use these funds to support the housing market and improve affordability.

🔸 When the government purchases bonds, demand increases, causing bond prices to rise. As bond prices go up, yields decrease. Mortgage intere

View Original🔸 President Trump stated that he is directing his representatives to buy $200 billion in mortgage-backed securities to help reduce mortgage interest rates and lower monthly payments.

🔸 He believes that Fannie Mae and Freddie Mac currently hold large amounts of cash and can use these funds to support the housing market and improve affordability.

🔸 When the government purchases bonds, demand increases, causing bond prices to rise. As bond prices go up, yields decrease. Mortgage intere

- Reward

- like

- Comment

- Repost

- Share

🇺🇸 The United States Considers Direct Payments to Greenland Residents, the Largest Land Deal in History

🔹 According to Reuters, U.S. officials are discussing the possibility of direct payments to each Greenland resident as part of an effort to persuade Greenland to secede from Denmark and potentially join the U.S.

🔹 The proposed amount ranges from $10,000 to $100,000 per person. With a population of about 57,000, the total estimated cost would be approximately $570 million to $5.7 billion.

🔹 This is not the U.S. purchasing territory from the government but rather directly impacting the pe

View Original🔹 According to Reuters, U.S. officials are discussing the possibility of direct payments to each Greenland resident as part of an effort to persuade Greenland to secede from Denmark and potentially join the U.S.

🔹 The proposed amount ranges from $10,000 to $100,000 per person. With a population of about 57,000, the total estimated cost would be approximately $570 million to $5.7 billion.

🔹 This is not the U.S. purchasing territory from the government but rather directly impacting the pe

- Reward

- like

- Comment

- Repost

- Share

A simple diplomatic solution is Barron Trump marrying Princess Isabella of Denmark, and Greenland being handed over to the United States as a dowry.#GateSquareCreatorNewYearIncentives #DailyMarketOverview $BTC $ETH

View Original

- Reward

- like

- Comment

- Repost

- Share

Overview of the current situation.

We have just entered 2026, and even though the first trading week has not yet concluded, numerous new developments have already emerged. The market is in a state of information overload.

From the beginning of the year, we knew that 2026 would be a year with many major events:

Who will become the next Fed Chair, whether this person can cut interest rates as President Trump desires, the Supreme Court's rulings related to Trump administration's trade policies, the risk of the US government shutting down again at the end of January, and of course, all news revolv

View OriginalWe have just entered 2026, and even though the first trading week has not yet concluded, numerous new developments have already emerged. The market is in a state of information overload.

From the beginning of the year, we knew that 2026 would be a year with many major events:

Who will become the next Fed Chair, whether this person can cut interest rates as President Trump desires, the Supreme Court's rulings related to Trump administration's trade policies, the risk of the US government shutting down again at the end of January, and of course, all news revolv

- Reward

- 1

- Comment

- Repost

- Share

🇺🇸🇻🇪 PRESIDENT TRUMP SAYS VENEZUELA WILL TRANSFER 30–50 MILLION BARRELS OF OIL TO THE US

🔹 President Trump stated that the interim government of Venezuela will transfer 30–50 million barrels of oil to the US

🔹 This oil will be sold at market price, and the proceeds will be directly controlled by him to ensure benefits for both the US and the Venezuelan people

🔹 President Trump has instructed Energy Secretary Chris Wright to implement the plan immediately. The oil will be transported by tanker and directly delivered to ports in the US#GateAIOfficiallyLaunches #BitcoinSix-DayRally $BTC $E

View Original🔹 President Trump stated that the interim government of Venezuela will transfer 30–50 million barrels of oil to the US

🔹 This oil will be sold at market price, and the proceeds will be directly controlled by him to ensure benefits for both the US and the Venezuelan people

🔹 President Trump has instructed Energy Secretary Chris Wright to implement the plan immediately. The oil will be transported by tanker and directly delivered to ports in the US#GateAIOfficiallyLaunches #BitcoinSix-DayRally $BTC $E

- Reward

- like

- Comment

- Repost

- Share

VENEZUELA SILENTLY HOLDS 600,000 BITCOIN

🔹Recently, there have been rumors that Venezuela may have secretly accumulated up to 600,000 BTC, worth approximately $60 billion. This information has even been mentioned by CNBC.

🔹If the US confiscates this Bitcoin and adds it to the Strategic Bitcoin Reserve fund, it would be a very large amount since the US government currently holds about 328K+ BTC, more than the MicroStrategy company (673K+ BTC)

🔹However, there is currently no verified evidence supporting the figure of 600,000 BTC.

🔹On-chain data and monitored government wallets show that Vene

View Original🔹Recently, there have been rumors that Venezuela may have secretly accumulated up to 600,000 BTC, worth approximately $60 billion. This information has even been mentioned by CNBC.

🔹If the US confiscates this Bitcoin and adds it to the Strategic Bitcoin Reserve fund, it would be a very large amount since the US government currently holds about 328K+ BTC, more than the MicroStrategy company (673K+ BTC)

🔹However, there is currently no verified evidence supporting the figure of 600,000 BTC.

🔹On-chain data and monitored government wallets show that Vene

- Reward

- like

- Comment

- Repost

- Share

Ethereum Declares Solving the "Impossible Triangle" Problem

🔹 Vitalik Buterin states that Ethereum has solved the blockchain trilemma, achieving decentralization, consensus, and high scalability simultaneously after more than 10 years of development.

🔹 Breakthroughs from ZKEVM and PeerDAS, which are now running on mainnet, allow for partitioning computational loads while still ensuring cryptographic verification of the entire system.

🔹 ZKEVM performance has significantly improved, with proof generation time reduced from minutes to seconds, and costs decreased by tens of times, enabling the

View Original🔹 Vitalik Buterin states that Ethereum has solved the blockchain trilemma, achieving decentralization, consensus, and high scalability simultaneously after more than 10 years of development.

🔹 Breakthroughs from ZKEVM and PeerDAS, which are now running on mainnet, allow for partitioning computational loads while still ensuring cryptographic verification of the entire system.

🔹 ZKEVM performance has significantly improved, with proof generation time reduced from minutes to seconds, and costs decreased by tens of times, enabling the

- Reward

- like

- Comment

- Repost

- Share