Jamesvanst

No content yet

Jamesvanst

- Reward

- like

- Comment

- Repost

- Share

BTC drops to 10th largest asset globally. This time it really is over

BTC-5,58%

- Reward

- like

- Comment

- Repost

- Share

If Bitcoiners really believe in the "digital gold" narrative, then sideways consolidation periods are a big part of Bitcoin\'s new market structure.

BTC-5,58%

- Reward

- like

- Comment

- Repost

- Share

Japanese Yen at 152 but Bitcoin isn’t melting down is important.

BTC-5,58%

- Reward

- like

- Comment

- Repost

- Share

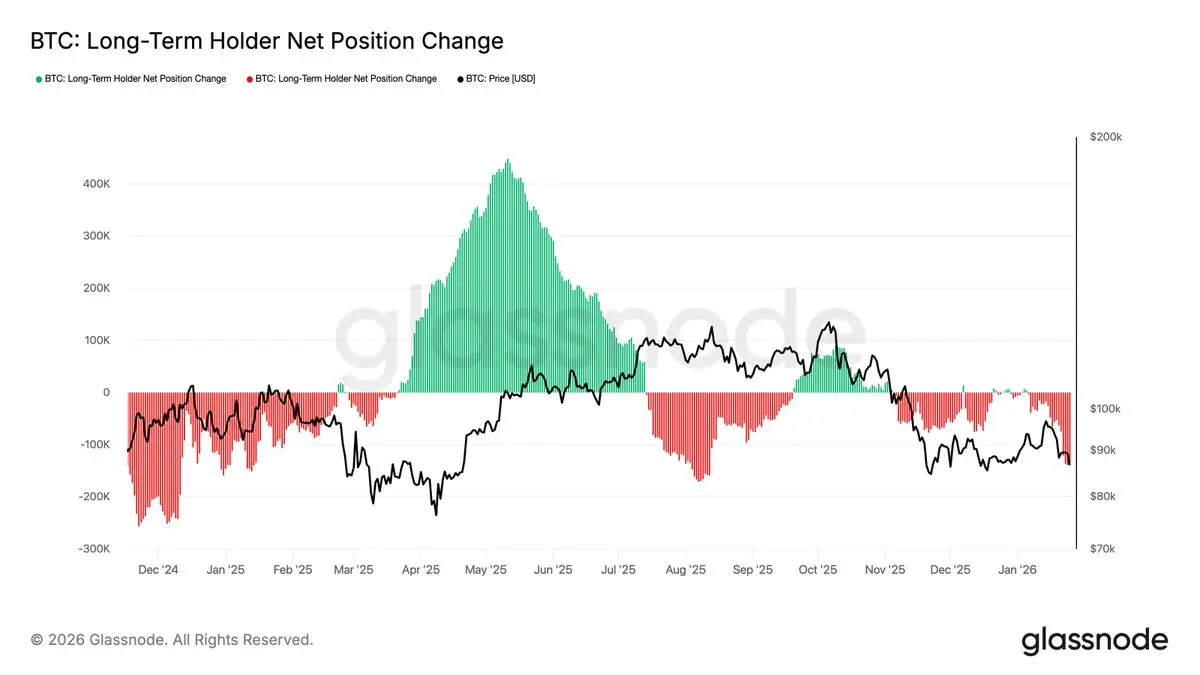

In the past 30 days, long-term holder have sold 134k BTC. LTH\'s were on aggregate net accumulators at the start of the year. While, MSTR has "only" purchased 40,147 BTC in January.

BTC-5,58%

- Reward

- like

- Comment

- Repost

- Share

In the past 30 days, long-term holder have sold 134k BTC. LTH\'s were net accumulators at the start of the year. While, MSTR has "only" purchased 40,147 BTC in January.

BTC-5,58%

- Reward

- like

- Comment

- Repost

- Share

Bitcoin is currently on course for four consecutive red months.Something that didn’t even happen in 2022.

BTC-5,58%

- Reward

- like

- Comment

- Repost

- Share

Metals Mooning

- Reward

- like

- Comment

- Repost

- Share

62 days ago bitcoin hit its bottom

BTC-5,58%

- Reward

- like

- Comment

- Repost

- Share

The answer my friend is blowing in the wind

- Reward

- like

- Comment

- Repost

- Share

The World Economic Forum is peak political theatre and reminds me how grateful I am to be buying Bitcoin below $100k.

BTC-5,58%

- Reward

- like

- Comment

- Repost

- Share

Gold = China \n\nBitcoin = U.S \n\nBitcoin is being thrown in with the sell America trade.

- Reward

- like

- Comment

- Repost

- Share

So the bond market won, again.

- Reward

- like

- Comment

- Repost

- Share

Amid all the chaos

- Reward

- like

- Comment

- Repost

- Share

Trump is trying everything to engineer a weaker DXY

- Reward

- like

- Comment

- Repost

- Share

There are decades where nothing happens; and there are weeks where decades happen.

Every day seems like a fourth-turning event.

Every day seems like a fourth-turning event.

- Reward

- like

- Comment

- Repost

- Share

There are decades where nothing happens; and there are weeks where decades happen.

- Reward

- like

- Comment

- Repost

- Share

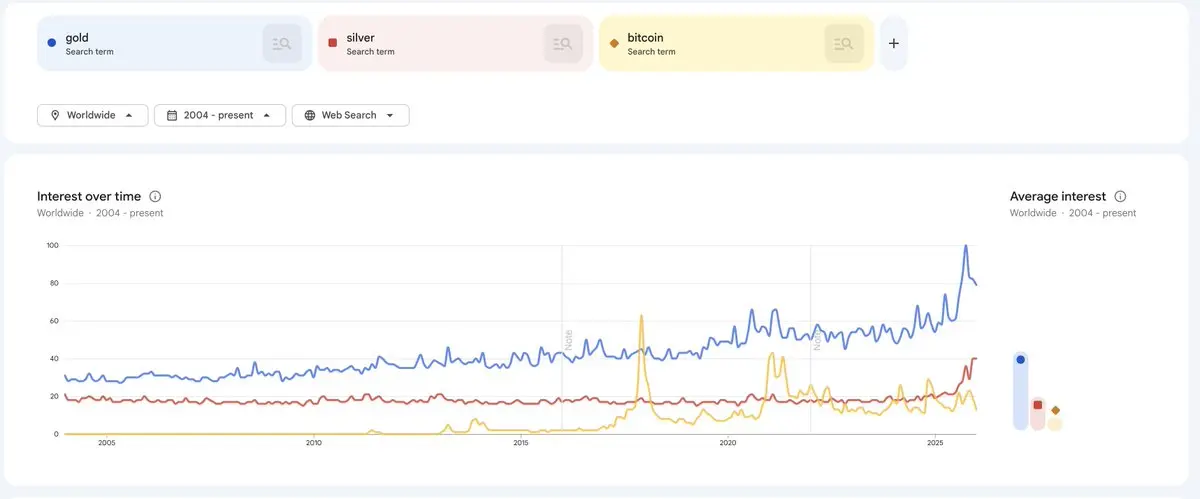

Even Silver's Google search interest has now overtaken Bitcoin's.

While each cycle attracts less and less retail interest in Bitcoin.

This is clearly the boring consolidation phase

While each cycle attracts less and less retail interest in Bitcoin.

This is clearly the boring consolidation phase

BTC-5,58%

- Reward

- like

- Comment

- Repost

- Share

They sell you fear, each and every time

- Reward

- like

- Comment

- Repost

- Share