HanssiMazak

No content yet

HanssiMazak

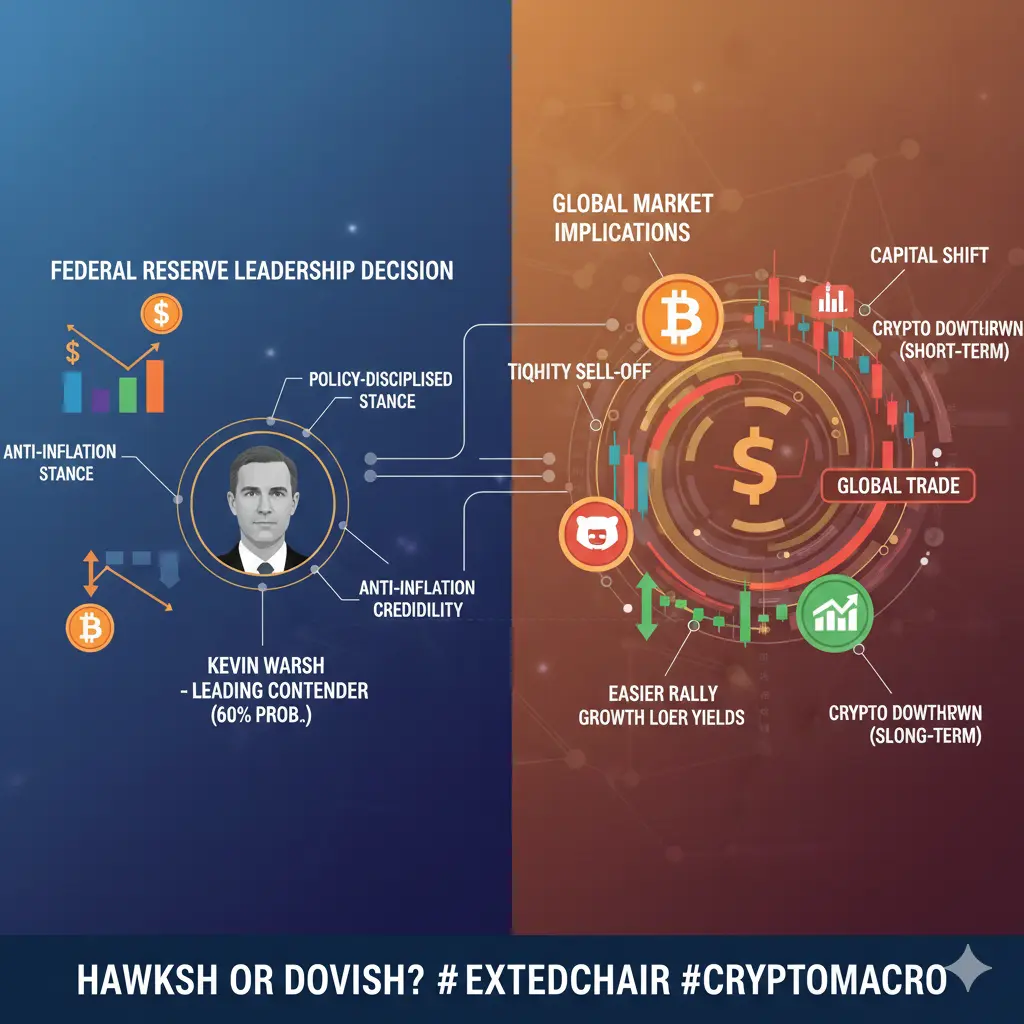

#NextFedChairPredictions The Decision That Could Define Market Direction in 2026

As 2026 progresses, all eyes are on the Federal Reserve — specifically, who will take the helm as the next Chair and what philosophy they will bring. This appointment is far more than political symbolism; it is the fulcrum of global liquidity. Every asset class — from U.S. Treasuries to emerging market equities and high-beta cryptocurrencies — is already positioning around expectations tied to this decision.

Recent market speculation highlights Kevin Warsh as a leading candidate, with implied odds reportedly aroun

As 2026 progresses, all eyes are on the Federal Reserve — specifically, who will take the helm as the next Chair and what philosophy they will bring. This appointment is far more than political symbolism; it is the fulcrum of global liquidity. Every asset class — from U.S. Treasuries to emerging market equities and high-beta cryptocurrencies — is already positioning around expectations tied to this decision.

Recent market speculation highlights Kevin Warsh as a leading candidate, with implied odds reportedly aroun

- Reward

- like

- Comment

- Repost

- Share

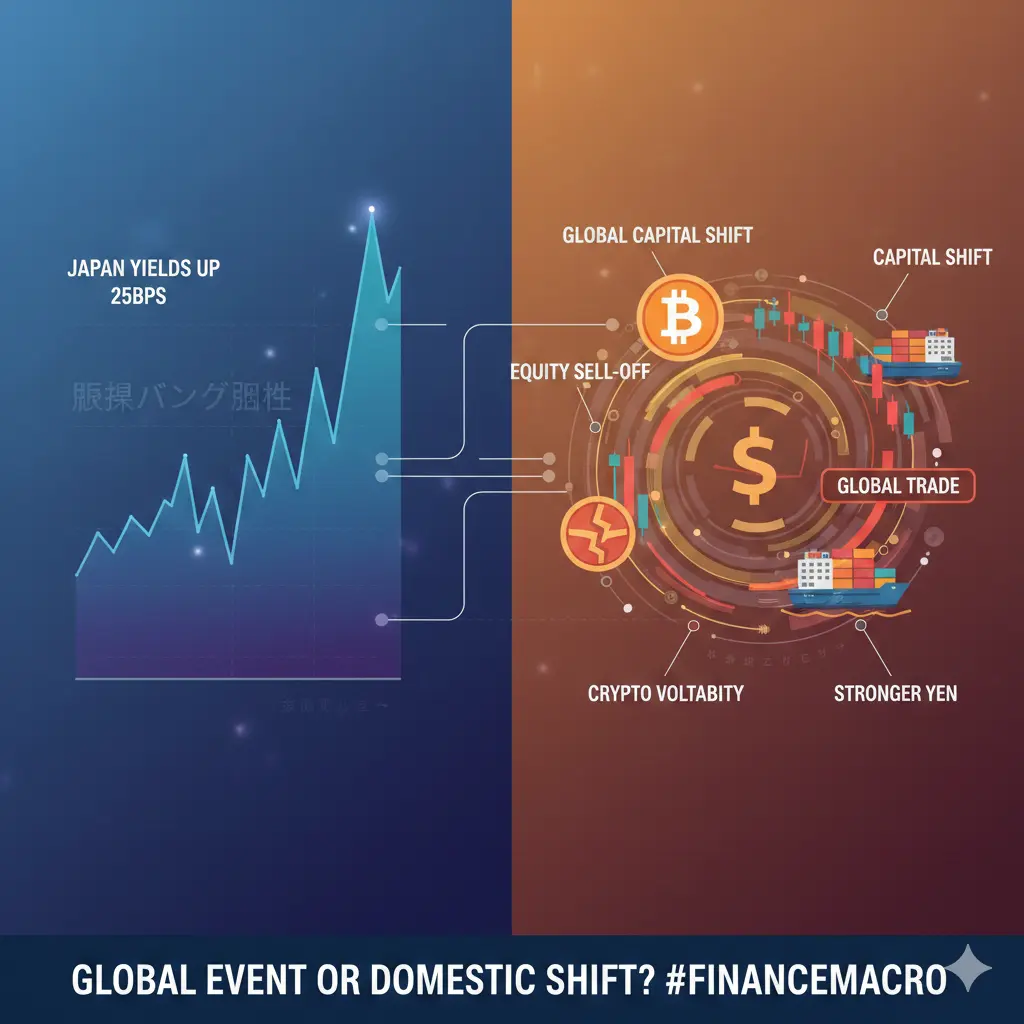

#JapanBondMarketSell-Off Global Markets in Flux: Consequences of Japan’s Historic Yield Surge (2026)

In early 2026, the world’s bond markets have been shaken by one of the most significant shifts in decades — Japan’s long-term government bond yields have surged to levels not seen in over 30 years, fundamentally challenging the ultra-low-yield status quo that has defined the Japanese financial landscape for generations. On January 20, 2026, 30- and 40-year Japanese Government Bond (JGB) yields jumped sharply, with 40-year yields breaching the 4% mark for the first time since their introduction

In early 2026, the world’s bond markets have been shaken by one of the most significant shifts in decades — Japan’s long-term government bond yields have surged to levels not seen in over 30 years, fundamentally challenging the ultra-low-yield status quo that has defined the Japanese financial landscape for generations. On January 20, 2026, 30- and 40-year Japanese Government Bond (JGB) yields jumped sharply, with 40-year yields breaching the 4% mark for the first time since their introduction

- Reward

- 1

- Comment

- Repost

- Share

#GrowthPointsDrawRound16 Celebrate the Year of the Horse with Gate.io!

Post, comment, like, and engage on Gate Square to earn Growth Points. Reach 300 points to enter the lottery — the more points, the higher your chances to win: iPhone 17, exclusive merch, tokens & crypto gifts!

🗓 Jan 21, 16:00 → Jan 31, 24:00 (UTC+8)

Join now 👉 https://www.gate.com/activities/pointprize?now_period=16

Full rules 📜 https://www.gate.com/announcements/article/49388

💡 Stay active — consistency is your key to winning!

Post, comment, like, and engage on Gate Square to earn Growth Points. Reach 300 points to enter the lottery — the more points, the higher your chances to win: iPhone 17, exclusive merch, tokens & crypto gifts!

🗓 Jan 21, 16:00 → Jan 31, 24:00 (UTC+8)

Join now 👉 https://www.gate.com/activities/pointprize?now_period=16

Full rules 📜 https://www.gate.com/announcements/article/49388

💡 Stay active — consistency is your key to winning!

- Reward

- 1

- Comment

- Repost

- Share

#GateTradFi1gGoldGiveaway Digital Effort, Real Rewards

In January 2026, Gate TradFi is redefining crypto rewards with its 1g Gold Giveaway, bridging high-speed digital trading with one of the oldest stores of value: gold. Unlike typical promotions, this campaign rewards consistency, discipline, and participation rather than luck, making real-world value the prize.

By connecting digital effort with tangible gold, Gate TradFi emphasizes trust, stability, and long-term engagement. Participants benefit from a fair and inclusive system where every user — big or small — can compete on the same trans

In January 2026, Gate TradFi is redefining crypto rewards with its 1g Gold Giveaway, bridging high-speed digital trading with one of the oldest stores of value: gold. Unlike typical promotions, this campaign rewards consistency, discipline, and participation rather than luck, making real-world value the prize.

By connecting digital effort with tangible gold, Gate TradFi emphasizes trust, stability, and long-term engagement. Participants benefit from a fair and inclusive system where every user — big or small — can compete on the same trans

- Reward

- 1

- 1

- Repost

- Share

Yusfirah :

:

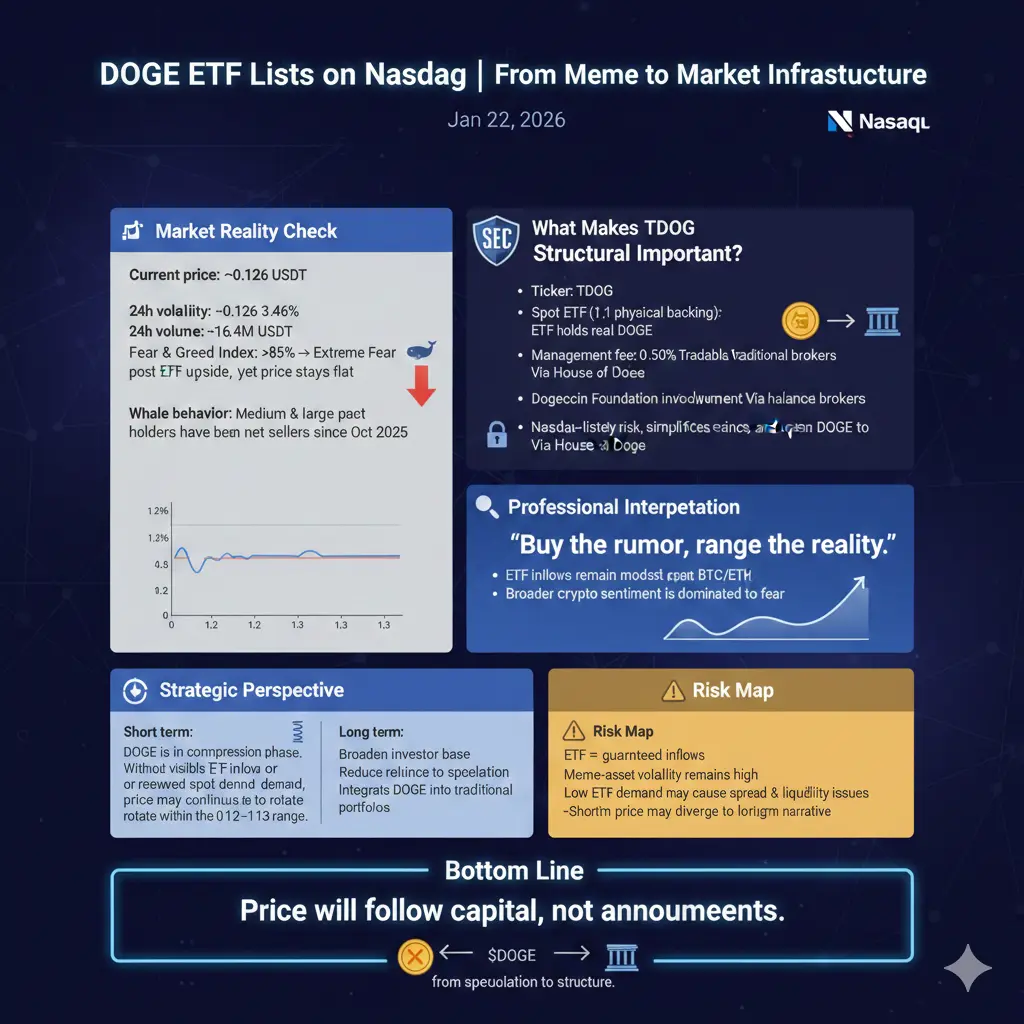

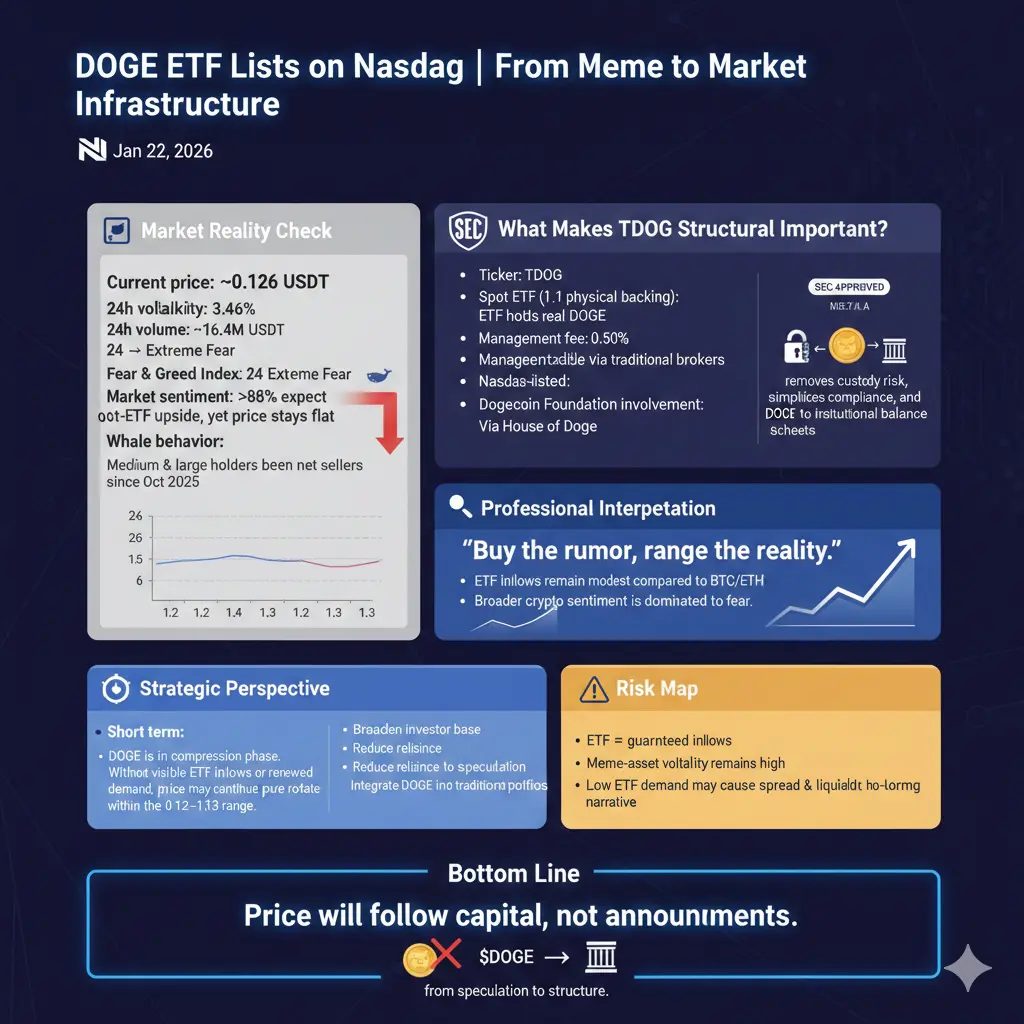

2026 GOGOGO 👊#DOGEETFListsonNasdaq The launch of the 21Shares Spot Dogecoin ETF (TDOG) on Nasdaq on January 22, 2026, represents a historic milestone for DOGE, signaling a shift from its meme-driven identity toward formal market infrastructure. Despite the headline-grabbing approval, DOGE’s price has remained range-bound, hovering around 0.126 USDT and consolidating between 0.12 and 0.13 USDT. Market volatility over 24 hours sits at 3.46%, with roughly 16.4 million USDT traded, while the Fear & Greed Index indicates extreme fear at 24. Interestingly, more than 85% of market participants expect post-ETF ups

- Reward

- 1

- Comment

- Repost

- Share

#RIVERUp50xinOneMonth RIVER, the Solana-native, chain-abstracted DeFi infrastructure token, has delivered one of the most extreme price moves of this market cycle, surging from $4 to nearly $70 in just one month and pushing its market capitalization close to $3 billion. Such an aggressive expansion — roughly +1,500% — is not a random event but the result of a confluence of narrative, leverage, and liquidity that aligned perfectly in a short timeframe. Unlike more organic spot-driven trends, RIVER’s price behavior reflects a leverage-centric process, amplified by derivatives volumes that are es

- Reward

- 1

- 1

- Repost

- Share

TigerTigerTiger :

:

What are you bragging about? Fake projects always end up in a complete mess.#GateWeb3UpgradestoGateDEX Gate.io Ushers in a New Era of Decentralized Trading

Gate.io is taking a bold step forward in the world of decentralized finance. With the official transformation of Gate Web3 into Gate DEX, the platform is no longer just a Web3 extension — it has become a fully integrated decentralized exchange designed to deliver speed, security, and accessibility at scale. This is far more than a rebrand; it represents a fundamental leap toward the next generation of DeFi infrastructure, merging the security and transparency of decentralized networks with the user experience and d

Gate.io is taking a bold step forward in the world of decentralized finance. With the official transformation of Gate Web3 into Gate DEX, the platform is no longer just a Web3 extension — it has become a fully integrated decentralized exchange designed to deliver speed, security, and accessibility at scale. This is far more than a rebrand; it represents a fundamental leap toward the next generation of DeFi infrastructure, merging the security and transparency of decentralized networks with the user experience and d

- Reward

- 2

- 2

- Repost

- Share

ybaser :

:

Happy New Year! 🤑View More

#TrumpWithdrawsEUTariffThreats From Confrontation to Calculation: A Strategic Reset in 2026

The first weeks of 2026 vividly illustrated how swiftly political signals can ripple through global markets. When U.S. President Donald Trump announced the possibility of imposing customs tariffs ranging from 10% to 25% on eight European nations—including Germany, France, the United Kingdom, and the Nordic bloc—investors immediately braced for a renewed trade war. This provocative move, tied to European resistance against Washington’s Arctic strategy and the highly debated Greenland acquisition proposal

The first weeks of 2026 vividly illustrated how swiftly political signals can ripple through global markets. When U.S. President Donald Trump announced the possibility of imposing customs tariffs ranging from 10% to 25% on eight European nations—including Germany, France, the United Kingdom, and the Nordic bloc—investors immediately braced for a renewed trade war. This provocative move, tied to European resistance against Washington’s Arctic strategy and the highly debated Greenland acquisition proposal

- Reward

- 1

- 1

- Repost

- Share

Yusfirah :

:

2026 GOGOGO 👊#GoldandSilverHitNewHighs A New Precious Metals Era: Historic Milestones in Early 2026

The opening weeks of 2026 have brought a remarkable surge in the global precious metals market, with gold and silver breaking records previously thought unattainable. Silver has crossed the psychologically significant $100 per ounce mark for the first time in history, while gold is approaching an unprecedented $5,000 per ounce. These historic milestones reflect not only investor enthusiasm but also a deeper structural shift in global demand and supply dynamics. Analysts and institutional observers are captiv

The opening weeks of 2026 have brought a remarkable surge in the global precious metals market, with gold and silver breaking records previously thought unattainable. Silver has crossed the psychologically significant $100 per ounce mark for the first time in history, while gold is approaching an unprecedented $5,000 per ounce. These historic milestones reflect not only investor enthusiasm but also a deeper structural shift in global demand and supply dynamics. Analysts and institutional observers are captiv

- Reward

- 1

- 1

- Repost

- Share

Yusfirah :

:

Buy To Earn 💎#CryptoMarketWatch 📉 The market is cooling off — and this is a healthy pause, not a warning sign.

Following the strong momentum seen earlier in January, Bitcoin, Ethereum, and leading altcoins are moving into consolidation. This phase looks less like panic and more like a reset of positioning and leverage.

🔍 Key Observations:

Bitcoin is stabilizing within a key demand range, flushing out late entries and excess leverage.

Ethereum continues to defend higher support levels, showing resilience rather than weakness.

Certain altcoins are quietly attracting accumulation, while others remain range-

Following the strong momentum seen earlier in January, Bitcoin, Ethereum, and leading altcoins are moving into consolidation. This phase looks less like panic and more like a reset of positioning and leverage.

🔍 Key Observations:

Bitcoin is stabilizing within a key demand range, flushing out late entries and excess leverage.

Ethereum continues to defend higher support levels, showing resilience rather than weakness.

Certain altcoins are quietly attracting accumulation, while others remain range-

- Reward

- 8

- 61

- Repost

- Share

Peacefulheart :

:

Watching Closely 🔍️View More

#CLARITYBillDelayed US Crypto Regulation Enters a New Phase of Uncertainty

The US crypto market is facing renewed uncertainty as the long-anticipated CLARITY Act has officially been delayed in the Senate. Originally expected to establish a unified federal framework for digital assets — covering exchanges, custodians, stablecoins, and DeFi platforms — the bill is now in legislative limbo. Investors and innovators are once again navigating a market defined more by questions than answers.

The delay reflects a convergence of political, procedural, and industry-driven challenges. Several major cryp

The US crypto market is facing renewed uncertainty as the long-anticipated CLARITY Act has officially been delayed in the Senate. Originally expected to establish a unified federal framework for digital assets — covering exchanges, custodians, stablecoins, and DeFi platforms — the bill is now in legislative limbo. Investors and innovators are once again navigating a market defined more by questions than answers.

The delay reflects a convergence of political, procedural, and industry-driven challenges. Several major cryp

- Reward

- 10

- 46

- Repost

- Share

ybaser :

:

Happy New Year! 🤑View More

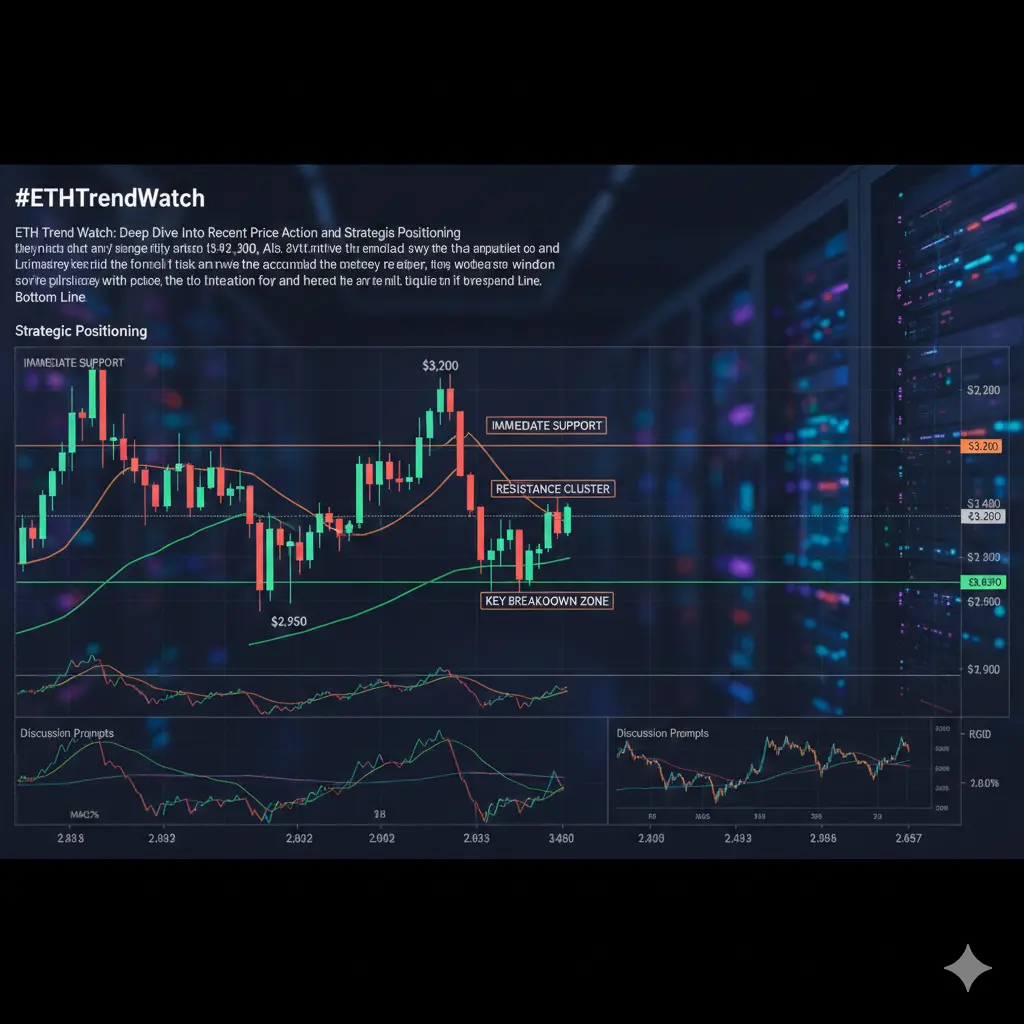

#ETHTrendWatch Ethereum Trend Watch: Navigating Consolidation and Strategic Positioning

Ethereum (ETH), the world’s second-largest cryptocurrency, is currently navigating a phase of consolidation and heightened volatility, as traders and investors weigh technical signals against evolving macroeconomic conditions. At present, ETH is trading within the $2,970–$3,200 range, following a retracement from recent highs and a period of indecisive, choppy price action.

Over the past month, Ethereum has largely oscillated between $2,950 and $3,260, indicating a market caught between accumulation and hes

Ethereum (ETH), the world’s second-largest cryptocurrency, is currently navigating a phase of consolidation and heightened volatility, as traders and investors weigh technical signals against evolving macroeconomic conditions. At present, ETH is trading within the $2,970–$3,200 range, following a retracement from recent highs and a period of indecisive, choppy price action.

Over the past month, Ethereum has largely oscillated between $2,950 and $3,260, indicating a market caught between accumulation and hes

- Reward

- 11

- 41

- Repost

- Share

Peacefulheart :

:

HODL Tight 💪View More

#DoubleRewardsWithGUSD As crypto market volatility intensifies, every investor seeks ways to protect their principal while capturing high-yield returns. Gate has created a Dual-Reward opportunity designed specifically for GUSD holders, combining a steady 4.4% APR from GUSD minting with the potentially explosive yields of the Launchpool. This hybrid model allows users to balance security with high-performance growth.

The strategy works on two complementary lines. The defensive component — GUSD minting — provides a reliable 4.4% APR, independent of market fluctuations. This offers a “safe harbor

The strategy works on two complementary lines. The defensive component — GUSD minting — provides a reliable 4.4% APR, independent of market fluctuations. This offers a “safe harbor

- Reward

- 9

- 40

- Repost

- Share

Peacefulheart :

:

2026 GOGOGO 👊View More

#NextFedChairPredictions As 2026 unfolds, global markets are increasingly focused on a single critical question: who will become the next Chair of the Federal Reserve, and what direction will that leadership impose on global liquidity? This decision goes far beyond politics — it represents the steering wheel of the world’s most influential central bank. Every asset class, from U.S. bonds to emerging markets and cryptocurrencies, is positioned around expectations tied to this outcome.

Recent speculation suggests Kevin Warsh has emerged as a leading contender, with market-implied odds reportedly

Recent speculation suggests Kevin Warsh has emerged as a leading contender, with market-implied odds reportedly

- Reward

- 8

- 28

- Repost

- Share

Peacefulheart :

:

2026 GOGOGO 👊View More

#JapanBondMarketSell-Off Japan’s bond market has experienced a sharp sell-off, with 30-year and 40-year government bond yields jumping sharply following the government’s announcement to end fiscal tightening and expand public spending. This dramatic move has raised significant questions about the potential impact on global interest rates, risk assets, and investor positioning.

The sell-off was triggered by the Japanese government signaling a shift toward expansionary fiscal policy. By promising increased public spending to stimulate growth, the government prompted a strong market reaction, par

The sell-off was triggered by the Japanese government signaling a shift toward expansionary fiscal policy. By promising increased public spending to stimulate growth, the government prompted a strong market reaction, par

- Reward

- 8

- 21

- Repost

- Share

MrFlower_XingChen :

:

2026 GOGOGO 👊View More

#GrowthPointsDrawRound16 Exciting news! The Year of the Horse has just begun, and Gate.io is celebrating with the 16th edition of the Growth Value New Year Lottery (Growth Points Draw Round 16). This event is a fun and easy way to earn rewards while staying active in the Gate community.

Here’s how it works: by posting, commenting, liking, and engaging in chats on Gate Square, you earn Growth Points. Once you reach 300 Growth Points, you can enter the lottery draw. The more points you accumulate, the more chances you have to win.

The prizes this round are impressive:

Brand-new iPhone 17

Exclusi

Here’s how it works: by posting, commenting, liking, and engaging in chats on Gate Square, you earn Growth Points. Once you reach 300 Growth Points, you can enter the lottery draw. The more points you accumulate, the more chances you have to win.

The prizes this round are impressive:

Brand-new iPhone 17

Exclusi

- Reward

- 9

- 24

- Repost

- Share

MrFlower_XingChen :

:

2026 GOGOGO 👊View More

#GateTradFi1gGoldGiveaway January 2026 marks a powerful shift in how crypto platforms define rewards. Gate TradFi’s 1g Gold Giveaway is more than just a promotional campaign — it represents a deeper transformation in user engagement. In an industry often driven by speculation, this event introduces something rare: certainty. Participants earn real gold, measurable value, and rewards that extend beyond screens and charts.

For years, traders have chased volatility, believing that success only comes from perfect entries and explosive price moves. Gate TradFi challenges that mindset by showing tha

For years, traders have chased volatility, believing that success only comes from perfect entries and explosive price moves. Gate TradFi challenges that mindset by showing tha

- Reward

- 8

- 16

- Repost

- Share

MrFlower_XingChen :

:

2026 GOGOGO 👊View More

#IranTradeSanctions Iran’s trade sanctions story in early 2026 has escalated from a long-running geopolitical tool into a wide-ranging force reshaping global economics and diplomacy. What began as targeted penalties tied to nuclear concerns and regional behavior has morphed into one of the most complex cross-border legislative and diplomatic challenges in recent decades. The multifaceted sanctions now not only restrict Tehran’s access to capital and technology, but also place pressure on Iran’s entire network of trading partners and global supply chains.

A dramatic recent development came when

A dramatic recent development came when

- Reward

- 8

- 24

- Repost

- Share

MrFlower_XingChen :

:

2026 GOGOGO 👊View More

Trending Topics

View More57.15K Popularity

33.15K Popularity

27.4K Popularity

9.7K Popularity

20.85K Popularity

Pin