Greenyeth

No content yet

Greenyeth

Do you believe in fate because Bitcoin topped in 2025 not 2024 😂

Some larps out there - stay safe friends.

Some larps out there - stay safe friends.

BTC-2,48%

- Reward

- 3

- Comment

- Repost

- Share

AI Automation processes I will be building out:

1. Daily recap on news & price action

2. YouTube content ideas & topics

3. Instagram content ideas & topics

4. Automating business processes

5. A Greeny AI with my knowledge & experience

6. 3 x trading bots (different risk)

1. Daily recap on news & price action

2. YouTube content ideas & topics

3. Instagram content ideas & topics

4. Automating business processes

5. A Greeny AI with my knowledge & experience

6. 3 x trading bots (different risk)

- Reward

- like

- Comment

- Repost

- Share

The next trillionaires aren’t CEOs. They’re 22 year olds in their bedroom shipping AI products at 2am.

- Reward

- like

- Comment

- Repost

- Share

I didn’t make money because I got lucky.

I took risks on myself, I used analysis and experience to have an edge. I used knowledge and skills to put the probability in my favour.

I took risks on myself, I used analysis and experience to have an edge. I used knowledge and skills to put the probability in my favour.

- Reward

- 1

- Comment

- Repost

- Share

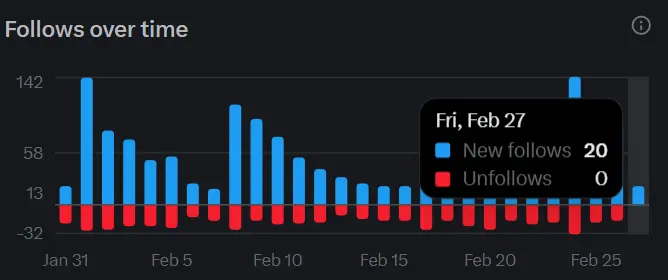

X growth hack - talk about AI and you will gain followers and lose none. Unlocked the full cheat code.

- Reward

- like

- Comment

- Repost

- Share

AI built my whole website. Using reverse engineering, I prompted Claude & ChatGPT to build this from scratch. Devs are no more.

- Reward

- 2

- Comment

- Repost

- Share

I miss when this used to happen

- Reward

- like

- Comment

- Repost

- Share

There's not enough hours in the day for me right now - it's so obvious that I need to embed ai seamlessly into my business and content life.

- Reward

- like

- Comment

- Repost

- Share

Weakness here is good for altcoins.

- Reward

- like

- Comment

- Repost

- Share

Claude is the ChatGPT Killer - Inside the first 24 hours on Claude Pro

- Reward

- 2

- Comment

- Repost

- Share

ICOs were the single greatest opportunity that we ever saw in 2017

DeFi was the single greatest opportunity that we ever saw in 2020

NFTs were the single greatest opportunity that we ever saw in 2021

Memecoins were the single greatest opportunity that we ever saw in 2024

InfoFi was the single greatest opportunity that we ever saw in 2025

Ai is the single greatest opportunity that we see in 2026.

I wonder what the future has in store.

DeFi was the single greatest opportunity that we ever saw in 2020

NFTs were the single greatest opportunity that we ever saw in 2021

Memecoins were the single greatest opportunity that we ever saw in 2024

InfoFi was the single greatest opportunity that we ever saw in 2025

Ai is the single greatest opportunity that we see in 2026.

I wonder what the future has in store.

DEFI5,53%

- Reward

- 1

- Comment

- Repost

- Share

Goals in life:

> do something you love

> travel

> make as much money as possible

> spend quality time with friends & family

> always be willing to learn new things

> step out of your comfort zone

> procreate

> don't sweat the small stuff

> be kind

What am I missing?

> do something you love

> travel

> make as much money as possible

> spend quality time with friends & family

> always be willing to learn new things

> step out of your comfort zone

> procreate

> don't sweat the small stuff

> be kind

What am I missing?

- Reward

- 1

- Comment

- Repost

- Share

'Dude, my altcoin bags are up 20% today'

'Dude, no way that's sick'

'How much are you up overall then?'

'Oh we don't talk about that (down 90% from ATHs)'

'Dude, no way that's sick'

'How much are you up overall then?'

'Oh we don't talk about that (down 90% from ATHs)'

- Reward

- 1

- Comment

- Repost

- Share

ARE WE BACK? AI Tokens Surge while Smart money pulls $400M from ETFs… yet price is ripping.

- Reward

- 2

- Comment

- Repost

- Share

I've been trading for 9+ years and creating content publicly for only 3... And I still lack patience from time to time on specific setups. As a trader you constantly battle with your own emotions and psychology.

I cut this for a loss yesterday when we broke below key macro support. The biggest suggestion I can make is become confident with your set up, trust your analysis and then step away completely. You won't win 100% of the time, no one does, but you'll learn to become comfortable in your ability to be right more often than not.

I cut this for a loss yesterday when we broke below key macro support. The biggest suggestion I can make is become confident with your set up, trust your analysis and then step away completely. You won't win 100% of the time, no one does, but you'll learn to become comfortable in your ability to be right more often than not.

- Reward

- 1

- Comment

- Repost

- Share