Core PCE YoY printed at 2.8% vs 2.9% expected — the Fed’s preferred inflation gauge continues to cool.

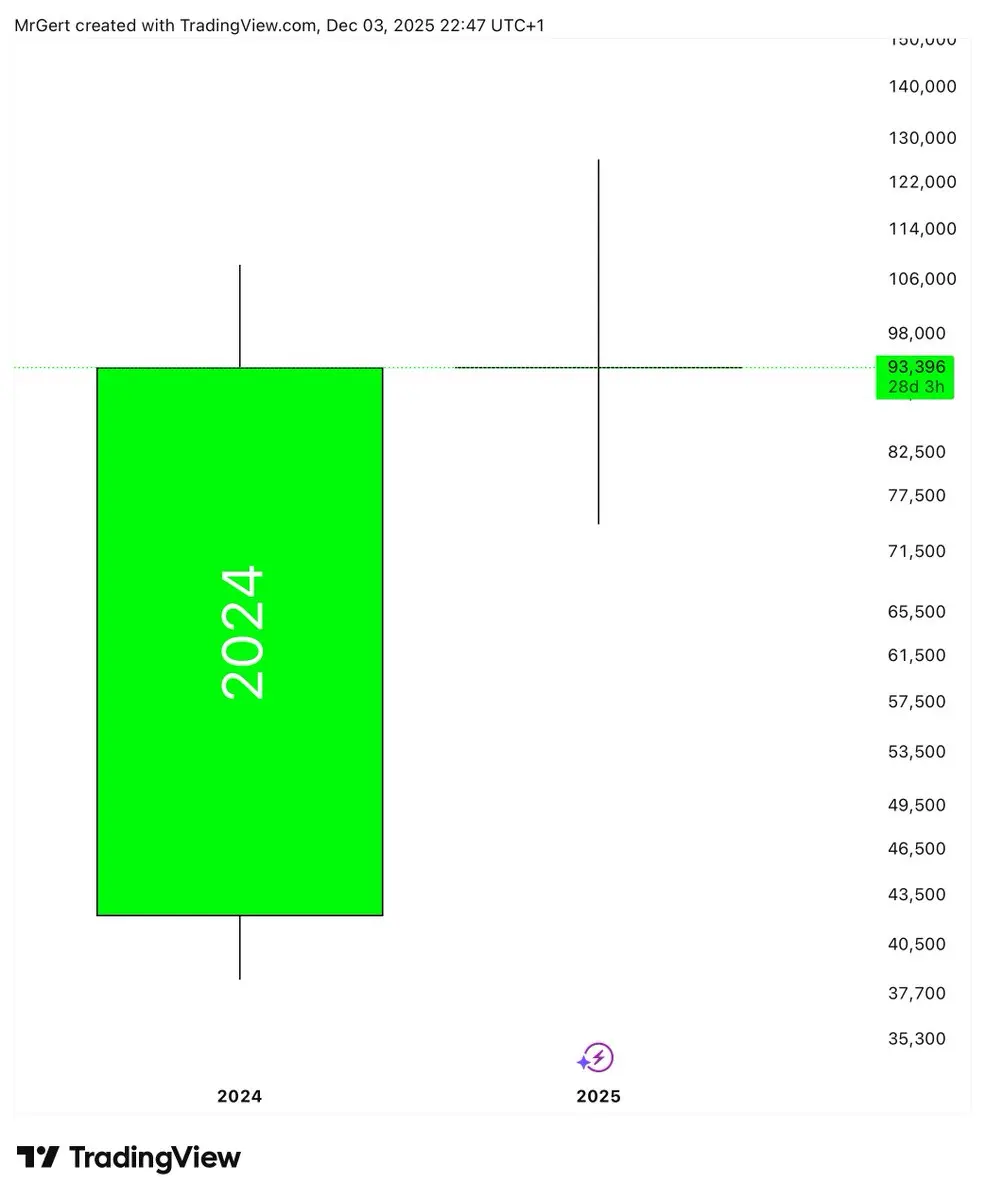

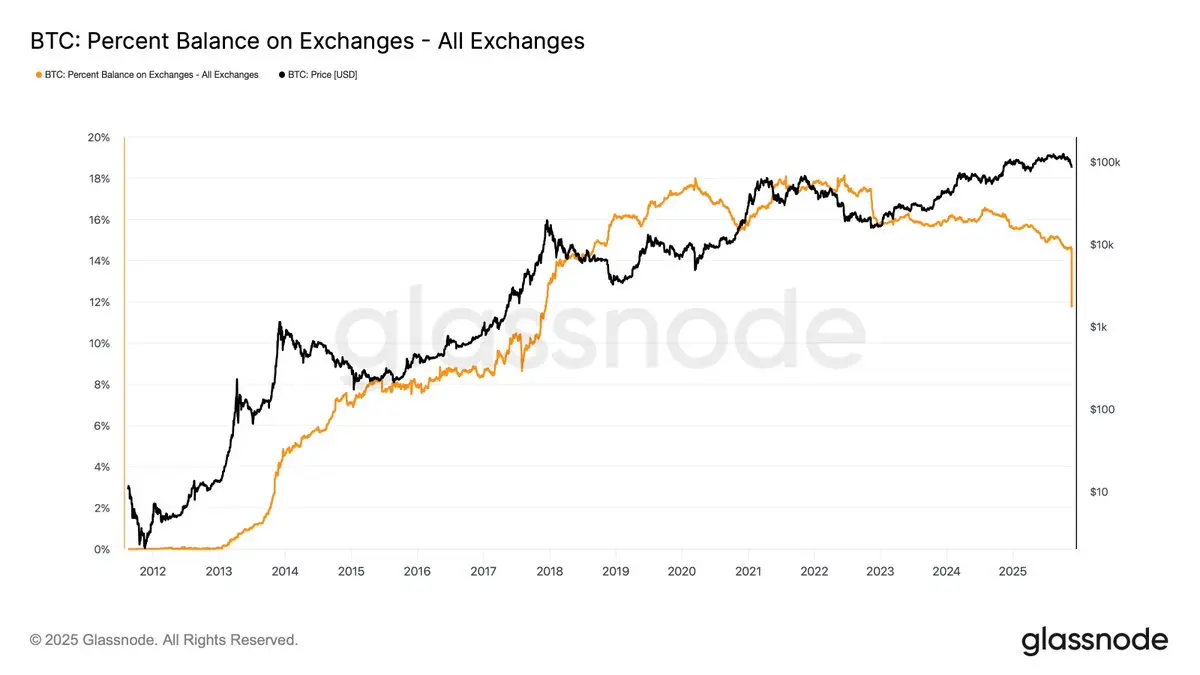

Perfect setup for risk-on momentum and a potential rate cut next week.

Santa rally, anyone? 🎅🚀

Perfect setup for risk-on momentum and a potential rate cut next week.

Santa rally, anyone? 🎅🚀