Top 3 silent killers of a crypto portfolio:

“It’s only -30%, I’ll wait for breakeven.”

“I’ll size bigger just this one time.”

“Surely it can’t go lower.”

Risk first, profits second.

Always remember survivors always get another cycle.

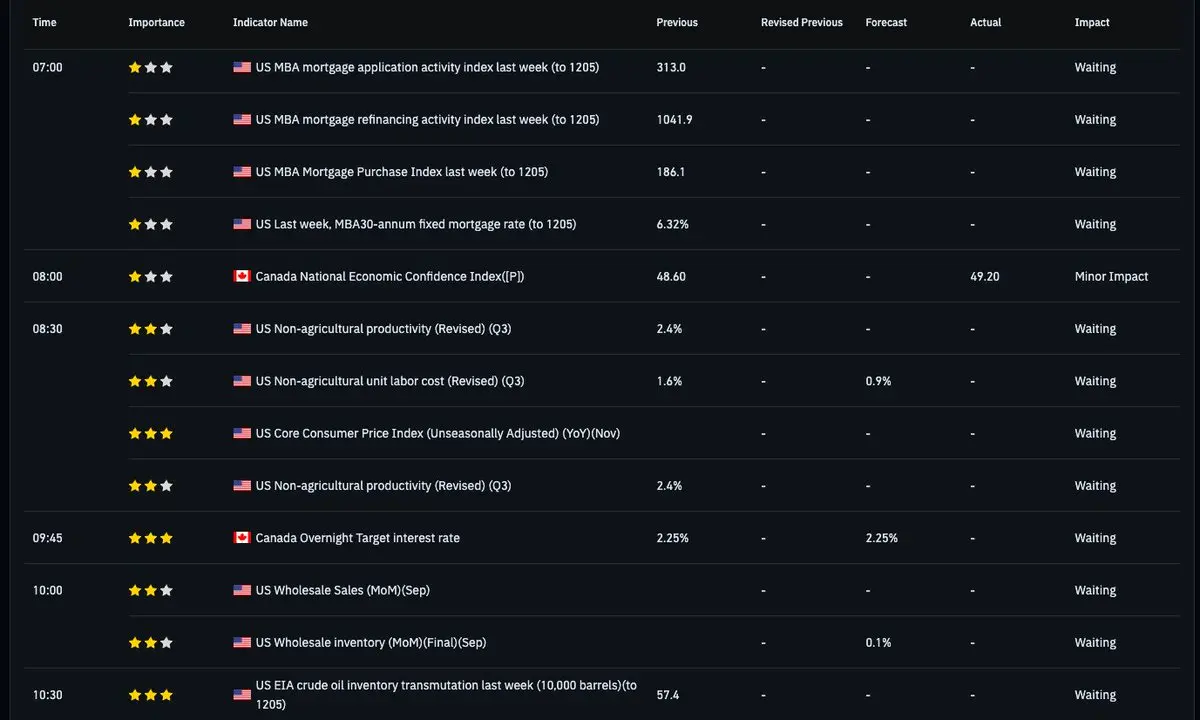

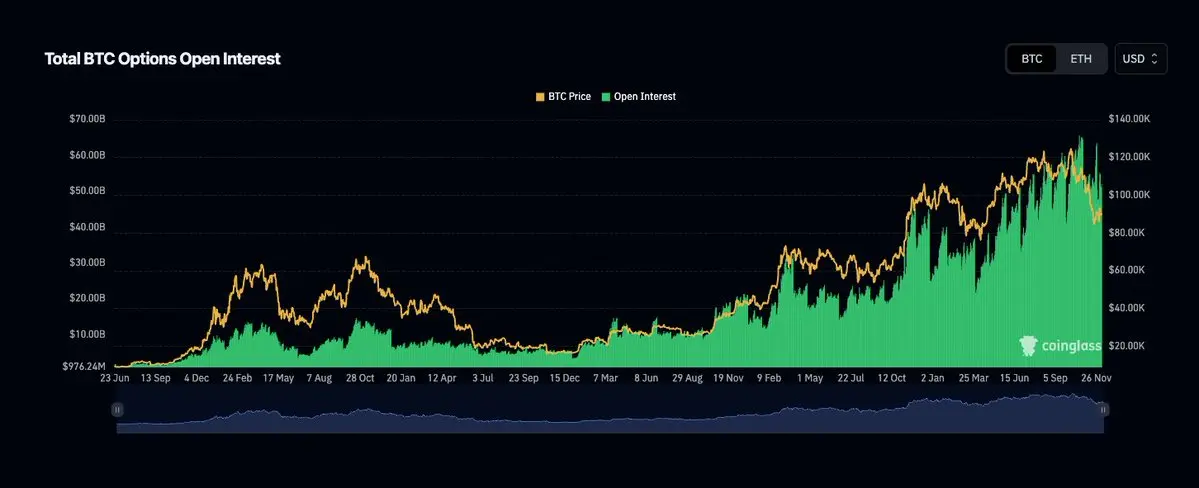

liquidity in this market is king

“It’s only -30%, I’ll wait for breakeven.”

“I’ll size bigger just this one time.”

“Surely it can’t go lower.”

Risk first, profits second.

Always remember survivors always get another cycle.

liquidity in this market is king