CryptoPatel

No content yet

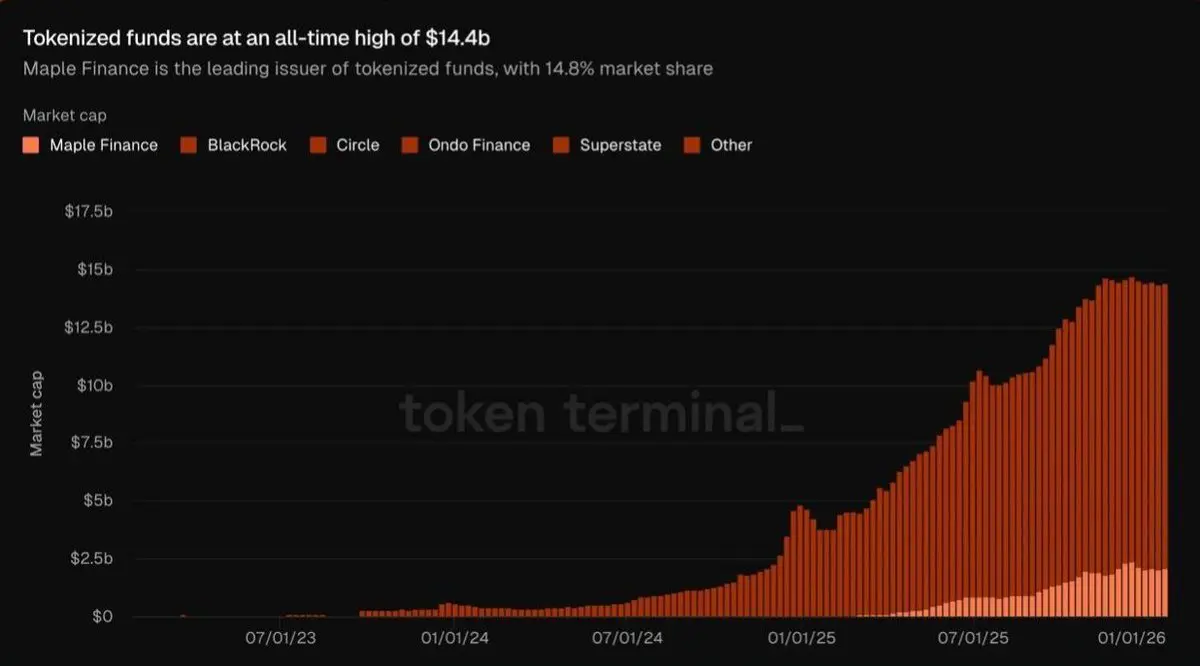

Tokenized Funds Have Reached A New All-Time High of $14.4B▶️ Strong demand from institutions▶️ Traditional finance moving faster into tokenization▶️ Real-world asset adoption continues to grow

- Reward

- 1

- 1

- Repost

- Share

HighAmbition :

:

Buy To Earn 💎- Reward

- like

- Comment

- Repost

- Share

🇺🇸 Lummis On Crypto Regulation“Every Day Without The Clarity Act Is A Day We Cede Our Competitive Edge To Other Nations.”Clear Crypto Rules = Faster InnovationCapital Stays OnshoreU.S. Leadership In Digital Assets

- Reward

- like

- Comment

- Repost

- Share

BREAKING: $6.9 trillion UBS will offer Bitcoin and crypto trading to its private banking clients.\n\nThe world’s largest wealth manager is adopting crypto, and people still think this market only moves in a 4-year cycle.

BTC-0,8%

- Reward

- like

- Comment

- Repost

- Share

🇺🇸 The SEC and CFTC will meet jointly next Tuesday to align crypto policy.\n\nFocus:\nRegulatory coordination\nMarket structure clarity\nKeeping the U.S. competitive in digital assets\n\nA meaningful step toward making the U.S. a global crypto hub.

- Reward

- like

- Comment

- Repost

- Share

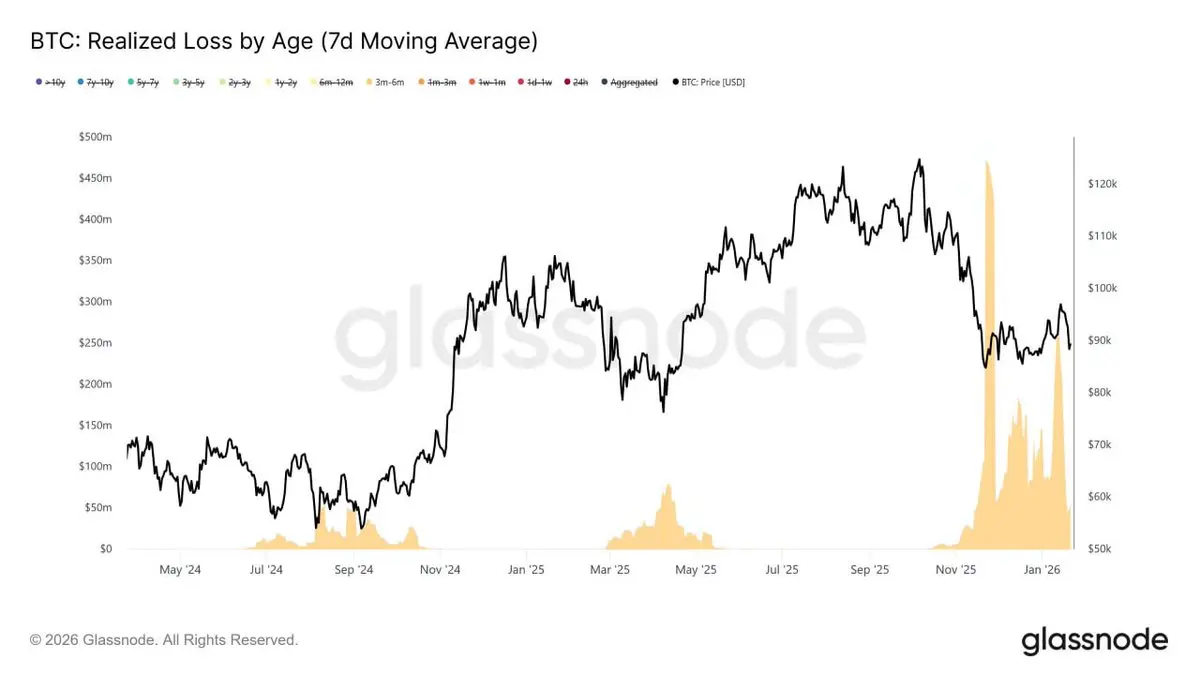

BITCOIN DIDN’T FAIL AT $98.4K. IT RAN INTO SELLERS\n\nSTH cost basis briefly reclaimed → instant rejection.\n\nWHY?\n3–6 month holders.\nAvg cost: $112.6K.\nStill deep underwater.\n\nThey’re selling every push to cut losses.\nRealized losses rising.\nMomentum capped.\n\nThis isn’t a technical ceiling.\nIt’s behavioral resistance.\n\n$BTC doesn’t break out\nuntil this cohort finishes exiting.\n\nPrice waits for people to capitulate.

BTC-0,8%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 1

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

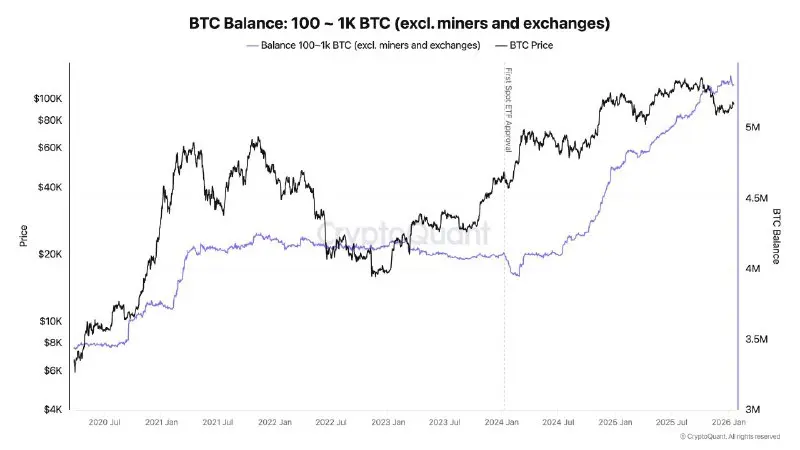

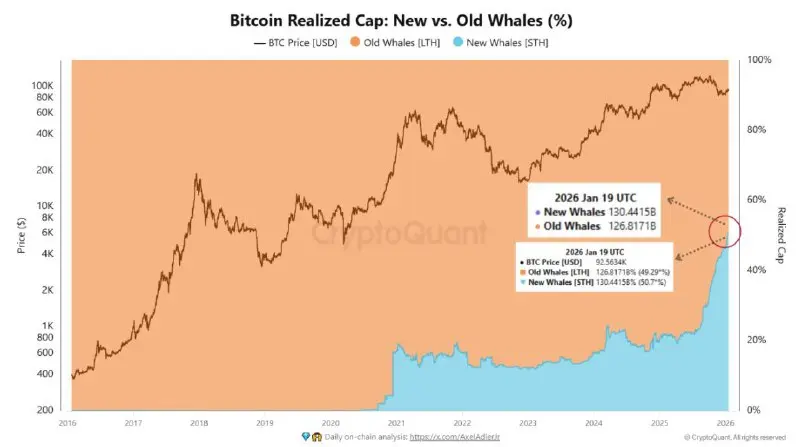

BITCOIN ISN’T JUST MOVING: IT’S TRANSFERRING.\n\n2024–2025 = THE LARGEST LONG-TERM HOLDER SUPPLY RELEASE IN HISTORY.\n\nON-CHAIN DATA CONFIRMS A TRUE REGIME SHIFT.\nOLD CONVICTION DISTRIBUTING. NEW HANDS ABSORBING.\n\nTHIS IS HOW MARKET STRUCTURES CHANGE.

BTC-0,8%

- Reward

- like

- Comment

- Repost

- Share

“I Think That #Bitcoin Could Hit $1 Million By 2030.”\n💬 Brian Armstrong, CEO Of Coinbase

BTC-0,8%

- Reward

- like

- Comment

- Repost

- Share

BREAKING: Iran\'s Central Bank Secretly Accumulated $507M In $USDT To Prop Up Its Collapsing Currency\n\nElliptic Report Reveals:\n→ Bought Via UAE Dirhams Through 50+ Wallets\n→ Funds Sent To Nobitex To Buy Rials\n→ Tether Froze $37M After Exposure\n→ Nobitex Later Hacked For $90M\n\nIran Is Using Stablecoins As “Digital Dollars” To Bypass Sanctions But Blockchain Transparency Exposed Everything.

- Reward

- like

- Comment

- Repost

- Share

#Bitcoin Market Influence Is Shifting Toward New Whales.\n\nThese Holders:\n◾️ Control Large Realized Capital\n◾️ Show Higher Turnover Activity\n◾️ Are More Reactive To Price Volatility\n\nThis Change Suggests Faster Market Rotations And Sharper Moves As Newer Capital Plays A Bigger Role.

BTC-0,8%

- Reward

- 1

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

If #BTC Breaks the $87K Bear-Flag Support, Where’s Your Downside Target?

Clean Breakdown + No Reclaim = Range Expansion Toward $80K → $72K → $60K.

Fast Reclaim Above $90K = Failed Breakdown / Bear Trap.

Clean Breakdown + No Reclaim = Range Expansion Toward $80K → $72K → $60K.

Fast Reclaim Above $90K = Failed Breakdown / Bear Trap.

BTC-0,8%

- Reward

- like

- Comment

- Repost

- Share

Trending Topics

View More67.97K Popularity

42.53K Popularity

35.56K Popularity

13.54K Popularity

28.71K Popularity

Pin