BiloCrypto

No content yet

BiloCrypto

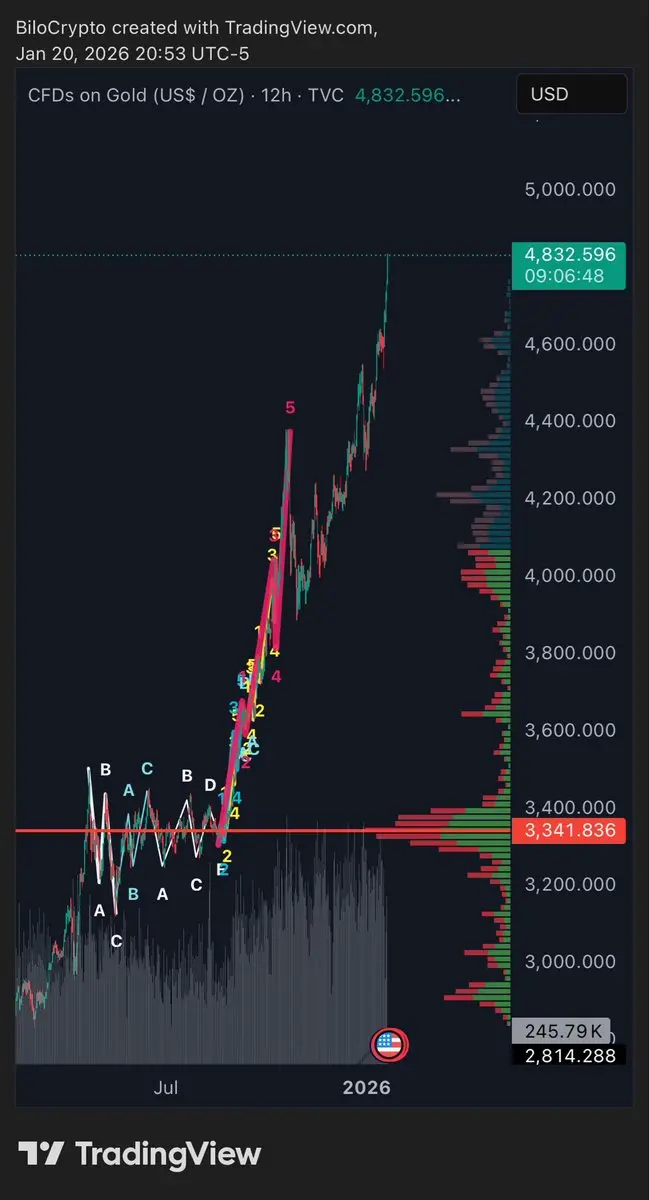

Sliver and gold took a major shellacking today on news Trump appointed the hawkish Kevin WarshRight or wrong, everyone including myself was sure that Trump would put in someone to do his bidding and while we don’t know that Kevin won’t his history said otherwiseI was not expecting this

- Reward

- 1

- Comment

- Repost

- Share

I find that $SUI has lost much of its hype From a TA POV, looks to be completing W4 of Wave C or already stared W5 I’m not a buyer hereI’d be interested in the ~$0.55 zoneIt shows a lot of confluence with sub counts as well as the fact that W1 of WC is a leading diagonal We have to ignore Oct 10Some fundamental changes or news could ofc shorten the retracement so keeping eyes on this.

SUI-6,76%

- Reward

- like

- Comment

- Repost

- Share

As long as this “new world order” is being pushed and shoved on everyone, Gold and Silver will remain strong

- Reward

- like

- Comment

- Repost

- Share

DOJ was to release Epstein files over a

month ago

Since then

1)Venezuela was invaded, it’s el presidente taken & their oil annexed

2)Another Iran fiasco,

3) threats to annex Greenland one way or another

Epstein who? 🤔

I don’t remember. Do you?

month ago

Since then

1)Venezuela was invaded, it’s el presidente taken & their oil annexed

2)Another Iran fiasco,

3) threats to annex Greenland one way or another

Epstein who? 🤔

I don’t remember. Do you?

- Reward

- 1

- 1

- Repost

- Share

Unoshi :

:

Thanks for letting us knowU.S. market closed tomorrow. If no appeasing news comes out of trumps latest bullying of countries that don’t support his takeover of Greenland and all his other shenanigans, the markets will not fair well

BTC is quiet now but expect extreme volatility tomorrow night when Tuesday’s Futures markets open

BTC is quiet now but expect extreme volatility tomorrow night when Tuesday’s Futures markets open

BTC-5,47%

- Reward

- 2

- 2

- Repost

- Share

ZAIDMIRZA :

:

Happy New Year! 🤑View More

Tell me again why not to invest in commodities while this man child threatens the entire planet when he doesn’t get what he wants.

- Reward

- like

- Comment

- Repost

- Share

The “free” world & MSM is rightfully calling out the Iranian regime for the way they treat their own people & for their repressive nature

The same “free” world & MSM are in the meantime silent as to the atrocities/war crimes carried out against Palestinians & neighbouring countries by your favourite middle eastern regime

Hypocrites

We in the west made Iran what it is today

We in the west made Israel what it is today

We in the west are the only ones that can bring about change

Vote for a fair and just world 🕊️

The same “free” world & MSM are in the meantime silent as to the atrocities/war crimes carried out against Palestinians & neighbouring countries by your favourite middle eastern regime

Hypocrites

We in the west made Iran what it is today

We in the west made Israel what it is today

We in the west are the only ones that can bring about change

Vote for a fair and just world 🕊️

- Reward

- like

- Comment

- Repost

- Share

Trump just accepted the physical Nobel peace prize medal that Maria Machado won and that he made a big fuss about.

She just gave it to him as she was visiting him at the White House today ( to change his mind and get his support) and he accepted.

This after he said last week or so she should have never accepted it as it should have been given to him and withdrew his support for her by saying she’s not fit to be president of Venezuela.

You can’t make this shit up.

She just gave it to him as she was visiting him at the White House today ( to change his mind and get his support) and he accepted.

This after he said last week or so she should have never accepted it as it should have been given to him and withdrew his support for her by saying she’s not fit to be president of Venezuela.

You can’t make this shit up.

- Reward

- like

- Comment

- Repost

- Share

🚨SCOTUS to rule on Trump tariffs ‼️

SCOTUS will release opinions Jan 14, 2026 from 10 AM ET, but doesn't announce which cases in advance.

The tariffs debacle may be included tomorrow.

Markets & Trump are preparing; he warns of economic "mess" if court rules against.

SCOTUS will release opinions Jan 14, 2026 from 10 AM ET, but doesn't announce which cases in advance.

The tariffs debacle may be included tomorrow.

Markets & Trump are preparing; he warns of economic "mess" if court rules against.

- Reward

- like

- Comment

- Repost

- Share

CPI data incoming in 15 minutes

- Reward

- like

- Comment

- Repost

- Share

My mom passed away too early 3 years ago today

I know for a fact she is with Jesus and with all the saints.

I love you mom ❤️❤️❤️

I miss you so much

I know for a fact she is with Jesus and with all the saints.

I love you mom ❤️❤️❤️

I miss you so much

- Reward

- like

- Comment

- Repost

- Share

It’s not hard to see BTC break upwards here

I wouldn’t say it would be the promised continuation of the bull but it would make sense for a mini pump soon

Some shorts need to be taught a lesson

Remember. The immediate objective is to lower OI

I wouldn’t say it would be the promised continuation of the bull but it would make sense for a mini pump soon

Some shorts need to be taught a lesson

Remember. The immediate objective is to lower OI

BTC-5,47%

- Reward

- like

- Comment

- Repost

- Share

INJ

What looked like a very promising project one year ago has disappointed many

Is it due for some love?

What looked like a very promising project one year ago has disappointed many

Is it due for some love?

INJ-7,2%

- Reward

- like

- Comment

- Repost

- Share

HYPE has 2 important short term tend lines to keep eyes on

Lots of protocols emerging trying to compete, but I don’t think anything comes close right now. That with FUD on team tokens has kept the price low

I continue to be long term bullish & accumulate decent retracements

Lots of protocols emerging trying to compete, but I don’t think anything comes close right now. That with FUD on team tokens has kept the price low

I continue to be long term bullish & accumulate decent retracements

HYPE2,09%

- Reward

- like

- Comment

- Repost

- Share

It’s a boy 🎊

- Reward

- like

- Comment

- Repost

- Share

The “no more wars” president just invaded Venezuela and ousted its president so he can install another one and grab their oil

Happy new year

Happy new year

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Be honest

In 2025, I…

In 2025, I…

- Reward

- like

- Comment

- Repost

- Share

Happy new year everyone.

Wishing you all a healthy, happy and prosperous 2026 ❤️

Wishing you all a healthy, happy and prosperous 2026 ❤️

- Reward

- like

- Comment

- Repost

- Share