The small level looks like it has basically topped out, but it's unlikely to drop directly. Most likely, it will choose to fluctuate and decline. If there's a rebound to the second-highest point, you can add to your short positions. This wave down will maximize profits. Get ready to earn big, guys!

View OriginalBTCNavigation

No content yet

BtcNavigation

Market outlook for the morning of January 7, 2026

The current chart shows a structure similar to an arc bottom, and the appearance of consecutive bullish candles has indeed stimulated short-term market bullish sentiment. However, it is necessary to calmly review the previous movement rhythm—how the price was rapidly driven up, and how it encountered concentrated selling pressure and fell back during the early morning hours. The frequent rise and fall essentially constitute a typical high-level shakeout, with a repetitive rhythm and strong destructive power, not a healthy accumulation.

In the e

View OriginalThe current chart shows a structure similar to an arc bottom, and the appearance of consecutive bullish candles has indeed stimulated short-term market bullish sentiment. However, it is necessary to calmly review the previous movement rhythm—how the price was rapidly driven up, and how it encountered concentrated selling pressure and fell back during the early morning hours. The frequent rise and fall essentially constitute a typical high-level shakeout, with a repetitive rhythm and strong destructive power, not a healthy accumulation.

In the e

- Reward

- like

- Comment

- Repost

- Share

2026/1/7 BNB Market Brief Analysis

Affected by overnight US stock market fluctuations, BNB prices initially surged higher, then retreated to around 892 during the early morning hours to find effective support and began a technical rebound. Currently, the price is trading around 908, with the overall trend entering a consolidation phase.

From the market structure perspective, the short-term rebound highs are continuously moving lower, indicating that selling pressure above is still accumulating. The trading volume is insufficient, and the bullish momentum is relatively weak, suggesting that the

Affected by overnight US stock market fluctuations, BNB prices initially surged higher, then retreated to around 892 during the early morning hours to find effective support and began a technical rebound. Currently, the price is trading around 908, with the overall trend entering a consolidation phase.

From the market structure perspective, the short-term rebound highs are continuously moving lower, indicating that selling pressure above is still accumulating. The trading volume is insufficient, and the bullish momentum is relatively weak, suggesting that the

BNB0,68%

- Reward

- like

- Comment

- Repost

- Share

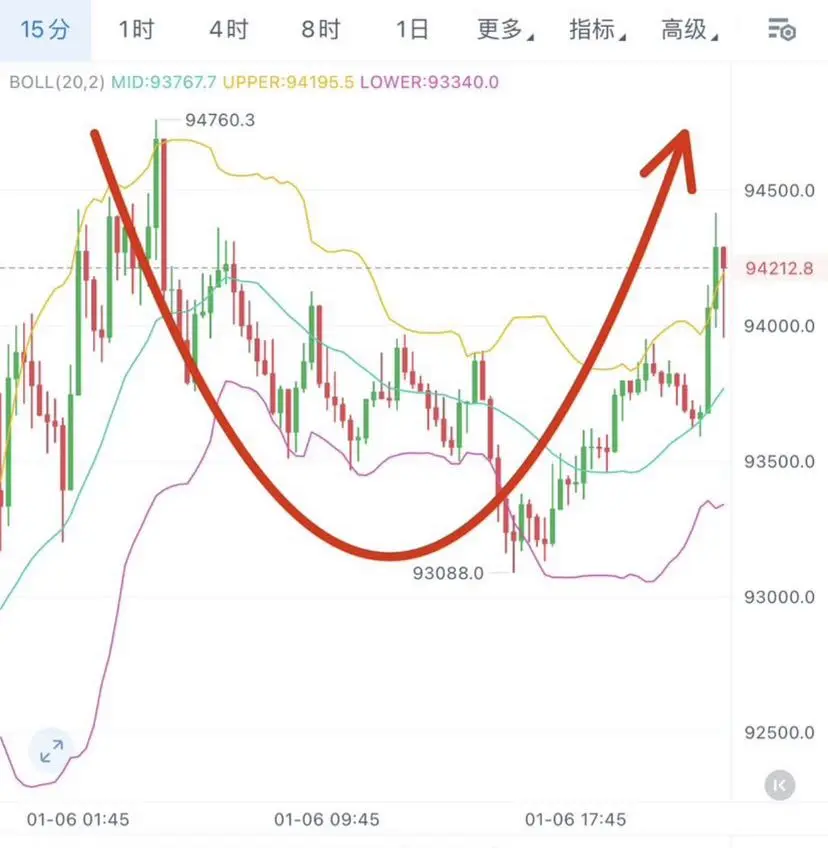

The idea is not about post-mortem review, but about proactive planning.

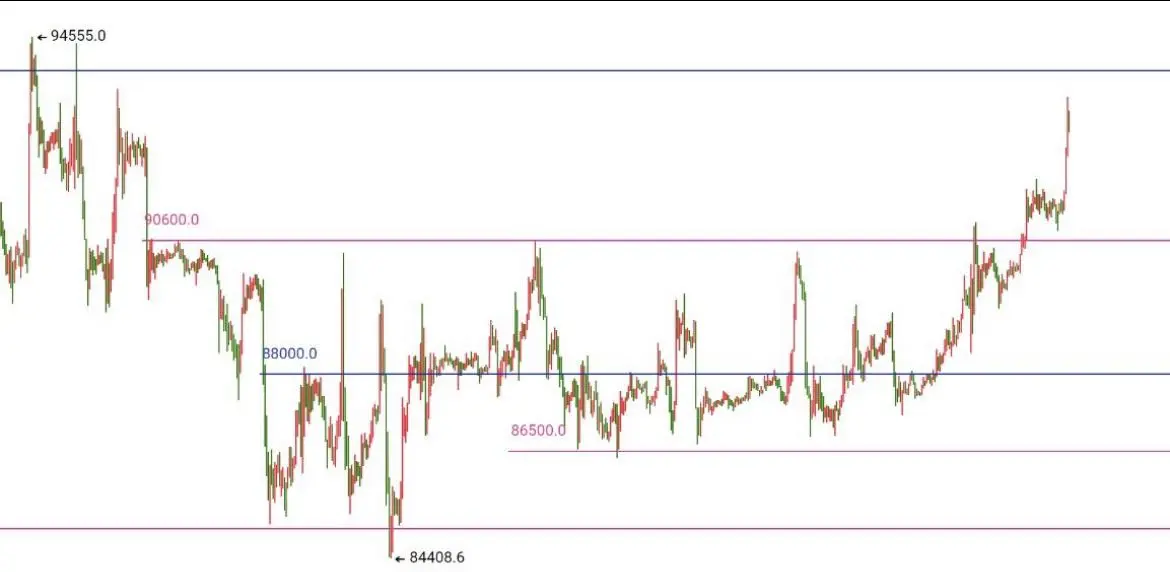

The key level around 94,500 was clearly identified early in the session, and the price was delivered exactly as specified. Subsequently, a standard retracement structure was completed, and the market moved out of a 1500-point range. Truly stable profits come from repeated validation of key price levels, not from chasing highs and selling lows.

View OriginalThe key level around 94,500 was clearly identified early in the session, and the price was delivered exactly as specified. Subsequently, a standard retracement structure was completed, and the market moved out of a 1500-point range. Truly stable profits come from repeated validation of key price levels, not from chasing highs and selling lows.

- Reward

- like

- 1

- Repost

- Share

_Echo :

:

2026 Go Go Go 👊- Reward

- like

- Comment

- Repost

- Share

Many people think that being trapped is the worst outcome in trading, but this is not true. What truly drags traders down is often emotional out-of-control caused by consecutive losses—hesitating to cut losses when it’s necessary, and prematurely exiting due to panic when holding is the right choice.

To break free from a passive situation, the key principles of resolving a trap always follow two core rules:

First, proactive correction.

Once the trading logic is proven wrong, you must decisively cut losses and exit. Only by protecting the principal can you preserve the capital needed for the ne

View OriginalTo break free from a passive situation, the key principles of resolving a trap always follow two core rules:

First, proactive correction.

Once the trading logic is proven wrong, you must decisively cut losses and exit. Only by protecting the principal can you preserve the capital needed for the ne

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

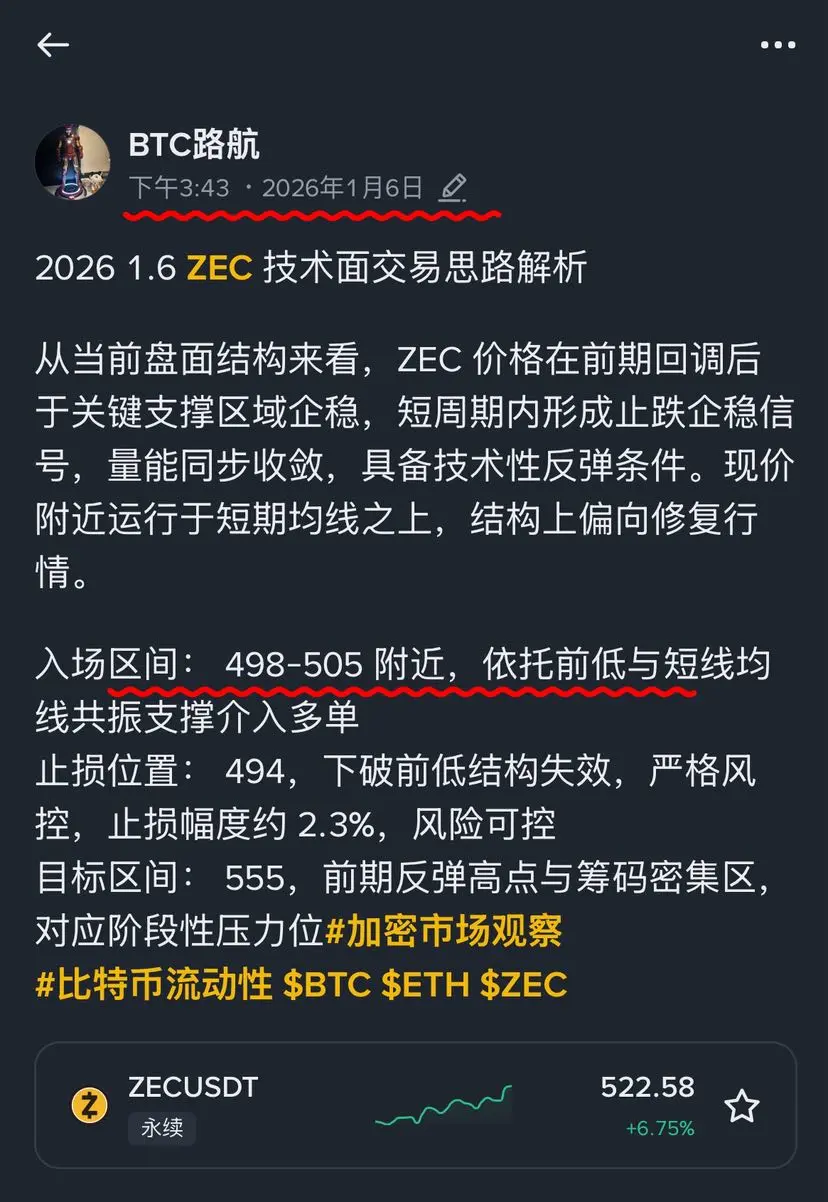

2026 1.6 ZEC Technical Trading Strategy Analysis:

From the current market structure, ZEC price has stabilized in the key support area after a previous correction, forming a short-term signal of stabilization and rebound. Trading volume is also converging, indicating technical rebound conditions. The current price is above the short-term moving averages, suggesting a recovery trend in structure.

Entry zone: Around 498-505, supported by previous lows and short-term moving average resonance for long positions #加密市场开年反弹 #我的2026第一条帖 $BTC $GT $ZEC

Stop-loss level: 494, breaking below the previous

View OriginalFrom the current market structure, ZEC price has stabilized in the key support area after a previous correction, forming a short-term signal of stabilization and rebound. Trading volume is also converging, indicating technical rebound conditions. The current price is above the short-term moving averages, suggesting a recovery trend in structure.

Entry zone: Around 498-505, supported by previous lows and short-term moving average resonance for long positions #加密市场开年反弹 #我的2026第一条帖 $BTC $GT $ZEC

Stop-loss level: 494, breaking below the previous

- Reward

- like

- Comment

- Repost

- Share

I'm in the crypto world, going through a full cycle from tens of thousands of RMB to 1 million U

The first time I opened the Bitcoin market chart, I didn't really understand what blockchain was.

I only remember that candlestick chart on the screen that kept going up and down, making my heart race.

That year, I had only tens of thousands of RMB in my account.

For many people, that might be savings, a sense of security;

But for me, it was a ticket to the unknown.

Daytime working, nighttime studying.

While others were already asleep, I was still repeatedly pulling the same market segment,

asking

The first time I opened the Bitcoin market chart, I didn't really understand what blockchain was.

I only remember that candlestick chart on the screen that kept going up and down, making my heart race.

That year, I had only tens of thousands of RMB in my account.

For many people, that might be savings, a sense of security;

But for me, it was a ticket to the unknown.

Daytime working, nighttime studying.

While others were already asleep, I was still repeatedly pulling the same market segment,

asking

BTC-0,91%

- Reward

- 32

- 13

- Repost

- Share

RideTheBull77 :

:

2026 Go Go Go 👊View More

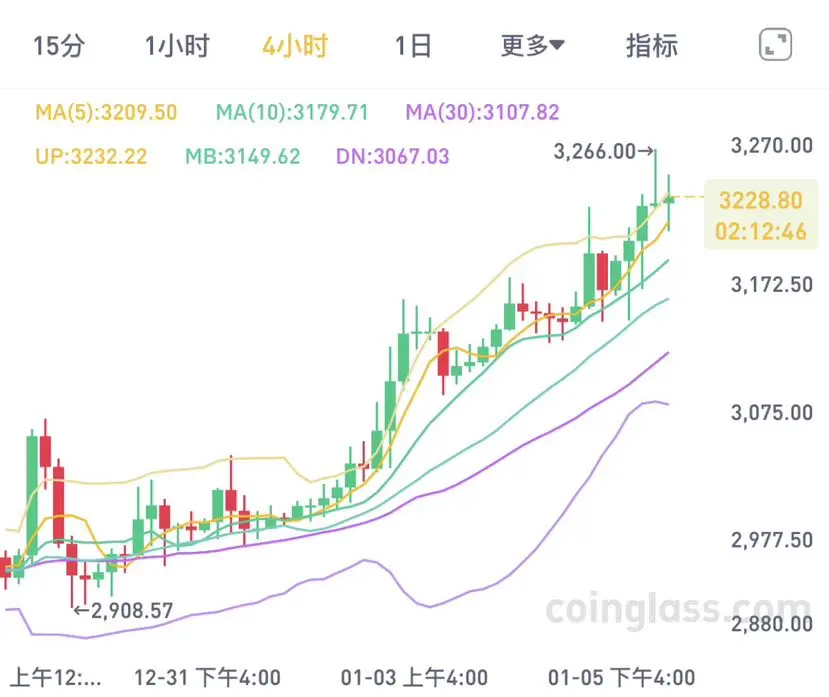

2026. 1. 6 ETH/BNB Intraday Analysis

$ETH Ethereum Intraday Structure Observation

Key short-term support level is 3202.

As long as the price retraces to this level and remains effectively stable, the short-term bullish structure will not be broken, and the overall trend remains strong, with a higher probability of continuation upward.

The resistance zones to watch above are 3265 / 3325 / 3388. Approaching these areas, pay attention to changes in volume and short-term divergences.

If during the session the price retraces and effectively breaks below 3202, the short-term structure will shift int

View Original$ETH Ethereum Intraday Structure Observation

Key short-term support level is 3202.

As long as the price retraces to this level and remains effectively stable, the short-term bullish structure will not be broken, and the overall trend remains strong, with a higher probability of continuation upward.

The resistance zones to watch above are 3265 / 3325 / 3388. Approaching these areas, pay attention to changes in volume and short-term divergences.

If during the session the price retraces and effectively breaks below 3202, the short-term structure will shift int

- Reward

- like

- Comment

- Repost

- Share

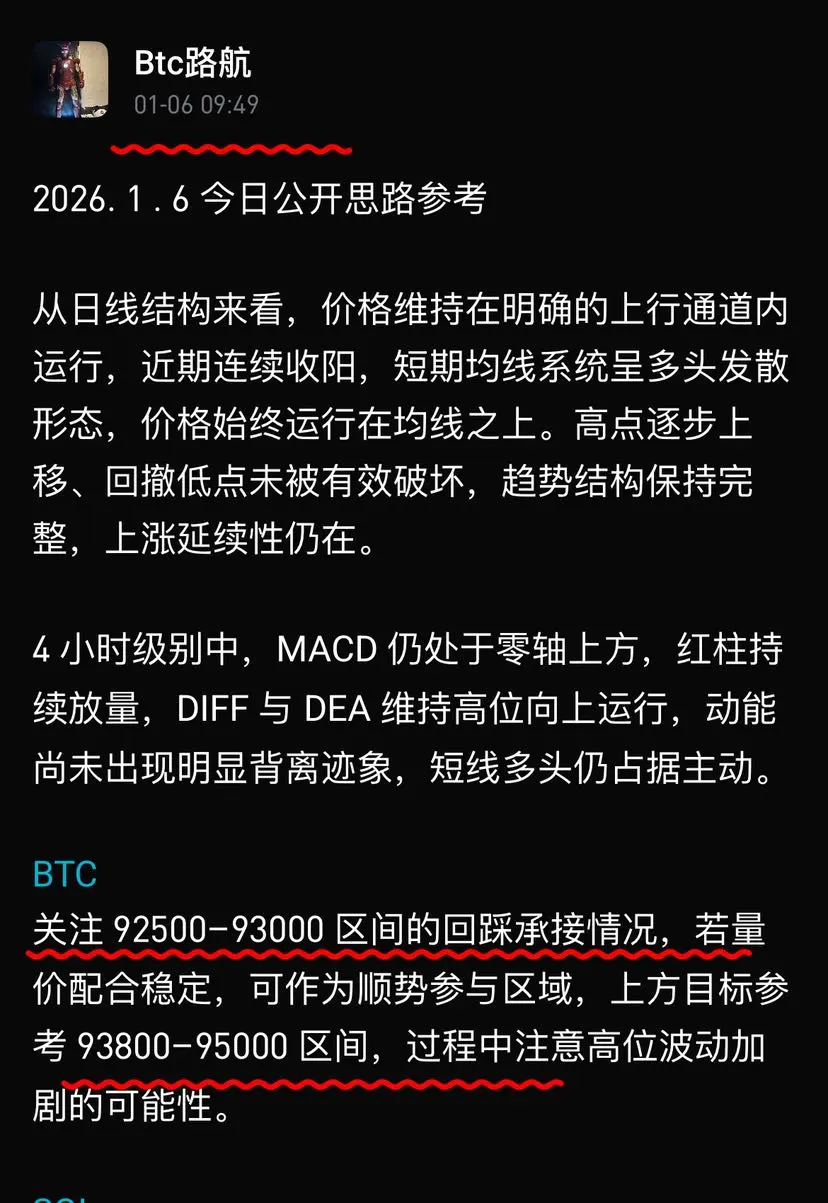

January 6, 2026, Public Thought Reference

From the daily chart structure, the price remains within a clear upward channel, with recent consecutive bullish candles. The short-term moving average system shows a bullish divergence pattern, and the price has consistently stayed above the moving averages. The highs are gradually moving higher, and the retracement lows have not been effectively broken, maintaining the integrity of the trend structure, and the upward continuation remains.

On the 4-hour level, the MACD is still above the zero line, with the red histogram continuously expanding. The DI

View OriginalFrom the daily chart structure, the price remains within a clear upward channel, with recent consecutive bullish candles. The short-term moving average system shows a bullish divergence pattern, and the price has consistently stayed above the moving averages. The highs are gradually moving higher, and the retracement lows have not been effectively broken, maintaining the integrity of the trend structure, and the upward continuation remains.

On the 4-hour level, the MACD is still above the zero line, with the red histogram continuously expanding. The DI

- Reward

- like

- Comment

- Repost

- Share

BTC / ETH Short-term Structure Analysis and Trading Ideas

BTC surged to touch 94044.6 and then quickly pulled back, forming a clear short-term double top at high levels. The candlestick shows long upper shadows, indicating that selling pressure around 94000 is concentrated and released. The bullish momentum is clearly insufficient to continue.

From the moving average perspective, the price is diverging from MA7, and the short-term moving averages are flattening and turning. The trend is likely entering a high-level pullback phase. Pay close attention to the support at MA39 (around 92166) for e

View OriginalBTC surged to touch 94044.6 and then quickly pulled back, forming a clear short-term double top at high levels. The candlestick shows long upper shadows, indicating that selling pressure around 94000 is concentrated and released. The bullish momentum is clearly insufficient to continue.

From the moving average perspective, the price is diverging from MA7, and the short-term moving averages are flattening and turning. The trend is likely entering a high-level pullback phase. Pay close attention to the support at MA39 (around 92166) for e

- Reward

- like

- Comment

- Repost

- Share

Fan real trading sharing, not just calling orders, but real-time guidance, full synchronization, clear entry and exit points.

Trading is not just about ups and downs, but also discipline, timing, and companionship. Trading is not difficult; the hard part is that you haven't made the decision to start.

View OriginalTrading is not just about ups and downs, but also discipline, timing, and companionship. Trading is not difficult; the hard part is that you haven't made the decision to start.

- Reward

- like

- Comment

- Repost

- Share

The AI sector's representative coin FET has been in a full downward cycle since its peak of 3.48 in April last year, with a minimum retracement to 0.1130, and the risk has been fully released through the decline.

Since New Year's Day, the price has been steadily increasing with high volume for several consecutive days, with daily gains consistently above 12%. The capital inflow characteristics are obvious, and it is currently operating within a weekly oversold rebound structure.

From a trend perspective, this rebound is still primarily a correction and has not entered a trend reversal stage, b

Since New Year's Day, the price has been steadily increasing with high volume for several consecutive days, with daily gains consistently above 12%. The capital inflow characteristics are obvious, and it is currently operating within a weekly oversold rebound structure.

From a trend perspective, this rebound is still primarily a correction and has not entered a trend reversal stage, b

FET-0,34%

- Reward

- like

- Comment

- Repost

- Share

January 5, 2026 BTC/ETH/BNB/SOL Intraday Market Trend Analysis

Today’s Market Analysis:

$btc Bitcoin today watch the 91920 level. As long as the price retraces without breaking this level, the bulls remain strong, and the price continues to rise. Watch for resistance levels around 93385-94530-96450!

If today’s price retraces and breaks below 91920, then a correction will start at the 1-2 hour level. Support levels to watch are around 90770-89540-88420!

$eth Ethereum today watch the 3152 level. As long as the price retraces without breaking this level, the bulls remain strong, and the

View OriginalToday’s Market Analysis:

$btc Bitcoin today watch the 91920 level. As long as the price retraces without breaking this level, the bulls remain strong, and the price continues to rise. Watch for resistance levels around 93385-94530-96450!

If today’s price retraces and breaks below 91920, then a correction will start at the 1-2 hour level. Support levels to watch are around 90770-89540-88420!

$eth Ethereum today watch the 3152 level. As long as the price retraces without breaking this level, the bulls remain strong, and the

- Reward

- like

- Comment

- Repost

- Share

BTC Morning Trend Analysis

In the early trading session, Bitcoin experienced a volume surge, with the price temporarily breaking through the daily chart structure. Currently, it is repeatedly testing the key level around 93,000. From a structural perspective, although there was a breakout attempt, its sustainability remains to be verified.

From the liquidation data, during this upward movement, the bullish liquidation intensity was not concentrated and did not form a clear "short squeeze" structure; instead, once the price breaks below the current range, there will be a liquidity cluster with

In the early trading session, Bitcoin experienced a volume surge, with the price temporarily breaking through the daily chart structure. Currently, it is repeatedly testing the key level around 93,000. From a structural perspective, although there was a breakout attempt, its sustainability remains to be verified.

From the liquidation data, during this upward movement, the bullish liquidation intensity was not concentrated and did not form a clear "short squeeze" structure; instead, once the price breaks below the current range, there will be a liquidity cluster with

BTC-0,91%

- Reward

- like

- Comment

- Repost

- Share

Recently, many people have asked me one question:

“Luge, my position is trapped, what should I do?”

I want to start by saying something from the heart.

My ability to stay in this market continuously is not because I win every trade, but because I didn’t get carried away in a bull market, and I didn’t die in a bear market. After going through several cycles of bull and bear markets, you will realize that what truly widens the gap between people is never a single market move, but the repeated choices on how to respond.

Below are the experiences I’ve accumulated after stepping into countless pits

View Original“Luge, my position is trapped, what should I do?”

I want to start by saying something from the heart.

My ability to stay in this market continuously is not because I win every trade, but because I didn’t get carried away in a bull market, and I didn’t die in a bear market. After going through several cycles of bull and bear markets, you will realize that what truly widens the gap between people is never a single market move, but the repeated choices on how to respond.

Below are the experiences I’ve accumulated after stepping into countless pits

- Reward

- like

- Comment

- Repost

- Share

This Week's Key Data Overview

This Week's Core Data Calendar (January 5-9, 2026)

January 5 Monday

Event: ISM Manufacturing Index, Vehicle Sales Data Release

Importance: Medium

January 6 Tuesday

Event: S&P Global Services PMI, Richmond Fed President Barkin Speech

Importance: Medium

January 7 Wednesday

Event: ADP "Small Non-Farm" Employment Data, ISM Services Index, JOLTS Job Openings, Factory Orders Data Release

Importance: High (Especially the ADP and JOLTS data)

January 8 Thursday

Event: Initial Jobless Claims, Trade Balance, Productivity and Consumer Credit Data Release

Importance: Medium

Ja

View OriginalThis Week's Core Data Calendar (January 5-9, 2026)

January 5 Monday

Event: ISM Manufacturing Index, Vehicle Sales Data Release

Importance: Medium

January 6 Tuesday

Event: S&P Global Services PMI, Richmond Fed President Barkin Speech

Importance: Medium

January 7 Wednesday

Event: ADP "Small Non-Farm" Employment Data, ISM Services Index, JOLTS Job Openings, Factory Orders Data Release

Importance: High (Especially the ADP and JOLTS data)

January 8 Thursday

Event: Initial Jobless Claims, Trade Balance, Productivity and Consumer Credit Data Release

Importance: Medium

Ja

- Reward

- like

- Comment

- Repost

- Share